As July unfolds, the National Retail Federation (NRF) has predicted a significant surge in U.S. import volumes, followed by a steep drop in August. For importers sourcing goods from China, this volatile cycle brings both opportunities and critical risks. Misaligned shipping schedules and fluctuating rates can erode profit margins in a heartbeat.

To stay competitive, importers must rethink their China–U.S. ocean freight strategy—balancing peak season urgency with post-peak rate optimization. Choosing the right logistics partner and aligning with real-time market shifts is now more essential than ever.

Whether you're shipping clothing, accessories, or promotional goods from Chinese ports like Ningbo, Shenzhen, or Qingdao, you must adapt to these dynamic volume patterns. Let’s dive into how smart importers can adjust for this volatile 2025 summer freight season.

What causes July's peak and August's expected decline?

This year, the surge in imports is largely driven by early back-to-school shipments, Prime Day sales stocking, and retailers frontloading inventory ahead of a possible tariff shift in Q4. Once these orders clear U.S. ports, volumes are projected to sharply dip.

Understanding this forecast allows importers to book space early while avoiding inflated post-peak costs.

Why are retailers frontloading shipments this year?

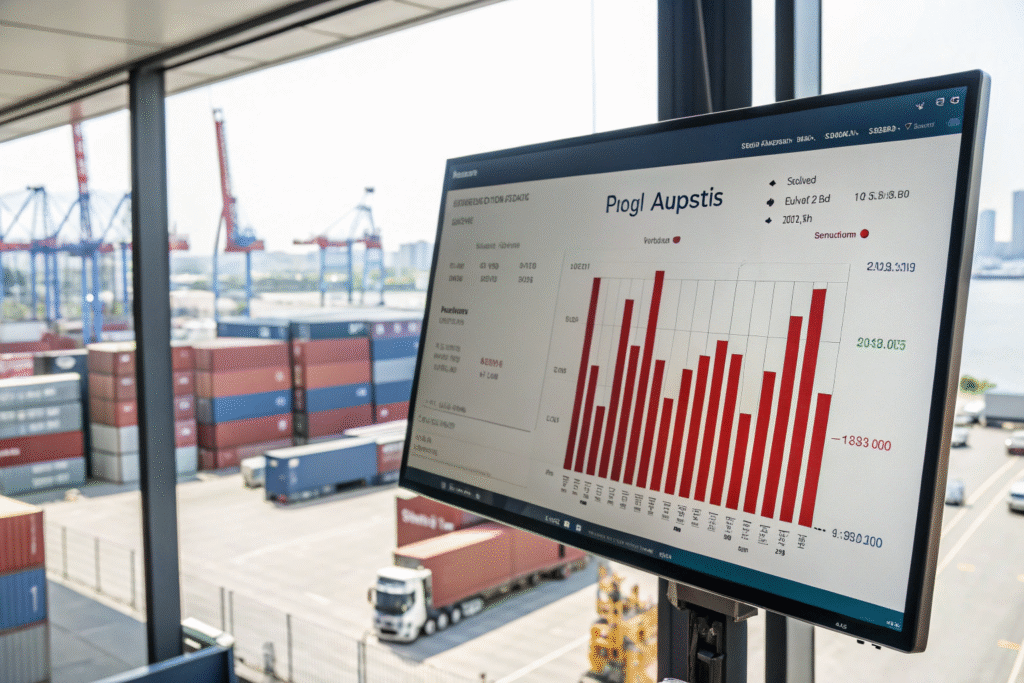

Retailers anticipate tariff policy shifts, labor disputes, and uncertain demand later in the year. These uncertainties push large U.S. chains to accelerate purchase orders and compress their shipping timelines. According to NRF’s Global Port Tracker, July 2025 could see the highest container volumes since 2022.

Also, Amazon Prime Day and other e-commerce events contribute to seasonal frontloading, especially for fast-moving items. By moving goods earlier, importers reduce the chance of delays caused by vessel rollovers or port congestion, which were common in the past few summers.

What risks do importers face if they don't adjust?

Those who delay bookings into August might assume they’ll catch lower rates but may instead face blank sailings or equipment shortages. Carriers often cut capacity sharply post-peak, leaving last-minute shippers scrambling.

A lack of space, especially from Tier 2 ports, leads to increased origin charges and forced rerouting. As noted by FreightWaves, failure to plan around these cycles can create bottlenecks at both ends—hurting warehouse operations and sales launches.

