With ongoing disruptions in ocean shipping and the high costs of air freight, many businesses are exploring China-Europe rail as a potential solution. The China-Europe Railway Express has grown dramatically, but questions remain about its reliability, cost-effectiveness, and suitability for different types of cargo. Understanding the real-world performance of rail freight helps determine if it fits your specific supply chain needs.

Rail freight from China to Europe offers an excellent alternative for time-sensitive goods that don't justify air freight costs, typically cutting transit time by 50-60% compared to sea freight while costing 70-80% less than air freight. The 18-22 day transit time and growing reliability make rail particularly attractive for electronics, automotive parts, and mid-value consumer goods.

Let's examine the specific advantages, limitations, and practical considerations of using China-Europe rail services for your shipments.

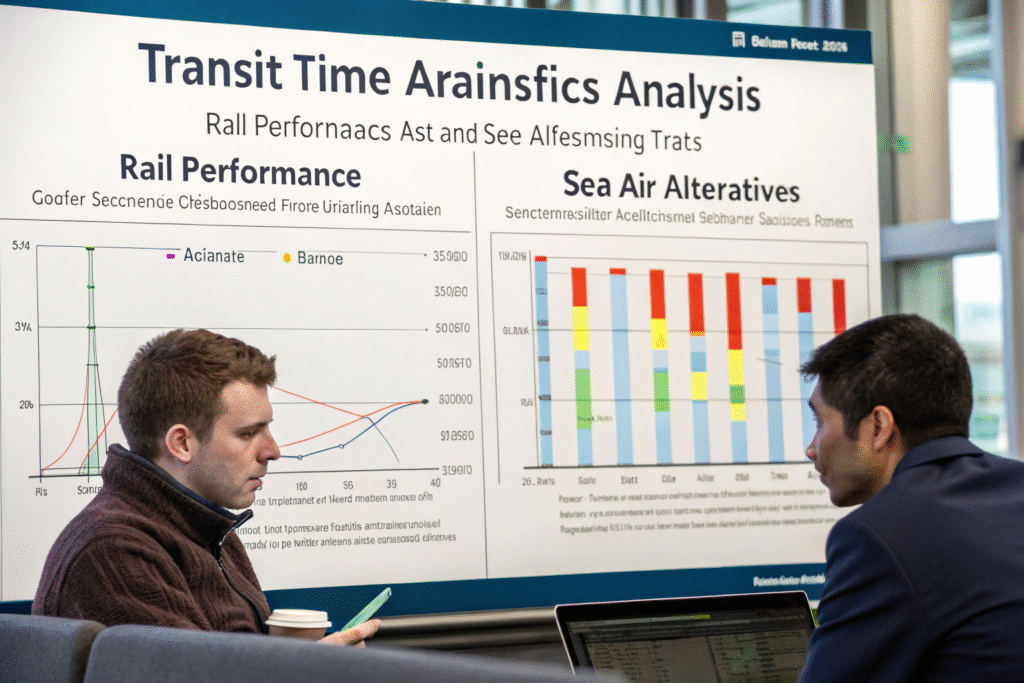

What are the actual transit times and reliability?

Transit time consistency represents one of rail's most significant advantages over sea freight, though actual performance varies by specific route and terminal pairs. Understanding the realistic timelines helps set proper expectations for your supply chain planning.

The main China-Europe rail routes typically require 18-22 days from Chinese departure to European arrival, with western Chinese cities like Xi'an and Chengdu offering the fastest services. This compares favorably to 35-45 days for sea freight and 3-5 days for air freight. Reliability has improved significantly, with most services now achieving 85-90% on-time performance. However, border crossings—particularly at Khorgos between China and Kazakhstan, and at various EU entry points—remain potential bottlenecks that can add several days during peak periods or political disruptions.

How do different departure cities affect transit times?

