Tensions in the Red Sea are flaring up again. As Houthi attacks on merchant vessels intensify, shippers moving goods between China and Europe are being forced to reevaluate routes, costs, and delivery timelines. If you source goods from China and rely on the Suez Canal, the renewed volatility could affect not only your freight bill but also your supply chain stability.

Yes, the resurgence of Houthi threats near the Bab al-Mandeb Strait is impacting Suez Canal traffic and driving up China-Europe freight rates. For shippers, this creates both cost and routing uncertainty.

In this article, we’ll unpack how these geopolitical risks affect your logistics, what alternatives exist, and how GeeseCargo is helping clients adapt rapidly in this volatile shipping climate.

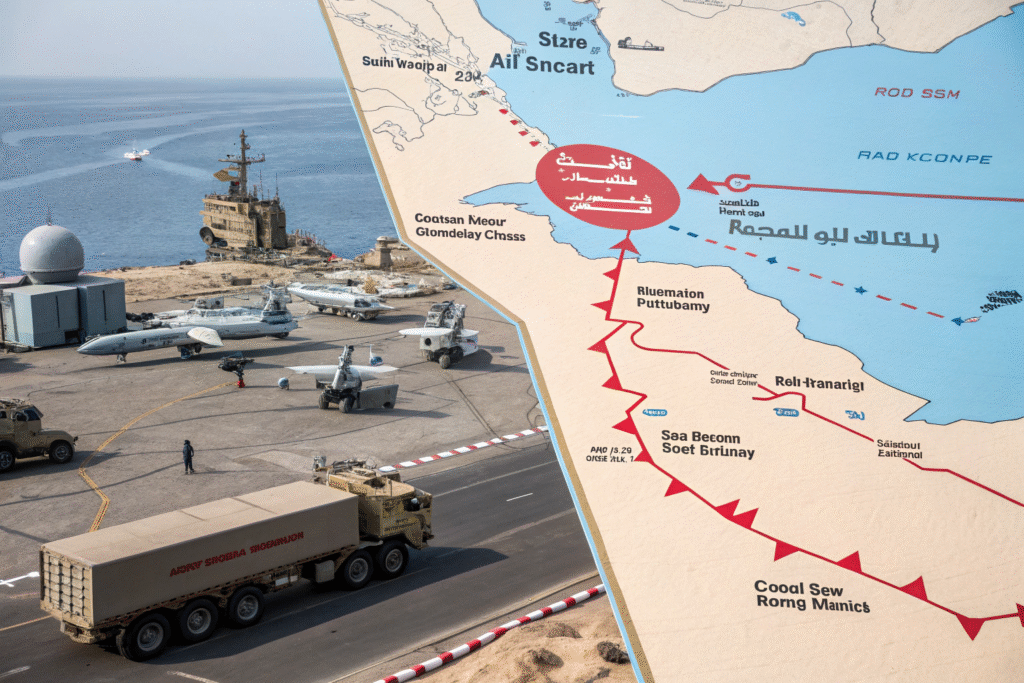

Why Is the Red Sea Becoming a High-Risk Zone Again?

Instability in the Red Sea isn’t new—but its resurgence is already disrupting the world’s busiest maritime routes. Dozens of global carriers have announced suspensions or diversions around the Cape of Good Hope, bypassing the Suez Canal altogether.

The Houthi group has launched multiple attacks on cargo ships near Yemen, prompting security alerts and increased insurance premiums. As a result, China-Europe shipments via Suez are facing longer transit times and surging costs.

What Specific Routes Are Affected?

The Bab al-Mandeb Strait, which connects the Red Sea to the Gulf of Aden, is a chokepoint for vessels transiting from Asia to Europe via the Suez Canal. Disruptions here force carriers like Maersk and MSC to reroute around Africa—adding 12 to 18 days of transit time.

What Are the Implications for Freight Pricing?

Detours increase fuel consumption, labor costs, and vessel wear, resulting in rate hikes. According to Xeneta, average spot rates from China to Europe via Suez are up over 45% since June 2025. War risk surcharges and maritime insurance have further amplified this burden for shippers.

