Last quarter, one of our clients had a $35,000 shipment held at customs for 12 days because their commercial invoice missed two critical fields. As founder of GeeseCargo, I've seen how incomplete documentation can disrupt supply chains and damage customer relationships. The commercial invoice isn't just paperwork—it's the financial and legal foundation of your international shipment.

A commercial invoice must include seller and buyer information, detailed product descriptions, quantities, values, Incoterms, and country of origin. Missing or inaccurate information causes customs delays, additional inspections, and potential penalties. Proper documentation ensures smooth customs clearance and accurate duty assessment.

The commercial invoice serves multiple purposes: it's a customs declaration, a certificate of value, and a transaction record. Getting it right the first time prevents costly delays and maintains your supply chain momentum. Let's examine the essential components that belong on every commercial invoice.

What Seller and Buyer Information Is Required?

Complete contact information for both trading parties forms the foundation of any commercial invoice. Customs authorities need clear identification of who's conducting the transaction.

What Seller Details Must Appear?

The seller's complete legal name and address must match their business registration documents. Include the street address, city, state/province, postal code, and country. A PO box alone is insufficient for customs purposes.

Contact information should include a phone number and email address for verification purposes. Many customs authorities now require email addresses for electronic processing. The seller's tax identification number or VAT registration number is increasingly mandatory.

For Chinese exporters, the Chinese company name in characters may be required alongside the English translation. Some countries require both languages for verification against business licenses. Consistency with other export documents is crucial.

What Buyer Information Is Essential?

The importer of record's complete legal name and address must be accurate and detailed. This is the entity legally responsible for customs compliance and duty payment. Using a freight forwarder's address as the importer can cause compliance issues.

The ultimate consignee—the party receiving the goods—may differ from the importer of record. If they're different entities, both addresses and relationships must be clearly stated. Many countries have strict rules about import/consignee relationships.

Contact information for the importer should include a reliable phone number. Customs brokers often need to contact importers quickly for clarification or additional documentation. Incomplete contact information causes unnecessary delays.

How Should Product Descriptions and Values Be Detailed?

The product description section is where most invoices fail customs scrutiny. Vague descriptions trigger inspections and delays, while detailed descriptions facilitate smooth processing.

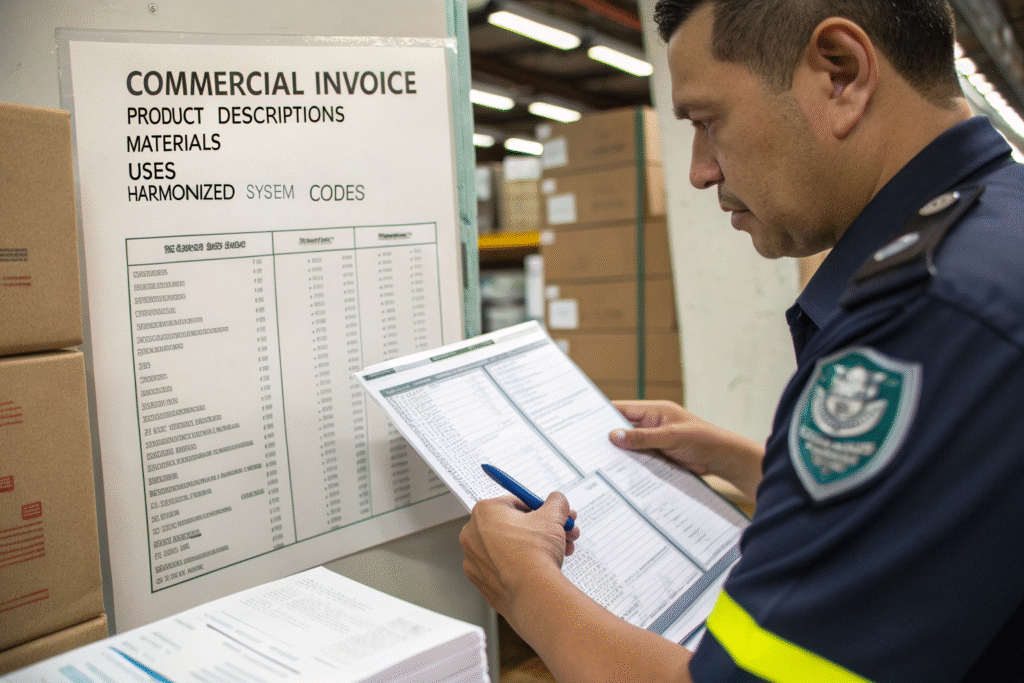

What Product Information Prevents Customs Delays?

