Indonesia’s new 19% import duty in 2025 has triggered major adjustments for exporters and importers alike. If your business relies on shipping goods—especially from China to Indonesia—this update could increase your overall landed costs significantly. Without a solid logistics and compliance strategy, you may face delays, unexpected fees, or even rejected shipments at customs.

This guide outlines practical steps exporters can take to lower costs and improve shipping efficiency when facing Indonesia’s 19% import duty. From rethinking Incoterms to leveraging bonded warehousing, we break down smart ways to stay compliant and profitable.

As an experienced freight forwarder trusted across Asia, GeeseCargo works closely with clients navigating policy shifts like this one. Our goal is to ensure your products keep moving, even when import rules change.

What Does the New 19% Import Duty Cover?

Indonesia’s 19% import duty doesn’t apply to every commodity, but the impact on key industries is undeniable.

This new rate affects a wide range of goods from textiles and electronics to household items. Exporters must now recalibrate profit margins and negotiate smarter freight terms.

Which Product Categories Are Most Affected?

The new 19% rate especially impacts sectors like garments, fashion accessories, electronics, and processed food items. For brands shipping from China, these categories now experience significantly higher landed costs when imported into Indonesia.

Refer to Indonesia’s Ministry of Trade tariff index or search HS codes via Trade Map to identify exact changes relevant to your products.

Why Did Indonesia Raise These Duties?

The government’s aim is to reduce non-essential imports, protect domestic manufacturers, and balance the trade deficit. While this benefits local suppliers, it creates price competition challenges for foreign exporters unless they adapt quickly.

Explore Indonesia's 2025 customs policy updates to understand the strategic intent behind these measures.

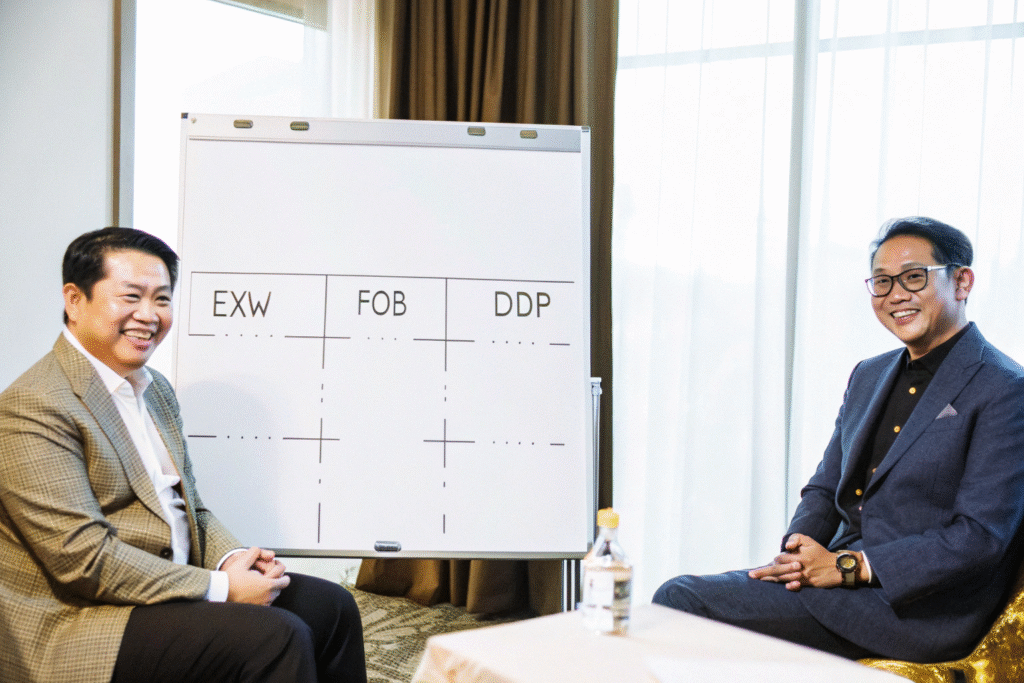

How Can You Reduce Costs With Smarter Incoterms?

Your shipping terms directly influence how the 19% duty hits your bottom line.

Shifting Incoterms can shift financial responsibility—giving you control over tariffs or passing them to your Indonesian buyer. Done right, it helps both parties manage exposure and budgeting.

Is Switching from DDP to FOB a Good Idea?

Yes, in many cases. With DDP (Delivered Duty Paid), you’re on the hook for the full 19% duty. By switching to FOB (Free on Board) or EXW (Ex Works), you shift responsibility to the importer, which can simplify your tax burden and customs clearance.

Use Incoterms explained from the ICC or compare real-world shipping calculators at Freightos to model cost outcomes.

Can You Use FCA with an Indonesian Distributor?

Absolutely. With FCA (Free Carrier), you deliver goods to a nominated carrier, and your buyer handles customs and duty on their side. This offers a middle ground, especially when working with experienced distributors in Jakarta or Surabaya.

Check out this FCA Incoterm breakdown to assess fit for your current routes.

Should You Reroute Through ASEAN to Avoid Duties?

Indonesia’s duty policies are part of a larger ASEAN framework that can offer duty relief—if used smartly.

By leveraging Free Trade Agreements (FTAs) and bonded logistics zones in neighboring countries, exporters can lower or defer the 19% duty on certain goods.

Can You Use Vietnam or Malaysia for Preprocessing?

Yes. Products routed through Vietnam’s bonded warehouses or Malaysia’s Port Klang FTZ may qualify for different duty treatment—especially if further processing or value-add occurs. This is ideal for goods like semi-finished garments or electronics.

Review bonded zone regulations via VSIP Vietnam and PKFZ Malaysia for eligibility and timelines.

What Is the Role of ASEAN Trade Agreements?

Indonesia is a member of ASEAN-China FTA and RCEP, meaning goods with certified origin documentation can qualify for reduced or zero tariffs under specific rules.

Verify if your product qualifies under the ASEAN Trade in Goods Agreement (ATIGA) and secure a Form E Certificate of Origin to support the claim.

What Role Can Freight Forwarders Like Us Play?

You don’t need to solve this alone. Freight forwarders like GeeseCargo exist to help clients navigate trade policy changes and optimize global logistics.

By consulting a professional forwarder, you gain access to smarter route design, real-time tax updates, and secure compliance—all without hiring in-house customs experts.

Can a Freight Forwarder Help With HS Code Reclassification?

Yes. We help reclassify goods to more favorable HS codes when possible, especially for multi-purpose items. This must be based on genuine product usage and supported by documentation, but can lead to 5–10% landed cost savings.

Tools like WCO’s HS tools and Trademo Intel can help, or you can contact us for a full review.

Do Forwarders Offer End-to-End Tax Simulation?

Absolutely. At GeeseCargo, we run customs simulation reports that forecast duties and suggest alternative routes based on trade data. This lets buyers like Ron in the U.S. make smarter choices upfront—before production starts.

You can also access GoComet's landed cost estimator or get our tailored spreadsheet analysis by emailing us directly.

Conclusion

Indonesia’s 2025 19% import duty marks a turning point for exporters into Southeast Asia. It’s no longer enough to rely on standard logistics flows or assume buyers will absorb costs.

Smart businesses must now update Incoterms, reconsider bonded rerouting options, prepare airtight compliance files, and lean on logistics partners who understand the region’s customs ecosystems.

At GeeseCargo, we help you transform policy changes into profit opportunities. To talk about your Indonesia shipping strategy—or get help recalculating duty exposure for your next order—reach out to Ben Zhu at benzhu@geesecargo.com. We’re ready to move with you, duty or no duty.