When one of our clients had a $120,000 clothing shipment held at customs for improper labeling, I realized how many importers underestimate the complexity of textile regulations. As founder of GeeseCargo with extensive apparel import experience, I've learned that clothing and textiles face some of the most detailed and strictly enforced import requirements in US trade. Understanding these regulations isn't just about compliance—it's essential for avoiding costly delays, seizures, and penalties.

US import requirements for clothing and textiles include proper country of origin labeling, fiber content disclosure, care instruction labeling, flammability compliance, and customs documentation with correct HTSUS classification. Additionally, many textiles require specific documentation for quota categories, trade preference programs, and consumer safety regulations enforced by CPSC.

The regulatory framework for textiles combines customs requirements with consumer protection regulations, creating a multi-agency compliance challenge. Proper adherence typically reduces clearance delays by 60-80% and prevents penalties that can reach 300% of product value for intentional violations.

What Labeling Requirements Apply to Imported Clothing?

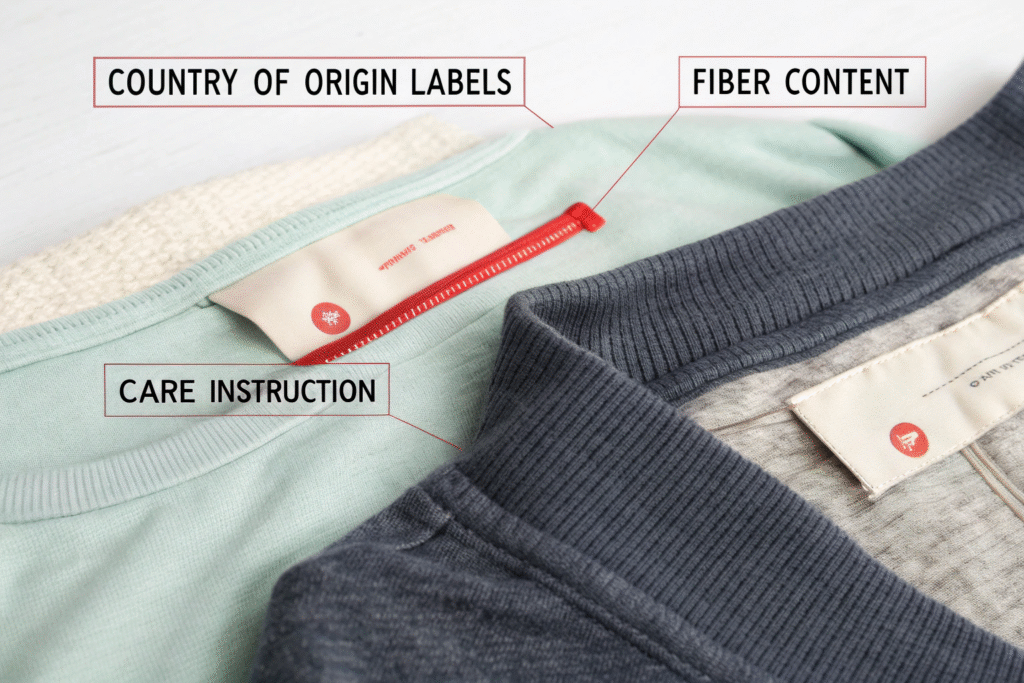

Proper labeling represents the most immediate compliance requirement, with specific rules governing what information must appear on clothing and how it must be presented.

What Are the Essential Labeling Elements?

Country of origin must be permanently and conspicuously displayed. The label must state "Made in [Country Name]" in English, securely attached to the garment where it remains visible until purchase. The designation must reflect where the garment was substantially transformed, not just where finishing occurred.

Fiber composition must be listed in descending order by weight. The label must show percentage content of each fiber exceeding 5% of total weight, using generic fiber names rather than trademarks (e.g., "polyester" not "Dacron").

Care instructions must be provided in English. The Federal Trade Commission requires clear cleaning instructions, including washing, drying, ironing, bleaching, and warnings when needed. Symbols may supplement but not replace written instructions.

What Are the Common Labeling Mistakes?

Temporary or removable labels violate permanence requirements. Hangtags or stickers that can be easily removed don't satisfy labeling requirements, which demand permanent attachment.

Inaccurate country of origin claims trigger severe penalties. Claiming incorrect origin to avoid quotas or duties can result in penalties up to the domestic value of the goods.

Insufficient fiber content detail causes compliance failures. Vague terms like "100% imported fabric" or incomplete percentage breakdowns don't meet FTC requirements.

What Safety Standards Must Clothing Meet?

Beyond labeling, clothing must comply with specific safety standards designed to protect consumers from various hazards.

How Do Flammability Standards Affect Different Garments?

Children's sleepwear (sizes 0-14) must meet CPSC flammability standards 16 CFR Part 1615/1616. These require rigorous testing and specific labeling, with garments needing to self-extinguish and resist rapid burning.

General wearing apparel must meet the Flammable Fabrics Act standards 16 CFR Part 1610. While less stringent than sleepwear requirements, garments must pass specific flammability tests based on their fiber content and construction.

Vinyl plastic film in clothing has separate flammability requirements 16 CFR Part 1611. Garments containing plastic film or similar materials face additional testing and compliance documentation.

What Other Safety Regulations Apply?

Children's clothing must comply with small parts regulations 16 CFR Part 1501. Buttons, snaps, decorations, and other components must not present choking hazards for children under 3 years.