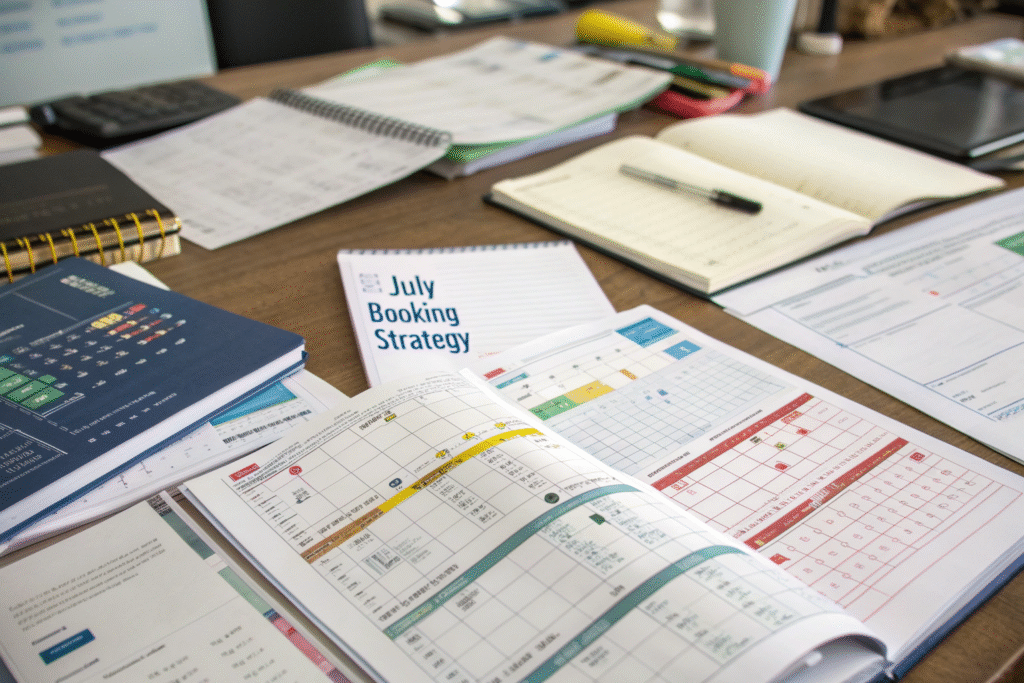

How to time bookings around seasonal freight cycles?

Planning freight movements aligned with market volume patterns gives importers a significant advantage. With July nearing its peak, now is the time to finalize all bookings for early August delivery.

Waiting until August to act could lead to shipment rollovers or higher fees due to constrained capacity.

Should importers prioritize FCL or LCL during volatility?

If you’re shipping from China to the U.S., FCL (Full Container Load) generally gives better control and predictability during volatile cycles. FCL shipments lock in a full box, offering a buffer against volume-driven pricing or space constraints.

That said, LCL (Less than Container Load) can still be effective for smaller importers, especially if working with a reliable consolidator. Platforms like Flexport allow better tracking and rate transparency in peak seasons.

| Criteria | FCL Shipping | LCL Shipping |

|---|---|---|

| Cost per unit | Lower | Higher |

| Speed | Faster | Moderate |

| Risk of Delay | Lower | Higher |

| Best for | Large loads | Small batches |

How do GeeseCargo help optimize container booking?

At GeeseCargo, we work closely with clients to pre-block container space ahead of peak volume weeks. Our network across Ningbo, Shanghai, and Xiamen allows us to anticipate port congestion and reroute as needed.

Using tools like Maersk Flow Pro and our DDP tracking systems, we monitor both ETDs and ETAs. With our long-standing relationships in China and the U.S., we quickly pivot in response to capacity cuts or rate fluctuations—ensuring your supply chain remains stable even in July’s chaos.

How to protect margins when ocean rates swing wildly?

When rates spike in July and fall hard in August, the wrong booking can erode thousands from your margins. Importers need to adopt contract strategies and backup routing plans.

Flexible agreements and tech-enabled freight visibility can cushion you against extreme price swings.

What freight contracts help stabilize price exposure?

A blend of spot and fixed-rate contracts is ideal in this climate. Spot rates offer agility during downturns, while fixed agreements provide cost protection during July’s surge. Some clients also explore NAC contracts or index-linked rates for partial stability.

Leading ocean carriers like CMA CGM and freight forwarders like GeeseCargo also offer blank-sailing alerts, helping buyers dodge high-risk departure weeks.

