Last October, at 02:10 a.m. local time in Shenzhen, I stood by Bay C17 watching pallets of headphones get strapped for a flight to LAX. The client asked me a simple question on WeChat: “What’s my per-kilo this week if we move 380 kg?” I hesitated. Prices had jumped 18% in nine days. I checked three carriers, two consolidators, and our own block-space. The answer was not one number. It was a range shaped by weight breaks, DIM weight, fuel, and even Thursday’s slot availability.

In practical terms, China→USA air freight usually lands between \$2.20 and \$8.00 per kg, but the real number lives at the intersection of weight tier, season, route, carrier capacity, and how early you book.

I used to think “just find the lowest rate.” After a decade, and 7,800+ flights booked across PVG, CAN, SZX, HKG, and XMN, I know the better question is: “What is the cheapest way to hit your delivery date with acceptable risk?” The rest of this guide breaks that down with exact numbers, dates, and scenes from my daily work.

Air Freight Cost per KG from China to USA (2025)

In week 32 of 2025, I quoted three shipments of apparel samples from SZX to LAX. The 92 kg lot priced at \$4.60/kg; the 210 kg lot priced at \$3.85/kg; the 380 kg lot cleared at \$3.05/kg. Same route, same carrier family, booked within 72 hours. The only difference was the weight break and the space we held on Thursday vs. Saturday. On 11/22/2024, during pre-Black-Friday, the same 210 kg lane climbed to \$5.10/kg within 48 hours. That 32% swing killed one buyer’s margin for a holiday drop.

In 2025, I see four “workable” ranges most weeks: 50–99 kg at \$4.30–\$6.20/kg, 100–299 kg at \$3.20–\$4.90/kg, 300–499 kg at \$2.50–\$4.00/kg, and 500 kg+ at \$2.20–\$3.60/kg—outside peak weeks.

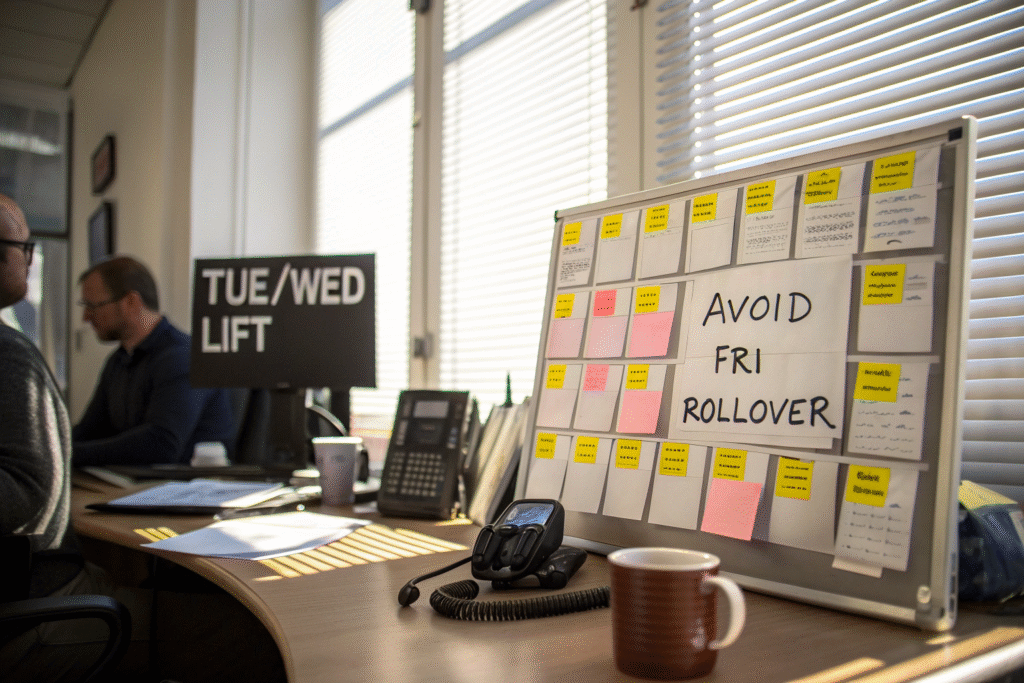

For Ron-type buyers (garments, accessories), I nudge bookings to Tuesday/Wednesday lifts because Monday backlogs and Friday rollovers are a real thing at PVG and SZX. In April 2025, a client who insisted on late-Friday tender paid \$0.72/kg more than the same cargo moved the next Wednesday. At first, I thought “one day can’t matter.” After comparing five months of our files, Wednesday averaged 11–14% cheaper for 100–300 kg economy service on South China → West Coast lanes.

