Door-to-door (DDP) shipping has long been the preferred logistics model for many U.S. importers sourcing from China. It's simple, transparent, and hands-free—making it the go-to choice for small to mid-sized brands, distributors, and Amazon sellers. But with new U.S. tariff rules and customs enforcement tightening in 2025, some are asking: is DDP still the smartest option?

DDP remains a powerful solution—but it requires careful execution and updated compliance to match new U.S. regulations and tariff hikes.

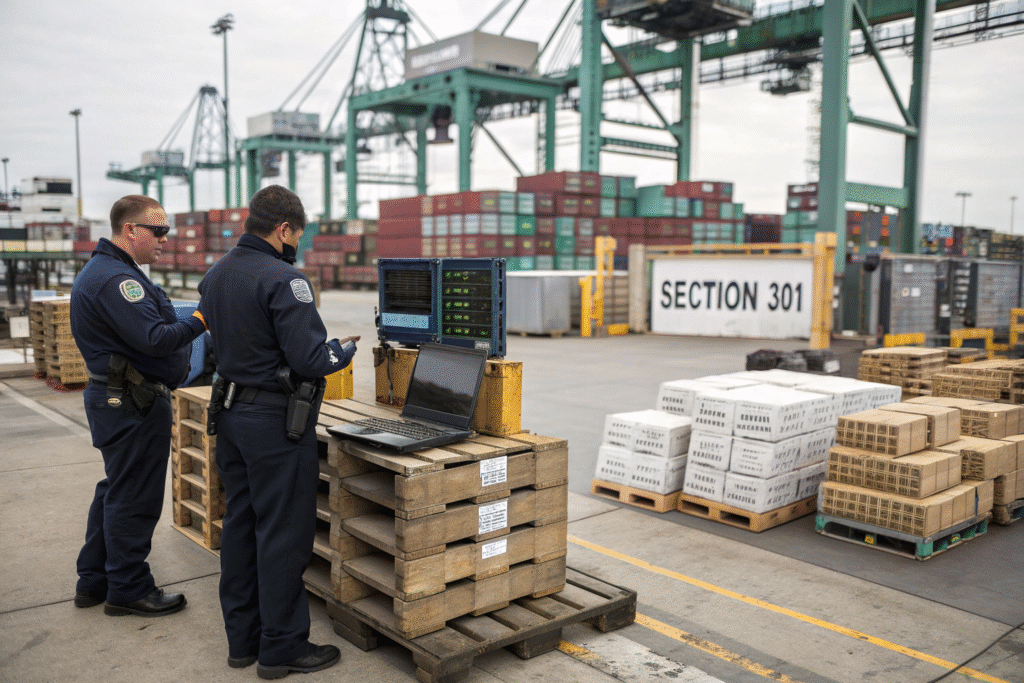

In a landscape shaped by rising customs inspections, changes to Section 301 tariffs, and reduced de minimis privileges, not all DDP services are created equal anymore.

As a freight forwarder specializing in high-volume DDP shipments from China to the U.S., I’ll walk you through what’s changed, where the risks now lie, and how to make sure your DDP strategy still works under today’s evolving customs rules.

What’s Changing with US Tariffs and Customs in 2025?

How Have Section 301 Tariffs Shifted?

In mid-2025, the U.S. Trade Representative (USTR) updated the scope of Section 301 tariffs, affecting many product categories sourced from China—including textiles, electronics, and plastic goods. Some categories now face additional duties of 15% to 25%, even if previously excluded.

If your supplier has not updated HTS classifications accordingly, your DDP provider may miscalculate duty totals, exposing you to underpayment penalties or delayed delivery.

Check official USTR 301 updates and track tariff changes on CustomsInfo Tariff Tool.

