A customs bond represents one of the most fundamental yet misunderstood requirements in international trade. Many importers encounter this requirement for the first time when their shipments are held at customs, creating urgent situations where understanding comes too late. A customs bond serves as a critical financial guarantee that protects both the government and your business in international transactions.

A customs bond is a legally binding contract between the importer, the surety company, and U.S. Customs and Border Protection that guarantees payment of duties, taxes, and penalties owed to the government. You need a customs bond for any formal entry exceeding $2,500 in value, for certain restricted commodities regardless of value, and to maintain import privileges for frequent shipments.

Let's examine the specific types of bonds, their operational mechanisms, and strategic considerations to determine your bonding requirements and optimize your import compliance strategy.

What are the different types of customs bonds and their applications?

Customs bonds come in two primary forms with distinct purposes, coverage limits, and cost structures. Understanding these differences ensures you obtain the appropriate bond type for your specific import activities.

A single transaction bond covers one import entry and is typically used for occasional imports where the importer doesn't regularly bring goods into the United States. A continuous bond covers all imports for one year and is required for frequent importers or those participating in specific customs programs. The continuous bond typically costs more initially but provides better value for regular importers, while single transaction bonds offer flexibility for occasional imports without ongoing commitment.

When is a single transaction bond sufficient?

Single transaction bonds work well for:

- Occasional importers bringing in fewer than 5-10 shipments annually

- First-time importers testing international markets without commitment

- High-value single shipments where continuous bond costs wouldn't be justified

- Temporary import situations like trade shows or exhibition goods

- Experimental shipments where ongoing import needs are uncertain

This approach provides necessary compliance without long-term financial commitment.

What advantages does a continuous bond offer?

Continuous bonds provide significant benefits for regular importers:

- Cover all shipments for one year without individual bond purchases

- Streamlined processing with faster customs clearance on every shipment

- Program participation enabling customs programs like duty deferral

- Cost efficiency for importers with regular shipment volume

- Financial predictability with known annual bonding costs

- Higher coverage limits accommodating growing import volumes

The continuous approach transforms bonding from transactional overhead to strategic compliance.

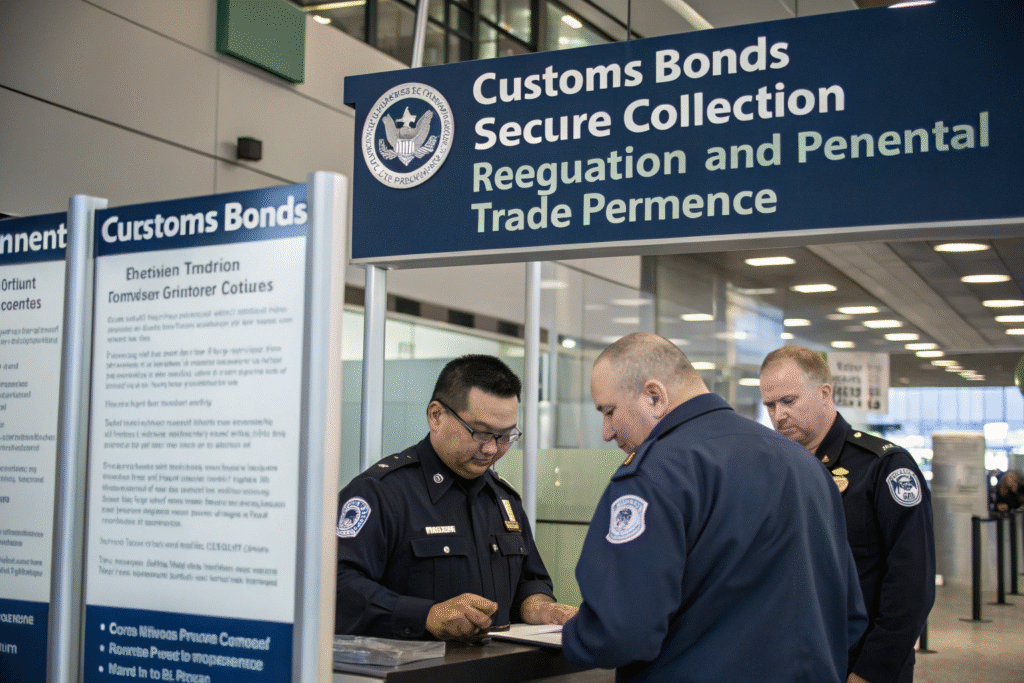

How does the customs bond protect government interests?

The primary purpose of a customs bond is to ensure the U.S. government receives all legally required revenues from international trade. This financial guarantee mechanism addresses the inherent challenges of collecting duties and taxes after goods have been released into commerce.

The bond guarantees payment of import duties, taxes, and fees that might not be accurately assessed at the time of entry. It ensures compliance with all customs regulations, including proper classification, valuation, and country of origin marking. It covers potential penalties for violations of customs laws and regulations. It also secures payment for any additional duties identified during post-entry audits or verifications. This comprehensive protection allows customs to release goods quickly while maintaining revenue assurance.

What specific financial obligations does the bond cover?

Bond coverage includes:

- Basic import duties based on product classification and value

- Merchandise processing fees required for formal entries

- Antidumping and countervailing duties for specific commodities

- Customs penalties for violations of import regulations

- Taxes including harbor maintenance fees and other government charges

- Additional duties identified during post-entry verification processes

This comprehensive coverage ensures all government revenues are protected.

