When a major retail client shifted their East Coast imports from New York to Savannah last year, they reduced their inland transportation costs by 18% and cut customs clearance time by three days. As founder of GeeseCargo, I've analyzed thousands of distribution networks and found that port selection can impact total supply chain costs by 15-25%. The right choice depends entirely on your specific cargo profile, customer locations, and service requirements.

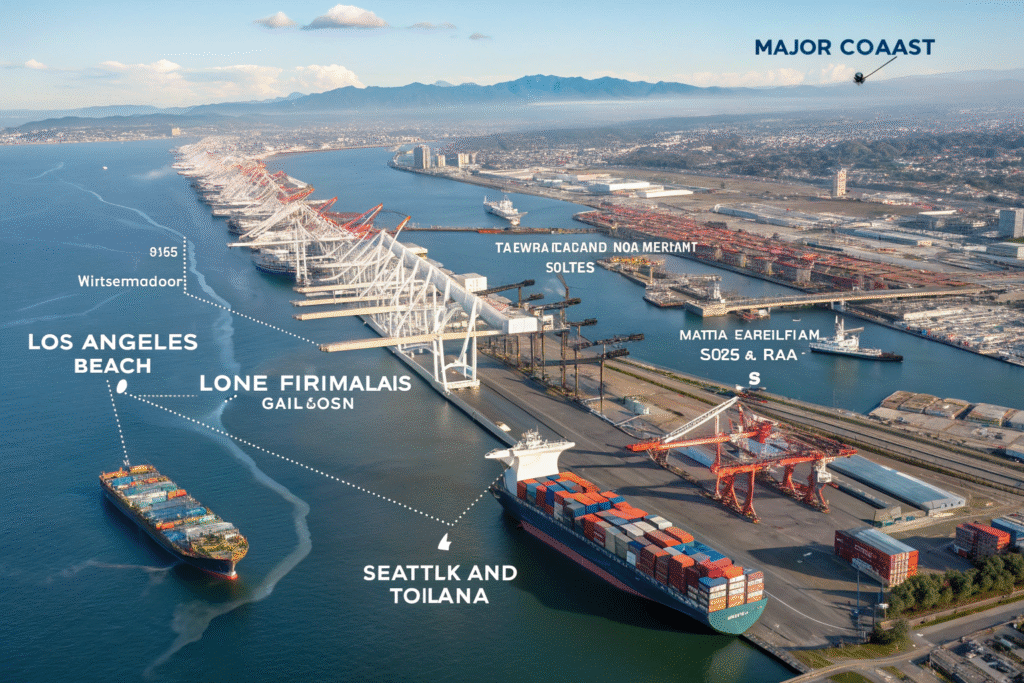

The best US ports for your distribution network depend on your final destination locations, cargo type, and service priorities. West Coast ports excel for destinations west of the Mississippi, East Coast ports serve the Eastern seaboard efficiently, and Gulf ports offer advantages for central US locations and specific commodities. Each port group has distinct infrastructure capabilities and congestion patterns.

Selecting the right port involves analyzing total landed costs rather than just ocean freight rates. The optimal choice balances port efficiency, inland transportation costs, congestion risks, and specialized handling capabilities for your specific products.

What Are the Key West Coast Port Options and Their Advantages?

West Coast ports provide the shortest transit times from Asia and handle the majority of trans-Pacific trade. Understanding their different strengths helps match specific ports to your operational needs.

Why Consider the LA/Long Beach Complex?

The San Pedro Bay complex handles approximately 40% of all US container imports, creating unparalleled infrastructure and service frequency. The massive scale means more vessel options, faster transit times, and greater equipment availability than any other US port pair.

Their intermodal connections are exceptional, with direct rail access to all major Midwest markets via double-stack trains. The Alameda Corridor provides dedicated rail access to downtown Los Angeles, avoiding urban congestion. For distribution to the western US or via rail to the Midwest, LA/Long Beach offers the most options.

The challenges include higher congestion during peak seasons and more complex labor dynamics. However, their scale also means more resources to resolve disruptions quickly. The ports have invested heavily in automation and night gates to improve fluidity.

When Do Northwest Ports Make Sense?

The Pacific Northwest ports of Seattle and Tacoma offer faster transit times to certain Midwest markets than Southern California routes. Their geographic position provides advantages for cargo destined for the Upper Midwest, including Chicago, Detroit, and Minneapolis.

These ports experience less congestion than Southern California while maintaining excellent rail connections via BNSF and Union Pacific. The natural deep-water channels accommodate the largest vessels without dredging constraints. For time-sensitive cargo or manufacturing components, the reliability advantage can outweigh slightly higher ocean freight costs.

The Pacific Northwest's specialized equipment availability excels for agricultural exports, automotive parts, and manufacturing goods. The ports have developed particular expertise in these commodities, providing better service and handling for relevant imports.

What Differentiates Major East Coast Ports?

East Coast ports have invested heavily to accommodate larger vessels following the Panama Canal expansion. Each major port has developed distinct advantages based on geography, infrastructure, and market focus.

What Makes the Port of New York/New Jersey Unique?

