When one of our clients lost $85,000 to a sophisticated supplier payment fraud last year, I realized how many importers underestimate payment risks in China trade. As founder of GeeseCargo with over a decade of China-US shipping experience, I've witnessed every payment method's vulnerabilities and strengths. The safest payment approach balances financial security, relationship building, and operational practicality.

The safest payment methods for Chinese suppliers are Letters of Credit (especially confirmed LCs), Escrow services through reputable platforms, and progressive Telegraphic Transfers with verification protocols. These methods typically reduce payment risk by 80-95% compared to advance payments while maintaining supplier relationships. Always avoid 100% advance payments unless dealing with extremely trusted, long-term partners.

Payment security in China trade requires understanding both financial mechanisms and cultural business practices. The optimal approach varies by transaction size, relationship history, and risk tolerance, but certain principles apply universally to protect your business from payment fraud and disputes.

How Do Letters of Credit Provide Maximum Security?

Letters of Credit (LCs) create a bank-guaranteed payment mechanism that protects both buyers and sellers by introducing financial institutions as trusted intermediaries in the transaction.

What Types of Letters of Credit Offer Different Protection Levels?

Confirmed Letters of Credit add a second bank's guarantee, typically your local bank confirming the Chinese bank's obligation. This provides crucial protection against Chinese bank payment refusal due to political, economic, or regulatory issues. The confirmation cost (1-2% of transaction value) is well justified for large transactions or new relationships.

Sight Letters of Credit require payment immediately upon presentation of compliant documents. This ensures suppliers receive payment quickly after shipping while you verify documents match order requirements before funds release—a balanced approach that motivates performance while providing document control.

Usance Letters of Credit (time drafts) delay payment for 30-180 days after document presentation. These are riskier for buyers but can negotiate better pricing from suppliers who factor the delayed payment into their costing. Use primarily with established, trusted suppliers.

How Does the Letter of Credit Process Work Step-by-Step?

Application to your bank details specific payment conditions tied to shipping documents. The LC should precisely specify required documents: commercial invoice, packing list, bill of lading, insurance certificate, and any inspection certificates.

Supplier shipment and document preparation occur after receiving the LC. The supplier knows payment is guaranteed if they meet documented requirements, creating strong performance motivation while ensuring you only pay for properly shipped goods.

Document examination by banks verifies compliance before payment release. Banks meticulously check documents against LC terms, rejecting discrepancies that could indicate problems. This professional scrutiny provides crucial protection against documentation fraud.

What Escrow Services Balance Risk for Both Parties?

Escrow services hold funds securely until predetermined conditions are met, creating equitable protection for both buyers and suppliers in transactions.

How Do Trade Escrow Services Specifically Work?

Fund deposition into a neutral third-party account occurs after order placement but before production. The supplier sees the committed funds, providing confidence to begin production, while you retain control until order requirements are met.

Release authorization happens after predetermined milestones are verified. For manufacturing orders, this might be 30% after production commencement proof, 40% after pre-shipment inspection, and 30% after shipping document presentation.

Dispute resolution mechanisms provide mediated solutions for disagreements. Reputable escrow services offer professional mediation when parties disagree about whether release conditions were met, preventing costly legal proceedings.

Which Escrow Platforms Specialize in China Trade?

Alibaba Trade Assurance integrates with the world's largest B2B platform and has established dispute resolution tailored to China trade. Their extensive supplier data helps assess reliability, and their China-based team understands local business practices.

PanPay offers specialized China escrow services with bilingual support and understanding of Chinese banking systems. Their expertise in cross-border transactions between China and Western markets provides valuable cultural and regulatory insights.

Escrow.com provides international service with strong buyer protection policies. While not China-specific, their global reputation and robust security measures make them reliable for significant transactions with new suppliers.

How Can Telegraphic Transfers Be Made More Secure?

