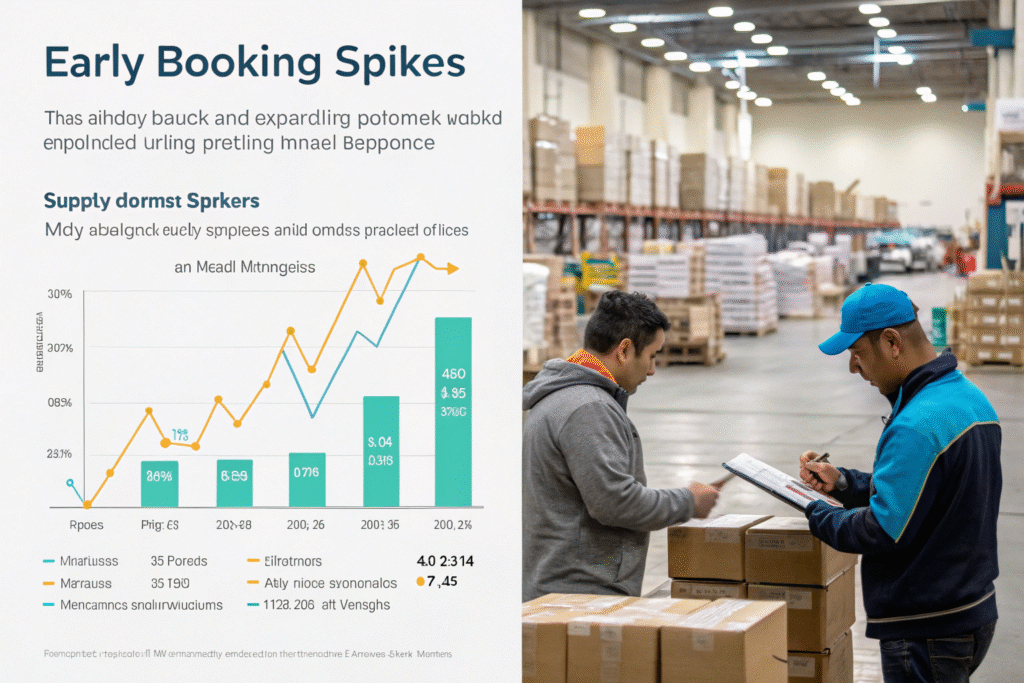

The traditional peak season in global shipping—especially from Asia to the U.S.—has long been August to October. But in 2025, something unexpected happened: the peak came early. By mid-June, capacity was tight, rates were climbing, and warehouse intake surged.

The peak season shifted to May–June. This caught many importers off guard—leading to missed shipments, higher costs, and supply chain strain. It’s a trend that might repeat in future years as buyer behavior and global risks evolve.

If you’re shipping clothing, accessories, or promotional goods from China, this shift matters. In this article, I’ll explain why the peak came early, how to spot early indicators next time, and how to prepare your supply chain.

Why Did the Peak Season Arrive Earlier in 2025?

The 2025 peak season wasn’t a random blip. Several global forces converged to shift demand forward by nearly two months.

Retailers, e-commerce sellers, and brand buyers pulled forward orders due to tariff uncertainty, inventory corrections, and early promotions. With carriers offering lower rates in Q2 and fears of Q3 congestion, the rush began.

What External Factors Triggered the Early Peak?

- U.S. Tariff Announcements: The threat of new tariffs from August pushed importers to clear inventory early.

- Inventory Recovery: Many sellers who understocked in Q1 rushed to replenish in Q2.

- Retail Promotions: Amazon and Walmart launched early summer campaigns in June, pulling demand forward.

- Carrier Announcements: Blank sailings in July warned of space cuts—prompting advance bookings.

According to Freightos, booking volumes in May surged by over 35% YoY, particularly on Asia–USEC routes.

Did This Affect Only Certain Industries?

No. While fashion and general merchandise led the surge, electronics and consumer goods followed closely. Clients shipping via DDP were among the first to respond, since we advised them of capacity tightening by late April.

