When one of our clients had a €85,000 shipment held at Rotterdam because they didn't understand EORI requirements, I realized how many businesses underestimate this crucial import prerequisite. As founder of GeeseCargo with extensive EU import experience, I've learned that the EORI number isn't just another formality—it's the fundamental identifier that enables your business to operate within EU customs systems.

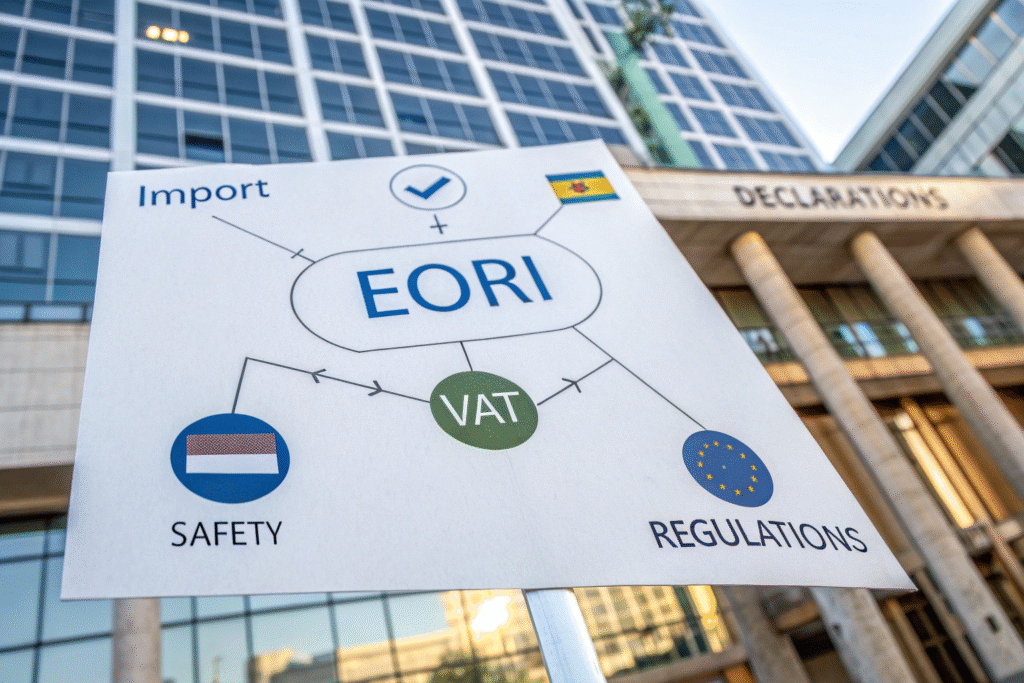

An EORI (Economic Operators Registration and Identification) number is mandatory for any business importing goods into the EU. It's a unique identifier used by customs authorities across all EU member states to track your customs activities. Businesses typically receive their EORI within 3-10 working days after submitting a complete application to the appropriate national customs authority.

The EORI system streamlines customs procedures by creating a single reference number for all your EU customs declarations. Understanding the registration process, requirements, and strategic considerations ensures smooth market entry and ongoing compliance.

What Exactly Is an EORI Number and Who Needs One?

The EORI system creates a standardized identification framework that simplifies customs interactions across all EU member states.

Which Businesses Require EORI Registration?

All businesses established outside the EU need EORI numbers for import activities. This includes companies in the US, China, UK, and other non-EU countries shipping goods to EU markets.

EU-based businesses engaging in import/export activities require EORI registration. Even companies within the EU need EORI numbers if they're involved in international trade with non-EU countries.

Certain customs procedures mandate EORI regardless of transaction size. While some simplified procedures have exemptions, most formal customs declarations require EORI identification.

What Activities Require an EORI Number?

Customs declarations for imports and exports are the primary use case. Every customs declaration submitted to EU authorities must include a valid EORI number for the declarant.

VAT-related customs procedures require EORI identification. When using special VAT schemes or customs procedures like postponed accounting, the EORI links your customs and VAT records.

Security declarations and entry summary declarations need EORI references. Pre-arrival security filings and other advance declarations require EORI numbers for all involved parties.

How Do You Apply for an EORI Number?

The application process varies by member state but follows consistent principles across the EU.

Where Should You Submit Your EORI Application?

Non-EU businesses typically apply in the member state of first import. If you're shipping to multiple EU countries, you generally register in the country where you'll conduct your first customs clearance.

EU-established businesses apply in their country of establishment. Companies with legal presence in an EU member state register with that country's customs authorities.

Businesses with multiple EU establishments may need multiple registrations. While the EORI should work EU-wide, complex structures sometimes require registrations in multiple member states.

What Documentation Is Required for EORI Registration?

Proof of business registration demonstrates legal existence. This typically includes certificates of incorporation, business registration documents, or equivalent proof of legal status.

Tax identification numbers establish your business identity. Your national tax ID or equivalent documentation helps customs authorities verify your business legitimacy.

Proof of address and business activities may be required. Some member states require additional documentation showing your business address and nature of trading activities.

What Are the Key Strategic Considerations?

Beyond basic compliance, strategic decisions about EORI registration impact your operational flexibility and tax optimization.

How Does EORI Location Affect Your EU Operations?

