International shipping involves numerous risks that can disrupt supply chains and impact business operations. From cargo damage and delays to regulatory compliance issues and unexpected costs, these risks threaten profitability and customer relationships. Many businesses struggle to manage these uncertainties alone, especially when operating across multiple countries and transportation modes.

Freight forwarders play a crucial role in reducing shipping risks through comprehensive insurance options, carrier vetting, route diversification, regulatory compliance management, and proactive problem-solving. Their expertise and established networks create multiple layers of protection that individual shippers cannot easily replicate on their own.

Let's examine the specific strategies and services that professional freight forwarders employ to identify, mitigate, and manage the various risks inherent in international shipping.

How do freight forwarders mitigate cargo damage and loss risks?

Cargo damage and loss represent significant financial risks in international shipping. The journey involves multiple handling points, transportation mode changes, and environmental exposures that can compromise cargo integrity. Professional freight forwarders implement systematic approaches to protect goods throughout their journey.

We begin with proper packaging consultation, ensuring goods are prepared for the specific challenges of their route. We select carriers with proven track records for careful handling and implement tracking technologies that monitor conditions like temperature, humidity, and impacts. Our documentation processes ensure accurate inventory records and clear chain of responsibility, which is crucial for claims processing when issues occur.

What insurance solutions do forwarders provide?

Comprehensive cargo insurance forms the foundation of financial risk protection. We offer:

- All-risk coverage protecting against physical loss or damage from external causes

- Specific risk policies tailored to unique product vulnerabilities

- Liability gap analysis identifying coverage shortfalls in carrier liabilities

- Claims management services ensuring prompt, fair settlement when losses occur

- Policy optimization balancing coverage levels with premium costs

These insurance solutions transform unpredictable potential losses into manageable, predictable costs, providing financial security and business continuity assurance.

How does carrier selection reduce damage risks?

Not all carriers maintain the same standards for equipment maintenance and handling procedures. Our carrier vetting process includes:

- Safety record analysis reviewing incident history and claims ratios

- Equipment inspection verifying container condition and maintenance standards

- Operator training assessment ensuring proper handling protocols

- Performance benchmarking comparing damage rates across carrier options

- Contractual protection including clear liability terms and service guarantees

This rigorous selection process significantly reduces the likelihood of damage from poor handling or equipment failure.

How do forwarders manage delivery timeline risks?

Delivery delays can disrupt production schedules, cause stockouts, and strain customer relationships. The causes range from weather events and port congestion to documentation errors and carrier scheduling issues. Forwarders employ multiple strategies to maintain timeline reliability despite these challenges.

