Importing from China often comes with unexpected costs that don't appear in initial quotes. Many businesses budget based on visible freight charges only to discover their actual costs are significantly higher. Understanding these hidden fees is crucial for accurate budgeting and maintaining profit margins.

Hidden fees when shipping from China include terminal handling charges, bunker adjustment factors, peak season surcharges, customs bond costs, demurrage and detention fees, and various carrier security and documentation charges. These can add 25-50% to your base freight costs if not properly anticipated.

Let's uncover the specific hidden fees you're likely to encounter and strategies to minimize their impact on your shipping budget.

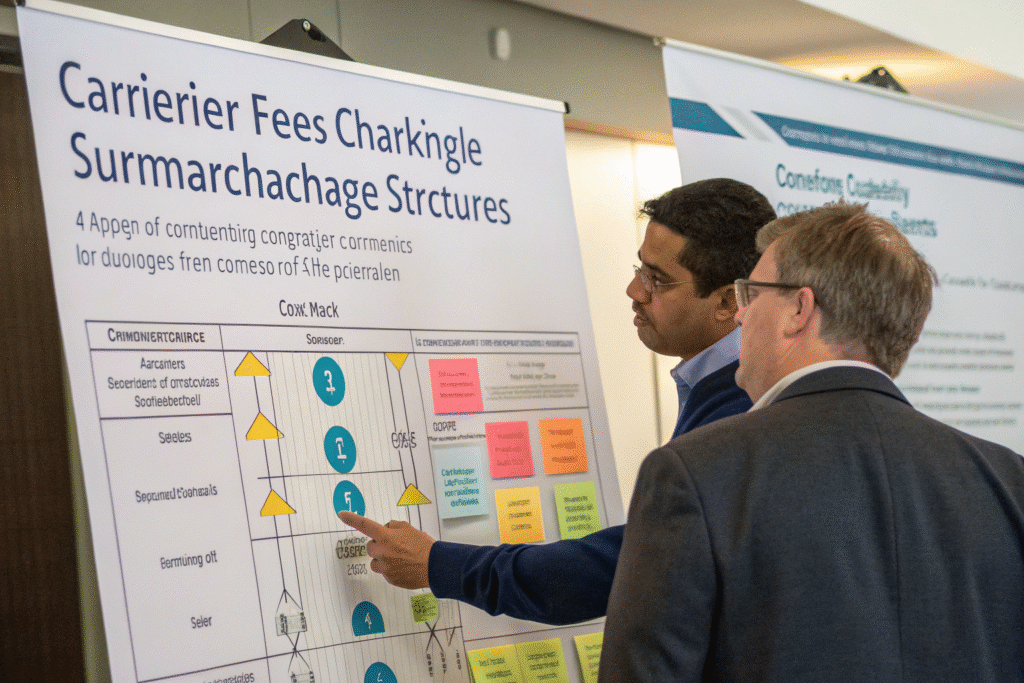

What are the common carrier surcharges and fees?

Carrier-imposed surcharges represent the most frequent source of hidden costs in China shipping. These fees are often buried in complex tariff rules and can fluctuate without clear warning, dramatically impacting your total shipping costs.

The Bunker Adjustment Factor (BAF) or Fuel Surcharge compensates carriers for fuel price fluctuations and typically represents 20-40% of your base ocean freight rate. The Terminal Handling Charge (THC) covers container movement at ports and can cost $200-500 per container. The Currency Adjustment Factor (CAF) addresses exchange rate volatility, while the Peak Season Surcharge (PSS) adds 15-30% during high-demand periods. Additionally, carriers charge Documentation Fees, Security Fees, and various Accessorial Charges that quickly accumulate.

How does the bunker adjustment factor impact costs?

The BAF is particularly significant because:

- It changes monthly based on global fuel price indexes

- It's calculated differently by each carrier

- It's often a percentage of your base freight rate

- It's rarely negotiable unlike base freight costs

- It can double during periods of rapid fuel price increases

Understanding BAF calculation methods helps predict this substantial cost component.

What triggers peak season surcharges?

PSS activation typically occurs during:

- Chinese New Year period (January-March) as factories rush shipments

- Back-to-school season (June-August) for consumer goods

- Holiday season (September-November) for retail inventory building

- Capacity shortages when demand exceeds available vessel space

- Port congestion periods adding operational complexity

Anticipating these periods allows for strategic shipping timing to avoid surcharges.

What destination port fees surprise importers?