The issuing member state becomes your primary customs relationship. While EORI works EU-wide, the issuing country handles your registration, updates, and primary communications.

VAT implications vary based on registration location. Your EORI location can influence which country handles your import VAT accounting and potential refunds.

Practical considerations like language and time zones matter. Choosing a country where you speak the language or that shares your time zone can simplify communications.

When Should You Apply for Your EORI Number?

Apply at least 4-6 weeks before your first planned shipment. While processing is typically faster, allowing buffer time prevents shipment delays if questions arise during application.

Consider applying before supplier contracts are finalized. Having your EORI early facilitates smoother logistics planning and documentation preparation.

Align application with your overall EU market entry strategy. Timing your EORI registration to coordinate with other EU requirements like VAT registration creates operational efficiency.

What Common Problems Occur During EORI Registration?

Understanding potential pitfalls helps businesses navigate the registration process smoothly.

What Documentation Issues Cause Delays?

Incomplete business registration documents trigger requests for additional information. Providing clear, translated (if necessary) business documents prevents back-and-forth communications.

Mismatched business names across documents create verification problems. Ensuring your business name appears consistently on all registration documents prevents confusion and delays.

Outdated registration information raises validity questions. Providing current business documents with recent registration dates helps establish your active business status.

What Communication Challenges Arise?

Language barriers complicate application processes in some member states. While many customs authorities accommodate English, some countries prefer or require local language communication.

Time zone differences delay question resolution. The 6-9 hour time difference between Asia and Europe or the 5-8 hour difference with North America can slow communication cycles.

Unclear application requirements cause submission errors. Some national customs websites have confusing instructions or incomplete information in English.

How Does EORI Interact with Other EU Requirements?

The EORI number forms part of a broader compliance framework for EU market access.

How Does EORI Relate to VAT Obligations?

EORI enables link between customs and VAT systems. Your EORI number helps customs authorities connect your import activities with your VAT registration and reporting.

Postponed VAT accounting requires valid EORI registration. To use this cash flow beneficial system, businesses need both EORI and VAT identification numbers.

VAT refund procedures reference EORI for verification. When claiming VAT refunds on imports, your EORI helps authorities verify the underlying transactions.

What's the Relationship with Other Customs Procedures?

Import declaration submission requires EORI identification. All customs declarations, whether simplified or full, must include the declarant's EORI number.

Customs special procedures authorization references EORI. Procedures like customs warehousing, inward processing, or temporary admission use EORI to track authorized operators.

Security filing requirements incorporate EORI data. Entry Summary Declarations and other security filings require EORI numbers for all supply chain participants.

What Are the Consequences of Not Having an EORI?

Operating without proper EORI registration creates significant operational and financial impacts.

What Operational Disruptions Occur Without EORI?

Customs clearance refusal prevents goods release. Without a valid EORI number, customs authorities will not process your import declarations, leaving goods stuck at borders.

Storage and demurrage charges accumulate during resolution. While EORI issues are resolved, goods incur daily storage fees that can quickly exceed hundreds or thousands of euros.

Supply chain disruptions impact customer commitments. Delayed shipments mean missed delivery dates, production stoppages, or stockouts that damage customer relationships.

What Financial Penalties Might Apply?

Customs penalties for incorrect declarations can be significant. Some member states impose fines for declarations submitted without proper EORI identification.

Lost business opportunities have indirect costs. Missed sales, production delays, and damaged customer relationships often exceed direct penalty amounts.

Additional professional service fees accumulate. Resolving EORI issues typically requires customs brokers, consultants, or legal assistance at premium rates.

How Can You Verify and Manage Your EORI Status?

Ongoing EORI management ensures continued compliance as your business evolves.

How Can You Verify EORI Validity?

EU EORI validation portal provides official confirmation. The European Commission maintains a search tool where you can verify EORI numbers across all member states.

National customs databases offer additional verification. Some member states provide their own validation tools with more detailed information about EORI status.

Customs broker verification confirms operational validity. Experienced brokers can often identify potential EORI issues before they cause clearance problems.

What Ongoing Maintenance Does EORI Require?

Business changes may require EORI updates. Significant changes like business name modifications, legal structure changes, or address updates should be reflected in your EORI registration.

Periodic validation ensures continued accuracy. Regularly checking that your EORI information remains current and accurate prevents unexpected issues during customs clearance.

Understanding expiration and renewal requirements. While EORI numbers don't typically expire for active businesses, understanding member state policies prevents surprises.

Conclusion

The EORI number represents your business's passport to EU trade, enabling customs authorities to identify and track your import activities across all member states. While the registration process is generally straightforward, strategic decisions about when, where, and how to register significantly impact your operational efficiency and compliance posture.

At GeeseCargo, we've helped hundreds of clients navigate EORI registration, with the most successful outcomes coming from businesses that treat EORI as a strategic enabler rather than a bureaucratic hurdle. The key is integrating EORI planning into your overall EU market entry strategy rather than treating it as a last-minute requirement.

Begin your EORI process by determining your optimal registration country based on your logistics patterns and business structure, then gather the required documentation well before your first shipment. Remember that in EU imports, your EORI number isn't just a compliance requirement—it's the foundation that supports all your customs activities and trade relationships.