When one of our clients faced a $28,000 penalty for ACE filing errors, I realized how many importers misunderstand this critical system. As founder of GeeseCargo with extensive US customs experience, I've learned that ACE isn't just a technological upgrade—it's a fundamental transformation of how importers interact with Customs and Border Protection. Understanding ACE is no longer optional; it's essential for efficient and compliant US imports.

The Automated Commercial Environment (ACE) is CBP's primary system for processing imports, exports, and other trade-related transactions. It serves as the single window for trade documentation, replacing previous paper-based processes and multiple legacy systems. Importers use ACE to submit electronic entries, pay duties, and communicate with CBP and Partner Government Agencies (PGAs).

ACE represents the most significant modernization of US customs processing in decades, creating both efficiency opportunities and compliance requirements that importers must understand to operate successfully. The system processes over $2.8 trillion in imports annually, handling more than 70,000 electronic transactions daily.

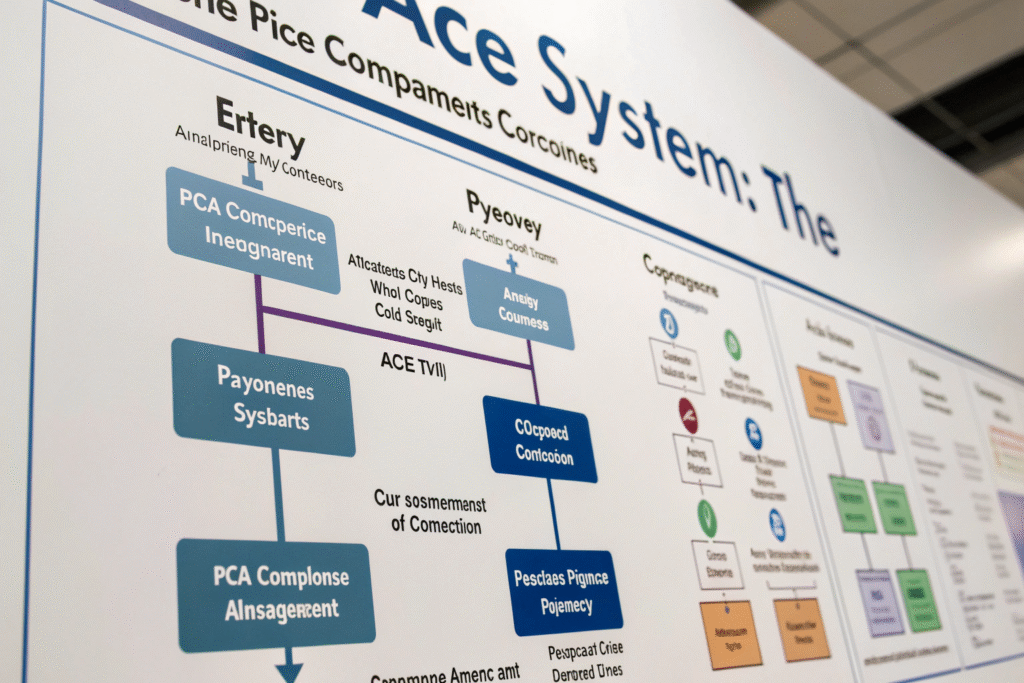

What Are the Core Components and Functions of ACE?

ACE integrates multiple functions into a unified platform, streamlining what previously required separate systems and manual processes.

How Does ACE Handle Entry Filing and Processing?

Electronic entry submission replaces paper CBP Form 3461. Importers or their brokers file entries electronically through ACE, with immediate validation and receipt confirmation. The system checks for errors and missing information in real-time, reducing rejection rates and speeding up clearance.

Entry summary filing (CBP Form 7501) occurs within 10 days of release. After goods are provisionally released, importers submit detailed entry summaries including classification, valuation, and duty calculation through ACE.

Automated validations flag potential compliance issues. ACE automatically checks for common errors like incorrect manufacturer identification, missing PGA data, or classification discrepancies that could indicate problems.

What Role Does ACE Play in Duty Payment and Accounting?

Automated billing and statement generation streamline financial processes. ACE generates periodic statements (typically monthly) that consolidate all entries and duties, simplifying accounting and payment reconciliation.

Multiple payment options accommodate different business needs. Importers can pay via Automated Clearinghouse (ACH), paper check, or through surety bonds, with ACE tracking all payment activities and balances.

