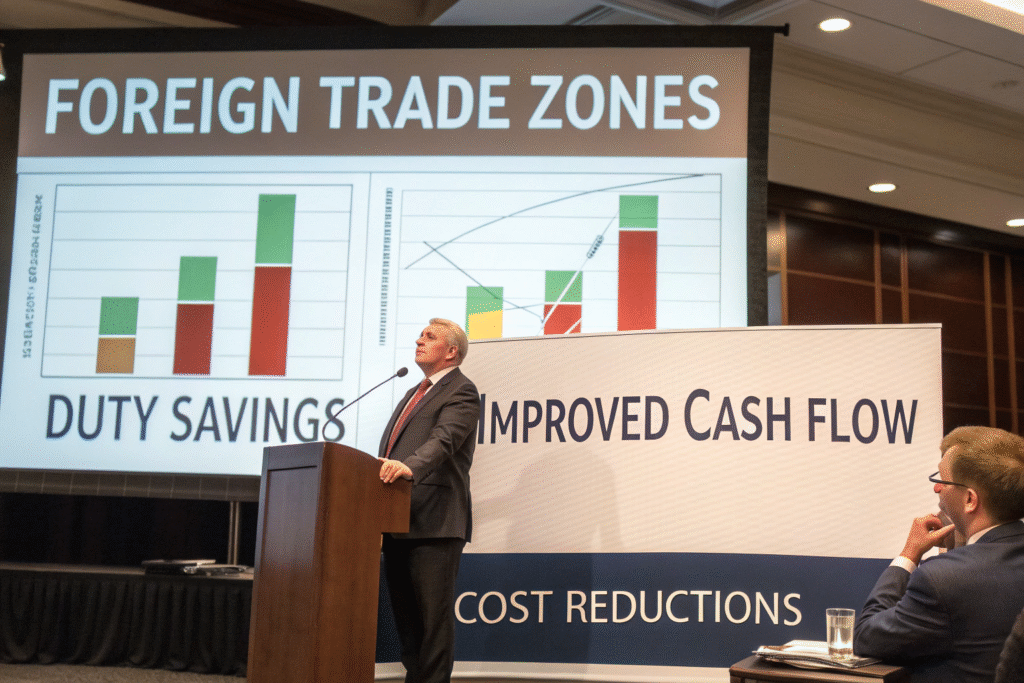

When one of our clients manufacturing automotive components started using a Foreign Trade Zone (FTZ), they reduced their annual duty payments by $387,000 while improving their cash flow by deferring $2.3 million in customs duties. As founder of GeeseCargo with extensive FTZ experience, I've witnessed how these specialized zones transform from obscure regulatory concepts into powerful financial tools that create significant competitive advantages.

Businesses can benefit from Foreign Trade Zones through duty deferral, elimination of duties on re-exports, inverted tariff savings, streamlined logistics, and improved cash flow. Typical savings range from 15-40% on import costs, with additional benefits including reduced insurance costs, improved inventory management, and enhanced supply chain security.

FTZs represent one of the most underutilized strategic tools in international trade. Understanding how to leverage these zones can significantly impact your bottom line while providing operational flexibility that traditional import models cannot match.

What Financial Benefits Can FTZs Deliver?

The financial advantages of FTZs extend far beyond simple duty savings to encompass cash flow improvement, inventory cost reduction, and risk management.

How Does Duty Management Create Savings?

Duty deferral improves cash flow by postponing payments until goods enter US commerce. Instead of paying duties upon importation, businesses using FTZs pay only when goods leave the zone for domestic consumption, creating substantial working capital advantages.

Duty elimination on exports and destroyed merchandise provides direct cost savings. Goods exported from FTZs incur no US duties, while damaged or obsolete inventory can be destroyed without duty payment.

Inverted tariff savings occur when finished goods have lower duty rates than components. By manufacturing in FTZs, companies can pay the lower finished goods rate rather than higher component rates, typically saving 3-15% on duty costs.

What Cash Flow Advantages Do FTZs Offer?

Weekly entry procedures consolidate duty payments and reduce administrative costs. Instead of paying duties shipment-by-shipment, FTZ users make single weekly payments covering all goods entering commerce that week.

No duties on inventory until needed for production or sale means capital isn't tied up in duty payments for goods that may sit in inventory for extended periods.

Reduced inventory carrying costs result from better cash flow management. The ability to maintain inventory without upfront duty payments improves overall working capital efficiency.

What Operational Advantages Do FTZs Provide?

Beyond financial benefits, FTZs offer significant operational improvements that enhance supply chain efficiency and flexibility.

How Do FTZs Streamline Logistics and Compliance?

Simplified customs procedures reduce administrative burden. FTZ operations typically involve streamlined documentation, reduced customs inspections, and simplified record-keeping requirements.

Consolidated operations improve supply chain efficiency. By combining international receipt, storage, and distribution in one location, companies reduce handling and transportation costs.

Enhanced security often reduces insurance costs. FTZs typically have superior physical security and inventory control systems, which can lead to reduced insurance premiums for stored goods.

What Inventory Management Benefits Can You Expect?

Quality control and product conditioning can occur without customs supervision. Goods can be inspected, tested, and reworked within FTZs without customs formalities or duty implications.

Inventory flexibility supports just-in-time manufacturing. Maintaining inventory in FTZs enables rapid response to demand fluctuations without duty payment until goods are actually needed.

