Navigating China's export customs process can seem daunting for international businesses. The system involves specific documentation, regulatory requirements, and procedures that differ from Western customs practices. Understanding these requirements is crucial for avoiding delays, penalties, or shipment rejections that can disrupt your supply chain.

China's export customs process requires proper business registration, accurate documentation, commodity-specific licenses, and compliance with evolving regulations. The process typically takes 1-3 days for standard shipments and involves submission through the China Electronic Port System, with customs brokers handling most interactions on behalf of foreign companies.

Let's examine the key components of China's export customs system and how to ensure your shipments clear customs efficiently and compliantly.

What are the essential documentation requirements?

Proper documentation forms the foundation of successful customs clearance in China. The documents must be complete, accurate, and compliant with specific Chinese formatting requirements that sometimes differ from international standards.

The core documents include the commercial invoice, packing list, sales contract, and shipping instructions. Additionally, China requires specific forms like the Customs Declaration Form, Export License for restricted goods, and various certificates depending on the commodity type. All documents must align perfectly—discrepancies between the commercial invoice, packing list, and bill of lading routinely cause delays. The documents must be submitted through authorized customs brokers who have access to China's Electronic Port system.

Why is the Chinese Commercial Invoice unique?

China's commercial invoice requires specific elements:

- Both Chinese and English descriptions for many product categories

- Detailed manufacturer information including name, address, and contact details

- Accurate HS codes using China's 10-digit classification system

- Clear payment terms matching the sales contract

- Proper incoterms specification defining responsibility transfer

- Company chops (seals) from both exporter and customs broker

Missing any required element can result in rejection and resubmission requirements.

What supporting documents might be required?

Additional documents depend on product type:

- Certificate of Origin for preferential tariff claims

- Inspection Certificates for regulated products like food, chemicals, or electronics

- Export Licenses for controlled commodities like certain minerals or technologies

- Quality Certificates demonstrating compliance with Chinese standards

- Packaging Declarations for wood or other regulated packaging materials

Identifying required additional documents early prevents last-minute scrambling.

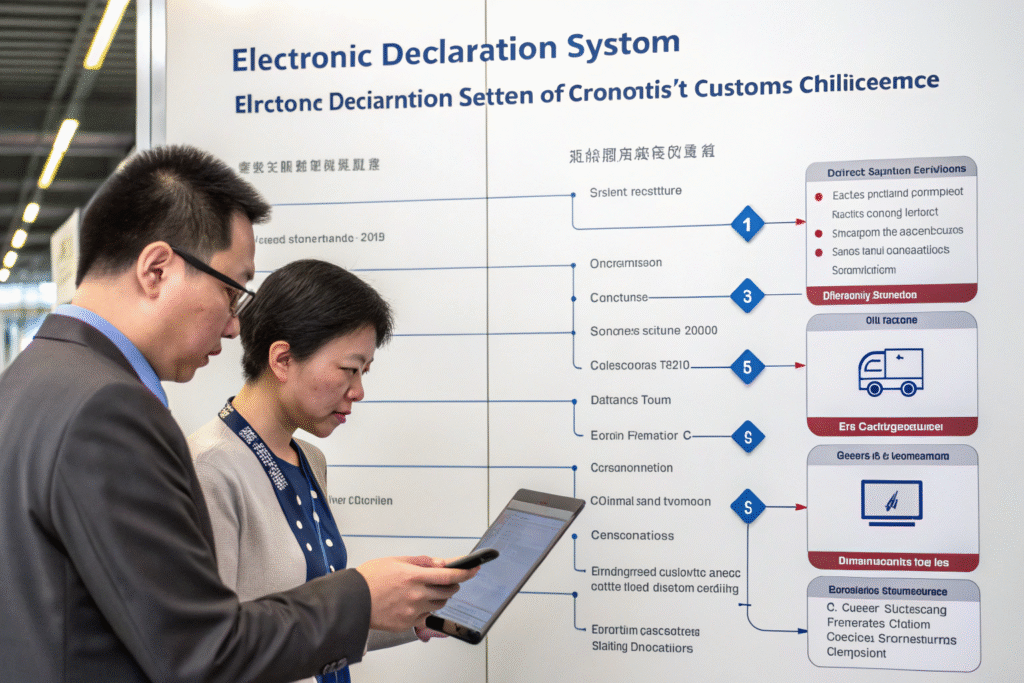

How does the customs declaration process work?

China's customs declaration process is highly electronic through the China Electronic Port system, with specific procedural steps that must be followed in sequence. Understanding this workflow helps set realistic timing expectations.

