South Korea’s 2025 import policy includes a 15% standard tariff on a broad range of consumer goods. For global sellers and e-commerce brands, this means higher costs at customs—unless you understand how to strategically manage compliance, logistics, and documentation.

In this article, we’ll break down how the 15% tariff works, which products it affects, and what cross-border sellers can do to avoid costly delays and duties while keeping their profit margins intact.

If you’re shipping apparel, beauty, electronics, or lifestyle goods into South Korea, this guide will help you stay compliant, competitive, and ready for market success.

What Goods Are Affected by South Korea's 15% Tariff?

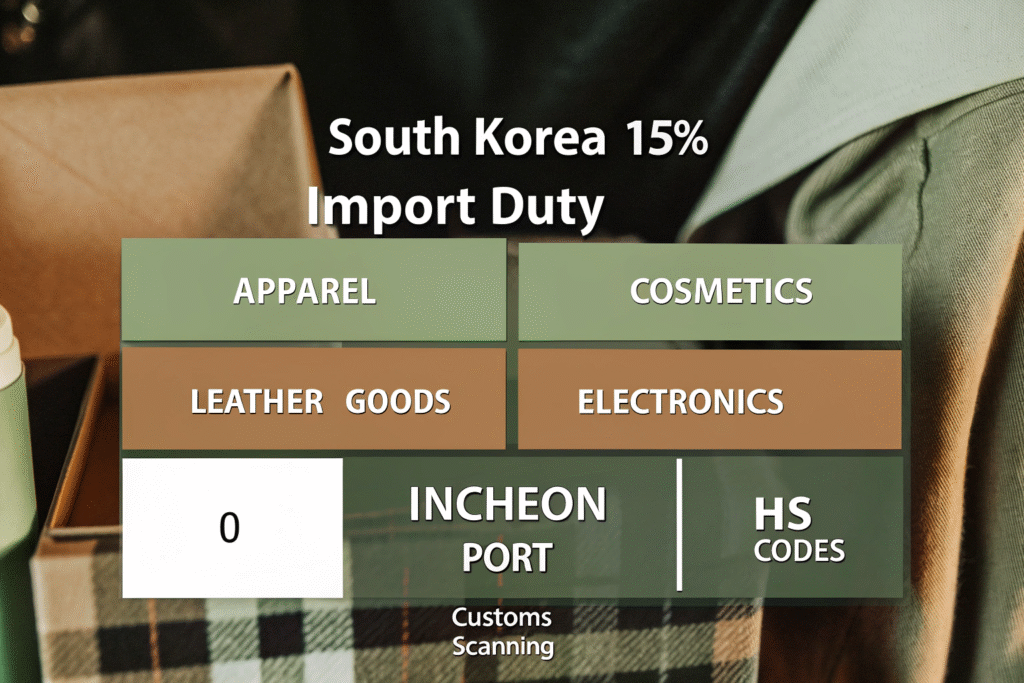

South Korea’s 15% base tariff applies to a wide range of goods, especially high-demand consumer products such as:

- Clothing and footwear (HS 61, 62, 64)

- Cosmetics and skincare (HS 33)

- Small home appliances and electronics (HS 85)

- Leather bags and fashion accessories (HS 42)

The 15% duty is calculated on CIF value and enforced upon import at ports like Incheon, Busan, and Gimpo.

How to Check Your Product’s Tariff?

You can search your product’s exact HS code and tariff rate using the Korea Customs Service Tariff Finder. Most apparel and electronics are charged 13–15%, while some food and luxury items exceed 20%.

At GeeseCargo, we help clients classify goods accurately to avoid errors and select the lowest applicable rate when dual-use classifications apply.

Are FTA-Eligible Goods Affected?

Yes—but many items are eligible for tariff exemptions under the KORUS FTA, which allows U.S.-origin products to enter South Korea at 0% duty. Proper Certificate of Origin (COO) submission is key.

How Can Sellers Reduce or Avoid the 15% Duty?

Import taxes may be standard, but smart sellers use legal strategies to reduce them—through FTAs, valuation, shipping method selection, and bonded logistics.

Using Free Trade Agreements, DDP shipping, and bonded storage can help cross-border sellers lower or defer the 15% tariff legally.

Is DDP Shipping Ideal for South Korea?

Yes. With DDP (Delivered Duty Paid), your forwarder pays all duties—including the 15% tariff—on your behalf. This simplifies the process and gives you cost certainty upfront.

