In containerized trade, freight rates are not static but fluctuate with global market dynamics, carrier capacity management, and contractual frameworks. For logistics managers and supply chain executives, strategic rate negotiation directly impacts landed cost, margin protection, and long-term supply chain resilience.

Freight rate negotiations involve aligning shipment forecasts with carrier capacity, leveraging volume commitments, structuring service contracts with clear KPIs, and incorporating surcharges and value-added services into holistic agreements.

From my experience supporting U.S. importers, organizations that commit volumes early and maintain long-term forwarder partnerships consistently outperform spot-market buyers exposed to General Rate Increases (GRIs) and Peak Season Surcharges (PSS).

What Variables Drive Freight Rate Negotiations?

Key variables in freight rate negotiations include:

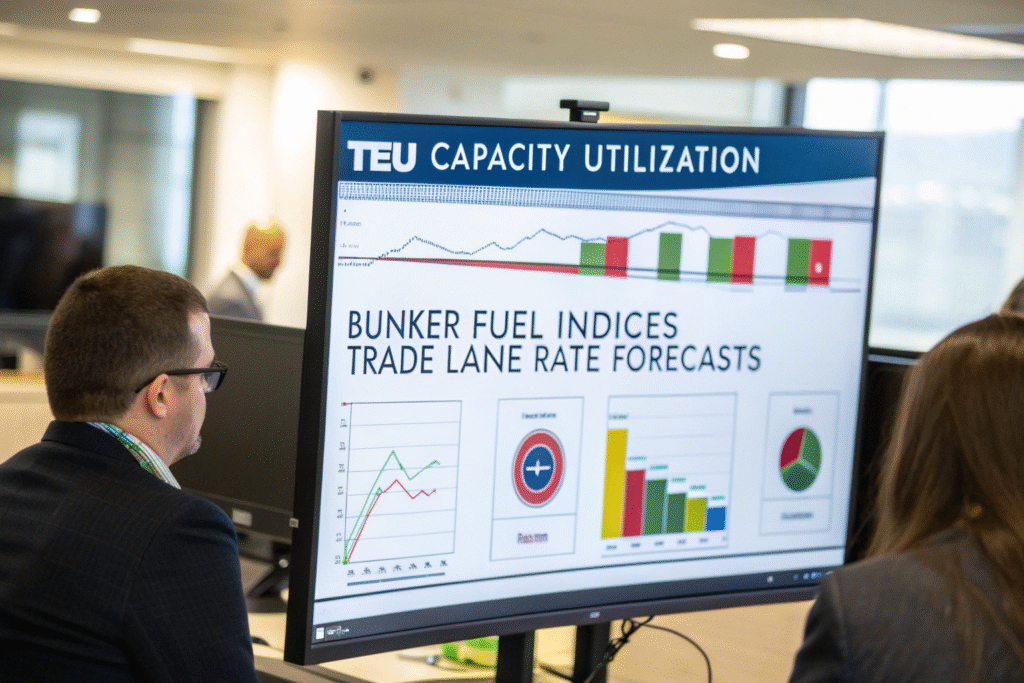

- Capacity and utilization: TEU allocation by carrier alliances.

- Bunker costs and BAF formulas: Fuel cost adjustments linked to oil price benchmarks.

- Seasonal demand: Lunar New Year, Golden Week, and holiday surges driving PSS.

- Service reliability KPIs: On-time vessel departure and schedule reliability metrics.

Effective negotiations require data-driven understanding of these variables and alignment with the carrier’s yield management model.

One of my clients secured a 14% rate reduction by presenting accurate quarterly volume forecasts, enabling the carrier to optimize slot allocation across Asia–U.S. East Coast rotations.

Why Are Market Benchmarks Important?

Drewry provides indices tracking spot rate volatility. Using these benchmarks during discussions improves transparency and negotiation leverage.

How Does Volume Leverage Work?

Freightos notes that forwarders aggregate multiple shippers’ volumes to negotiate base rates, while large BCOs (Beneficial Cargo Owners) secure MQC-based discounts directly.

How Are Contract Rates Structured?

Negotiated contracts specify base ocean rates along with surcharges such as BAF, PSS, and Emergency Bunker Surcharge (EBS). Contracts also define MQCs, service commitments, and free time at destination terminals.

Long-term service contracts mitigate exposure to GRIs, while spot bookings expose shippers to volatility but may offer short-term cost benefits.

I recall an importer of consumer electronics who switched from reliance on spot bookings to an MQC-based contract. This stabilized his landed cost structure during a volatile freight cycle.

Why Are Forwarders Critical in Rate Negotiations?

As Flexport highlights, forwarders pool volume across BCOs to secure competitive base rates and negotiate favorable detention/demurrage terms.

How Do Contracts Protect Shippers?

Hapag-Lloyd explains that service contracts define obligations on both sides, including allocation guarantees and penalties for rollovers, improving predictability for supply chain planning.

How Do Seasonality and Forecasting Influence Rates?

Seasonality drives sharp price fluctuations, especially in the Asia–U.S. trade. Forwarders and shippers use forecasting tools to anticipate GRIs and negotiate bunker-inclusive rates in advance.

Forecast accuracy enhances bargaining power, allowing importers to lock in rates and space allocations before seasonal surges.

For example, a U.S. toy importer avoided peak surcharges by negotiating MQC-based space six months before Q4 demand.

Why Is Forecasting a Negotiation Lever?

Sea-Intelligence demonstrates that accurate forecasting reduces rollover risk and strengthens the shipper’s position in rate discussions.

How Are PSS and GRI Applied?

Maersk clarifies that carriers implement PSS and GRI to offset demand spikes. Forwarders negotiate caps or deferment clauses to protect shippers during peak cycles.

What Role Do Value-Added Services Play in Negotiations?

Negotiations extend beyond ocean base rates. Bundled solutions incorporating drayage, customs brokerage, and digital visibility platforms are increasingly part of competitive pricing structures.

Forwarders that offer integrated supply chain solutions provide not only cost savings but also KPI-driven visibility and risk management, enhancing the total value proposition.

One of my clients reduced total logistics spend by 17% through a DDP bundle that included freight, duties, and last-mile delivery negotiated under a single framework.

Why Do Bundled Services Strengthen Negotiation?

UPS explains that integrated logistics reduces handoffs and administrative costs, allowing forwarders to provide more competitive rates.

How Do Digital Platforms Enhance Value?

Supply Chain Digital emphasizes that real-time visibility tools improve decision-making, enabling forwarders to justify bundled cost efficiencies.

Conclusion

Freight rate negotiation in containerized trade is a complex, data-driven process that combines market intelligence, volume leverage, contractual structures, and value-added services. By partnering with forwarders who aggregate volumes and manage surcharges strategically, shippers gain resilience against volatility, secure predictable landed costs, and ensure long-term competitiveness in global supply chains.