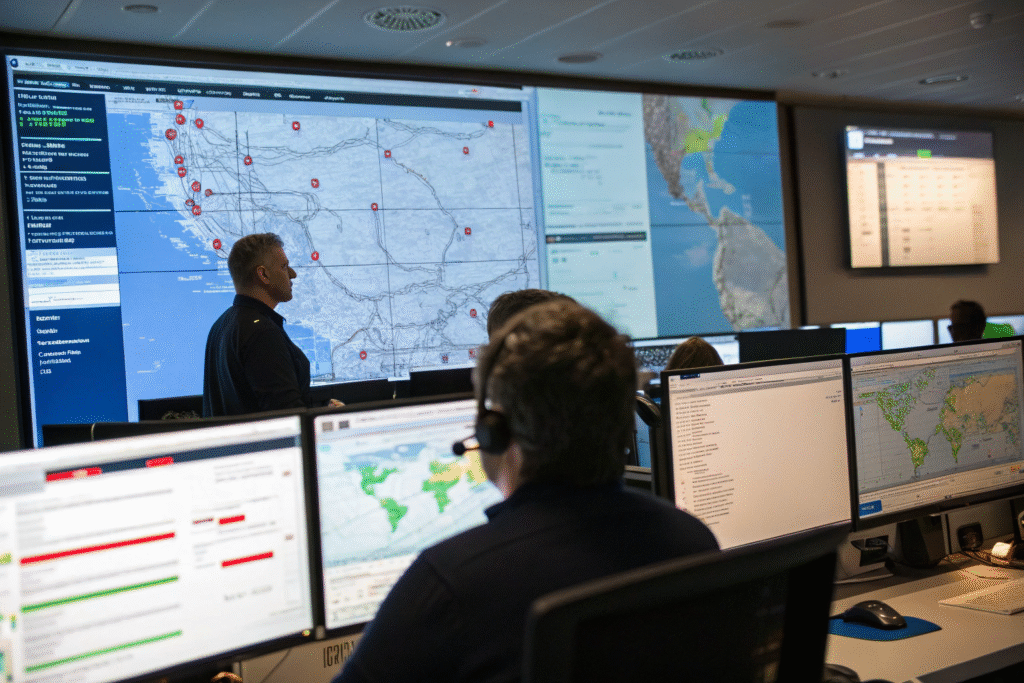

How Are Carriers and Forwarders Responding?

The shipping industry is responding fast—but unevenly. Some vessels are risking the Suez route under escort. Others are committed to Africa detours. In this confusion, a reliable freight forwarder makes a big difference.

Carriers are split between risk-mitigated Suez passage and full diversions via Cape of Good Hope. Forwarders like GeeseCargo help clients choose the best route based on cargo type, urgency, and budget.

Are All Shipments Affected Equally?

No. High-value goods and time-sensitive cargo are being prioritized for air freight or escorted Suez passage. Low-priority shipments are being grouped in slow steaming convoys via Africa. If you're shipping fashion or accessories for peak season, this change could shift your delivery window significantly.

What Kind of Support Can Freight Forwarders Offer?

GeeseCargo works closely with both global carriers and regional authorities to monitor developments. We offer dynamic routing based on security updates, vessel ETAs, and risk surcharges. Clients receive real-time alerts on port congestion and weather reroutes—keeping your operations agile and predictable.

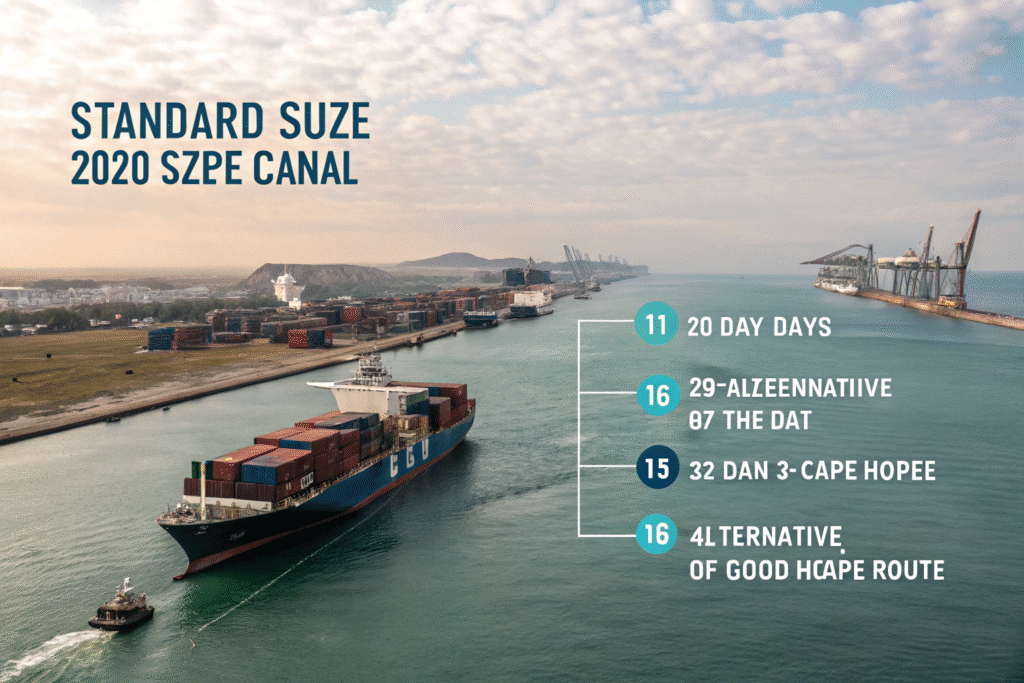

What’s the Impact on China-Europe Transit Times?

