When one of our clients reduced their inventory carrying costs by 38% while improving stock availability from 89% to 96%, they demonstrated how strategic inventory management transforms import operations. As founder of GeeseCargo with extensive import logistics experience, I've learned that inventory management for importers isn't just about counting stock—it's about balancing complex variables across global supply chains to optimize working capital and service levels simultaneously.

The best inventory management strategies for importers combine demand forecasting, strategic safety stock placement, lead time optimization, and technology-enabled visibility. Successful importers typically maintain 15-30% less inventory than competitors while achieving 2-5% higher service levels through systematic approaches that account for import-specific challenges like long lead times, customs delays, and currency fluctuations.

Import inventory management faces unique challenges including extended supply chains, volatile transit times, and complex cash flow considerations. The most successful strategies address these import-specific factors while implementing inventory fundamentals.

How Can Importers Optimize Inventory Planning and Forecasting?

Accurate forecasting forms the foundation of effective import inventory management, requiring specialized approaches that account for global supply chain variables.

What Demand Forecasting Methods Work Best for Importers?

Integrated demand planning combines historical data with market intelligence. While historical sales provide baseline forecasts, importers must incorporate new product introductions, market trends, and promotional calendars that affect demand patterns.

Lead time-adjusted forecasting accounts for supply chain variability. Rather than using simple time-based forecasts, importers should use lead time-based models that consider ocean transit, customs clearance, and domestic transportation timelines.

Collaborative planning with suppliers improves forecast accuracy. Sharing forecasts with Chinese manufacturers enables production planning alignment and identifies capacity constraints before they cause shortages.

How Should Safety Stock Calculations Differ for Importers?

Lead time variability requires larger safety buffers than domestic operations. While domestic businesses might calculate safety stock based on demand variability, importers must also factor in transit time fluctuations that can vary by 10-20 days.

Geopolitical and seasonal factors necessitate strategic buffer planning. Importers should increase safety stock before Chinese New Year, weather-affected seasons, or during known geopolitical tensions that disrupt shipping lanes.

Cost-based optimization balances carrying costs against stockout risks. Higher-margin products justify larger safety stock, while low-margin items require tighter inventory control to preserve working capital.

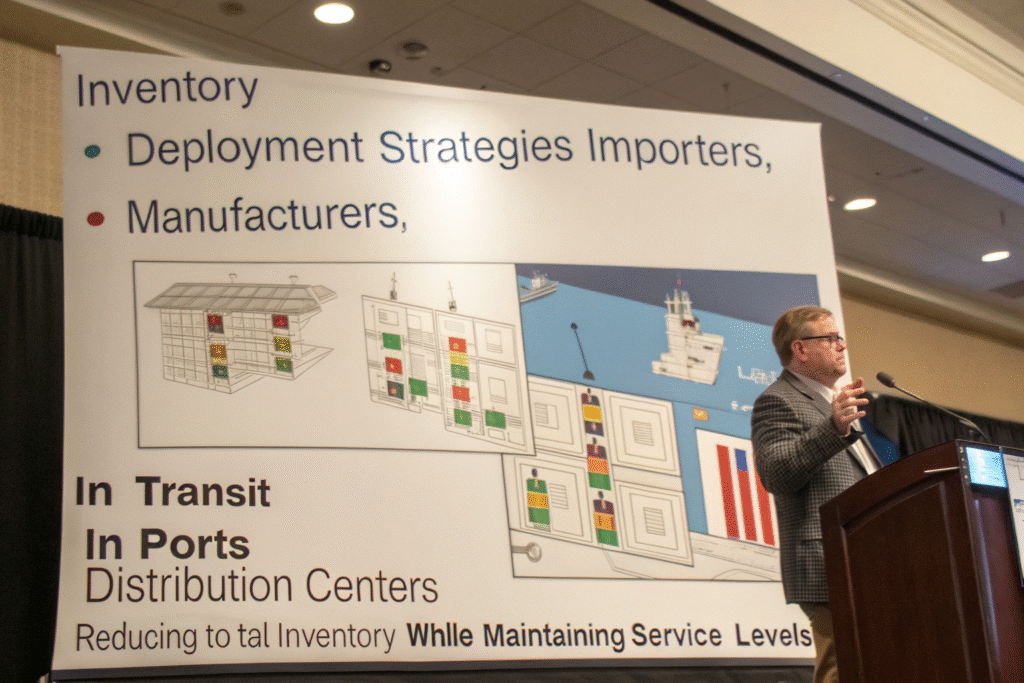

What Inventory Deployment Strategies Maximize Efficiency?

Strategic inventory placement across the supply chain significantly impacts both costs and service levels.

How Can Importers Optimize Inventory Across the Supply Chain?

Multi-echelon inventory optimization positions stock strategically across locations. Rather than concentrating inventory in US warehouses, successful importers maintain balanced inventory at Chinese consolidation centers, in-transit, and in regional US distribution centers.

Push-pull boundary strategies determine where inventory is committed. Importers typically "push" base inventory based on forecasts but "pull" allocation to specific locations based on actual demand, creating flexibility while maintaining efficiency.

Transit stock management treats in-transit inventory as active pipeline. Rather than ignoring inventory during ocean transit, successful importers track and manage in-transit stock as part of their available inventory calculations.

What Role Do Consolidation Centers Play in Inventory Strategy?

Asian consolidation centers enable inventory pooling and flexibility. Maintaining inventory at consolidation centers in China or regional hubs like Singapore allows reallocation before transoceanic shipping based on changing demand.

Cross-docking strategies minimize storage while maintaining flow. For fast-moving products, direct transfer from marine containers to outbound trucks eliminates storage costs and reduces handling.

Postponement strategies delay final configuration until demand is known. Importing generic products and performing final assembly, packaging, or configuration in the US reduces inventory variety while maintaining flexibility.