US destination charges often catch importers unprepared because they're separate from origin costs and may not be visible until after shipment arrival. These fees can substantially increase your total landed costs.

The Pier Pass fee at West Coast ports averages $100-200 per container for off-peak movements. The Harbor Maintenance Fee (HMF) adds 0.125% of cargo value. The Merchandise Processing Fee (MPF) costs 0.3464% of entry value with a $27 minimum and $528 maximum. Additionally, you'll encounter Terminal Handling Charges at destination ports, Pier Delivery Fees, and various Port Security Fees that vary by location and carrier.

How do pier pass fees work?

The Pier Pass program involves:

- Off-peak incentives encouraging nighttime and weekend container movement

- Traffic mitigation reducing port area congestion

- Per-container charges applied to all loaded containers

- Terminal funding supporting extended gate hours

- Mandatory participation for all users of participating terminals

Understanding this program helps plan container movement timing to potentially avoid fees.

What determines merchandise processing fees?

MPF calculation depends on:

- Entry type (formal vs informal) with different fee structures

- Shipment value with percentage-based calculation

- Minimum and maximum fee limits protecting very small and large shipments

- Entry method (paper vs electronic) with potential fee differences

- Customs bond requirements for formal entries

This fee applies to nearly all US imports regardless of origin or product type.

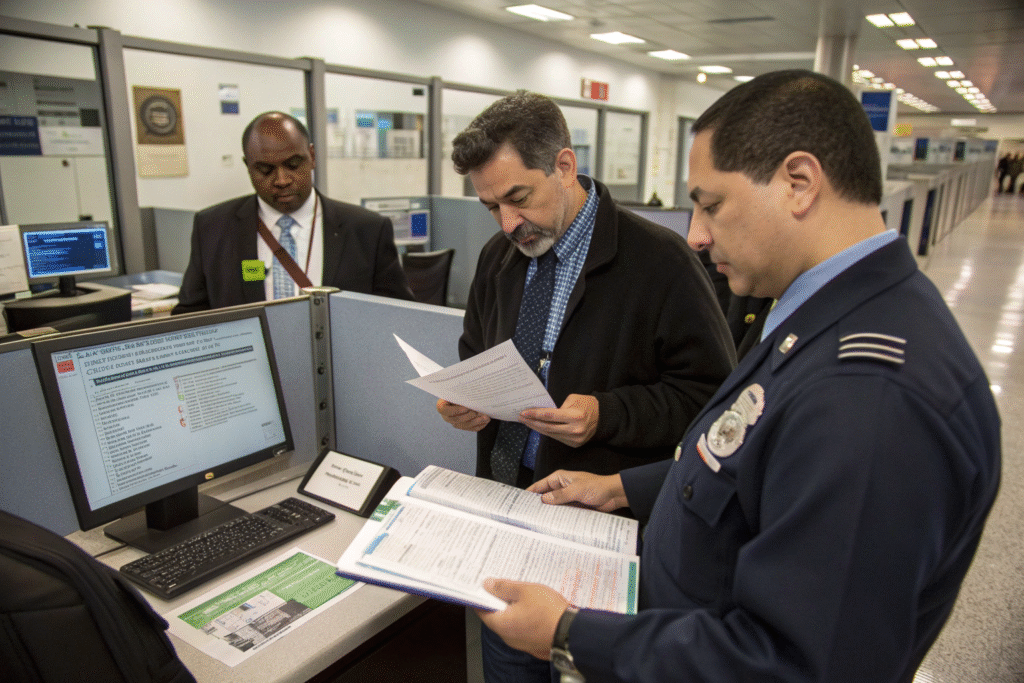

What customs and compliance costs emerge unexpectedly?

Customs-related fees often surprise importers because they involve government requirements and third-party services beyond basic freight charges. These compliance costs are essential but frequently underestimated in initial budgeting.

Customs bonds cost $250-500 annually for continuous coverage or $75-150 for single transaction bonds. Customs examination fees range from $200-800 if your shipment is selected for inspection. Laboratory testing for certain products can cost $300-1,000. ISF filing fees average $25-50 per submission, while ISF late filing or amendment fees can reach $5,000 per violation. Additionally, post-entry amendments or protests involve professional fees if errors are discovered later.

When are customs examination fees triggered?

Examinations occur due to:

- Random selection through customs targeting systems

- Document discrepancies raising red flags

- Product type targeting for restricted or regulated goods

- Value verification for high-value shipments

- Previous compliance issues with the importer

Budgeting for examination probability prevents surprise costs when they occur.