Major Chinese rail hubs offer varying performance:

- Xi'an: 16-18 days to Germany (fastest and most frequent services)

- Chengdu: 18-20 days to Poland (strong electronics specialization)

- Chongqing: 19-21 days to Duisburg (established automotive route)

- Zhengzhou: 18-22 days to Hamburg (growing frequency and reliability)

- Yiwu: 20-24 days to Madrid (small commodities specialization)

Selecting the optimal departure city based on your factory locations and destination provides meaningful time savings.

What causes transit time variability?

Several factors influence actual delivery times:

- Border processing efficiency at China-Kazakhstan and Belarus-Poland crossings

- Weather conditions particularly during harsh winter months

- Political relations between transit countries affecting customs cooperation

- Infrastructure maintenance requiring temporary route adjustments

- Volume fluctuations during peak seasons creating congestion

Understanding these variables helps build appropriate buffer time into your planning.

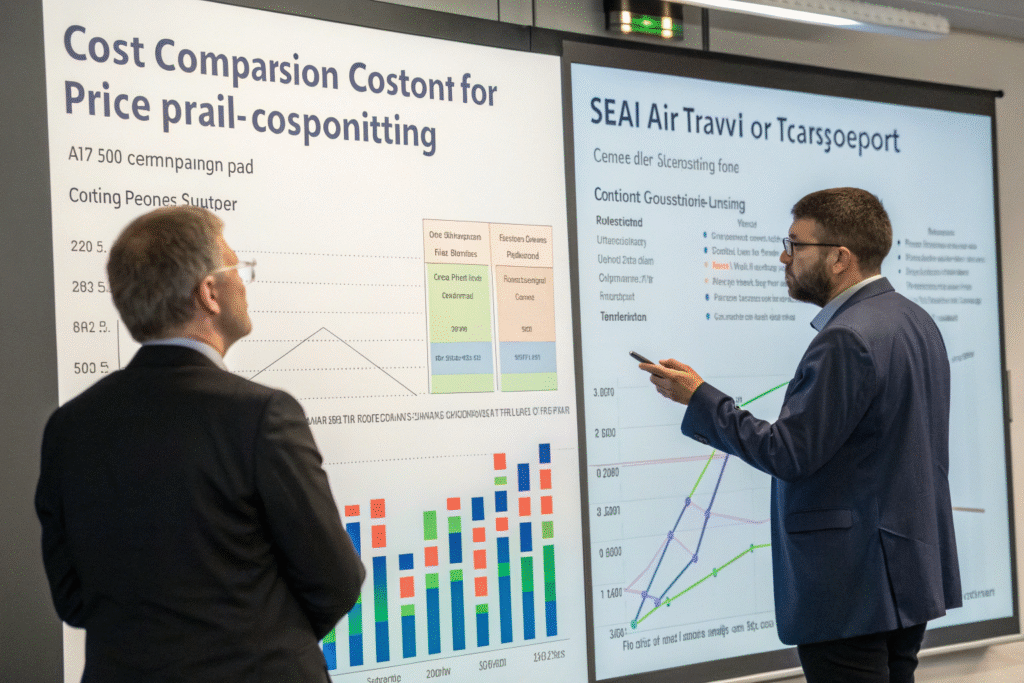

How do costs compare to other transport modes?

Rail freight occupies a unique middle ground in the cost spectrum between ocean and air transportation. While exact pricing fluctuates with market conditions, the fundamental value proposition remains consistent for specific types of shipments.

Rail typically costs 2-3 times more than sea freight but only 20-30% of air freight costs. For a standard 40-foot container, rail costs approximately $8,000-12,000 compared to $3,000-5,000 for sea freight and $40,000-60,000 for equivalent air cargo capacity. This positioning makes rail particularly economical for mid-value goods where inventory carrying costs and market timing justify the premium over sea freight but cannot support air freight expenses. Additionally, rail's consistent transit times can reduce safety stock requirements, providing hidden cost savings.

What factors influence rail freight pricing?

