Tariff rules are no longer fixed—they’re dynamic, shifting with geopolitical, environmental, and economic forces. In 2025, importers, exporters, and logistics teams face a complex regulatory environment across the U.S., EU, ASEAN, and China.

This article answers the most frequently asked questions about 2025 tariffs, with insights directly from freight forwarders and customs compliance experts. It’s your quick guide to avoid costly surprises and stay compliant.

At GeeseCargo, we help companies across Asia and the West navigate tariff risks, avoid port delays, and stay ahead of policy changes.

Why Are So Many Countries Raising Tariffs in 2025?

Many governments are adjusting tariffs to protect domestic industries or generate revenue.

Countries like the U.S., Indonesia, and the EU have increased duties in key sectors such as electronics, textiles, and auto parts. Tariffs are now both a fiscal tool and a geopolitical lever.

Is This Related to Trade Wars or Internal Economics?

Both. For example, the U.S. imposed new Section 301 tariffs on EV components from China, while Indonesia raised textile duties to protect local factories. Meanwhile, the EU is balancing trade deficits by targeting strategic sectors.

Refer to official updates via USTR and the EU Trade Portal.

Will These Tariffs Affect All Importers?

No. Some buyers benefit from exemptions, preferential trade zones, or bonded warehousing. But if you use DDP shipping and handle duties yourself, you’re directly exposed to increases.

Consider adjusting Incoterms or switching to FOB to share the duty responsibility with buyers.

How Can I Know If My Products Are Impacted?

Tariff exposure depends on your product’s HS code, origin, and destination.

If your product is categorized under high-risk commodity codes or manufactured in newly targeted countries, it’s likely to face duty adjustments.

How Do I Check My Product’s Tariff?

Use online platforms like WCO Trade Tools, TradeMap, or your national customs portal. You’ll need:

- HS code (6 to 10 digits)

- Country of origin

- Country of import

You can also email your forwarder or customs broker for a verified classification report.

What If I Have Multiple Components in My Product?

Composite products often fall under a single HS code based on the essential character rule. If uncertain, ask for a Binding Tariff Information (BTI) or Advance Ruling from the destination’s customs authority.

What’s the Best Way to Lower My Tariff Costs?

Lowering tariff costs is about route planning, document accuracy, and the smart use of trade agreements.

Options include leveraging Free Trade Agreements (FTAs), shipping through bonded zones, or optimizing Incoterms to avoid full tax responsibility.

Can I Use an FTA to Reduce Duties?

Yes, if your goods qualify. Agreements like RCEP, ASEAN-China FTA, and USMCA provide preferential tariff treatment when you prove origin eligibility with documents like Form E or Certificate of Origin.

Check official FTA terms at ASEAN.org or RCEP Overview.

Does Using a Bonded Warehouse Help?

Definitely. Goods stored in bonded zones are not subject to import duties until released for domestic sale. This is ideal for temporary storage, assembly, or relabeling.

Explore facilities like Port Klang FTZ in Malaysia or Shanghai FTZ in China.

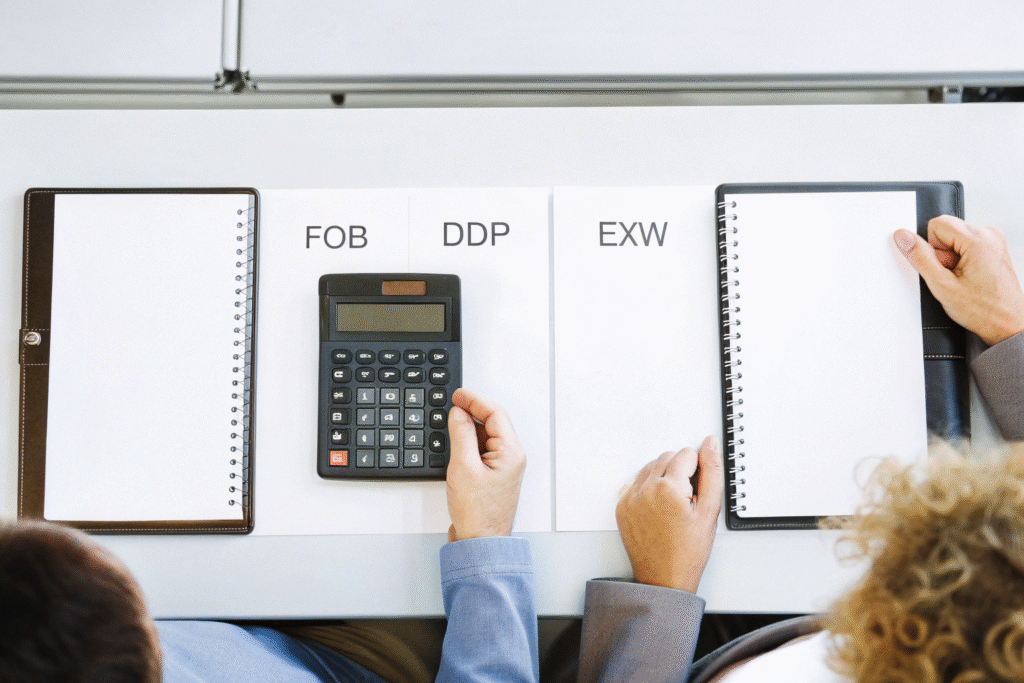

Should I Rethink My Incoterms in Light of New Tariffs?

Yes. Incoterms determine who pays for freight, insurance, and customs duties.

When tariffs rise, shifting from DDP to FOB or EXW can protect you from paying duties in the buyer’s country. It also ensures buyers take ownership of tax risk.

Is DDP Too Risky Now?

In volatile markets, yes. Under DDP (Delivered Duty Paid), the seller assumes full responsibility for import clearance and duty. If tariffs change during transit, your margin disappears.

Check DDP scenarios using Freightos Incoterms Guide.

Which Term Gives Buyers More Control?

EXW (Ex Works) gives full control to buyers—they handle freight and customs. This works well for large distributors who prefer managing risk in-house.

What Role Does My Freight Forwarder Play in Tariff Planning?

Your forwarder is your first line of defense against tariff errors and overspending.

From advance warning of duty changes to reclassification advice and route simulation, your logistics partner ensures compliance without delay or penalty.

Do Forwarders Track Tariff Policy in Real Time?

Yes. At GeeseCargo, we maintain real-time dashboards on global tariff changes. We notify clients of risks, suggest timing adjustments, and provide alternative route options.

Other tools include GoComet and Kuehne+Nagel SeaExplorer.

Can They Help During Customs Audits?

Absolutely. We prepare your documentation to meet customs standards, assist during inspections, and file appeal documents if disputes arise. Our local contacts at major ports give us direct insight into evolving procedures.

Conclusion

Understanding tariffs in 2025 is about more than memorizing numbers—it’s about strategy. By staying informed, verifying your classifications, adjusting Incoterms, and working with a freight partner like GeeseCargo, you can navigate this volatile landscape with confidence.

To get a tariff simulation or HS classification audit for your next shipment, contact Ben Zhu at benzhu@geesecargo.com. Let’s simplify tariff planning and keep your supply chain competitive this year.