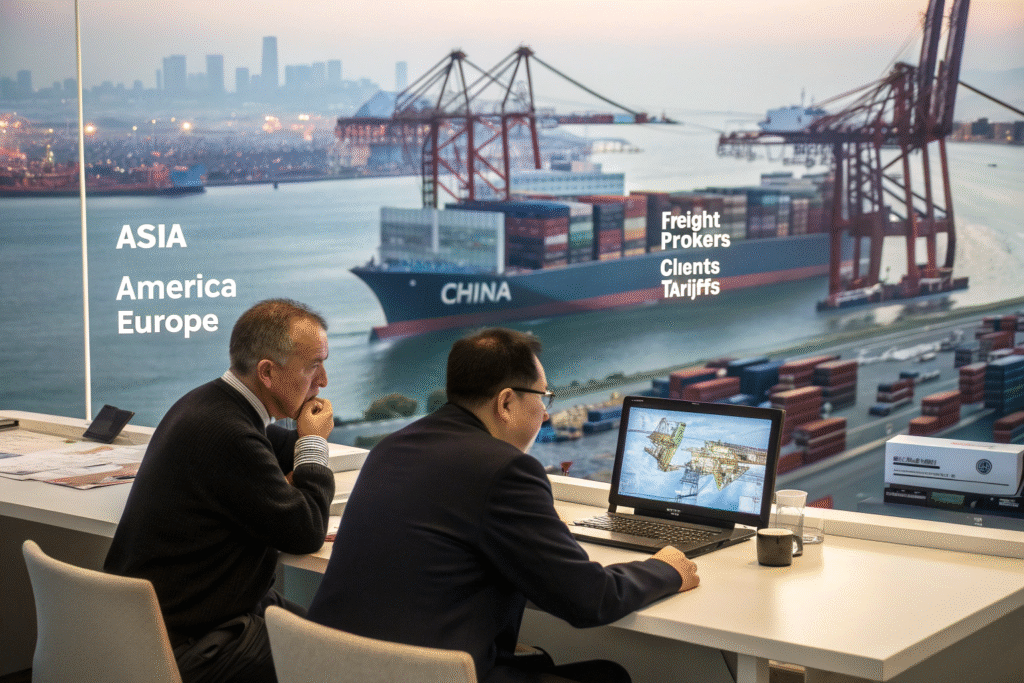

The August 1 tariff adjustment is shaking up the entire import-export industry—and if you're sourcing goods from China to the US or Europe, this matters more than ever.

New reciprocal tariff policies implemented by the U.S. and several EU countries as of August 1, 2025, will alter shipping costs, tax rates, and compliance requirements for exporters and importers. You need a clear strategy to avoid hidden fees and delays.

As the founder of GeeseCargo, I’ve helped hundreds of American and European clients navigate trade changes over the years. This one is different. These aren’t just minor hikes—they’re structured responses to existing tariffs, and they’ll impact nearly every container we help ship. If you're sourcing from China, understanding what changed and how to act will protect your margins.

What’s Changing Under the New Reciprocal Tariff Rule?

These tariffs target reciprocity. If a country places 15% tariffs on imports, they should now expect the same rate back.

The U.S. and EU have adopted a synchronized reciprocal approach to international tariffs effective August 1, 2025. The core principle is simple: match tariffs imposed by a trade partner, sector by sector. While it seems fair, the consequences for shippers and importers are complex.

What Products Are Most Affected?

In our lane—freight forwarding between China and the U.S.—textiles, consumer electronics, toys, and household goods face major shifts. For instance, if the U.S. imposes a 20% tariff on Chinese-made headphones, China now imposes the same 20% on equivalent American exports.

How Are Logistics Providers Responding?

Freight forwarders like us must now proactively account for these changing duty rates. We've integrated customs intelligence software that tracks U.S. Harmonized Tariff Schedule updates in real time. We also cross-check against China Customs Tariff Database. It’s not optional—clients demand transparency and efficiency.

