In July 2025, freight forwarders and importers are facing a growing mystery: Why are rates from China to the Mediterranean significantly lower than rates to Northern Europe? On some routes, the difference exceeds $1,200 per FEU.

This rate gap, once only seasonal, has become a persistent market imbalance. Whether you're shipping to Hamburg or Barcelona, understanding the spread matters—because it affects your margins, routing strategy, and even supplier lead times.

Let’s explore what’s driving this divergence, how it impacts cargo flows, and what smart importers are doing in response.

How Wide Is the Rate Gap Between the Two Regions?

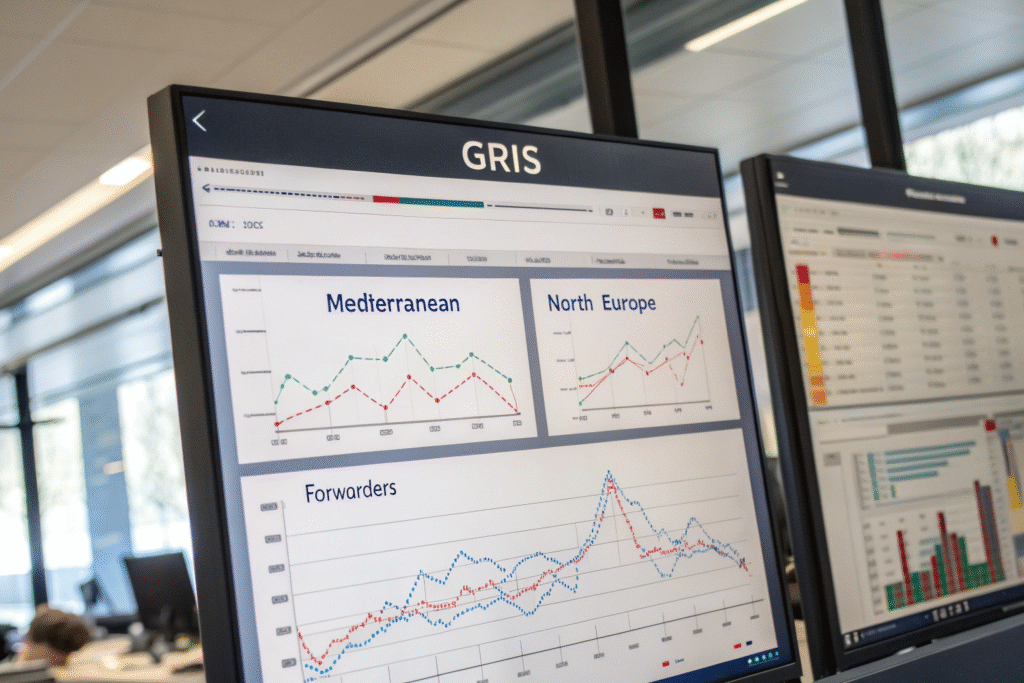

Spot rates from China to Mediterranean ports like Genoa, Valencia, and Istanbul are currently 25–35% lower than rates to Northern ports such as Rotterdam, Hamburg, and Antwerp.

This month, China–Genoa rates averaged $2,350/FEU while China–Rotterdam hovered around $3,600/FEU. That’s a $1,250 gap, even for similar cargo volumes.

What Are the Latest Average Rate Benchmarks?

| Route | July 2025 Rate (per FEU) | Year-over-Year Change |

|---|---|---|

| Shanghai – Genoa | $2,350 | -22% |

| Ningbo – Valencia | $2,410 | -18% |

| Yantian – Istanbul | $2,200 | -25% |

| Qingdao – Rotterdam | $3,600 | +5% |

| Shenzhen – Hamburg | $3,550 | +7% |

These figures are based on updates from Drewry and Xeneta, showing clear divergence.

Is This Just a Short-Term Market Fluctuation?

Not anymore. The gap has been sustained since Q1 2025 and appears structurally driven. While GRIs affect both regions, capacity and demand shifts are playing a larger role—especially on high-volume corridors from Southern China.