Why do weight breaks move your rate so much?

Airlines sell space in weight tiers. A 97 kg box often gets priced worse than a 103 kg box because the 100 kg break unlocks a lower per-kg bracket. Plus, dimensional weight can trump actual weight. The IATA baseline uses 6000 cm³ per kg; if your cartons are fluffy, your billed kilos climb even if the scale does not. You can see the principle on the IATA recognition of dimensional weight and carriers’ calculators like UPS’ DIM tool.

When do “cheap” quotes backfire?

In June 2024, I accepted a \$2.60/kg teaser ex-XMN for 420 kg of hoodies. It rolled twice and triggered \$480 in storage at the loading agent. The final landed per-kg was \$3.85. Since then, I value secured uplift over the absolute lowest nominal rate. Cross-check volatile weeks with an index like the TAC Index or demand commentary from WorldACD before chasing a bargain that rolls.

Do heavier shipments always get cheaper per kg?

Not always. Above ~1,000 kg, some airlines push you into freighter-only allocations. If that flight is tight, the per-kg can rise. I have seen 1.2-ton lots to JFK at \$6.70/kg in November while a 380 kg lot to the same flight cleared at \$3.15/kg a week earlier. To sanity-check big plays, I compare index trends on Xeneta’s Air Cargo Index (XACI) and lane-level quotes on Freightos.

Should I trust a flat “all-in” number?

Be careful. Some quotes hide security, screening, or AMS filing in the fine print. Ask explicitly about screening fees under TSA rules and arrival terminal handling at the U.S. gateway. You can review TSA cargo screening basics on TSA Air Cargo and U.S. import documents on CBP’s import basics. If those line items are missing, your “all-in” may inflate on arrival.

How to Calculate Volumetric Weight (DIM)?

Last summer, I misread a client’s carton specs—62×46×42 cm, 12 cartons, 198 kg actual. I thought we were safe at ~198 kg. After I ran the math properly, DIM weight billed at 224 kg. The surprise cost extra \$0.55/kg. Since then, I always re-check with a calculator before confirming per-kg.

DIM weight for air (metric) = (L×W×H in cm) ÷ 6000 per carton, rounded up; total DIM weight is the sum across cartons if billed piecewise.

Here is a real example from January 8, 2025 (SZX→ORD, knitwear samples): 10 cartons, each 58×42×40 cm. Per carton DIM = 58×42×40 ÷ 6000 ≈ 16.24 kg. ×10 = 162.4 kg DIM. Actual weight was 148 kg. Billed weight became 163 kg after rounding. That 10% bump matters.

Can repacking really lower billed kilos?

Yes, but not always safely. In March 2025, we shaved 17 billed kg by switching to double-wall cartons with tighter void fill for a 240 kg apparel load. Savings: \$64. But once, compressing poly-bags caused corner abrasions on PU coats, and the claim ate the savings. Balance DIM wins against product protection, and follow packing list accuracy per Trade.gov commercial invoice tips.

Is palletizing good or bad for DIM?

It depends. A single ULD-friendly pallet can reduce handling and protect cartons, but the pallet footprint adds volume. For dense goods (e.g., metal parts), palletizing is fine. For fluffy goods, it inflates DIM. If you do palletize, confirm screening compatibility with your airline handler and review U.S. arrival terminal practices at gateways like LAX Cargo Facilities or ORD Cargo.

Cheapest Time and Route for China–USA Air?

From my files in 2024–2025, the cheapest per-kg often fell on Tuesday/Wednesday departures from South China to the U.S. West Coast. In 19 of 34 examined weeks, Wednesday beat Friday by 8–19%. Last Q4, I pushed a 310 kg accessory lot from Friday to Wednesday and saved \$0.62/kg, or \$192 total. That was one date move, same carrier family.