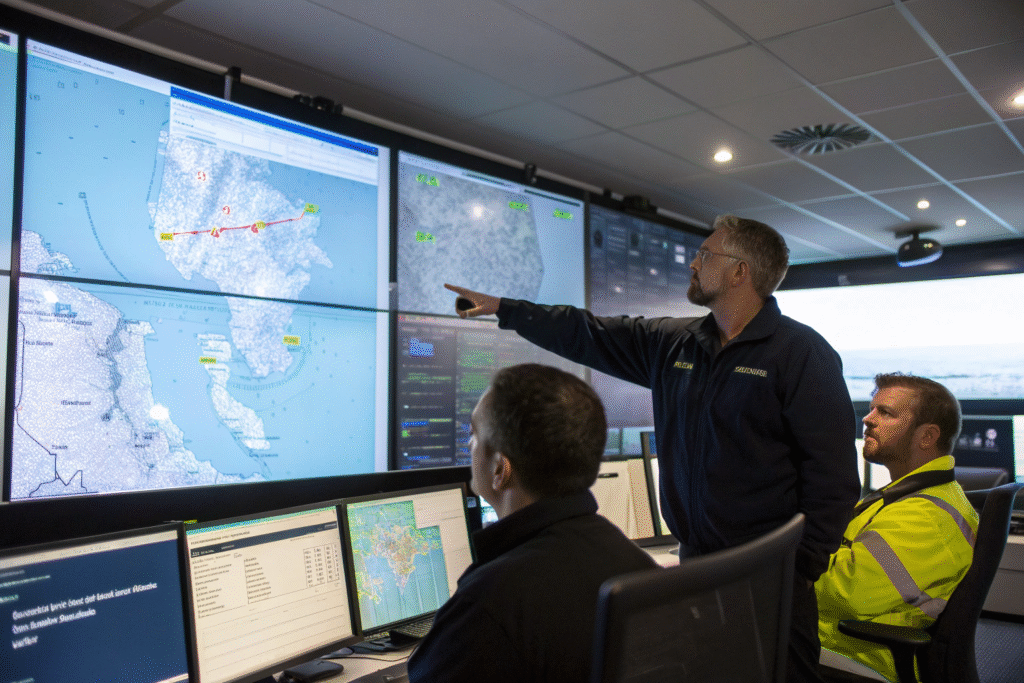

We implement redundant routing options, maintain buffer capacity with multiple carriers, utilize predictive analytics to anticipate delays, and establish clear communication protocols for schedule changes. Our advanced tracking systems provide real-time visibility, allowing for proactive intervention when timelines are threatened. This comprehensive approach minimizes both the frequency and impact of shipping delays.

What role does route diversification play?

Over-reliance on single routes creates vulnerability to localized disruptions. Our diversification strategy includes:

- Multiple port options avoiding dependency on congested gateways

- Intermodal alternatives seamlessly switching between transportation modes

- Regional bypass routes circumventing known bottleneck areas

- Seasonal routing adjusting for weather patterns and peak season impacts

- Carrier redundancy maintaining capacity across multiple service providers

This flexible routing approach ensures that localized disruptions don't paralyze your entire supply chain.

How does documentation accuracy prevent delays?

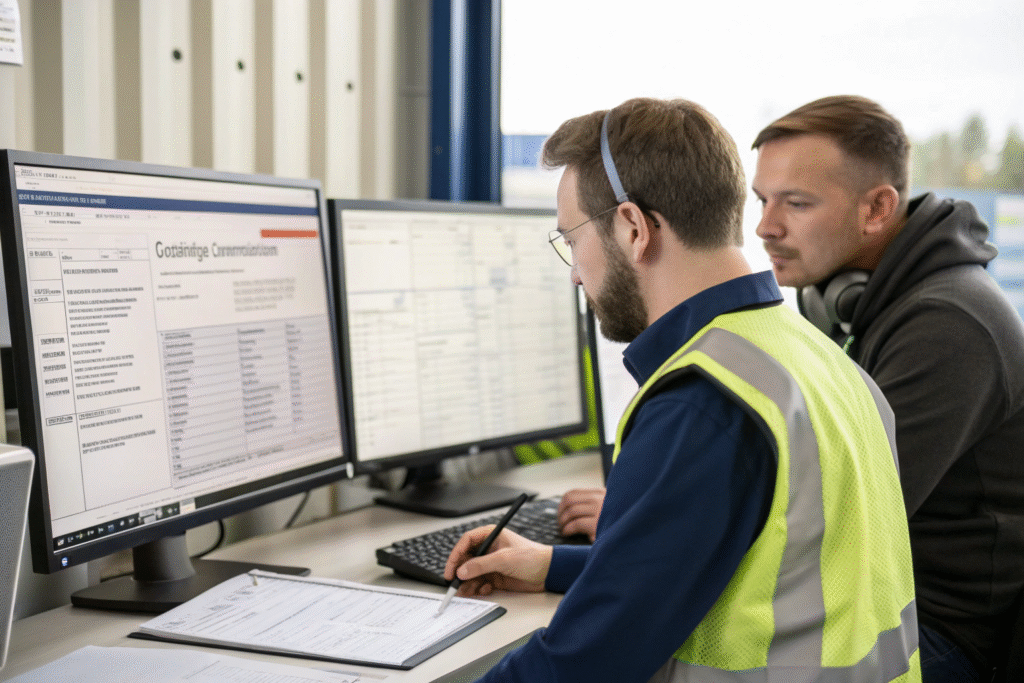

Proper documentation is crucial for avoiding customs and carrier delays. We ensure:

- Advanced submission of customs documents before cargo arrival

- Accuracy verification through multiple review checkpoints

- Regulatory compliance with constantly changing requirements

- Carrier requirement adherence meeting specific documentation standards

- Electronic filing where available to speed processing

This meticulous documentation management prevents the administrative delays that often plague international shipments.

