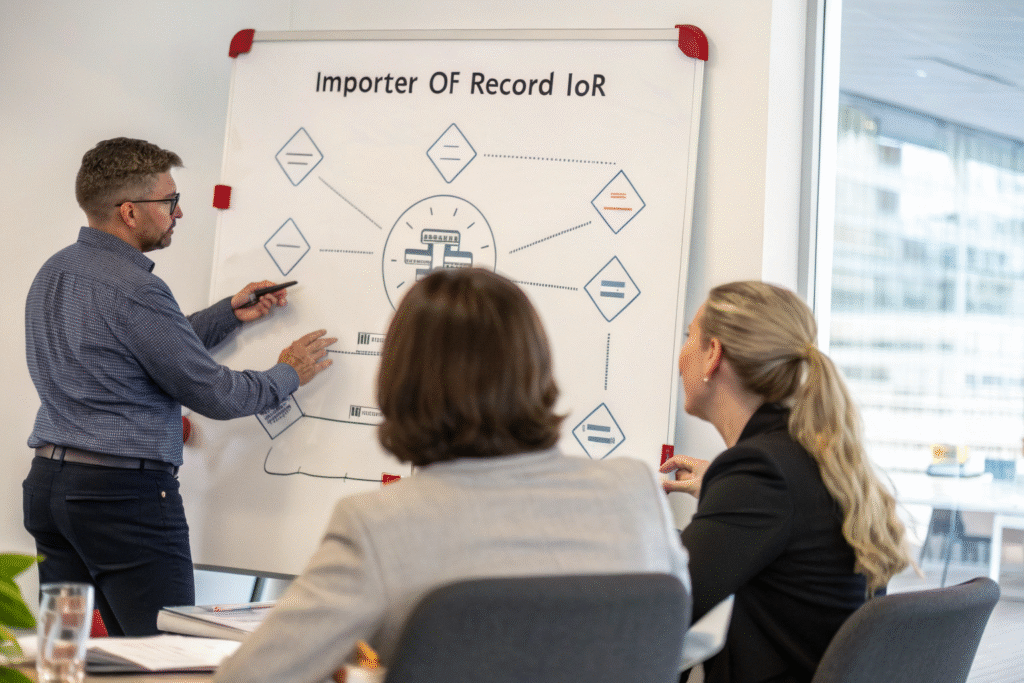

When one of our clients discovered they were unknowingly acting as Importer of Record for their Chinese supplier's shipments, they faced $28,000 in unexpected customs duties and compliance penalties. As founder of GeeseCargo with extensive customs experience, I've learned that misunderstanding this role creates some of the costliest mistakes in international trade. The Importer of Record isn't just a formality—it's a legally designated role with significant responsibilities and liabilities.

The Importer of Record is the entity legally responsible for ensuring imported goods comply with all customs laws, paying required duties and taxes, and maintaining proper import documentation. This can be the actual goods owner, a customs broker acting under power of attorney, or a third-party logistics provider. The IOR assumes full legal and financial liability for the import transaction.

Understanding who should serve as your Importer of Record and what the role entails is fundamental to compliant, cost-effective international trade. The designation affects everything from customs clearance efficiency to financial liability and regulatory compliance.

What Are the Legal Responsibilities of the Importer of Record?

The Importer of Record carries specific legal obligations that extend far beyond simple duty payment to encompass comprehensive regulatory compliance.

What Customs Compliance Obligations Does the IOR Bear?

Accurate classification using the correct Harmonized System codes is fundamental. The IOR must ensure products are classified under proper HS codes, which directly impacts duty rates, trade agreement eligibility, and regulatory requirements.

Proper valuation declaration according to customs methodologies is mandatory. The IOR must declare the correct transaction value following World Trade Organization valuation agreements, including all assists, royalties, and proceeds subsequently realized.

Truthful country of origin designation affects duty rates and admissibility. The IOR must accurately declare where goods were substantially transformed, as this determines duty rates under various trade agreements and eligibility for special programs.

What Documentation and Recordkeeping Is Required?

Commercial documentation maintenance includes invoices, packing lists, and bills of lading. The IOR must ensure all commercial documents accurately reflect the transaction and are available for customs examination.

Regulatory compliance records demonstrate adherence to partner government agency requirements. Depending on the products, this may include FDA, USDA, CPSC, or other agency certifications, permits, or testing reports.

Record retention for five years from date of entry is standard requirement. The IOR must maintain all import documentation, including communications with customs brokers and internal decision records, for potential audit or verification.

Who Can Serve as Importer of Record?

The designation of who acts as Importer of Record depends on business structure, capabilities, and strategic decisions about risk management.

When Should the Actual Goods Owner Be the IOR?

Companies with established import compliance programs often self-designate. Businesses with dedicated trade compliance teams, robust processes, and understanding of regulatory requirements typically benefit from acting as their own IOR.

Businesses wanting direct control over customs decisions maintain IOR status. When classification, valuation, or origin decisions have significant financial or compliance implications, direct control may be preferable.

Importers using preferential trade programs usually need IOR status. To claim benefits under free trade agreements or special programs, the actual importer often must be designated as IOR rather than using a third party.

When Does Using a Third-Party IOR Make Sense?

First-time importers or those with limited compliance resources benefit from third-party IORs. Companies new to importing or without dedicated compliance staff can transfer risk and complexity to experienced providers.

Businesses without physical presence in the destination country require local IOR. When companies lack legal entity status in the import country, they must use a third-party IOR who meets local presence requirements.

High-risk product importers sometimes use third parties for liability protection. When importing products with significant regulatory risk, using a third-party IOR can provide liability buffer, though ultimate responsibility may still trace back to the actual owner.