Transit delays are the most visible consequence. Rerouting adds two to three weeks of delivery time. For European buyers with fixed retail schedules, this is a logistical nightmare unless contingency plans are in place.

Transit times from China to Europe have jumped from 20 days to as long as 35 days due to route diversions. This can jeopardize seasonal launches and create warehouse bottlenecks.

How Long Will These Delays Continue?

It’s difficult to predict. If the geopolitical risks escalate or port authorities impose stricter vessel inspections, expect disruptions to continue through Q4 2025. Some carriers are even adjusting service contracts with longer validity periods to avoid re-negotiations under volatile conditions, as reported by The Maritime Executive.

What Can You Do to Reduce Delay Risk?

Start by planning 4–6 weeks ahead of your target delivery date. Also, diversify your transport modes—combining rail, sea-air options, or westbound rail via Kazakhstan to Europe. As RailFreight reports, rail volumes are rising as a strategic response to maritime uncertainty.

How Should You Adjust Your Budget and Logistics Plan?

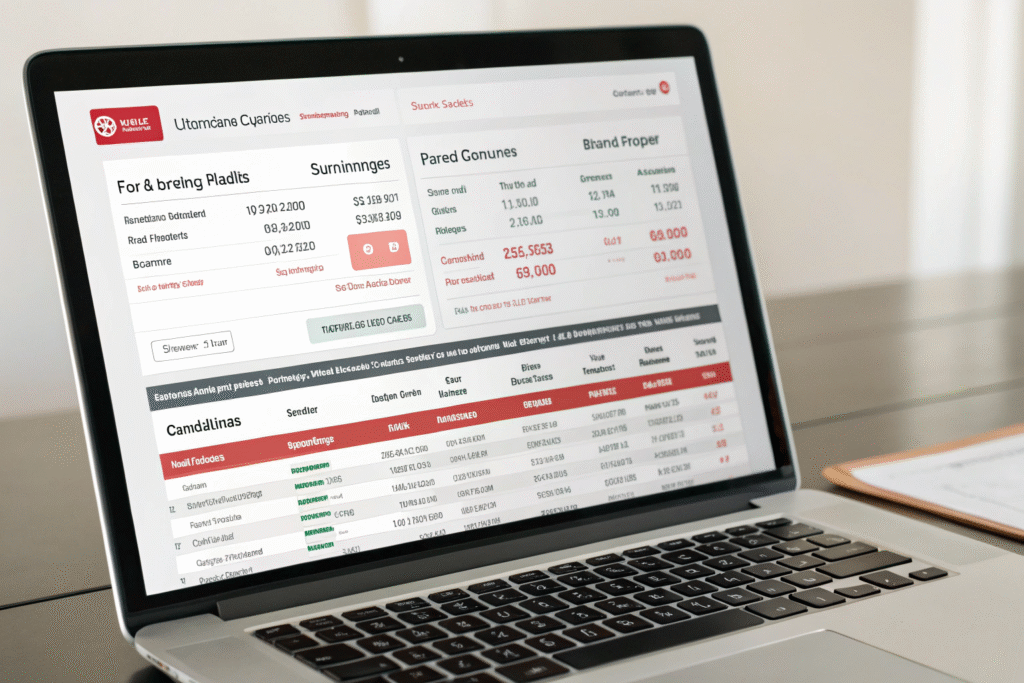

Beyond the operational impact, your financial planning also needs to adjust. Shippers need to account for potential re-quotes, contract renegotiations, and additional charges on invoices.

If your logistics budget hasn’t been updated since Q1 2025, you’re likely underestimating freight costs. You should add 20–30% buffer for China-Europe shipments and revisit your Incoterms for added flexibility.

Which Charges Are Likely to Appear on Invoices?

Expect to see “war risk surcharges,” “fuel adjustments,” and “emergency routing fees.” Some carriers are also imposing temporary congestion surcharges at ports like Hamburg or Antwerp due to slot bunching.

How Can GeeseCargo Help You Stay Competitive?

We negotiate with carriers weekly and share market briefings with our clients. We also offer routing simulations, showing price vs. time for each option. For clients in the apparel and accessories industry, we’ve helped reduce landed cost volatility by up to 22% using split-routing tactics and regional warehouses in Poland and Rotterdam.

Conclusion

The return of Red Sea risks is more than a headline—it’s a direct threat to supply chain predictability, costs, and timelines. For shippers relying on the Suez Canal, this crisis is forcing tough decisions: delay or divert? Pay more or plan earlier?

At GeeseCargo, we help you do both smartly. From flexible routing plans to 24/7 security updates and budgeting guidance, we’re not just your logistics provider—we're your crisis navigation partner. In this volatile time, agility is the new stability.

Stay ahead. Stay informed. And let GeeseCargo sail you through safely.