One wrong field on your shipping paperwork can hold your cargo for days—or even weeks.

The most common documentation mistakes in shipping include incomplete invoices, incorrect HS codes, missing signatures, and mismatched customs forms. Avoiding these errors is key to faster, smoother freight clearance.

At GeeseCargo, we've seen how small mistakes turn into big costs. Let’s look at the worst offenders and how we help our clients get it right the first time.

Incorrect or incomplete commercial invoices

Your commercial invoice is more than a bill—it's the customs authority's roadmap.

Incorrect or incomplete commercial invoices cause major delays during customs inspections, resulting in holds, penalties, or even shipment rejection. Every detail must be consistent, accurate, and complete.

Why are commercial invoices so critical?

Customs uses them to:

- Verify declared value

- Confirm product descriptions and quantities

- Match shipment to the declared HS code

- Assess import duties and taxes

A U.S. client once listed “accessories” on their invoice. Customs flagged the vague term, requiring a breakdown of the shipment. That added 4 days of delay and a $300 inspection fee.

| Invoice Field | Common Errors | Customs Issue Caused |

|---|---|---|

| Product description | Vague or too general | Requires clarification |

| Quantity and unit price | Mismatch with packing list | Suspicion of under-invoicing |

| Currency and total value | Missing or not aligned | Incorrect duties |

| Buyer/seller information | Spelling errors, incomplete data | Risk of misrouting |

What does a correct invoice include?

- Accurate product descriptions (not just “goods” or “samples”)

- Harmonized values and totals across documents

- Exact match with the Bill of Lading and Packing List

- Date, signature, and exporter’s full contact details

At GeeseCargo, we provide invoice templates and check each one before submission. That’s one simple way we eliminate delay risks.

Misdeclared HS codes and product descriptions

One wrong code can stop your cargo cold.

Using the wrong HS code or a vague product description can result in misclassification, incorrect tariffs, and customs rejections—all of which delay shipping and increase costs.

Why are HS codes so sensitive?

HS (Harmonized System) codes determine:

- Customs duty rates

- Import and export control checks

- Special documentation (e.g., MSDS, certifications)

Even a small change in a product description can bump it into a new HS code, with different requirements.

For example, one client shipped “synthetic leather belts” but used the HS code for “leather belts.” Customs required proof of material, halting the shipment until corrected.

| Problem | Risk | Example |

|---|---|---|

| Too generic product names | Extra inspections | “Gifts” vs. “plastic toys” |

| Wrong HS code | Misapplied duties, penalties | 4203 vs. 6217 for accessories |

| Code not matching invoice | Reconciliation delays | Manual review by officers |

| No product breakdown | Hold until clarification provided | Mixed-use shipments |

How do we ensure correct classification?

- Use product images and specs to verify HS code

- Cross-check with customs tariff database

- Get written confirmation from customs consultants if needed

We once helped a first-time shipper avoid a $1,500 misclassification fine—just by correcting an HS code from 9503 to 3926 before submission.

Missing signatures or stamps on key documents

Unsigned documents are dead on arrival at customs.

Missing signatures or company seals on commercial invoices, certificates of origin, or other official documents will cause customs to reject the paperwork, delaying clearance.

What documents typically require stamps or signatures?

- Commercial Invoice

- Packing List

- Certificate of Origin (COO)

- Form A or RCEP/FTA certificates

- Bill of Lading (for manual submissions)

I once saw a client miss a certificate stamp for a shipment of handmade jewelry. Customs wouldn’t apply tariff reductions under RCEP—until the supplier couriered a signed original 4 days later.

| Document Type | Signature Required | Stamp Required | Delay Risk if Missing |

|---|---|---|---|

| Commercial Invoice | Yes | Recommended | Medium |

| COO or Form A | Yes | Yes | High |

| Packing List | Yes | No | Low |

| B/L (non-digital) | Yes | No | Medium |

What do we do to prevent signature errors?

