Last month, one of our clients saved $3,200 by switching from LCL to FCL after their shipment volume grew. As the founder of GeeseCargo, I've helped hundreds of businesses optimize their container choices. The decision between LCL and FCL isn't just about current costs—it's about understanding your growth trajectory and total supply chain impact.

LCL (Less than Container Load) costs more per cubic meter but offers flexibility for smaller shipments. FCL (Full Container Load) provides better rates for larger volumes but requires committing to container-sized quantities. The breakeven point typically occurs around 15-18 cubic meters, but multiple factors influence the final decision.

Choosing between LCL and FCL involves more than simple math. It affects your inventory costs, risk exposure, and supply chain flexibility. Let's examine how to make the right choice for your specific situation.

How Do You Calculate the True Cost Difference?

Many businesses compare only the ocean freight rates, missing crucial hidden costs that impact total expenses. A comprehensive cost analysis reveals the actual financial picture.

What Are the Direct Shipping Cost Components?

LCL pricing includes a freight rate per cubic meter or ton plus multiple additional charges. Terminal handling charges (THC) apply to both LCL and FCL but differ significantly. FCL offers a flat rate per container regardless of how much space you utilize within legal limits.

LCL shipments incur consolidation and deconsolidation fees that FCL avoids. Both options pay port charges, but LCL often has higher documentation fees per shipment. The basic ocean freight represents only 60-70% of total shipping costs for most shipments.

For accurate comparisons, request all-in quotes from your freight forwarder. Ensure both LCL and FCL quotes include the same service scope. Remember that currency fluctuations affect both options differently due to their pricing structures.

How Do Hidden Costs Impact Your Decision?

Inventory carrying costs represent the most significant hidden factor in shipping decisions. LCL's faster transit times reduce inventory in transit, freeing up working capital. FCL's economies of scale must offset longer inventory holding periods.

Damage risk increases with LCL due to additional handling during consolidation. Insurance rates may differ between the two options based on risk assessment. Storage charges at destination can vary significantly between LCL and FCL clearance processes.

Consider your cost of capital when evaluating the financial impact. Faster turnover through LCL might justify higher shipping costs for high-margin products. Calculate total supply chain cost rather than focusing solely on transportation expenses.

