When shipments stall at customs, businesses lose money fast. These delays damage delivery timelines, customer relationships, and cash flow.

To ensure your goods pass customs quickly, prepare the right documents, avoid common mistakes, partner with an experienced customs broker, and follow pre-shipment best practices. A reliable freight forwarder like GeeseCargo can help you stay compliant and fast-track your cargo through global checkpoints.

If you're tired of missed deadlines and surprise fees, you're not alone. I’ve seen U.S. importers lose key clients over small customs issues. In this post, I’ll show you how to speed up the entire customs process—from paperwork to port.

Key documents required for fast customs clearance

When documents are missing or incomplete, your goods don’t move. This is the most common cause of delays I’ve seen among new importers.

The key documents needed for fast customs clearance include a commercial invoice, packing list, bill of lading (or airway bill), and applicable certificates like origin or compliance forms. Submitting these early and correctly prevents holds and inspections.

Why is the commercial invoice the backbone of your clearance?

The commercial invoice is more than just a receipt. It lists what’s inside the shipment, who sold it, who bought it, how much was paid, and where it’s going. Customs officers use this to determine the product’s classification and declared value.

If your invoice misses product descriptions, HS codes, or the right consignee information, clearance could be denied. I once had a client whose delivery was delayed 10 days because their invoice said “accessories” without specifics. The inspector couldn’t tell if it was jewelry or electronics.

Keep invoices clean and consistent. Always include:

- Seller and buyer names and addresses

- Full product descriptions

- Quantities and unit prices

- Total value and currency

- Incoterms (e.g. FOB, CIF, DDP)

What other documents are required, and how should they be submitted?

| Document Name | Purpose | Common Pitfalls |

|---|---|---|

| Packing List | Lists exact contents of the shipment | Item mismatch with invoice |

| Bill of Lading (B/L) | Proves ownership and shipment route | Incomplete consignee info |

| Certificate of Origin | Verifies where goods were made (for duty purposes) | Missing when required by FTA |

| Compliance Certificates | Confirms safety or industry standards compliance | Not provided for regulated goods |

Submit these electronically if possible—many ports use digital clearance systems now. At GeeseCargo, we check all document formats in advance to match U.S. Customs Border Protection (CBP) systems.

Common mistakes that cause customs delays

Customs delays often come from avoidable errors—ones that even seasoned importers make under pressure.

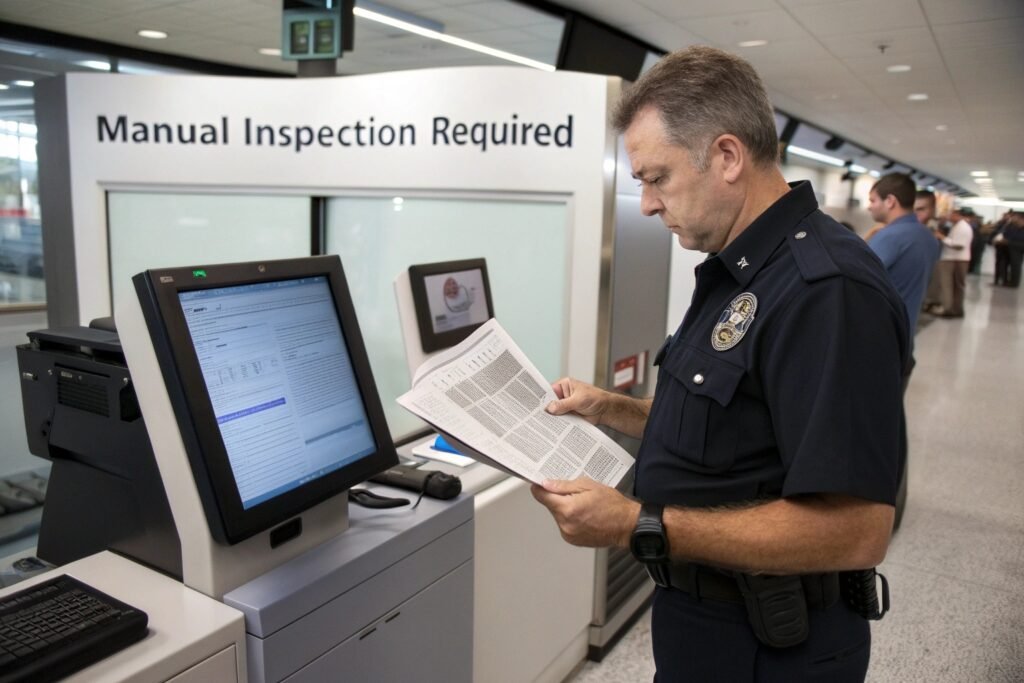

Common mistakes include vague item descriptions, wrong HS codes, undervalued invoices, or inconsistent documents. These trigger red flags and manual inspections that stall your delivery.