What determines customs bond costs?

Bond pricing factors include:

- Bond type (continuous vs single transaction)

- Importer history and compliance record

- Shipment volume and frequency

- Product risk level and duty rates

- Bond provider and underwriting criteria

Continuous bonds typically offer better value for regular importers despite higher upfront cost.

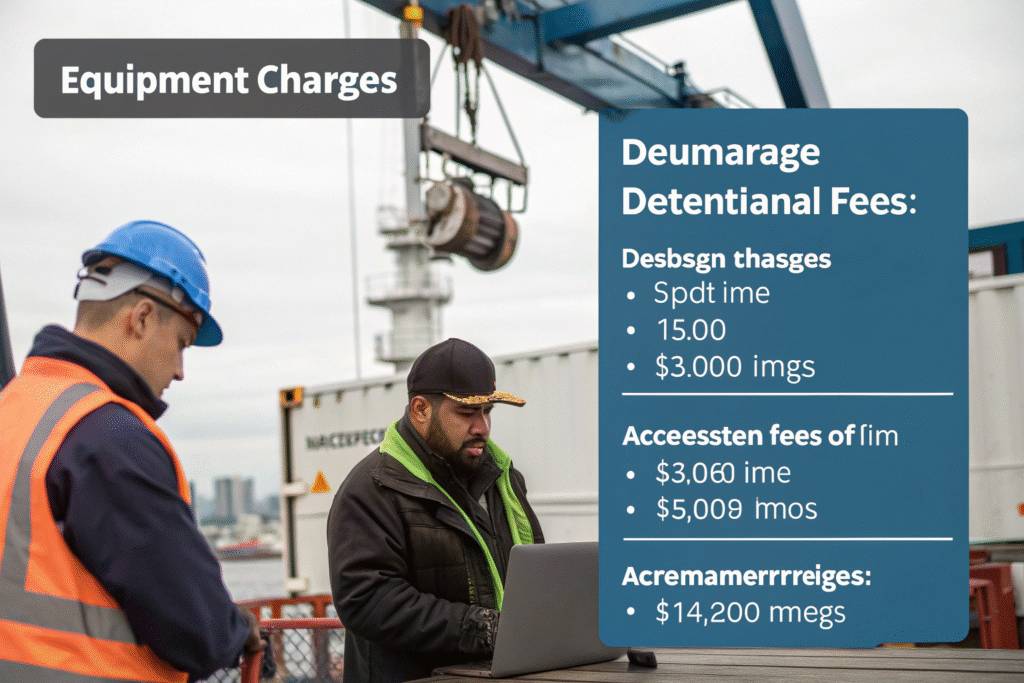

What equipment and accessorial charges accumulate?

Equipment-related fees and special service charges represent another category of hidden costs. These fees apply when containers are used beyond standard timeframes or when special handling is required.

Demurrage charges accrue when containers remain at port beyond free time, typically costing $100-300 per day. Detention fees apply when you hold containers outside the port beyond allowed time, averaging $75-200 daily. Chassis usage fees add $25-75 daily in some locations. Additionally, you may encounter Overweight Surcharges, Cleaning Fees for soiled containers, and Various Accessorial Charges for services like inside delivery or liftgate service.

How can you avoid demurrage and detention fees?

Prevention strategies include:

- Understanding free time allowances at your specific ports

- Scheduling pickup appointments immediately upon container availability

- Maintaining equipment tracking to avoid forgotten containers

- Planning labor availability for prompt unloading

- Monitoring port status during congestion periods

Proactive equipment management prevents these rapidly accumulating charges.

What accessorial charges commonly surprise importers?

Frequent unexpected accessorial fees include:

- Fuel surcharges for trucking beyond base rates

- Inside delivery fees for placement within facilities

- Liftgate service for locations without loading docks

- Limited access fees for remote or restricted locations

- Sort and segregate charges for mixed SKU shipments

Understanding these potential charges allows for accurate comparison of carrier quotes.

Conclusion

Hidden fees in China shipping can significantly impact your total landed costs, but they become manageable through education, proper budgeting, and strategic planning. By understanding common surcharges, destination fees, compliance costs, and equipment charges, you can transform unpredictable expenses into anticipated budget items. The most successful importers work with transparent partners who disclose all potential fees upfront, maintain contingency budgets for unexpected charges, and implement processes to avoid preventable fees like demurrage and detention. With comprehensive fee awareness, you can make informed shipping decisions that protect your profit margins while maintaining reliable supply chain operations.