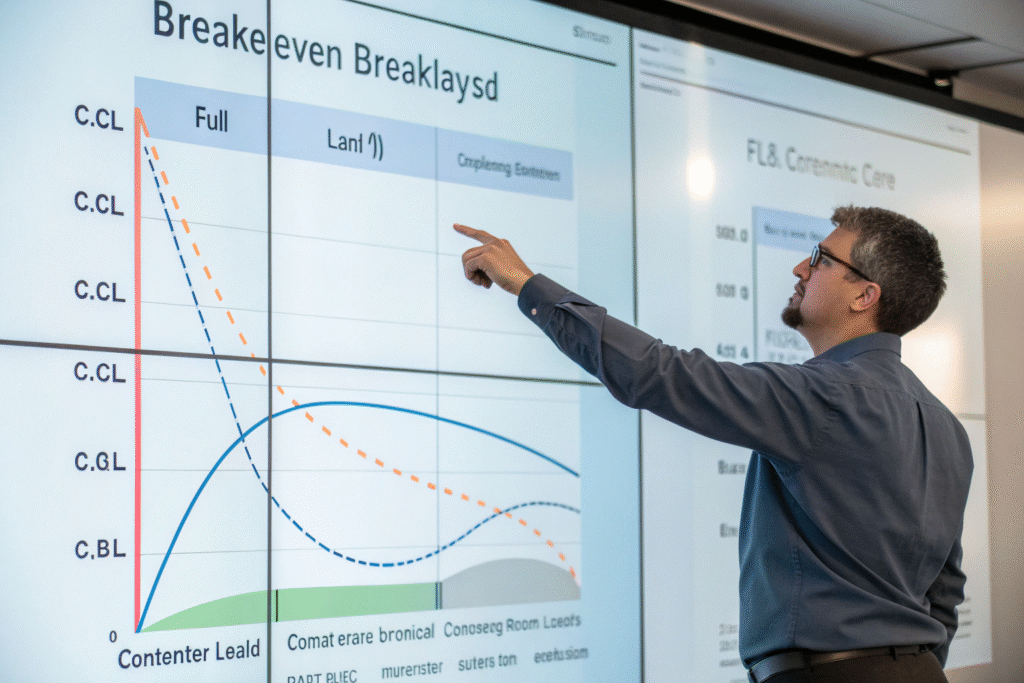

Where Is the Breakeven Point for Your Shipment?

The volumetric breakeven point provides a starting point, but your specific circumstances may shift this threshold. Understanding the variables helps you make informed decisions.

What Is the Standard Volumetric Breakeven?

Industry standards suggest 15-18 cubic meters as the general LCL/FCL breakeven range. At 15 CBM, LCL and FCL costs typically equalize for main trade lanes. This varies by route, with Asia-Europe sometimes reaching 20 CBM breakeven points.

The calculation changes for high-weight, low-volume cargo. Weight breaks rather than volume may determine your optimal choice. Container type selection also affects the equation—40-foot containers have different economics than 20-foot units.

Actual breakeven analysis requires current market rates from your specific lanes. Peak season surcharges affect LCL and FCL differently, shifting the breakeven point. Regular rate monitoring ensures you recognize when your shipment pattern crosses the threshold.

How Do Product Characteristics Influence the Decision?

High-value goods often justify LCL despite volumetric inefficiency. The faster turnover and reduced inventory exposure offset higher per-unit shipping costs. Perishable items benefit from LCL's faster transit despite premium pricing.

Fragile products may require FCL to minimize handling damage risks. Oversized items that consume disproportionate container space change the calculation. Hazardous materials have different restrictions and costs for LCL versus FCL.

Your product's margin structure significantly impacts the decision. Low-margin products cannot absorb LCL premiums without eroding profitability. Consider your complete cost structure rather than isolation shipping expenses.