Key cost drivers include:

- Fuel prices affecting traction costs across the long journey

- Exchange rates between Chinese yuan and European currencies

- Infrastructure fees charged by multiple transit countries

- Equipment availability and repositioning costs for containers

- Government subsidies that vary by Chinese departure city

- Market competition between different rail operators

Understanding these factors helps anticipate price changes and negotiate effectively.

What hidden costs should you consider?

Beyond published freight rates, consider:

- Terminal handling charges at both origin and destination

- Customs clearance fees in multiple transit countries

- Security requirements and associated compliance costs

- Insurance premiums reflecting rail's risk profile

- Documentation processing for complex cross-border requirements

These additional costs typically add 15-25% to base rail freight rates.

What types of goods are best suited for rail transport?

Rail freight isn't optimal for all commodities. Understanding which products benefit most from rail's specific advantages ensures you select the right transportation mode for each shipment category.

Electronics, automotive components, industrial equipment, and mid-value consumer goods represent ideal candidates for rail transport. These products typically have sufficient value to justify the cost premium over sea freight but don't require the extreme speed of air transport. Additionally, goods sensitive to maritime conditions like humidity and vibration often arrive in better condition via rail. However, ultra-heavy machinery, hazardous materials, and temperature-controlled cargo face more restrictions and require special arrangements on rail routes.

What commodities show the strongest rail performance?

Ideal rail candidates include:

- Consumer electronics with moderate value and time sensitivity

- Automotive components supporting just-in-time manufacturing

- Industrial machinery requiring careful handling

- Apparel and textiles with seasonal timing requirements

- Medical equipment needing faster delivery than sea allows

- Home appliances with sufficient value density

These commodities consistently demonstrate the best rail transportation economics.

What restrictions or challenges exist for certain goods?

Some products face limitations:

- Dangerous goods requiring special approvals and equipment

- Perishable items needing consistent temperature control

- Oversized equipment facing gauge restrictions in certain sections

- High-value luxury goods with security concerns

- Food products subject to complex customs inspections

Understanding these constraints prevents problematic shipments and delays.

How does rail service reliability compare to alternatives?

Reliability has become a key differentiator for China-Europe rail services as infrastructure matures and operational experience grows. While not matching air freight's near-perfect reliability, rail consistently outperforms sea freight in schedule adherence.

Modern rail services achieve 85-90% on-time performance compared to 60-75% for sea freight and 95%+ for air cargo. The primary advantage over sea freight comes from rail's immunity to weather disruptions and port congestion that frequently delay ocean vessels. However, rail remains vulnerable to border processing delays, political disputes between transit countries, and occasional infrastructure issues. For businesses needing better predictability than sea freight but unable to justify air costs, rail offers a compelling reliability compromise.

What operational improvements have enhanced reliability?

Recent advancements include:

- Digital documentation reducing border processing time

- GPS tracking providing real-time visibility and issue detection

- Standardized processes across different rail operators

- Infrastructure upgrades at critical border crossings

- Coordinated scheduling between different national rail systems

These improvements have steadily increased reliability year over year.

What disruptions still affect rail services?

Common challenges include:

- Political tensions between countries along the route

- Customs policy changes requiring procedural adjustments

- Extreme weather during winter months in Central Asia

- Technical failures of locomotives or rail infrastructure

- Security incidents requiring route diversions

While less frequent than sea freight disruptions, these issues still require contingency planning.

Conclusion

China-Europe rail freight has matured into a viable middle-ground transportation option that genuinely competes with both sea and air freight for specific types of shipments. Its 18-22 day transit time, 70-80% cost savings versus air freight, and steadily improving reliability make it particularly attractive for electronics, automotive components, industrial equipment, and other mid-value goods. While not suitable for all commodities or budgets, rail offers a strategic alternative that can reduce supply chain risk, lower inventory carrying costs, and provide more predictable delivery than ocean transport. Businesses that carefully evaluate their product characteristics, timing requirements, and total cost considerations increasingly find that rail deserves a permanent place in their multimodal transportation strategy alongside traditional sea and air options.