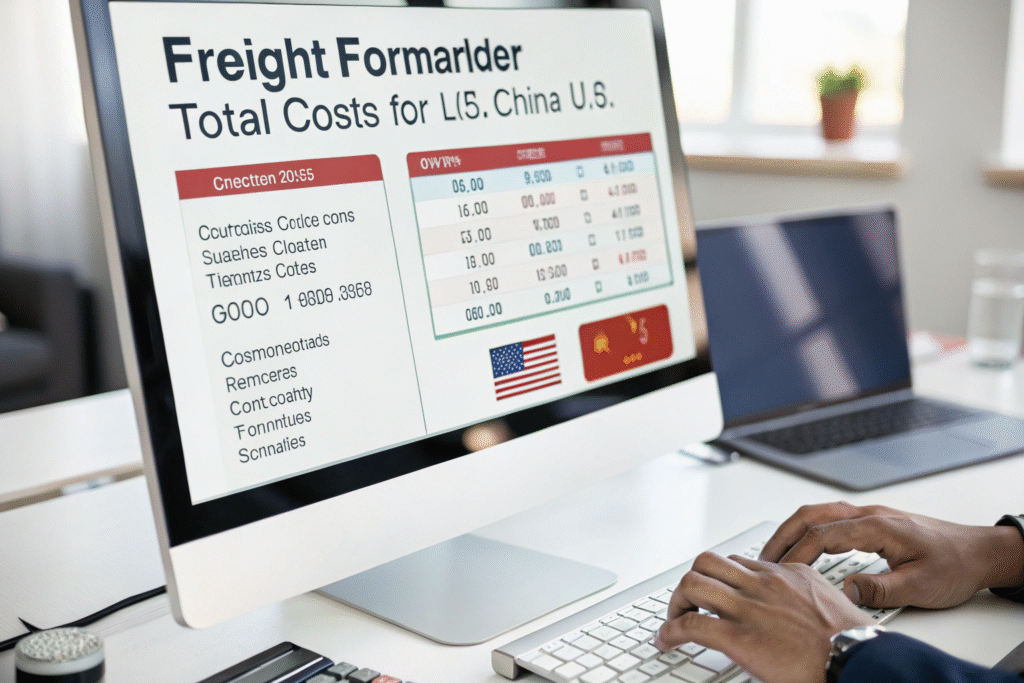

Will These Tariffs Increase Your Total Landed Costs?

Yes—tariffs will directly increase your total landed cost unless mitigated by smart routing or duty relief strategies.

Tariff surcharges are now calculated at port entry based on declared value and category. If you're importing high-volume goods, the extra 5–20% duties could destroy profit margins without a proper plan.

What Is Total Landed Cost and Why Does It Matter?

Your total landed cost includes freight, customs duties, taxes, and inland delivery. With the August 1 tariff rules, you must update your product pricing or shift logistics methods—such as choosing DDP shipping—to maintain predictability.

Can DDP Services Offset These New Tariffs?

Absolutely. At GeeseCargo, our DDP Door-to-Door service bundles duty, customs clearance, and final mile delivery into one all-inclusive rate. This is ideal for brands who need accurate cost forecasting in the wake of tariff fluctuations. Learn how DDP works globally.

How Should You Update Your Freight Strategy Now?

You need to reassess Incoterms, pricing contracts, and inventory lead times—fast.

It’s not enough to react. You need a proactive approach to keep your goods moving with minimal cost disruptions. Many buyers are restructuring supplier contracts with built-in buffer clauses to absorb tariff shocks.

Should You Switch from FOB to DDP Terms?

FOB might offer control at origin, but it exposes you to unpredictable tariffs at destination. DDP terms can shield you from that—especially if your logistics partner handles end-to-end customs, like we do.

How Can You Minimize Shipping Delays?

Work with a forwarder that pre-clears cargo using digital customs systems. We’ve synced our platform with ACE (Automated Commercial Environment) and China’s Single Window to reduce customs holds that are increasing due to stricter inspections.

What Are the Long-Term Implications for Global Trade?

The shift toward reciprocity will pressure all parties—buyers, sellers, and forwarders—to become more agile and better informed.

The goal of reciprocal tariffs is fairness, but in practice it leads to more complexity and documentation. We expect some brands to shift manufacturing to lower-tariff regions, though this often takes years.

Will Trade Routes Shift to Avoid Tariffs?

Some already are. We’ve seen clients pivot to exporting via Vietnam or Malaysia to circumvent high tariffs on Chinese-origin goods. However, origin tracing enforcement is tightening, so this isn't risk-free.

What Role Will Freight Forwarders Play in the New Trade Era?

A larger one. We're no longer just moving boxes—we’re interpreting tariff codes, advising on duty optimization, and planning routing strategies. Your freight forwarder is now your supply chain advisor.

Conclusion

The August 1, 2025 reciprocal tariff shift marks a new phase in global trade. For importers shipping from China to the U.S. and Europe, understanding these rules isn't optional—it's mission-critical. From product classification to Incoterm renegotiation, every detail affects cost, delivery, and compliance.

If you're unsure how these tariffs affect your next shipment, or if you want to secure a stable, transparent freight solution under DDP or other shipping terms, reach out to us. At GeeseCargo, we’ve been navigating tariff changes for years. Let’s make your freight secure, efficient, and profitable.

Contact Ben Zhu at benzhu@geesecargo.com to start optimizing your logistics today.