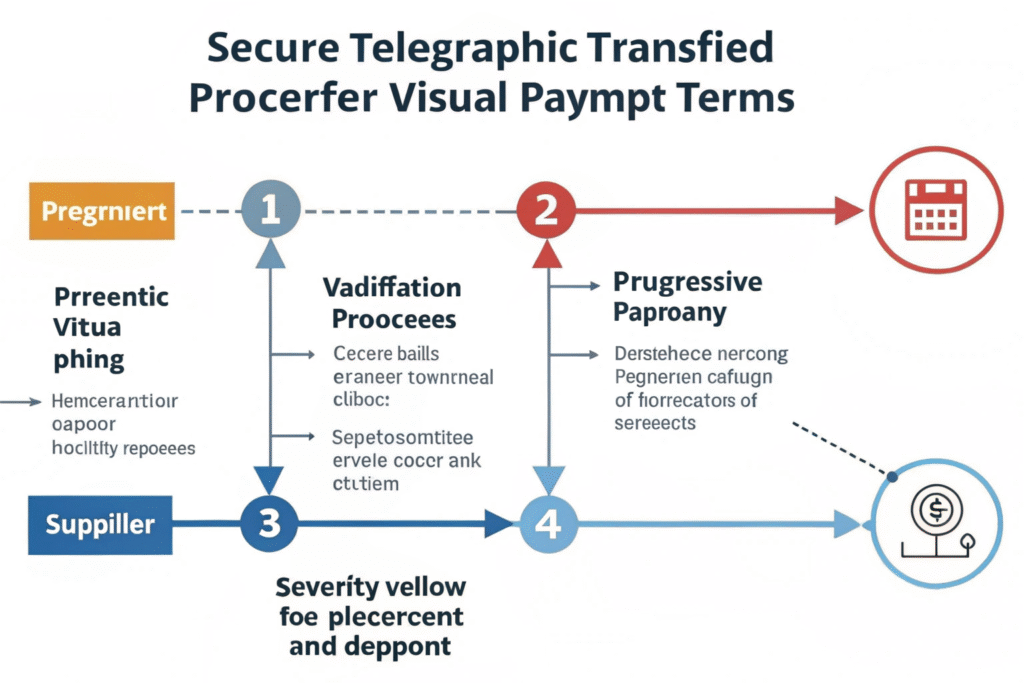

Telegraphic Transfers (TT) remain the most common payment method but carry significant risk if not properly structured with verification protocols and progressive payment terms.

What Progressive Payment Terms Reduce Risk?

30% deposit/70% against copy documents is the standard balanced approach for established suppliers. The deposit shows commitment and funds production, while the balance payment requires presentation of shipping documents proving goods were dispatched.

40% deposit/60% after loading is more supplier-friendly but still provides document control. This approach may help negotiate better pricing while maintaining some leverage until goods are shipped.

10% deposit/90% LC provides minimal upfront commitment with maximum security. This hybrid approach reduces cash outflow while maintaining the security of documentary control through the Letter of Credit mechanism.

What Verification Protocols Prevent Payment Fraud?

Supplier bank account validation through multiple independent sources is crucial. Verify account details directly with the supplier via multiple communication channels, and consider small test payments ($1-5) to confirm receipt before transferring large amounts.

Document verification before balance payment should include inspection certificates and shipping documents. Use third-party inspection services to verify product quality and quantity before authorizing balance payments.

Communication channel security requires verified contact methods. Establish multiple communication channels (WeChat, email, phone) directly with senior company representatives to prevent man-in-the-middle attacks where fraudsters impersonate suppliers.