How do forwarders address regulatory and compliance risks?

International trade regulations present complex compliance challenges with serious consequences for violations. Mistakes can result in fines, cargo seizures, and loss of import/export privileges. Forwarders provide essential expertise in navigating this regulatory landscape.

We maintain updated knowledge of customs regulations, trade agreements, sanction programs, and product-specific restrictions across all countries we serve. Our compliance teams conduct classification reviews, verify export control requirements, and ensure proper licensing. This proactive compliance approach protects clients from regulatory penalties and maintains their good standing with customs authorities worldwide.

What specific compliance services do forwarders provide?

Our comprehensive compliance services include:

- HS code classification ensuring accurate duty assessment and regulatory treatment

- Export control screening verifying compliance with restricted party lists

- Trade agreement optimization maximizing duty savings under preferential programs

- Recordkeeping management maintaining required documentation for audits

- Regulatory update monitoring implementing changes before they impact shipments

These services transform compliance from a business burden into a strategic advantage while minimizing regulatory risks.

How do forwarders manage security risks?

Cargo security threats including theft, tampering, and terrorism require specialized measures. We implement:

- Container security protocols verifying seals and monitoring access

- Facility security standards ensuring safe storage at all handling points

- Carrier security requirements selecting partners with robust security programs

- Tracking technology providing real-time location and condition monitoring

- Security training ensuring all handling personnel follow established protocols

These layered security measures protect both the physical cargo and the broader supply chain from security breaches.

How do forwarders handle financial and cost risks?

Unexpected costs can dramatically impact the profitability of international trade. From currency fluctuations and duty changes to accessorial charges and demurrage fees, financial uncertainties abound. Forwarders provide cost predictability and financial risk management.

We offer all-inclusive pricing models that minimize surprise charges, provide duty and tax estimation services, implement detention and demurrage prevention strategies, and offer currency hedging advice. Our volume purchasing power also secures favorable rates that individual shippers cannot obtain, creating direct cost savings while enhancing financial predictability.

What strategies control unexpected accessorial charges?

Accessorial charges often surprise shippers. We prevent these through:

- Comprehensive quoting including all potential charges upfront

- Process optimization minimizing special handling requirements

- Carrier negotiation limiting or capping accessorial fees

- Client education explaining how to avoid charge triggers

- Invoice auditing challenging unjustified charges

This proactive approach to charge management ensures cost predictability and budget adherence.

How do forwarders manage currency and duty risks?

International trade involves currency exchange and duty calculation uncertainties. We provide:

- Duty optimization strategies leveraging trade agreements and classification options

- Currency fluctuation monitoring advising on timing for maximum advantage

- Bonded warehouse options deferring duty payments until goods are sold

- Drawback services recovering duties on re-exported goods

- Regulatory change alerts providing advance notice of duty rate changes

These financial management services protect profit margins from international trade uncertainties.

Conclusion

Freight forwarders serve as essential risk management partners in international shipping, providing protection far beyond simple transportation arrangements. Through insurance solutions, carrier vetting, compliance management, route diversification, and financial controls, they create layered defenses against the numerous risks inherent in global supply chains. This comprehensive risk mitigation approach not only prevents losses and disruptions but also provides the confidence businesses need to expand internationally and compete effectively in global markets. The value extends beyond cost savings to include business continuity, regulatory compliance, and strategic advantage in an increasingly complex global trade environment.