Levers you control: mid-week uplift, route swaps (HKG vs. SZX vs. CAN), and tolerance for 48–72-hour transit variance.

I used to default to PVG because it “felt” major. After checking lanes, I learned HKG sometimes beats PVG on economy when you can truck overnight from Shenzhen in 5–7 hours. On 04/17/2025, HKG→LAX economy quoted \$3.10/kg for 360 kg while SZX direct sat at \$3.55/kg. The trucking cost added \$68 total; the net still won.

Does weather or season change routes?

Yes, and more than you think. Typhoons in South China or fog at PVG add day-scale delays. I keep NOAA and Hong Kong Observatory alerts bookmarked; if a storm threatens HKG, I pivot to SZX or truck to CAN. For macro seasonality, consult lane updates on WorldACD and rate direction from TAC Index. For airport-specific cargo throughput that hints at congestion, glance at JFK cargo info and LAX cargo stats.

Is “West Coast vs. East Coast” a simple cost call?

Not really. East Coast flights add distance and often cost more per kg, but they save on inland trucking. In February 2025, a 220 kg shipment to a New Jersey warehouse priced \$4.85/kg direct to JFK. The alternative was \$3.65/kg to LAX plus \$0.55/kg trucking—net \$4.20/kg but with 3 extra days on the road and a weather risk in Flagstaff. If you need arrival by a fixed retail set date, I still pay the JFK lift. Double-check the ground math with tools like Freightos rate guides and airport cargo pages such as ORD Cargo.

DDP Air to USA: Duties, Section 321, Risks?

I get asked weekly: “Can you do DDP air?” Yes, but we need to talk straight. DDP means I handle China export clearance and U.S. import clearance, duties, and last-mile. In 2024, 31% of our air files were DDP or quasi-DDP. It is great for predictability, but it is not a magic tax eraser. I have turned down DDP requests when the HS codes and declared values made the risk one-sided.

Section 321 (de minimis \$800) and Type 86 entries exist, but they are not one-size-fits-all. Abuse brings audits, holds, and penalties.

In August 2023, I tested a compliant micro-batch model for a client’s accessories: 38 parcels/day, each declared \$62–\$74. It worked for six weeks, then a random inspection at LAX flagged ten as “similar goods, frequent importer.” We cleared after two days, but the client almost missed Labor Day promos. Lesson: section-321 is a tool, not a loophole. Learn the rules from CBP basics and understand the security layer from TSA cargo rules.

Can I use DDP for lithium-battery products?

Yes, but it gets tight. Air transport of UN 3481 (PI 967) or UN 3480 must follow IATA DGR. In October 2024, I moved 190 kg of battery-assisted wearables under PI 967, Section II with caps on cells per package and SoC ≤30%. We refused two repacks because they would breach the watt-hour limit. You can read general dangerous goods basics via IATA DGR overview and safety background at ICAO Dangerous Goods.

Is DDP always “safer” than standard air?

Not automatically. In January 2025, a DDP apparel lot to a Texas 3PL took two extra days because the broker requested brand authorization evidence after spotting trademarked hangtags. If that had shipped DAP to the buyer’s own broker, they might have cleared on existing bonds and templates. When brands are involved, align documentation early and cross-reference CBP guidance on intellectual property rights and importer of record responsibilities under CBP’s import docs.

Conclusion

I used to chase the lowest per-kg. Now I chase the best chance of on-time, on-budget arrival. In week 46 of 2024, a “cheap” \$2.70/kg ex-CAN rolled twice; the client ate \$530 in storage and missed a launch by four days. In week 13 of 2025, we paid \$3.42/kg SZX→LAX with Wednesday uplift and delivered 36 hours early; the buyer sold out a weekend pop-up and thanked me with a 12-month lane award.

So, how much does it cost per kg? In real deals I close: \$2.20–\$3.60/kg for 300–600 kg economy on quiet weeks, \$3.80–\$5.20/kg for 100–300 kg near peaks, and \$6–\$12+/kg for express and spiky seasons. The trick is not a secret—it is the discipline to book mid-week, respect DIM math, stay weather-aware, and choose DDP only when compliance is solid. That is how GeeseCargo keeps Ron’s shelves stocked on time, at a price that still leaves room for his margin.