Customs regulations are one of the biggest challenges for international trade. Many importers and exporters, including my own clients, often feel frustrated because even when every document is prepared, unexpected rules or sudden policy updates delay shipments. These delays increase costs and create uncertainty for business owners who rely on timely deliveries.

Customs regulations are complex because they combine multiple countries’ laws, tariff policies, and security checks, while also requiring accurate documents and compliance with free trade agreements.

From my years of experience handling freight forwarding between China, the United States, and Europe, I have seen how unpredictable customs can be. Let’s explore why these regulations are so complicated and what business owners should understand before shipping goods across borders.

What documents are required for international shipping?

International shipping always starts with paperwork. Clients often think that customs clearance is only about paying duties, but in reality, missing or inaccurate documents are the top reason for delays.

The main customs documents are the commercial invoice, packing list, and bill of lading, which customs officers use to verify cargo details, value, and compliance.

Why is documentation so important?

Customs officers rely on documents to confirm whether goods match their declared value and description. If the bill of lading shows different details from the packing list, the shipment will be flagged. This step is essential because authorities use the paperwork to calculate tariffs and assess security risks.

Which errors cause the most delays?

The most common mistakes are incorrect HS codes or undervalued invoices. HS codes, explained by the World Customs Organization, classify products globally. Misclassification leads to fines or re-inspection. Undervaluation, on the other hand, is seen as fraud, and shipments can even be seized.

How do tariff policies create uncertainty?

Tariffs make customs procedures even more complicated. They are not fixed rules but rather tools that governments adjust depending on economic and political needs. For importers, this means that duty rates can change overnight.

Tariff policies are complex because they depend on trade agreements, product classifications, and the political relationship between countries.

Why do tariffs change so often?

Governments often use tariffs to protect domestic industries or as part of trade negotiations. For example, the U.S. introduced Section 301 tariffs on many goods from China. Importers of clothing and accessories must regularly check updated lists before shipping to avoid unexpected costs.

How do businesses manage tariff risks?

Many companies work with customs brokers who monitor policy updates daily. Others use global trade platforms like Trade Map to calculate landed costs in advance. These strategies help reduce surprises and ensure that supply chains remain stable despite tariff uncertainty.

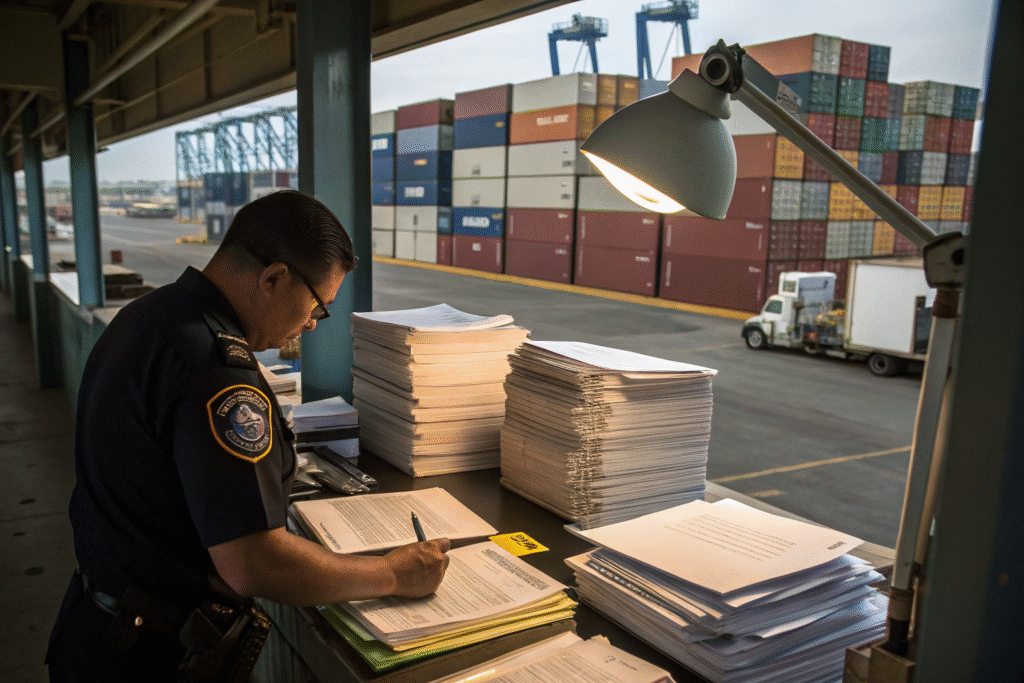

Why are security checks so strict?

Security has become a top priority for customs worldwide. Since trade involves millions of containers, governments must ensure that dangerous, counterfeit, or illegal goods do not cross borders.

Security checks are strict because customs agencies must protect public safety, prevent smuggling, and enforce anti-terrorism measures.

What role do inspections play?

Inspections allow customs to catch risks before they reach consumers. The U.S. Customs and Border Protection uses technology like X-ray scanners, risk assessment software, and random checks. Even compliant shipments may be delayed because of these inspections.

How does this affect importers?

Importers often face uncertainty since inspections can be random. Even if all documents are correct, customs officers may still open containers. Many companies protect themselves with cargo insurance from providers such as Allianz Trade, which covers potential financial losses caused by these unexpected delays.

How do free trade agreements simplify and complicate rules?

Free trade agreements (FTAs) are meant to simplify trade between countries. They reduce tariffs, but they also introduce strict compliance requirements that many businesses struggle to meet.

FTAs help reduce costs but require precise proof of origin and strict certification to qualify for tariff benefits.

What benefits do FTAs bring?

The USMCA agreement allows U.S., Canadian, and Mexican companies to ship many goods with zero tariffs. This saves importers thousands of dollars when they can provide the right certificates of origin.

What makes FTAs hard to use?

The main challenge is documentation. If an importer cannot prove that goods meet FTA requirements, customs will deny tariff reductions. The International Trade Administration provides guidance, but most businesses still need expert freight forwarders or trade lawyers to handle compliance.

Conclusion

Customs regulations are complex because they are influenced by documentation, tariffs, security rules, and international agreements—all of which can change at any time. From my experience as a freight forwarder, I know how confusing this process is for importers. However, by preparing documents correctly, monitoring tariff policies, understanding security procedures, and using free trade agreements wisely, businesses can minimize delays and protect their profits. Partnering with a reliable freight forwarder is often the difference between a smooth customs clearance and a costly setback.