Are there ways to predict rate trends more accurately?

Yes, especially with tools that analyze market indicators such as BAF surcharges, capacity forecasts, and sailing schedules. Platforms like Xeneta offer insights on historical and predictive trends by lane and vessel type.

At GeeseCargo, we integrate this intel into your weekly freight updates. Our system flags volatility windows so you can adjust PO release dates accordingly—protecting not just your freight cost, but your inventory turnover ratio too.

What can importers do post-peak to stay agile?

Post-July, importers must shift from urgency to optimization. With ocean rates falling, this is the best time to renegotiate, bundle shipments, and trial alternate carriers.

A proactive post-peak strategy can turn soft seasons into high-margin wins.

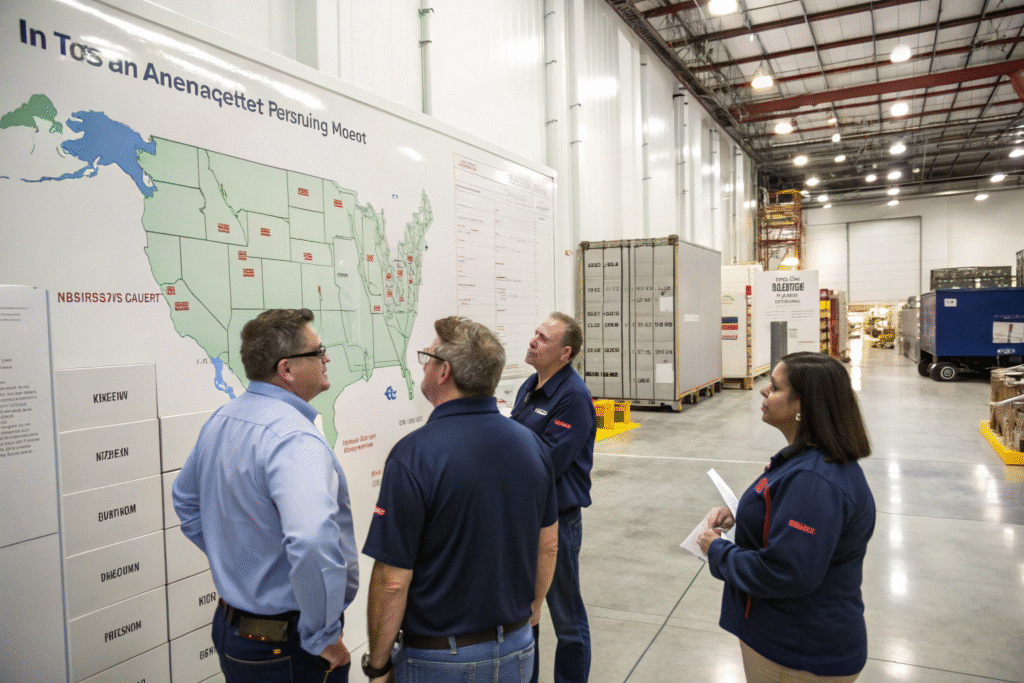

Should shippers consider alternate port routes?

Absolutely. With fewer vessels on the water in August, using underutilized U.S. ports like Oakland or Houston can cut transit times and inland drayage costs. At origin, less busy Chinese ports like Nansha or Taicang offer faster gate-outs and lower congestion.

Many importers in 2024 began leveraging trans-Pacific express lanes, like Matson’s CLX, to dodge overbooked mainline routes. These options, while niche, can offer smoother logistics in post-peak valleys.

How can GeeseCargo support post-peak scaling?

After July’s peak, we help clients optimize container pooling, switch to partial-load air or express ocean, and scale down DDP door delivery when warehouse congestion hits. Our multimodal options keep your goods flowing across seasons.

Whether you’re shipping from Guangzhou, Yiwu, or Tianjin, our routing experts identify volume-compatible carriers and relay real-time ETA variance. This reduces idle inventory, unlocks faster replenishment, and sharpens your retail competitiveness.

Conclusion

As the NRF predicts a classic boom-and-drop in July-August freight, importers who adapt early will win. Timing bookings, hedging rates, and working with agile partners like GeeseCargo can make the difference between margin gains or freight losses.

With deep roots across China’s port ecosystem and decades of experience, we understand how to stabilize your supply chain amid wild ocean cycles. Don’t let seasonal freight chaos dictate your bottom line—let GeeseCargo help you sail smart, not just fast.