Each product requires a detailed description that goes beyond marketing names. "Men's cotton knit shirts" is better than "fashion tops." The description should include materials, composition percentages, and primary use.

Harmonized System codes should appear for each product line. While not always mandatory on the invoice itself, including HS codes helps customs brokers classify goods accurately. The codes should be at the 6-digit level or higher depending on destination country requirements.

Country of origin must be specified for each item. "Made in China" should appear clearly for goods manufactured in China. Some free trade agreements require specific origin certification language for preferential treatment.

How Should Valuation Be Documented?

The unit price and total value for each product line must be clearly stated in the transaction currency. The price should reflect the actual amount paid or payable, not an estimated value. Undervaluation risks severe penalties.

The currency type must be specified (USD, EUR, etc.), and the total invoice value clearly calculated. Any discounts, rebates, or price adjustments should be transparently documented. Hidden price adjustments raise red flags with customs authorities.

Break down costs when goods aren't sold but transferred between related parties. Include development, tooling, and material costs that contribute to the product's value. Transfer pricing between related entities receives particular scrutiny.

What Shipping and Payment Terms Are Required?

The commercial invoice must clearly define the transaction terms that affect customs valuation and risk transfer. Inconsistent terms across documents cause immediate customs holds.

Why Do Incoterms Matter on Commercial Invoices?

The agreed Incoterms must appear clearly and accurately. "FOB Shanghai" or "EXW Shenzhen" determines where risk transfers and which costs are included in the product value. Incorrect Incoterms lead to improper duty calculation.

Incoterms must be consistent with other shipping documents. The bill of lading, certificate of origin, and commercial invoice should all reflect the same terms. Inconsistency suggests errors or misrepresentation.

The Incoterms version year should be specified (e.g., Incoterms 2020). While not always mandatory, including the version year prevents ambiguity about term definitions. Customs authorities increasingly expect version specification.

What Payment Information Supports Customs Valuation?

The payment method should be clearly stated: wire transfer, letter of credit, open account, etc. This information helps verify the transaction value and payment timing. Unusual payment terms may trigger additional scrutiny.

If partial payments have been made or will be made, these should be documented. Customs values goods based on the total payment, not just the amount paid before shipment. Future payment obligations affect duty calculations.

For royalty or license fee arrangements, the commercial relationship should be explained. Payments made as conditions of sale typically must be included in the customs value. Transparency prevents later disputes and penalties.

What Additional Information Ensures Smooth Clearance?

Beyond the basic requirements, certain additional information prevents questions and facilitates automated processing. Proactive disclosure is always better than reactive explanation.

Why Are Document Identifiers Important?

The commercial invoice number and date are essential for document tracking. The invoice number should be unique and sequential for accounting and reference purposes. Duplicate numbers create confusion in customs systems.

The purchase order number(s) being fulfilled should be referenced. This helps match the shipment to your internal accounting systems. Multiple POs can be consolidated on one invoice with proper referencing.

Import license numbers or permit references may be required for restricted goods. Products subject to quota, anti-dumping duties, or special regulations need corresponding license numbers. Missing references cause immediate holds.

What Certifications and Signatures Are Required?

A truthfulness statement and signature from an authorized company representative are mandatory. The signer should have authority to represent the company legally. Digital signatures are increasingly accepted but must meet destination country requirements.

Many countries require specific certification language depending on the goods and trade programs. "This commercial invoice shows the actual price of the goods described" is a common requirement. Research destination-specific certification requirements.

For preferential tariff treatment under trade agreements, include the appropriate origin certification statement. The exact wording varies by agreement, so use the specific language required by each free trade agreement. Incorrect wording voids preferential treatment.

Conclusion

A complete and accurate commercial invoice is your first line of defense against customs delays and compliance issues. The document should tell the complete story of your transaction clearly and consistently. When in doubt, include more information rather than less—customs authorities prefer transparency over brevity.

At GeeseCargo, we've helped thousands of clients perfect their commercial invoicing processes. The most successful approach involves creating standardized templates that capture all required information consistently. Remember that customs authorities in different countries have varying requirements, so adapt your invoices for each destination.

Start by auditing your current commercial invoices against this checklist. Identify missing elements and implement processes to ensure they're included going forward. The few extra minutes spent perfecting each invoice can save days of delays and thousands of dollars in additional costs. Proper documentation isn't just about compliance—it's about business efficiency.