At GeeseCargo, we’ve tracked this spread weekly and adjusted routing for cost optimization.

What Factors Are Driving the Rate Gap?

Multiple structural and strategic factors contribute to the persistent difference between North and South Europe rates.

From vessel overcapacity and equipment imbalance to inland bottlenecks and demand recovery, each region faces different market realities.

How Is Carrier Capacity Allocation Influencing Rates?

Carriers deployed more ships to Northern Europe in anticipation of post-Brexit demand recovery and stronger industrial flows. But real demand hasn’t matched the expectations.

Meanwhile, Mediterranean capacity remained relatively stable, with fewer blank sailings and better vessel utilization.

Reports from Alphaliner show that weekly TEU capacity on Asia–N. Europe routes is 15% higher than on Med routes, leading to lower utilization and rate pressure.

What Role Do Port Bottlenecks and Hinterland Issues Play?

Northern Europe faces:

- Trucking shortages in Germany and the Netherlands

- Longer rail turnaround to inland hubs (e.g., Poland, Czechia)

- Port labor disruptions, especially in Hamburg

These issues reduce schedule reliability and inflate carrier costs, which are passed to shippers.

Mediterranean ports like Valencia and Piraeus, on the other hand, offer faster turnaround, fewer strikes, and strategic feeder access to North Africa and Southern Europe.

We use tools like Portcast to analyze real-time port delays and cost impact.

How Should Importers Respond to the Rate Spread?

For cost-conscious importers, this rate difference opens up strategic opportunities. Re-routing cargo to Med ports—even with longer inland legs—can slash total shipping costs.

Apparel brands shipping to Germany, France, or Benelux are now exploring Southern Europe transits with rail or truck bridges.

Is It Worth Rerouting Through Mediterranean Ports?

Let’s look at an example:

| Option | Route | Total Cost | Transit |

|---|---|---|---|

| Standard | Ningbo – Rotterdam – Düsseldorf | $3,600 + $800 drayage | 30 days |

| Optimized | Ningbo – Valencia – Rail to Lyon | $2,400 + $1,100 rail | 28 days |

You save $900+ per container and maintain similar lead time.

We’ve helped clients reroute 20+ FCLs/month to Valencia and Istanbul using this model.

What Are the Trade-Offs?

- More complex inland routing

- Customs handling at alternate ports

- Language/cultural differences with local agents

But we mitigate these with multilingual port agents, bonded transit corridors, and guaranteed rail links. For clients using CargoWise, these changes are easily integrated into TMS workflows.

What Should Forwarders and Buyers Watch in the Coming Months?

This spread could narrow—or widen—depending on key market signals. Smart importers are staying agile and monitoring several early indicators.

At GeeseCargo, we publish monthly forecasts and recommend route shifts when savings exceed $500 per FEU.

What Market Trends Could Narrow the Rate Gap?

- GRIs on Asia–Med lanes, which are expected in late Q3

- Supply rationalization by THE Alliance and 2M carriers

- Demand rebound in Northern Europe due to holiday stockpiling

If Asia–Med rates rise by $400–$600/FEU, the benefit of rerouting could shrink.

We use Sea-Intelligence updates to track blank sailing forecasts and GRIs by corridor.

Should You Lock in Contracts or Stay Spot?

For now, spot is still more advantageous on the Med route. But we advise clients shipping above 100 TEU/quarter to consider fixed-rate contracts for blended coverage.

Contracts help avoid sudden volatility—especially if the North Europe lane rebounds in Q4 2025.

Conclusion

The rate gap between China–Med and China–North Europe shipping isn’t just a temporary glitch—it’s a sign of evolving market dynamics.

For importers willing to adjust routing and inland strategies, this spread offers major savings. At GeeseCargo, we help clients analyze cost-per-route in real time and make proactive shifts that optimize transit and budget.

This market is all about agility. Monitor trends, question old habits, and use rate divergence as your new strategic edge.