How does the bond facilitate trade while ensuring compliance?

The bond enables:

- Goods release before final duty determination and payment

- Streamlined processing by reducing customs financial risk

- Trade facilitation while maintaining revenue protection

- Importer flexibility in managing cash flow for duty payments

- Government efficiency in processing imports without prepayment requirements

This balance between trade facilitation and revenue protection benefits all parties.

Why might your business need a customs bond?

Understanding the specific triggers that require customs bonds helps importers plan appropriately and avoid shipment delays. The requirements extend beyond simple value thresholds to include specific commodities and import programs.

Any formal entry of merchandise valued over $2,500 requires a bond, regardless of commodity type. Certain restricted merchandise requires bonds regardless of value, including textiles, firearms, and products subject to quota. Participants in customs programs like foreign trade zones or duty deferral programs need specific bond types. Frequent importers benefit from continuous bonds for operational efficiency. The bond requirement represents a fundamental component of maintaining import privileges rather than just a transactional necessity.

What are the specific regulatory triggers for bond requirements?

Mandatory bonding situations include:

- Formal entries for goods valued over $2,500

- Textiles and apparel regardless of value due to quota systems

- Products requiring permits like firearms or certain chemicals

- IPR-intensive goods with high counterfeit risk

- Antidumping cases where additional duties might be assessed

- Customs program participation including many trade facilitation programs

These triggers ensure high-risk shipments have adequate financial guarantees.

How do business characteristics influence bonding needs?

Business factors affecting bonding:

- Import volume determining continuous versus single transaction approach

- Product risk profile influencing bond amount requirements

- Financial stability affecting surety company willingness to issue bonds

- Compliance history impacting bond costs and availability

- Growth plans suggesting appropriate bond capacity planning

- Cash flow considerations influencing duty payment timing needs

Understanding these factors helps determine optimal bonding strategy.

How are bond amounts determined and what do they cost?

Bond amounts and costs involve specific calculation methods that balance government protection needs with importer financial practicality. Understanding these calculations helps businesses budget accurately and maintain compliance.

Continuous bonds are typically set at 10% of the total duties, taxes, and fees paid in the previous year, with a minimum of $50,000. Single transaction bonds are usually set at the total value of duties, taxes, and fees for that specific entry plus any potential penalties. Bond premiums (the cost you pay) typically range from 0.5% to 2.5% of the bond amount annually, depending on the importer's financial strength and compliance history. These costs represent the surety company's risk assessment of your import activities.

What factors influence bond premium costs?

Premium determinants include:

- Importer financial strength and credit history

- Compliance record with customs regulations

- Industry risk profile and product characteristics

- Import volume and value patterns

- Claims history on previous customs bonds

- Business longevity and industry experience

These factors collectively determine the risk premium surety companies charge.

How can you minimize bond costs while maintaining compliance?

Cost optimization strategies:

- Maintain clean compliance history to qualify for lower rates

- Provide financial documentation demonstrating business stability

- Shop multiple surety companies for competitive pricing

- Bundle insurance products with the same provider for discounts

- Negotiate based on volume when import levels justify better terms

- Implement compliance systems that reduce risk profile

Strategic management can reduce bond costs by 20-40% while maintaining adequate coverage.

What are the consequences of operating without required bonds?

Attempting to import without proper bonding creates immediate operational disruptions and potential long-term consequences for import privileges. Understanding these repercussions emphasizes the importance of proper bonding.

Shipments requiring bonds will be held at customs until proper bonding is established, creating storage charges and supply chain disruptions. Repeated violations can lead to increased scrutiny of all imports and potential loss of import privileges. Financial penalties can be assessed for attempting to circumvent bonding requirements. Additionally, the inability to obtain bonding signals underlying compliance or financial issues that may require broader addressing. These consequences make proper bonding fundamental to sustainable import operations.

What immediate operational impacts occur without proper bonds?

Immediate consequences include:

- Customs holds preventing cargo release until bonding is resolved

- Storage and demurrage charges accumulating during resolution periods

- Supply chain disruptions affecting production and customer commitments

- Additional inspection scrutiny on current and future shipments

- Administrative burdens resolving the situation under time pressure

- Relationship strain with suppliers and customers due to delays

These operational impacts typically far exceed the cost of proper bonding.

What long-term implications can bonding issues create?

Long-term consequences include:

- Increased scrutiny on all customs transactions

- Difficulty obtaining bonding from surety companies after violations

- Higher bond premiums due to perceived increased risk

- Limited program participation in customs trade facilitation programs

- Reputational damage with customs authorities and business partners

- Business interruption if import privileges are temporarily suspended

These long-term implications make bonding compliance strategically important.

Conclusion

A customs bond serves as the essential financial guarantee that enables your import activities while protecting government revenue interests. Understanding when you need a bond, which type serves your business best, and how to manage bonding costs transforms this requirement from a compliance burden into a strategic import facilitation tool. The most successful importers treat bonding as an integral component of their international trade strategy rather than an afterthought, maintaining appropriate coverage, monitoring changing requirements, and leveraging their compliance history to optimize costs. By mastering customs bonding requirements, you ensure smooth import operations while building the compliance foundation that supports business growth and supply chain reliability.