Obsolete inventory can be disposed of without duty liability. Products that become outdated or damaged can be destroyed within the FTZ without payment of duties that would apply in traditional warehousing.

How Can Manufacturing in FTZs Create Advantages?

FTZs particularly benefit manufacturers through specialized provisions that support production operations.

What Production-Specific Benefits Do FTZs Offer?

No duties on components that become waste or scrap during manufacturing. Traditional import models pay duties on all imported materials regardless of what ultimately enters commerce, while FTZ manufacturers pay only on finished products.

No duties on defective components or production rejects. Materials that don't meet quality standards can be destroyed or returned without duty payment, unlike traditional manufacturing where duties are paid on all imports.

Export manufacturing incurs no US duties on imported components. Products manufactured in FTZs for export markets completely avoid US duties on both components and finished goods.

How Does FTZ Manufacturing Support Global Operations?

Production equipment can be imported duty-free for manufacturing operations. Machinery and equipment used within FTZs for production can often be imported without duty payment until removed from the zone.

International distribution can be optimized from central FTZ locations. By manufacturing in FTZs, companies can efficiently serve both domestic and international markets from a single location with optimized duty treatment.

Trade agreement optimization enhances global competitiveness. FTZ manufacturing can help qualify products for preferential treatment under various trade agreements by meeting specific origin requirements.

What Industries Benefit Most from FTZ Utilization?

While virtually all importers can benefit from FTZs, certain industries realize particularly significant advantages.

How Do Automotive and Aerospace Companies Benefit?

Inverted tariff situations are common in automotive manufacturing. Components often have higher duty rates than finished vehicles, making FTZ manufacturing particularly advantageous for duty savings.

Global supply chains benefit from FTZ flexibility. The ability to import components from multiple countries, manufacture products, and distribute globally from FTZs supports complex international operations.

High-value inventory management improves with FTZ controls. The sophisticated inventory tracking and security in FTZs benefit industries with expensive components and finished goods.

What Advantages Do Electronics and Technology Companies Gain?

Rapid product lifecycle management is enhanced by FTZ flexibility. The ability to reconfigure products, update software, and modify packaging without customs formalities supports fast-moving technology sectors.

Component sourcing optimization reduces costs. Electronics manufacturers can import components from various countries, manufacture in FTZs, and optimize duty payments based on finished product classifications.

Reverse logistics and returns processing are streamlined. returned products can be received, evaluated, and repaired in FTZs without duty complications that would occur in traditional facilities.

What Are the Implementation Considerations?

Successful FTZ utilization requires careful planning and understanding of regulatory requirements and operational implications.

What Are the Activation and Operational Requirements?

FTZ application and activation involve specific regulatory processes. Gaining FTZ status requires application to the Foreign-Trade Zones Board and activation with Customs and Border Protection.

Compliance systems must meet CBP requirements. FTZ operators must implement inventory control and record-keeping systems that meet specific regulatory standards and enable audit trails.

Staff training ensures proper procedures and compliance. Employees working with FTZ operations require specific training on zone procedures, documentation, and compliance requirements.

How Should Companies Evaluate FTZ Feasibility?

Volume analysis determines potential savings. Companies typically need significant import volumes (usually $1 million+ annually in duties) to justify FTZ implementation costs.

Product characteristics influence benefit levels. Products with high duty rates, inverted tariff situations, or significant export components typically deliver greater FTZ benefits.

Operational compatibility affects implementation ease. Companies with existing warehousing or manufacturing operations that can be adapted to FTZ requirements typically realize benefits faster.

What Common Misconceptions Should Businesses Avoid?

Understanding frequent misunderstandings helps companies make informed decisions about FTZ utilization.

What Misunderstandings Deter FTZ Adoption?

Complexity concerns often exaggerate actual requirements. While FTZs involve specific procedures, the compliance burden is typically manageable with proper systems and training.

Cost misconceptions overestimate implementation expenses. Many companies overestimate FTZ costs while underestimating benefits, though total savings typically exceed costs within 12-18 months.

Geographic limitations are less restrictive than commonly believed. FTZ services are available throughout the US, not just at ports, through numerous general-purpose and subzone facilities.

What Strategic Mistakes Limit FTZ Benefits?

Inadequate planning reduces potential savings. Companies that treat FTZs as simple duty deferral tools rather than strategic assets typically realize only partial benefits.

Poor system implementation creates compliance risks. Inadequate inventory control or record-keeping systems can undermine benefits and create compliance issues.

Underutilization of available benefits leaves value unrealized. Many companies use FTZs for basic storage without leveraging manufacturing, exhibition, or other valuable zone services.

Conclusion

Foreign Trade Zones offer compelling benefits for businesses engaged in international trade, particularly those with significant import volumes, manufacturing operations, or export activities. The most successful FTZ users treat these zones as strategic assets rather than simple regulatory designations, integrating them fully into their supply chain and financial planning.

At GeeseCargo, we've helped clients achieve average first-year FTZ savings of 18-35% on import costs, with the most significant benefits coming from companies that strategically align their operations with FTZ capabilities. The key is recognizing that FTZs provide a framework for rethinking traditional import processes rather than just modifying existing procedures.

Begin your FTZ evaluation by conducting a comprehensive analysis of your import patterns, duty payments, and operational flows to identify potential benefits. Then develop a phased implementation approach that starts with the highest-value applications while building operational expertise. Remember that in global trade, FTZs represent one of the most powerful—yet underutilized—tools for creating competitive advantage through optimized duty management and enhanced operational flexibility.