Lead content in coatings and accessories must meet CPSIA requirements 16 CFR Part 1303. Surface coatings cannot exceed 90 ppm lead content, with similar restrictions for substrates.

Drawstrings in children's upper outerwear have specific restrictions 16 CFR Part 1120. Hood and neck drawstrings are prohibited in sizes 2T-12, while waist and bottom drawstrings have length restrictions.

How Should Textiles Be Classified and Documented?

Proper customs classification and documentation determine duty rates, quota eligibility, and regulatory requirements.

What Classification Challenges Do Importers Face?

Textile HTSUS classification requires detailed product knowledge. Classification depends on fiber composition, construction method, garment type, and specific features, with duty rates varying from 0% to 32% based on these factors.

Quota categories still apply to certain textiles from specific countries. While most quotas have been eliminated, some remain for non-WTO members and specific products, requiring visa requirements and category management.

Special trade programs offer duty reductions for qualifying goods. Programs like CBTPA, AGOA, and USMCA provide preferential treatment for textiles meeting specific origin and manufacturing requirements.

What Documentation Supports Proper Importation?

Commercial invoice must include detailed product descriptions. Beyond standard information, textile invoices should include fiber content, construction details, gender/age classification, and manufacturing processes.

Textile visa or export license may be required for certain countries. Shipments from specific countries require visas issued by the exporting country's government to control quota categories.

Special program certificates support preferential duty claims. For free trade agreements, certificates of origin or manufacturer's affidavits document compliance with rules of origin.

What Are the Enforcement Priorities for Textile Imports?

Understanding enforcement focus areas helps importers prioritize compliance efforts and risk management.

What Violations Trigger the Most Severe Consequences?

Country of origin fraud carries severe penalties and potential criminal charges. Intentionally misrepresenting origin to evade quotas or duties can result in penalties up to three times the domestic value of goods.

Transshipment through third countries to evade restrictions is aggressively pursued. CBP maintains sophisticated monitoring to detect textiles shipped through intermediate countries to conceal true origin.

Safety standard violations can trigger recalls and substantial fines. CPSC can require recalls, destruction of non-compliant goods, and impose significant penalties for safety violations.

How Does CBP Target Textile Examinations?

Intelligence-driven targeting focuses on high-risk shipments. CBP uses advance data, historical patterns, and specific indicators to select shipments for intensive examination.

Industry-specific initiatives address known compliance challenges. The Textile Production Verification Team conducts focused assessments of importers with complex supply chains or previous compliance issues.

Partner government agency referrals trigger additional scrutiny. When CPSC, FTC, or other agencies identify potential violations, they refer cases to CBP for enforcement action.

How Can Importers Ensure Ongoing Compliance?

Systematic compliance programs prevent violations and facilitate rapid resolution when issues are identified.

What Supplier Management Practices Ensure Compliance?

Supplier compliance agreements should specify detailed requirements. Contracts should explicitly require proper labeling, safety testing, accurate documentation, and right to audit manufacturing facilities.

Pre-shipment verification catches problems before importation. Third-party inspections, sample testing, and document review before shipment prevent compliance issues from reaching US borders.

Supplier training and capability building improve long-term compliance. Educating manufacturers about US requirements and helping them implement proper processes reduces recurring issues.

What Internal Controls Support Textile Compliance?

Product specification databases maintain accurate classification data. Centralized systems with detailed product information, classifications, and compliance requirements prevent inconsistent declarations.

Testing and certification management ensures safety compliance. Systematic programs for flammability testing, lead content verification, and other safety requirements with proper documentation.

Record retention for five years supports audit defense. Maintaining complete import documentation, testing records, and compliance verification for the required period.

What Are Common Textile Import Mistakes?

Understanding frequent errors helps importers avoid preventable compliance problems.

What Documentation and Classification Errors Occur?

Incorrect HTSUS classification causes duty payment errors. Using approximate classifications rather than precise codes based on detailed product analysis leads to incorrect duty payments and potential penalties.

Incomplete country of origin documentation supports claims. Failing to maintain proper manufacturing documentation makes it impossible to substantiate origin claims during verification.

Missing special program documentation forfeits duty savings. Without proper certificates of origin or manufacturer's affidavits, importers cannot claim preferential duty rates even when goods qualify.

What Labeling and Safety Compliance Mistakes Are Common?

Inadequate label permanence causes compliance failures. Labels that aren't securely attached or that don't remain legible for the product's useful life violate labeling requirements.

Insufficient safety testing for children's products risks violations. Assuming general compliance without product-specific testing for flammability, small parts, and lead content creates significant liability.

Poor communication of requirements to suppliers causes consistent issues. Assuming suppliers understand US requirements without clear specification and verification leads to recurring compliance problems.

Conclusion

US import requirements for clothing and textiles combine complex customs regulations with detailed consumer protection standards. The most successful importers treat textile compliance as an integrated business process rather than a series of disconnected requirements, building systems that ensure consistency across labeling, safety, classification, and documentation.

At GeeseCargo, we've helped clients reduce textile compliance issues by over 75% through systematic approaches that address both regulatory requirements and operational realities. The key is recognizing that textile import compliance requires ongoing attention rather than one-time implementation, with continuous monitoring, supplier management, and process improvement.

Begin your compliance enhancement by conducting a comprehensive review of your current practices against all applicable requirements, then implement graduated improvements that address your highest-risk areas first. Remember that in textile importing, compliance isn't just about avoiding penalties—it's about building a sustainable import business that delivers safe, properly labeled products to your customers while optimizing your customs operations.