Reconciliation programs manage complex entry adjustments. For entries requiring post-summary corrections or other adjustments, ACE provides structured processes for amending filings and recalculating duties.

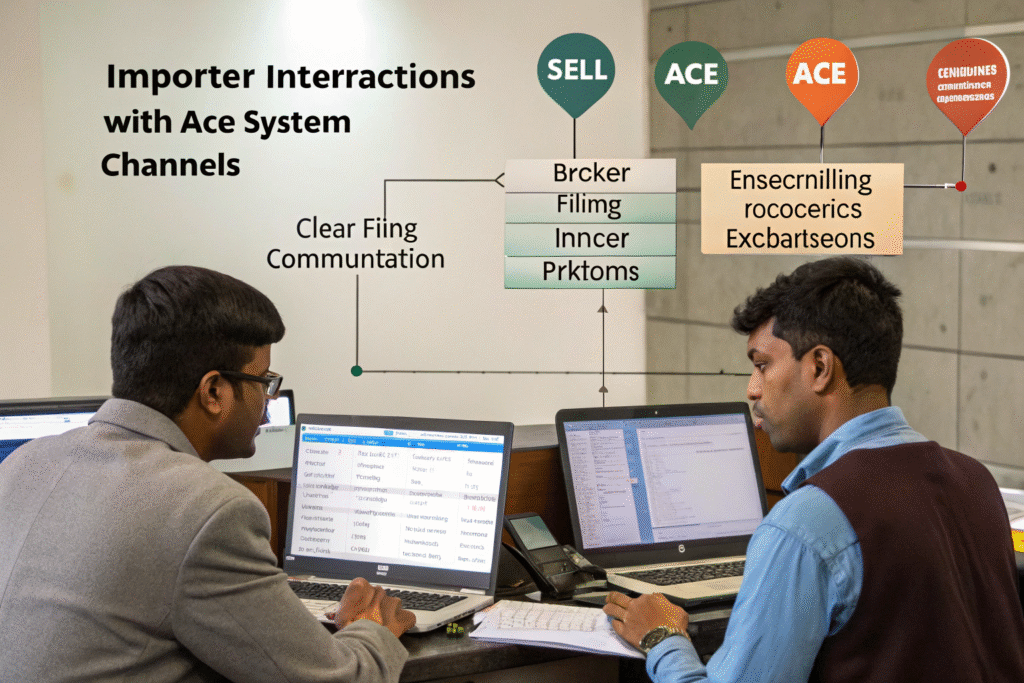

How Do Importers Interact with the ACE System?

Understanding the practical aspects of ACE operation helps importers optimize their use of the system and avoid common pitfalls.

What Are the Main Access Methods for Importers?

Self-filing through ACE Secure Data Portal allows direct importer access. Companies with sufficient volume and expertise can file directly through the ACE portal, maintaining complete control over their customs data.

Customs broker filing remains the most common approach. Most importers work with licensed customs brokers who file on their behalf using power of attorney, leveraging broker expertise while maintaining importer of record responsibility.

Integrated software solutions connect business systems to ACE. Many companies use customs management software that integrates with their ERP systems and connects directly to ACE for automated filing.

What User Roles and Permissions Exist Within ACE?

Multiple account types serve different organizational needs. Importers can establish corporate accounts with sub-accounts for different divisions or locations, each with appropriate permissions and access levels.

Role-based security controls data access and functions. ACE allows companies to assign different privileges to various team members—some may only view entries while others can file, pay duties, or manage account settings.

Third-party access can be carefully controlled. Importers can grant limited ACE access to consultants, attorneys, or other advisors without providing full account control.

How Does ACE Integration with PGAs Work?

One of ACE's most significant benefits is its function as a "single window" for multiple government agency requirements.

Which Agencies Are Integrated into ACE?

FDA integration handles food, drug, and medical device imports. Through ACE, importers submit prior notice for food shipments and electronic documentation for regulated products, with FDA providing release determinations directly through the system.

USDA agencies manage agricultural and animal product imports. The Animal and Plant Health Inspection Service (APHIS) and Food Safety and Inspection Service (FSIS) use ACE for permits, inspections, and release decisions for regulated commodities.

Environmental and safety agencies regulate specific products. The Environmental Protection Agency (EPA), Consumer Product Safety Commission (CPSC), and other agencies use ACE to review imports and communicate requirements to importers.

How Does PGA Data Submission Work in Practice?