The process begins with data entry into the Electronic Port system by an authorized customs broker. Customs officials then review the declaration and may request additional information, conduct an inspection, or issue immediate clearance. For standard shipments without complications, clearance typically occurs within 24-48 hours. However, selected inspections can add 1-3 days, while complex regulatory reviews may take significantly longer. The entire process requires working through licensed Chinese customs brokers rather than dealing directly with customs authorities.

What are the key steps in the declaration process?

The standard sequence involves:

- Data preparation and document collection by the customs broker

- System entry through the China Electronic Port platform

- Customs review and risk assessment by officials

- Potential inspection if selected by the risk management system

- Duty/tax determination for exports subject to charges

- Release notification allowing goods to proceed to port

Each step must complete successfully before the next can begin.

What triggers customs inspections?

Common inspection triggers include:

- Random selection by customs' risk management system

- High-value shipments exceeding certain thresholds

- Restricted commodities requiring verification

- First-time exporters with no established compliance history

- Discrepancies in documentation or declared values

- Specific targeting based on current customs priorities

Understanding these triggers helps assess inspection likelihood for your shipments.

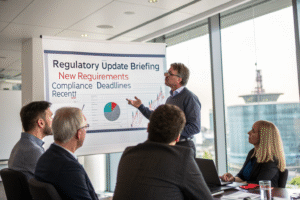

What regulatory compliance issues commonly cause problems?

China's export regulations evolve frequently and include unique requirements that catch foreign businesses unprepared. Compliance failures represent the most common cause of customs delays beyond basic documentation errors.

Key compliance areas include proper product classification using China's Customs Commodity HS codes, accurate valuation following Chinese methodologies, adherence to export control lists for sensitive technologies, compliance with destination country restrictions when known, and proper licensing for regulated commodities. Additionally, China has specific rules regarding intellectual property protection that can affect goods bearing trademarks or patents. Working with experienced partners who maintain current knowledge of regulatory changes is essential for ongoing compliance.

How do Chinese export controls differ from other countries?

China's export control system has unique characteristics:

- Broader scope covering some dual-use items other countries don't regulate

- Different classification systems for controlled commodities

- Vague criteria in some regulations requiring interpretation

- Frequent updates as trade policies evolve

- Strict enforcement with significant penalties for violations

These differences require specialized knowledge beyond general export control understanding.

What valuation rules apply to Chinese exports?

China customs valuation follows these principles:

- Transaction value is the primary basis using actual sale price

- Adjustments required for certain relationship between buyer and seller

- Documentation needed to support declared values

- Potential verification through factory visits or financial reviews

- Penalties applicable for deliberate undervaluation

Proper valuation prevents significant compliance issues and potential penalties.

How can you ensure smooth customs clearance?

Proactive preparation and relationship management significantly improve customs clearance efficiency. The most successful exporters implement systematic approaches rather than treating each shipment as an isolated event.

Develop relationships with reliable customs brokers who have specific experience with your product categories. Maintain accurate product databases with correct HS codes and regulatory information. Implement internal compliance checks before submitting declarations. Allow realistic timelines for the clearance process, including buffer for potential inspections. Keep thorough records of previous shipments to reference during declarations. These practices transform customs clearance from a recurring challenge into a predictable business process.

What makes a good customs broker partnership?

Effective broker relationships feature:

- Specific industry experience with your product types

- Strong track record with the relevant Chinese ports

- Proactive communication about regulatory changes

- Reasonable pricing with transparent fee structures

- Adequate staffing to handle your shipment volume

- Technology integration allowing seamless data exchange

Investing in the right broker partnership pays dividends through smoother operations.

How can technology improve customs compliance?

Modern systems assist through:

- Product databases maintaining accurate classification data

- Document management ensuring consistency across shipments

- Compliance checking flagging potential issues before submission

- Performance tracking monitoring clearance times and issues

- Record keeping maintaining required documentation archives

These technological capabilities reduce errors and improve efficiency.

Conclusion

Understanding China's export customs process requires recognizing its unique documentation requirements, electronic systems, regulatory framework, and procedural sequences. While the system can initially seem complex, it becomes manageable through proper preparation, experienced partners, and systematic approaches. The most successful exporters invest in understanding Chinese requirements specifically rather than assuming international standards apply, develop strong relationships with qualified customs brokers, maintain accurate product information, and implement robust compliance processes. With the right knowledge and partnerships, navigating China's export customs process transforms from a barrier into a competitive advantage that supports efficient, reliable supply chain operations.