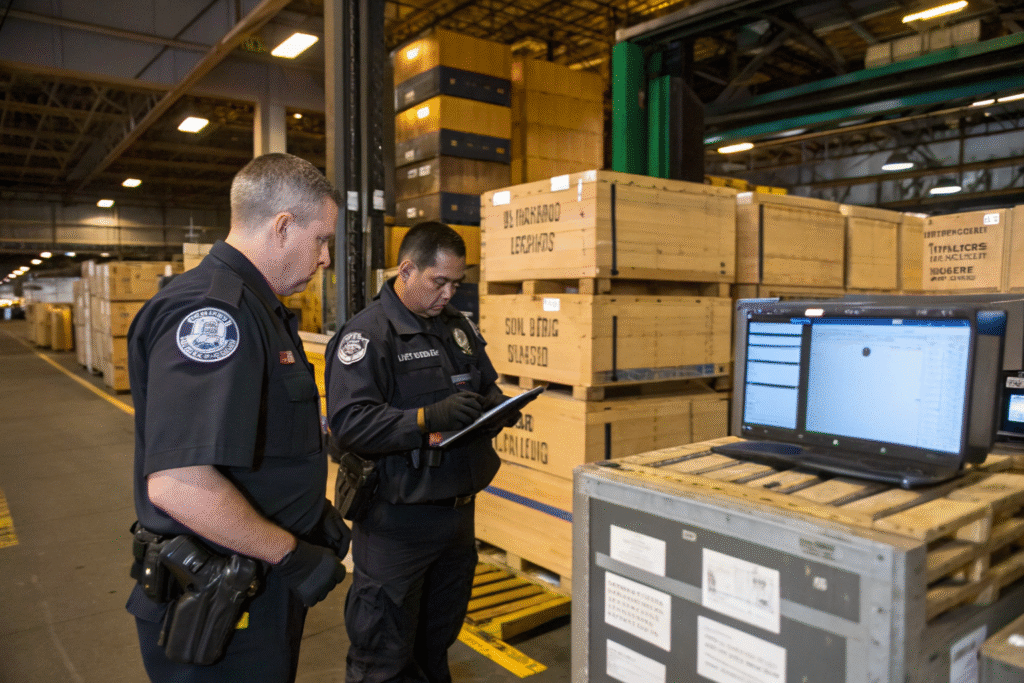

Are Customs Officers Enforcing More Strictly?

Yes. CBP has intensified inspections, especially for shipments under DDP terms. In particular:

- Verifying declared values

- Ensuring correct HS codes

- Checking for de minimis misuse (>$800 thresholds now more restricted)

- Inspecting for intellectual property violations

Many DDP shippers who used to rely on simplified or under-declared paperwork are now seeing longer clearance times or fines.

Stay informed with CBP’s cargo enforcement notices and Port Director guidelines.

What Are the Risks of Poorly Executed DDP Shipping?

Can DDP Still Be Misused for Tax Avoidance?

Unfortunately, yes—and that’s part of the problem. Some traders still promote low-ball DDP offers that rely on under-declaring values, falsely labeling shipments, or using non-compliant forwarders. These shortcuts might save money upfront—but they carry real risks:

- Seizure of goods

- Hefty penalties

- Permanent importer blacklisting

The smarter route is to choose transparent DDP partners who pay tariffs legally, declare accurate values, and offer visibility into customs records.

Avoid scams by consulting Freightos shipping fraud watchlist or verifying forwarders through WCA membership.

What Happens If Customs Challenges the Declared Value?

CBP can reassign a fair market value to the goods and retroactively assess duties, taxes, and fees. If they suspect that your Chinese supplier colluded to lower the invoice value, the burden of proof falls on the importer—even in a DDP deal.

This can halt deliveries, trigger audits, or even place your EIN under watch.

We recommend maintaining clean documentation and ensuring that your forwarder can show proof of duty payment upon request.

Review ACE portal registration and best practices on Trade.gov compliance guides.

What Are the Benefits of DDP When Done Right?

Is DDP Still the Fastest Option?

Yes—for most SMEs and eCommerce sellers, it still wins. With a vetted forwarder, DDP means:

- No need for an EIN or import bond

- No paperwork to file with CBP directly

- Delivery to final warehouse included in rate

- Flat pricing regardless of customs complexity

In many cases, goods clear customs while still in air transit or at bonded warehouse checkpoints—cutting 1–2 days off delivery times compared to traditional CIF/DDU shipping.

See more at Flexport’s DDP breakdown and Amazon’s FBA customs guidance.

Can DDP Help Budget Predictability?

Definitely. With tariffs constantly shifting and U.S. customs fees rising, many shippers want all-in-one pricing. DDP provides:

- Locked-in landed cost

- Zero surprise handling charges at arrival

- Easier bookkeeping for cost-of-goods reporting

For growing brands scaling from Alibaba to private-label, this model reduces back-office overhead and customs compliance headaches.

Explore budgeting tools from Cogoport or GoFreight’s DDP calculator.

How Should I Choose the Right DDP Partner Now?

Recraft指令--

What Should Be Included in a Real DDP Quote?

A proper DDP offer should include:

- Pickup from factory

- Export customs clearance

- International freight (air or sea)

- Import customs clearance in the U.S.

- All duties and taxes

- Final delivery to named address

Beware if any of these are "TBD" or "Excluded", especially customs duty or delivery fees. Ask for documentation proof (e.g., CBP entry number, broker info, ITN filing).

GeeseCargo always includes full breakdowns and submits customs declarations via licensed U.S. partners.

Verify DDP standards via ICC Incoterms 2020 or Descartes DDP workflows.

What Red Flags Should I Avoid?

- Unusually low DDP pricing below CIF or EXW benchmarks

- Lack of CBP entry confirmation

- No visibility platform or tracking

- Inability to answer HS code questions or tariff basis

These are signs the provider may be cutting corners—or worse, breaking compliance.

You can also verify freight legitimacy through Freightos’ forwarder review board and Trustpilot logistics reviews.

Conclusion

DDP is still one of the best shipping models for Chinese exports to the U.S.—but only when used correctly. Under today’s tariff and customs landscape, the wrong partner can cost you delays, penalties, or worse. The right forwarder—like GeeseCargo—helps you stay compliant, cost-effective, and fast. Let us handle the customs complexity so you can focus on growing your business with confidence.