What Are the Financial Responsibilities and Liabilities?

The Importer of Record assumes substantial financial obligations that extend beyond simple duty payments to include penalties, fines, and potential seizure costs.

What Direct Financial Obligations Does the IOR Bear?

Duty and tax payment represents the most obvious financial responsibility. The IOR must pay all applicable duties, taxes, fees, and surcharges based on accurate classification, valuation, and origin determinations.

Customs bond maintenance is required for most commercial shipments. The IOR must secure and maintain an appropriate customs bond that guarantees payment of duties, taxes, and potential penalties.

Anti-dumping and countervailing duties apply to specific products and countries. The IOR is responsible for identifying when these additional duties apply and ensuring their proper payment.

What Penalty Exposures Does the IOR Face?

Monetary penalties for compliance violations can be substantial. Errors in classification, valuation, origin, or documentation can trigger penalties ranging from hundreds to millions of dollars depending on violation severity.

Seizure and forfeiture risks exist for prohibited or restricted merchandise. The IOR bears financial responsibility for goods seized due to compliance failures, intellectual property violations, or prohibited status.

Liquidated damages claims against customs bonds occur for various violations. When import requirements aren't met, customs can make claims against the import bond for financial damages.

How Does the IOR Interact with Other Supply Chain Parties?

The Importer of Record coordinates with multiple parties throughout the supply chain to ensure compliant and efficient import processes.

What Is the Relationship Between IOR and Customs Broker?

The customs broker acts as the IOR's agent when properly authorized. Through a power of attorney, the broker can perform customs transactions on the IOR's behalf, but ultimate responsibility remains with the IOR.

Information sharing must be complete and accurate for proper representation. The IOR must provide the broker with all necessary information for correct customs declarations, as incomplete or inaccurate information creates compliance risk.

Supervision responsibility means the IOR must oversee broker performance. While brokers provide expertise, the IOR remains responsible for ensuring declarations are accurate and compliant with all regulations.

How Does the IOR Work with Suppliers and Carriers?

Supplier information requirements ensure accurate customs declarations. The IOR must obtain detailed product information, cost breakdowns, and origin documentation from suppliers to support proper import processes.

Carrier coordination ensures timely filing of required documentation. The IOR works with carriers to ensure vessel manifests, advance electronic information, and other carrier filings align with import declarations.

Liability allocation through contracts clarifies responsibility boundaries. Well-drafted contracts with suppliers, carriers, and service providers help define where IOR responsibility ends and other party responsibilities begin.

What Are the Strategic Considerations in IOR Selection?

Choosing who acts as Importer of Record involves balancing control, cost, capability, and risk management considerations.

What Factors Influence the Make-or-Buy IOR Decision?

Compliance capability assessment determines internal capacity. Companies must honestly evaluate whether they have the expertise, systems, and processes to manage IOR responsibilities effectively.

Volume and frequency analysis impacts the economics. High-volume importers often benefit from internal IOR capabilities, while sporadic importers may find third-party solutions more cost-effective.

Risk tolerance affects liability preferences. Companies with low risk tolerance may prefer third-party IOR solutions despite higher costs, while those comfortable managing risk may choose direct control.

How Does Business Structure Impact IOR Decisions?

Legal entity presence requirements vary by country. Some countries require the IOR to have physical presence or legal entity status, forcing certain structural decisions.

Related-party transactions require special consideration. When importing from related companies, transfer pricing documentation and special valuation rules add complexity to IOR responsibilities.

Multiple entity structures may need consolidated IOR approaches. Companies with multiple legal entities importing goods may benefit from centralized IOR management despite operational complexity.

What Are Common IOR Mistakes and How to Avoid Them?

Understanding frequent errors helps importers avoid costly compliance problems and operational disruptions.

What Documentation and Process Errors Occur Frequently?

Incorrect power of attorney management creates representation gaps. Improperly executed or outdated powers of attorney can invalidate customs broker actions, leaving imports non-compliant despite broker involvement.

Inadequate product information from suppliers causes declaration errors. Failure to obtain detailed product specifications, manufacturing processes, and cost breakdowns leads to classification and valuation mistakes.

Recordkeeping disorganization hampers audit defense. Poor document management makes responding to customs inquiries or audits difficult, potentially transforming minor errors into major penalties.

How Can Companies Ensure Ongoing IOR Compliance?

Regular compliance audits identify process gaps before they become violations. Systematic reviews of import processes, documentation, and decisions catch errors proactively rather than reactively.

Continuous education on regulatory changes maintains compliance. Customs regulations change frequently, requiring ongoing education for staff managing IOR responsibilities or overseeing third-party IORs.

Technology implementation supports consistent processes. Customs management software helps maintain classification databases, document retention, and process consistency across all imports.

Conclusion

The Importer of Record role represents one of the most significant but misunderstood responsibilities in international trade. The designation carries substantial legal, financial, and compliance obligations that extend far beyond simply paying duties. Companies that strategically manage their IOR approach typically experience fewer customs delays, lower compliance costs, and reduced penalty exposure.

At GeeseCargo, we've helped hundreds of clients navigate IOR decisions, with the most successful outcomes coming from companies that treat the designation as a strategic choice rather than an automatic default. The key is matching IOR approach to your specific business capabilities, risk tolerance, and operational model.

Begin your IOR evaluation by conducting a thorough assessment of your internal capabilities, then carefully consider the control, cost, and risk tradeoffs of different approaches. Remember that whoever acts as Importer of Record assumes significant responsibilities—proper understanding and management of these obligations is essential for successful international trade operations.