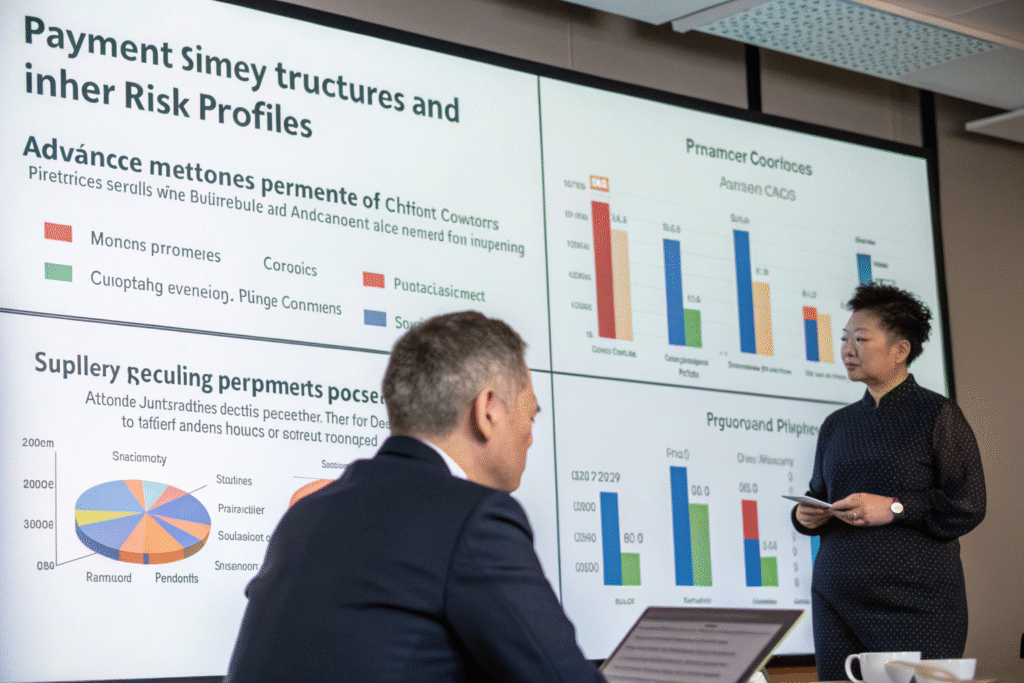

What Role Do Payment Timing and Amount Structures Play?

The timing and proportion of payments significantly impact risk exposure, with various standard structures offering different risk profiles suitable for different relationship stages.

How Should Payment Structures Evolve with Relationship History?

100% advance payment should be reserved for small orders (<$5,000) with trusted, long-term suppliers or when pricing advantages justify the risk. Even with trusted partners, consider splitting larger advance payments across multiple smaller transactions.

Progressive milestone payments suit custom manufacturing and larger projects. Typical structures might include 30% with order, 40% after production completion, and 30% after shipment. Each milestone should require verifiable proof of completion.

Open account terms (payment after delivery) become viable after 3-5 successful transactions. Start with smaller amounts and gradually increase as trust develops, always monitoring the supplier's financial health and performance consistency.

What Security Measures Protect Each Payment Stage?

Order placement stage requires supplier due diligence beyond simple website checks. Verify business licenses through third-party services, check export history, and conduct video calls showing manufacturing facilities.

Production stage benefits from third-party inspection services. Scheduled and surprise inspections during production provide assurance that work is progressing and meets quality standards before balance payments.

Shipping stage verification includes independent bill of lading authentication. Verify shipping details directly with carriers rather than relying solely on supplier-provided documents to prevent documentation fraud.

How Can Technology and Banking Services Enhance Security?

Modern financial technology and specialized banking services offer additional layers of protection and verification for international payments to Chinese suppliers.

What Banking Services Add Security Layers?

Supplier verification services through banks with strong China presence can confirm supplier legitimacy and banking history. HSBC, Standard Chartered, and Citibank have extensive China operations and verification capabilities.

Documentary collection services provide a middle ground between Telegraphic Transfers and Letters of Credit. Banks handle document verification and exchange, releasing payment only against compliant documents at lower cost than full LCs.

Trade finance platforms offered by major banks integrate payment, documentation, and tracking. These digital platforms provide transparency and control throughout the transaction lifecycle with automated compliance checks.

How Does Blockchain Technology Improve Payment Security?

Smart contracts enable automatic payment releases upon verified milestone completion. The decentralized nature prevents single-point failures, and the immutable ledger provides transparent transaction history.

Cryptographic verification ensures payment instructions cannot be altered in transit. Blockchain's security features prevent man-in-the-middle attacks that sometimes compromise traditional banking communications.

Supply chain financing integration allows financing based on verified transaction history. As blockchain verifies each supply chain step, financing can be secured against authenticated progress rather than promises alone.

Conclusion

Secure payment to Chinese suppliers requires a strategic approach that balances financial protection with practical business relationships. The most successful importers use layered security approaches that evolve with supplier relationships, transaction sizes, and risk assessments.

At GeeseCargo, we've facilitated thousands of supplier payments and witnessed how proper payment structures prevent disputes while building strong manufacturer relationships. The key is matching payment methods to specific situations—using maximum protection for new relationships while gradually transitioning to more efficient methods as trust develops.

Begin with thorough supplier verification, then implement payment structures that protect your interests without making transactions unnecessarily cumbersome for reliable partners. Remember that the safest payment approach often combines financial instruments with verification processes, relationship building, and ongoing monitoring. In China trade, payment security isn't just about avoiding fraud—it's about creating frameworks that enable successful long-term partnerships.