As the largest East Coast port, NY/NJ offers the most direct vessel calls and service options. Its proximity to the massive Northeast consumer market provides obvious advantages for goods destined for the Boston-to-Washington corridor.

The port's intermodal network includes extensive rail connections to Chicago, the Ohio Valley, and Canada. While known for congestion challenges, recent infrastructure investments have significantly improved terminal efficiency and truck turnaround times.

NY/NJ excels for high-value cargo, perishables, and time-sensitive shipments where proximity to market outweighs cost considerations. The port's specialized facilities for temperature-controlled cargo and dangerous goods are among the best on the East Coast.

Why Has Savannah Become So Popular?

The Port of Savannah has experienced explosive growth due to its significant cost advantages and efficient operations. As a single-terminal operation, it avoids the complexity of multi-terminal ports, simplifying container movement and reducing intra-port transportation costs.

Savannah's location positions it ideally to serve both the Southeast and growing Southern markets. The inland port system extends its reach to Atlanta, Charlotte, and Nashville via efficient rail connections. For distribution centers located in the Southeast, Savannah often provides the lowest total landed cost.

The port's ongoing expansion projects will further increase capacity and accommodate larger vessels. While currently experiencing some congestion during peak periods, the long-term infrastructure investments position Savannah for continued growth.

How Do Gulf Coast Ports Fit into Distribution Strategies?

Gulf Coast ports have transformed from primarily handling bulk commodities to becoming competitive container gateways. Their strategic advantages for specific trade lanes and cargo types are often overlooked.

What Are Houston's Strengths Beyond Energy?

The Port of Houston has developed into a diversified gateway handling containerized, breakbulk, and project cargo. Its location provides excellent access to the growing Texas market and manufacturing centers throughout the Southwest.

Houston excels for project cargo, industrial equipment, and manufacturing components supporting the energy and petrochemical industries. The port's heavy-lift capabilities and experience with oversized cargo are particularly valuable for industrial importers.

The container terminals have expanded significantly, now handling substantial Asia-US Gulf services. For distribution to Texas, Oklahoma, Arkansas, and Louisiana, Houston often provides the most direct routing and lowest inland costs.

When Should You Consider Mobile or New Orleans?

The Port of Mobile has emerged as a cost-effective alternative with excellent rail connections to the Midwest. CSX and Norfolk Southern provide direct service, making Mobile competitive for destinations as far north as Chicago and Columbus.

Mobile offers particularly competitive pricing for agricultural products, forest products, and automotive cargo. The port has developed specialized facilities for these commodities, providing efficiency advantages over more congested alternatives.

New Orleans provides unique access to the Mississippi River system, enabling cost-effective barge transportation to inland points. For project cargo or bulk items requiring waterway access, New Orleans offers capabilities unavailable elsewhere.

How Should You Evaluate Ports for Your Specific Needs?

Systematic port evaluation requires analyzing multiple factors beyond basic port capabilities. The optimal choice depends on your specific cargo characteristics, customer locations, and service requirements.

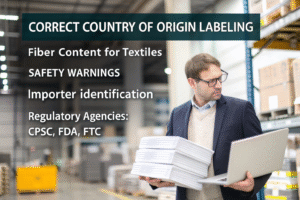

What Cost Factors Should You Analyze Beyond Ocean Freight?

Inland transportation costs typically represent 40-60% of total port-to-door expenses. Analyze drayage rates, rail costs, and trucking expenses from each port alternative to your distribution centers. Ports with higher ocean freight rates may offer lower total costs when inland transportation is considered.

Port charges vary significantly between gateways. Terminal handling charges, wharfage fees, and port security charges can differ by hundreds of dollars per container. These differences become substantial at volume.

Demurrage and detention exposure depends on port efficiency and local chassis availability. Ports with chronic congestion or equipment shortages create hidden costs through unexpected container storage fees.

How Do Reliability and Efficiency Metrics Impact Your Choice?

Vessel schedule reliability varies by port and carrier. Some ports consistently experience better on-time performance due to weather patterns, labor relations, and terminal efficiency. Reliability often matters more than small cost differences for time-sensitive supply chains.

Gate efficiency measures how quickly trucks can enter terminals, complete transactions, and exit with cargo. ports with extended gate hours, appointment systems, and automated processing typically provide faster, more predictable turn times.

Peak season performance indicates how well ports handle volume surges. Some ports maintain reasonable service levels during busy periods while others experience severe degradation. Historical peak season data provides valuable insights for long-term planning.

Conclusion

Selecting the right US ports for your distribution network requires balancing multiple factors including geography, cost, reliability, and specialized capabilities. The most successful companies develop port diversification strategies that provide flexibility during disruptions while optimizing costs during normal operations.

At GeeseCargo, we've helped hundreds of clients implement port strategies that reduced total supply chain costs by 12-18% while improving service levels. The process begins with understanding your specific distribution patterns, then matching those requirements to port capabilities through detailed modeling and analysis.

Remember that the optimal port choice today may change as your business evolves, port infrastructure improves, or new shipping services emerge. Regular review of your port strategy ensures you continue benefiting from the best options available in a dynamic logistics environment.