- Provide editable PDF templates with signature prompts

- Ask suppliers to use company letterhead with printed names

- Request hard copies of COO documents in advance

We don’t just accept what the factory gives us. We verify and request re-issues when needed—before the goods even board the vessel.

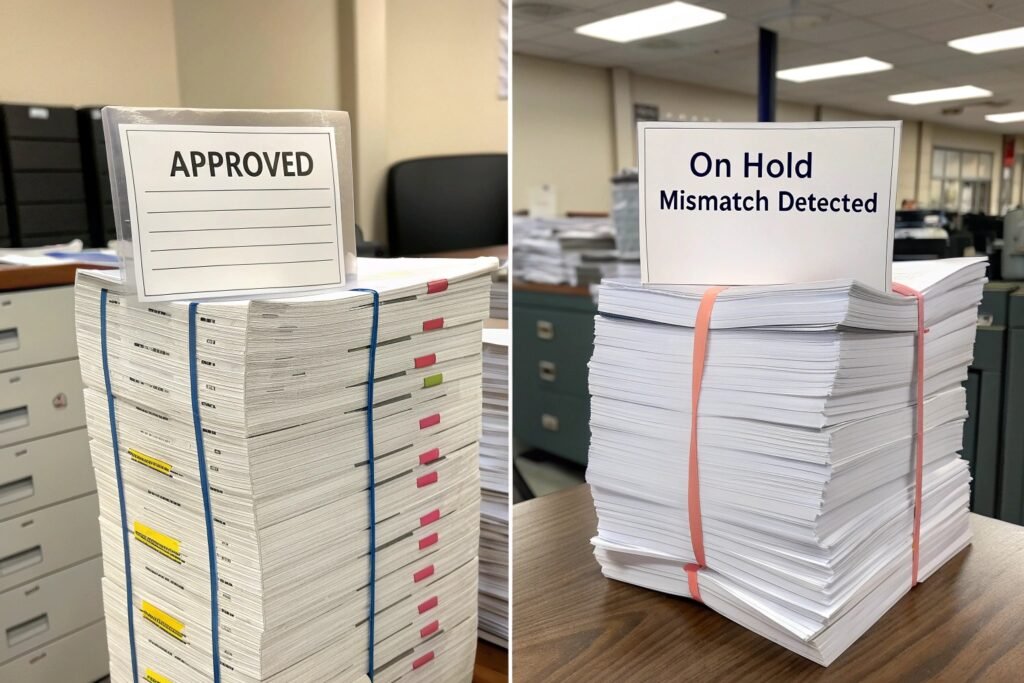

Failure to align documents with customs regulations

Consistency is everything. Every form must tell the same story.

If your invoice, packing list, bill of lading, and certificates contain mismatched information, customs will suspect fraud or error, and delay clearance until resolved.

Where do document mismatches often occur?

- Product name spelled differently across forms

- Different currency formats between invoice and B/L

- Address mismatch between B/L consignee and invoice buyer

- Quantity listed as “10 pieces” vs. “1 carton of 10”

These inconsistencies confuse customs officers. They raise red flags and often result in manual inspection.

| Form A Says... | B/L Says... | Result |

|---|---|---|

| “Plastic Hangers” | “Hanger Accessories” | Held for review |

| Buyer: “ABC Imports” | Consignee: “ABC Ltd.” | Delay in release |

| 10 kg/unit | 12 kg total | Weight check |

| FOB Value: $900 | Declared: $950 | Duty mismatch |

How to keep your documents aligned?

- Use one “master product list” for all forms

- Copy/paste descriptions, values, and terms

- Triple-check buyer, shipper, and port data

- Use a forwarder who reviews all files for logic and clarity

At GeeseCargo, we check documents in-house before booking and before customs. This double-check saves our clients from hours of clearance headaches.

Conclusion

Documentation errors are the silent killers of shipping speed. At GeeseCargo, we prevent costly delays by helping clients prepare flawless invoices, use accurate HS codes, apply proper signatures, and keep all forms aligned. Clean paperwork means fast delivery.