When the Red Sea crisis erupted in late 2023, one of our clients faced a 28-day shipping delay and a 350% cost increase on their Europe-bound shipments overnight. As founder of GeeseCargo, I've learned that political risk isn't a theoretical concern—it's a tangible threat that can paralyze supply chains without warning. Understanding how global politics impacts your shipping lanes is no longer optional; it's essential for business continuity.

Global political tensions regularly disrupt key shipping lanes through military conflicts, trade sanctions, naval blockades, and regulatory changes. The Red Sea crisis, Panama Canal drought restrictions, and Russia-Ukraine Black Sea closures demonstrate how quickly political events can increase transit times by 10-40 days and raise shipping costs by 200-500% on affected routes.

Political disruptions differ from weather or operational challenges because they're often unpredictable, prolonged, and require complete rerouting rather than simple schedule adjustments. Building political resilience into your supply chain is becoming as important as cost optimization.

Which Geographic Chokepoints Face the Highest Political Risk?

Strategic maritime chokepoints concentrate global shipping into vulnerable narrow passages where political events can disrupt disproportionate volumes of world trade.

How Vulnerable Are Middle Eastern Shipping Lanes?

The Strait of Hormuz handles 20-30% of global oil shipments and remains perpetually vulnerable to Iran-US tensions. Beyond energy, container shipping between Asia and Europe transits nearby waters, with recent Houthi attacks demonstrating how regional conflicts can close entire sea lanes.

The Suez Canal shortcut between Asia and Europe saves 10-15 days versus Africa routing but creates single-point failure risk. The 2021 Ever Given grounding and ongoing Red Sea instability demonstrate how this artery can close unexpectedly, forcing vessels onto much longer routes.

Bab el-Mandeb Strait at the Red Sea's southern entrance has become increasingly volatile. What was historically a piracy concern has evolved into missile and drone threats that render the entire Red Sea passage high-risk during regional conflicts.

What Political Risks Affect Asian Maritime Routes?

The South China Sea sees escalating tensions over territorial claims and military presence. While complete closure is unlikely, military exercises, increased inspections, and navigation restrictions already cause occasional delays and routing complications.

The Taiwan Strait represents one of the world's most politically sensitive waterways. Any escalation in cross-strait tensions could disrupt this vital route between Northeast and Southeast Asia, affecting over 50% of the world's container traffic.

The Malacca Strait bottleneck between Indonesia and Malaysia handles 25% of global trade. While relatively stable, this narrow passage faces potential terrorism risks, piracy resurgence, or environmental regulations that could restrict transit.

How Do Trade Wars and Sanctions Impact Shipping Lanes?

Economic statecraft increasingly weaponizes trade relationships, creating legal and operational complexities that directly impact shipping accessibility and routing.

How Do Sanctions Alter Global Shipping Patterns?

Russian sanctions following the Ukraine invasion completely restructured Black Sea and Baltic shipping. Vessels face port access restrictions, insurance challenges, and payment processing barriers that effectively remove sanctioned territories from global shipping networks.

Iran and North Korea sanctions create complex compliance requirements for all supply chain participants. Vessels calling at these ports face secondary sanctions risk, while companies must conduct enhanced due diligence to avoid inadvertent sanctions violations.

Venezuelan and Cuban embargoes demonstrate how long-term sanctions create permanent shipping route alterations. Decades of restrictions have eliminated these destinations from mainstream shipping networks, requiring specialized carriers and compliance protocols.

What Happens During Tariff Disputes and Trade Wars?

US-China tariffs triggered massive supply chain reconfiguration as companies diversified manufacturing away from China. Shipping patterns shifted from direct China-US routes to transshipment through Vietnam, Malaysia, and Mexico to avoid punitive tariffs.

EU-UK post-Brexit trade complications introduced new border formalities that slowed Channel crossings. The additional documentation, inspections, and compliance requirements effectively reduced capacity on short sea routes between Britain and mainland Europe.

Retaliatory tariffs often target politically sensitive commodities to maximize pressure. Agriculture, automotive, and technology sectors frequently see abrupt shipping pattern changes as tariffs make certain trade routes economically unviable overnight.

How Can Regional Conflicts Create Cascading Disruptions?

Localized conflicts often generate global shipping impacts through insurance restrictions, crew safety concerns, and military navigation advisories that extend far beyond immediate combat zones.

What Are the Immediate Operational Impacts of Conflict?

War risk insurance premiums increase exponentially in conflict zones, making routes economically unviable. Premiums for Red Sea transits increased from 0.01% to 1% of vessel value during recent conflicts, adding over $1 million per voyage for large container ships.

Crew safety regulations require rerouting when conflict zones expand. Maritime labor conventions give crews rights to refuse sailing into high-risk areas, forcing carriers to find alternative routes or face crew resignation and recruitment challenges.

Military navigation warnings establish exclusion zones that close large maritime areas. What begins as a small conflict zone often expands through military advisories that close vast stretches of ocean to commercial shipping.

How Do Conflicts Create Global Capacity Constraints?

Vessel rerouting around conflict zones reduces effective global capacity. The Red Sea diversions around Africa's Cape of Good Hope added 10-15 days to Asia-Europe voyages, effectively removing 10-15% of global container capacity from circulation.

Equipment imbalances worsen when vessels avoid certain regions. Containers accumulate in destinations that become inaccessible, creating shortages in manufacturing regions and disrupting normal shipping patterns worldwide.

Cascading port congestion occurs when rerouted vessels overwhelm alternative ports. Vessels avoiding conflict zones often concentrate at fewer safe ports, creating congestion that delays entire vessel schedules globally.