How do errors in product classification lead to customs delays?

Every product must be assigned a proper Harmonized System (HS) code. This code helps determine tariff rates and regulations.

If your HS code is off, your cargo could be:

- Misclassified and charged a wrong duty

- Held for inspection or denied entry

- Flagged for fraud or underdeclaration

In one case, a U.S. buyer of knitted hats used the code for “cotton scarves” instead. Customs thought it was a misdeclaration. That shipment was detained for physical inspection and the importer had to pay extra duties—plus a penalty.

To avoid this:

- Use the official Harmonized Tariff Schedule

- Ask your supplier or freight partner to confirm the HS code

- Don’t guess—one number off can make a difference

What are some document-related issues that often trigger customs holds?

Here’s a breakdown of red flags that delay shipments:

| Mistake Type | Example | Result |

|---|---|---|

| Vague Descriptions | “Accessories” or “Samples” with no details | Manual inspection requested |

| Inconsistent Info | Packing list shows 200 units, invoice shows 180 | Shipment questioned for accuracy |

| Undervaluation | Listing $1000 for goods worth $5000 | Customs fines and valuation check |

| Missing Licenses | Shipping medical goods without compliance forms | Shipment rejected or confiscated |

Even one inconsistency can pull your goods out of the fast lane and into a slow queue. That’s why our GeeseCargo team runs pre-submission audits to catch these issues before the port ever sees your file.

How to work with a customs broker effectively

Working with a licensed customs broker should make your process smoother—but only if you know how to manage the relationship.

To work well with a customs broker, provide full documentation, be transparent about your products, and communicate early. A proactive approach saves time and avoids surprise inspections.

What should you expect from your customs broker—and what do they need from you?

A good broker:

- Classifies your products correctly

- Submits documents to customs

- Pays duties and taxes on your behalf

- Advises on regulatory compliance

But they aren’t magicians. They rely on your input to do their job. If you send incomplete documents or vague shipment details, they can't help you clear goods quickly.

You should always:

- Share product samples or photos if needed

- Provide HS codes and certificates

- Tell them where goods are shipping from and to

- Keep them updated on shipment timelines

I once helped a U.S. client switch brokers because the old one waited until the shipment landed to request documents. By then, customs had already flagged the shipment. We took over, pre-cleared the next batch, and avoided repeat delays.

How can you find and manage the right broker for your needs?

Here’s what I recommend when choosing a broker:

| Selection Factor | Why It Matters | Red Flag to Watch |

|---|---|---|

| Port Experience | Local knowledge speeds up clearance | Only works with inland locations |

| Industry Knowledge | Knows the rules for your product type | Generic broker with no product focus |

| System Access | Uses digital customs platforms (ACE, etc.) | Manual submissions still used |

| Responsiveness | Quick replies avoid delays | Slow to respond or unclear answers |

At GeeseCargo, we partner with brokers in every major U.S. port. For our DDP clients, we handle broker communication directly, so you never have to worry about missing a clearance deadline.

Pre-shipment tips to speed up border inspections

Customs clearance starts long before your cargo lands. What you do before shipping sets the stage for a smooth—or painful—clearance process.

To avoid delays, inspect your goods before shipping, package them clearly, use readable labels, and file entry documents in advance. A little planning goes a long way.

What kind of packaging and labeling makes inspections faster?

Inspectors often don’t open every box—they rely on packaging and labeling for quick assessments.

Use these best practices:

- Clearly label all cartons with item descriptions

- Use large, legible fonts in English

- Match box labels with the packing list

- Avoid reused or unclear packaging

If boxes are damaged, dirty, or hard to open, inspectors may delay processing. In one shipment, a client’s fashion accessories arrived in reused packaging with handwritten labels. Customs inspected the full batch, and clearance took two extra days.

Use uniform cartons. Print barcodes if possible. Place “This Side Up” and “Fragile” labels if relevant.

What steps should be taken at the factory before shipment?

Here’s a checklist we share with our clients:

| Pre-shipment Task | Description | Benefit |

|---|---|---|

| Pre-Export Inspection | Check quality and conformity with specs | Avoid regulatory holds |

| Document Review | Verify invoice, packing list, and certificates | Corrects mistakes early |

| HS Code Confirmation | Match product with correct customs code | Prevents reclassification issues |

| Booking Confirmation | Secure sailing or flight schedule | Aligns document submission timelines |

| Pre-Clearance Filing | Submit entry data before goods arrive | Saves time at destination |

Factories play a huge role in customs outcomes. That’s why at GeeseCargo, we coordinate directly with suppliers in China. We audit the documents before they leave the warehouse. If anything is off, we fix it before the goods ever move.

Conclusion

Smooth customs clearance starts before your shipment even leaves the factory. With the right documents, proactive planning, and expert help from teams like ours at GeeseCargo, you can keep your goods moving and your business growing.