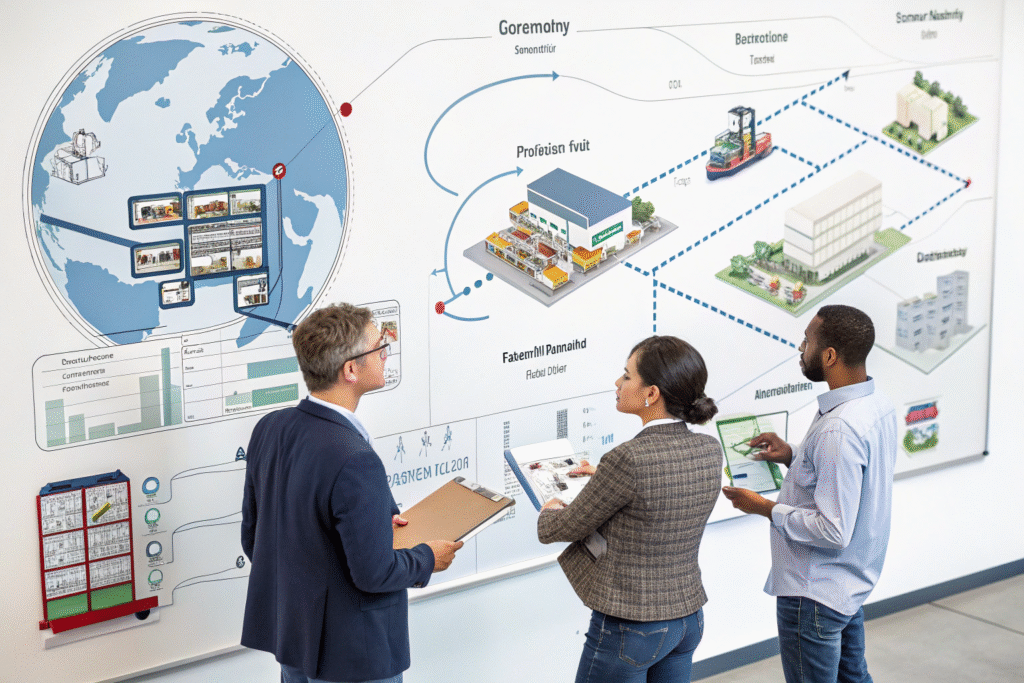

How Does Supply Chain Strategy Affect the Choice?

Your broader supply chain objectives should influence container selection beyond immediate cost calculations. Strategic considerations often outweigh temporary cost advantages.

When Does Flexibility Outweigh Pure Cost?

Businesses with fluctuating order volumes benefit from LCL's scalability. You pay only for space used rather than committing to container quantities. New market entries often prefer LCL while testing demand patterns.

Seasonal products require the flexibility to scale shipping volumes quickly. LCL allows rapid response to unexpected demand spikes without container commitments. Businesses with uncertain growth trajectories maintain agility through LCL utilization.

The premium for flexibility represents insurance against demand volatility. Calculate the value of maintaining optionality in your supply chain. Sometimes paying more per unit provides greater overall business value.

How Does Inventory Strategy Impact Shipping Mode?

Just-in-time manufacturing typically requires LCL's faster, more frequent shipments. The higher shipping cost per unit is offset by reduced inventory carrying costs. Bulk purchasing strategies naturally align with FCL's economies of scale.

Safety stock calculations should incorporate shipping mode implications. FCL shipments may require higher safety stocks due to longer lead times. Analyze your complete inventory policy when evaluating shipping options.

Inventory turnover rates significantly influence the decision. High-turnover products can absorb FCL quantities quickly, making containers economical. Slow-movers risk obsolescence when shipped in large quantities.

What Are the Risk Considerations for Each Option?

Risk management represents a crucial but often overlooked aspect of the LCL/FCL decision. Different risk profiles require appropriate mitigation strategies.

How Does Cargo Security Differ Between Options?

FCL provides dedicated container space with single supplier cargo. The seal remains intact from origin to destination, minimizing pilferage opportunities. LCL involves multiple handling points during consolidation and deconsolidation.

Customs examinations affect LCL and FCL shipments differently. LCL shipments may face delays if other cargo in the consolidation encounters customs issues. FCL inspections focus solely on your products, providing more control.

Insurance claims statistics show different risk profiles for the two options. Understand how your coverage applies to each shipping method. Discuss specific risk concerns with your freight forwarder before deciding.

What Are the Contingency Planning Implications?

LCL offers natural diversification through multiple weekly sailings. If one vessel delays, other consignments continue moving. FCL represents a single point of failure—container issues affect your entire shipment.

Port congestion impacts LCL and FCL differently. FCL containers may wait for berth space while LCL gets processed through different channels. Equipment availability varies between the options during peak seasons.

Develop contingency plans specific to your chosen shipping method. LCL problems require different responses than FCL issues. Build relationships with providers who strong capabilities in both LCL and FCL solutions.

Conclusion

The LCL versus FCL decision requires analyzing your specific shipment characteristics, cost structure, and supply chain strategy. While cost per unit typically favors FCL above 15-18 CBM, other factors may justify LCL for larger volumes. The most successful businesses regularly reevaluate this decision as their operations evolve.

At GeeseCargo, we've developed a proprietary assessment tool that analyzes 12 factors beyond simple volume measurements. The right choice today may change as your business grows and market conditions shift. Remember that the optimal shipping strategy balances cost efficiency with operational flexibility and risk management.

Start by analyzing your last six shipments using both LCL and FCL cost models. Identify patterns where you might have saved money or reduced risk by choosing differently. Use these insights to develop a more strategic approach to your container decisions moving forward.