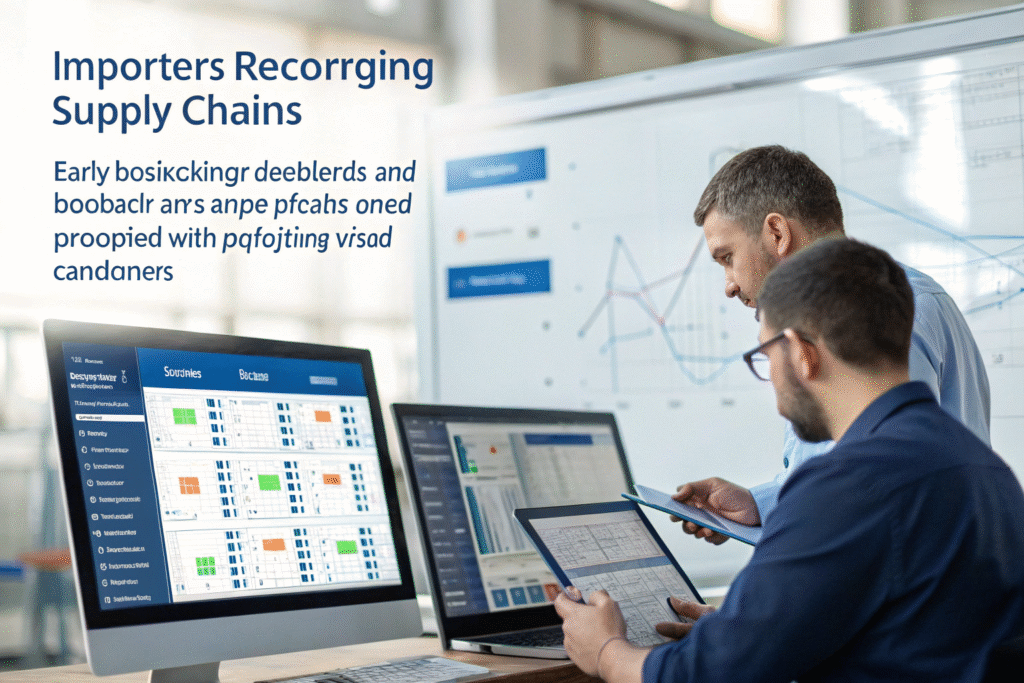

Importers relying on fixed shipping cycles (e.g., quarterly replenishment) faced the most disruption. Real-time flexibility became key.

Will Peak Season Shift Again in the Future?

Peak season is no longer fixed. It’s a moving target shaped by market psychology, economic policies, and retailer strategy.

We expect future peak seasons to be flexible, with early waves becoming more common. Importers must adapt from fixed timelines to dynamic models based on data.

What Are the New Indicators to Watch?

- Tariff timelines – Watch for any announced duty changes from USTR (ustr.gov)

- Retail calendars – Monitor early campaigns by Amazon, Target, and Walmart

- Carrier announcements – GRI and blank sailing notices are signals

- Port data – Weekly throughput published by PIERS shows booking surges

We provide clients with alerts using AI-based forecasting tools like project44, which combine vessel space, consumer sentiment, and booking data.

Could This Trend Become the New Normal?

Quite possibly. If retailers keep shortening sales cycles, tariffs remain volatile, and logistics costs fluctuate mid-year, the May–June peak may become standard.

Carriers are also adjusting—shifting contract seasons forward and repositioning vessels earlier. As forwarders, we’re already prepping for early peak planning in Q2 2026.

How Should Importers Adjust Their Logistics Strategy?

If you plan like it’s 2019, you’ll get left behind. To avoid delays and rate surges, your planning needs to move up—starting as early as March for May departures.

We advise our clients to build flexible Q2 booking calendars, lock in rates early, and maintain PO-level shipment control. Your supply chain can’t afford to be reactive anymore.

When Should I Start Planning for the Next Peak?

Here’s a practical guide:

| Task | Timeline |

|---|---|

| Review SKUs and demand forecasts | February |

| Get supplier lead times | Early March |

| Request freight forwarder forecasts | Mid March |

| Lock in space and rates | April |

| Begin staged shipments | May |

Tools like Shifl allow advance booking visibility and rate comparisons. We also offer shipment spread planning to avoid cargo congestion.

How to Avoid Getting Caught in the Rush?

- Ship partial POs earlier (even if storage needed)

- Diversify ports of entry (e.g., NY + Savannah)

- Use LCL consolidation to get rolling bookings

- Ask your forwarder for blank sailing alerts

We helped clients this year avoid $1,200/FEU rate surges simply by booking in April. That’s the power of forward-looking planning.

What Role Do Freight Forwarders Play in Seasonal Shifts?

When seasons shift, you need a logistics partner that watches every signal. That’s our job. We don’t just book space—we study trends, negotiate buffer slots, and warn you before problems hit.

At GeeseCargo, we helped over 85% of our May–June shippers avoid rate hikes by preparing in Q1.

What Can We Do Differently for You?

- Provide 60-day booking visibility dashboards

- Offer split-mode options (air + ocean) for early SKUs

- Update you on GRIs, port congestion, and demand forecasts weekly

- Negotiate seasonal space quotas in advance with carriers

We use platforms like Xeneta and our internal contract network to get space you can’t find last minute.

Should You Change Contracts or Terms?

Yes—if you’re still relying on month-by-month spot rates. Consider:

- Seasonal fixed-rate contracts for Q2-Q3

- DDP shipping to include duty + last mile delivery in one

- Rolling bookings across 2–3 carriers to stay flexible

Smart clients are now asking for “May-ready” plans instead of “August peak” strategies. We’re already building those models with them.

Conclusion

The 2025 peak season shift to May–June was a wake-up call. Rates rose, space vanished, and unprepared shippers lost money. But those who planned early came out ahead.

Will it happen again? Most likely. Global shipping no longer follows a fixed calendar. At GeeseCargo, we’re watching the trends and helping our clients stay ahead. Let us help you build a plan for 2026 that’s flexible, data-driven, and peak-ready—no matter when it comes.