Single submission eliminates duplicate filings. Instead of submitting separate documents to each agency, importers provide all required information once through ACE, which distributes it to relevant PGAs.

Electronic document upload replaces paper submissions. Importers can upload certificates, licenses, laboratory reports, and other required documents directly to ACE for PGA review.

Automated holds and releases streamline the process. When PGAs require additional information or physical examination, they place electronic holds through ACE, with clear instructions for resolution.

What Are the Key Benefits and Challenges of ACE?

While ACE offers significant advantages, importers must also navigate its complexities and requirements.

What Operational Benefits Does ACE Provide?

Faster release times reduce supply chain delays. Electronic processing and automated validations typically reduce customs clearance time from days to hours, with many shipments receiving immediate release.

Improved visibility enables better supply chain management. Real-time tracking of entry status, examination requests, and release information helps importers manage inventory and transportation more effectively.

Reduced paperwork lowers administrative costs. Electronic filing and document management significantly reduce printing, mailing, and storage expenses associated with paper-based processes.

What Implementation Challenges Do Importers Face?

System complexity requires specialized knowledge. ACE's comprehensive functionality has a steep learning curve, requiring training or specialized staff to utilize effectively.

Data quality demands are significantly higher. Electronic systems have less tolerance for errors or inconsistencies than paper processes, requiring robust data management practices.

Integration with existing systems can be challenging. Connecting ERP, inventory, and accounting systems to ACE often requires custom programming and ongoing maintenance.

How Can Importers Optimize Their ACE Usage?

Strategic approaches to ACE implementation can maximize benefits while minimizing compliance risks and operational disruptions.

What Data Management Practices Improve ACE Performance?

Standardized product information ensures consistent classification. Maintaining centralized product databases with verified HS codes, values, and country of origin information prevents filing errors and inconsistencies.

Regular data validation identifies problems proactively. Implementing systematic checks of ACE data against source systems catches errors before they cause compliance issues or clearance delays.

Historical analysis identifies improvement opportunities. Reviewing past entries, examinations, and corrections helps identify patterns that indicate systematic issues needing resolution.

What Process Improvements Enhance ACE Effectiveness?

Structured workflow management ensures consistent handling. Developing clear procedures for entry preparation, review, filing, and follow-up prevents oversights and ensures accountability.

Performance monitoring tracks key metrics. Measuring clearance times, error rates, and examination frequency helps identify improvement opportunities and benchmark against industry standards.

Continuous training maintains system proficiency. Regular updates on ACE enhancements, regulatory changes, and best practices keep importers and their staff current with system capabilities.

What Common ACE Mistakes Should Importers Avoid?

Understanding frequent errors helps importers prevent compliance issues and operational problems.

What Filing Errors Create the Most Serious Problems?

Incorrect manufacturer identification triggers AD/CVD issues. Wrongly identifying manufacturers or suppliers can lead to significant anti-dumping or countervailing duty liabilities and penalties.

Valuation errors cause duty underpayment and penalties. Incorrectly declaring transaction value, omitting assists, or misclassifying buying commissions creates compliance violations.

Classification mistakes affect duty rates and PGA requirements. Using wrong HS codes not only creates duty calculation errors but may also cause importers to miss PGA requirements entirely.

What Procedural Mistakes Cause Operational Issues?

Missing PGA data submissions cause clearance delays. Failing to provide required PGA information or documents through ACE results in automatic holds that delay cargo release.

Incorrect bond information prevents entry processing. Errors in continuous bond details or single transaction bond data cause immediate entry rejection and processing delays.

Poor timing of entry and summary filings creates compliance risks. Missing 10-day entry summary filing deadlines or submitting information after cargo arrival causes penalties and processing problems.

Conclusion

The ACE system represents a fundamental shift in how importers conduct business with US Customs, offering unprecedented efficiency and visibility while demanding higher data quality and procedural discipline. The most successful importers treat ACE not as a simple technological tool but as an integral component of their global trade management strategy.

At GeeseCargo, we've helped clients reduce ACE-related clearance delays by over 70% through systematic process improvement and data management. The key is recognizing that ACE excellence requires continuous attention to data quality, regulatory changes, and system enhancements rather than one-time implementation.

Begin your ACE optimization by conducting a comprehensive review of your current processes and data quality, then develop a phased improvement plan that addresses your highest-impact opportunities. Remember that in the modern customs environment, ACE proficiency isn't just about compliance—it's a competitive advantage that enables faster, more reliable, and more cost-effective import operations.