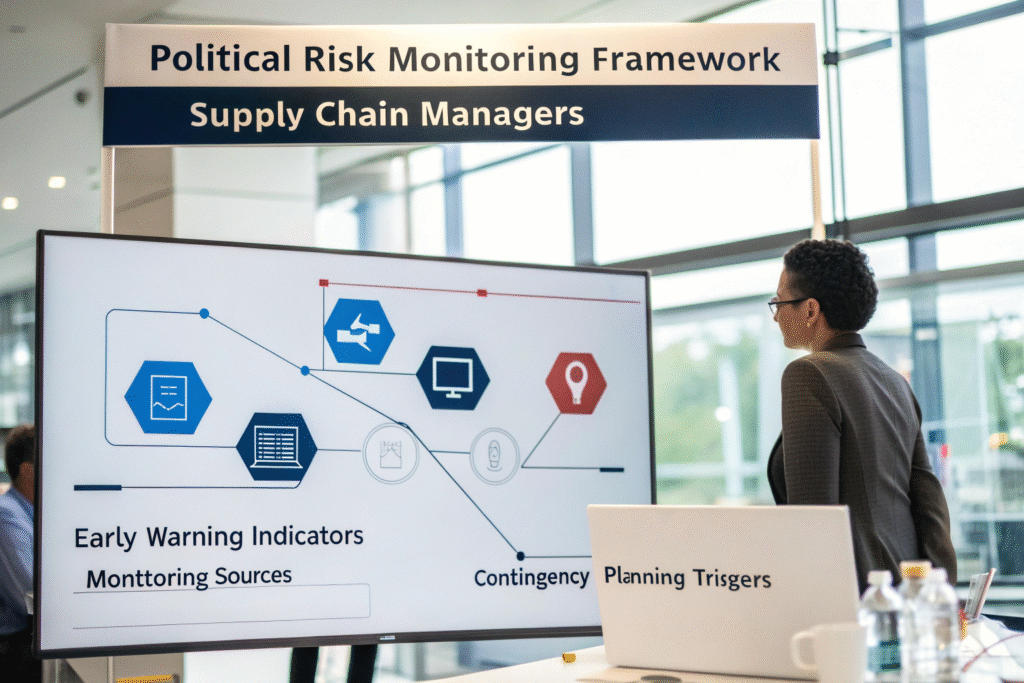

What Political Developments Should You Monitor Proactively?

Early warning of political risks enables proactive supply chain adjustments. Systematic monitoring of specific indicators provides crucial lead time before disruptions impact your operations.

Which Geopolitical Indicators Provide Early Warnings?

Election cycles in key maritime nations often signal potential policy changes. Presidential elections in the United States, Taiwan, and Panama frequently bring shipping policy shifts that impact global routes.

Military exercises and freedom of navigation operations often precede more significant tensions. Large-scale naval exercises in the South China Sea or Baltic Sea typically correlate with increased regional tensions that can impact commercial shipping.

Trade negotiation breakdowns between major economies signal potential tariff changes. Failed trade talks often precede retaliatory measures that abruptly alter shipping economics and routing patterns.

How Should You Monitor Regulatory and Policy Changes?

Sanction announcement patterns follow recognizable escalation trajectories. Monitoring OFAC, EU, and UN sanction developments provides warning before implementation forces shipping route changes.

Environmental regulation developments increasingly impact shipping routes. IMO emissions regulations, regional low-emission zones, and port environmental standards can make certain routes economically unviable for older vessels.

Port and infrastructure investment signals long-term shipping pattern shifts. Chinese Belt and Road investments, Panama Canal expansion plans, and Arctic development all signal future routing changes worth monitoring.

How Can You Build Political Resilience Into Supply Chains?

Proactive political risk management transforms vulnerability into competitive advantage. Companies with resilient supply chains maintain operations while competitors face disruptions.

What Routing Diversification Strategies Work Best?

Multi-corridor shipping strategies eliminate dependency on single chokepoints. Maintaining active relationships and processes for Suez, Panama, and Cape of Good Hope routes enables rapid adaptation when any single corridor becomes problematic.

Nearshoring and friendshoring reduce exposure to long-distance political risks. Shifting some production to Mexico for US markets or Eastern Europe for EU markets shortens supply chains and reduces maritime political exposure.

Multi-modal flexibility enables route shifting across transport modes. Maintaining air freight capacity for critical components and rail options for Europe-Asia trade provides alternatives when maritime routes become problematic.

What Contractual and Operational Protections Matter?

Force majeure and contingency clauses should address political disruptions specifically. Many standard force majeure clauses don't adequately cover political events, requiring customized contractual protection.

Flexible contracting with carriers maintains routing options. Avoiding exclusive corridor commitments preserves flexibility to redirect shipments as political conditions change.

Political risk insurance complements standard cargo coverage. Specialized policies can cover revenue losses, extra expenses, and contingency costs resulting from political disruptions.

Conclusion

Global political disruptions have shifted from rare exceptions to regular supply chain challenges. The most successful companies no longer simply react to political events but build systematic resilience that treats political risk as a fundamental business consideration rather than an unpredictable external factor.

At GeeseCargo, we've helped clients navigate everything from Suez Canal closures to sanction implementations, with the most resilient companies emerging stronger from each disruption. The key lies in acknowledging political risk as a permanent feature of global trade, then building systems that anticipate and adapt to these challenges.

Begin your political risk assessment by mapping your supply chain's exposure to vulnerable chokepoints and political flashpoints. Then develop specific contingency plans for each vulnerability, maintaining the relationships, documentation, and processes needed to activate alternatives quickly. Remember that in today's geopolitical environment, supply chain resilience is becoming a competitive advantage that separates market leaders from vulnerable followers.