How Can Technology Transform Import Inventory Management?

Modern inventory management systems provide capabilities specifically valuable for import operations with extended supply chains.

What System Capabilities Are Essential for Importers?

Supply chain visibility platforms provide real-time inventory tracking. Systems that track inventory from manufacturer through to customer provide the transparency needed to manage extended supply chains effectively.

Inventory optimization tools factor in import-specific variables. Advanced systems incorporate lead time variability, customs clearance patterns, and ocean transit schedules into inventory calculations.

Integration between systems prevents data silos and manual work. Seamless connectivity between ERP, WMS, and transportation systems ensures inventory records remain accurate across the organization.

How Can Analytics Improve Import Inventory Decisions?

Predictive analytics anticipate disruptions and demand shifts. Machine learning algorithms analyzing historical patterns can predict potential delays or demand changes before they impact inventory availability.

Inventory health analytics identify optimization opportunities. Analysis of turnover rates, obsolescence risk, and carrying costs highlights specific products needing inventory policy adjustments.

Scenario modeling evaluates different inventory strategies. Tools that simulate how different safety stock levels, order quantities, or placement strategies affect costs and service levels enable data-driven decisions.

What Financial Considerations Should Guide Inventory Strategy?

Inventory decisions directly impact financial performance through multiple mechanisms beyond simple carrying costs.

How Should Importers Balance Carrying Costs and Service Levels?

True carrying cost calculation includes often-overlooked expenses. Beyond storage and capital costs, importers must factor in insurance, taxes, obsolescence, damage, and handling in carrying cost calculations.

Stockout cost quantification enables informed tradeoff decisions. Understanding the true cost of lost sales, expedited shipping, and customer lifetime value loss helps determine optimal service levels.

Cash flow constraints often dictate inventory strategy for growing importers. Limited working capital may necessitate higher inventory turnover despite potentially higher unit costs or occasional stockouts.

What Import-Specific Financial Factors Affect Inventory Decisions?

Customs duties payment timing creates cash flow considerations. Since duties are typically paid upon importation, inventory in transit represents tied-up capital beyond the product cost itself.

Currency fluctuation management affects purchasing timing. Importers must decide whether to hedge currency exposure through forward buying or accept exchange rate volatility in inventory costing.

Trade financing options influence order quantity decisions. Access to letters of credit, supply chain financing, or inventory financing can enable larger, more economical orders despite working capital constraints.

How Can Importers Mitigate Supply Chain Risks Through Inventory Strategy?

Strategic inventory management provides powerful risk mitigation for importers facing global supply chain uncertainties.

What Inventory Strategies Address Common Import Risks?

Strategic safety stock buffers against supply disruptions. Maintaining inventory specifically to cover potential factory delays, transportation disruptions, or quality issues provides operational resilience.

Diversified inventory sourcing reduces single-point failures. Spreading inventory sourcing across multiple regions or suppliers prevents complete disruption from issues affecting single sources.

Demand variability buffers account for forecast inaccuracy. Recognizing that import forecasts are inherently less accurate due to longer planning horizons, successful importers maintain additional inventory to cover unexpected demand spikes.

How Can Inventory Planning Address Logistics Uncertainties?

Lead time variability buffers prevent stockouts from transit delays. Since ocean transit can vary by weeks due to weather, port congestion, or vessel scheduling, importers must inventory plan for worst-case scenarios rather than averages.

Customs clearance delays necessitate additional buffer inventory. Even with experienced brokers, customs examinations, documentation issues, or PGA requirements can delay inventory availability unexpectedly.

Seasonal transportation challenges require advance inventory positioning. Planning inventory arrivals before known challenging periods like winter weather or peak season congestion prevents stockouts.

What Are Common Inventory Management Mistakes Importers Make?

Understanding frequent errors helps importers avoid costly inventory problems.

What Strategic Errors Undermine Import Inventory Performance?

Underestimating total lead time variability causes chronic stockouts. Importers often plan based on ideal transit times rather than realistic ranges that account for multiple potential delay points.

Overlooking the cost of inventory in transit distorts financial analysis. Inventory financing costs during extended ocean transit significantly impact total inventory carrying costs but are often ignored.

Failing to account for order cycle time in reorder points. The complete cycle from recognizing need to inventory availability includes manufacturing, shipping, and clearance time beyond simple transit duration.

What Operational Mistakes Create Inventory Problems?

Poor communication between procurement and sales causes mismatches. When purchasing decisions aren't informed by sales forecasts and market intelligence, inventory inevitably becomes misaligned with demand.

Inadequate inventory tracking across locations creates blind spots. Without clear visibility into inventory at manufacturers, in transit, and in multiple warehouses, importers cannot optimize overall inventory levels.

Infrequent inventory policy review misses changing patterns. As products move through their lifecycles and supply chains evolve, inventory policies must be regularly updated to remain effective.

Conclusion

Effective inventory management for importers requires specialized strategies that account for extended supply chains, variable lead times, and complex financial considerations. The most successful importers treat inventory optimization as a continuous process rather than a periodic activity, leveraging technology, data analytics, and strategic planning to balance service levels with working capital efficiency.

At GeeseCargo, we've helped clients achieve an average 28% reduction in inventory carrying costs while improving service levels by 5-8% through systematic inventory management approaches. The most effective strategies combine accurate forecasting, strategic buffer planning, technology enablement, and continuous improvement rather than relying on any single solution.

Begin your inventory optimization by conducting a comprehensive assessment of your current inventory performance, then develop a phased improvement plan that addresses your highest-impact opportunities. Remember that in import operations, inventory excellence isn't just about reducing costs—it's about creating competitive advantage through reliable availability, efficient capital utilization, and supply chain resilience.