GeeseCargo provides DDP shipping from China, Vietnam, and the U.S. to major Korean hubs with complete documentation and delivery included.

Can Bonded Warehouses in Korea Help?

Yes. South Korea operates several bonded zones near Incheon and Busan ports. You can store goods temporarily without paying duty, and only clear the portion sold into the domestic market.

This strategy is excellent for brands doing multi-market distribution across Asia or handling seasonal inventory.

How to Handle HS Code and Invoice Accuracy for Korea?

Incorrect HS codes or invoice structuring can cause unnecessary taxes or shipment holds. It’s critical to ensure your declaration matches the physical goods.

Cross-border sellers must double-check that HS codes and invoices match Korean customs standards to avoid fines or clearance delays.

What Are Common HS Errors When Shipping to Korea?

- Declaring fashion handbags as general bags (HS 4202.92 vs. 4202.22)

- Misclassifying electronics kits as toys (HS 85 vs. HS 95)

- Using U.S. HS codes instead of Korea-specific ones

We recommend using the WCO HS Lookup Tool or consulting GeeseCargo’s classification team for pre-clearance checks.

Why Is Invoice Detail Important?

Korean customs require commercial invoices to include full breakdown of unit value, freight cost, insurance, and country of origin. Undervaluation or vague line items may result in reappraisal.

We help clients create compliant pro forma and commercial invoices based on KCS-approved formats to prevent costly inspection delays.

What Shipping Methods Work Best Under the 15% Tariff?

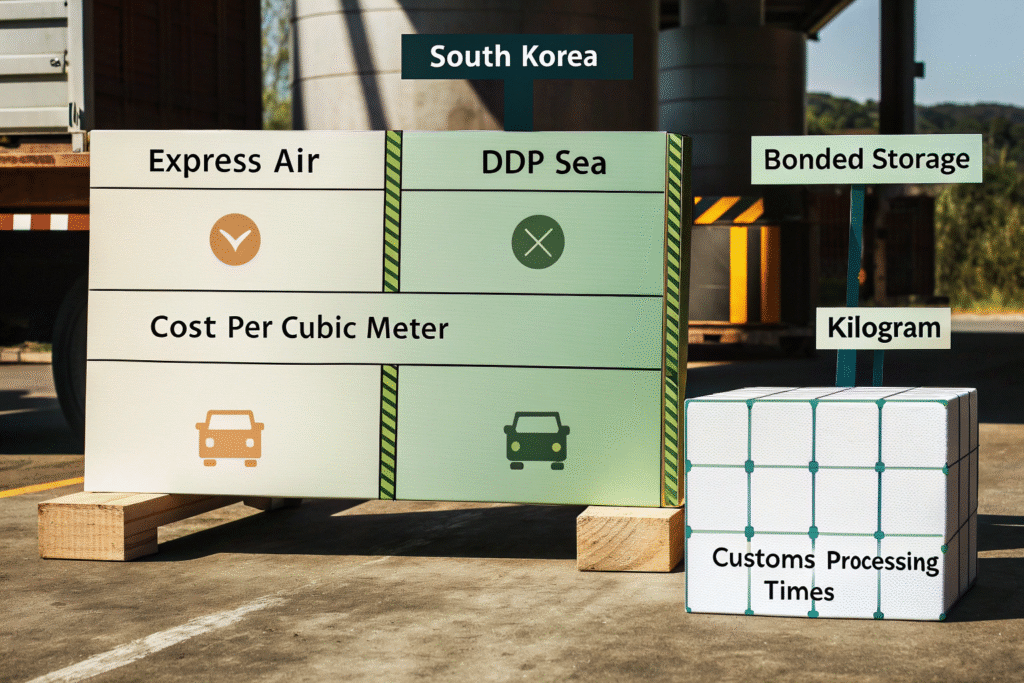

Shipping cost and duty exposure go hand-in-hand. Your shipping method determines how much tax you pay, how quickly you clear customs, and whether your items move efficiently through Korea’s logistics channels.

DDP sea freight, consolidated air cargo, and bonded storage offer the best balance between speed, cost, and compliance under Korea’s 15% tariff regime.

Is DDP Air Freight Worth It for E-Commerce?

Definitely. With daily flight lanes to Incheon and digital clearance integration, DDP air cargo lands in Korea within 3–5 working days and clears fast.

GeeseCargo’s DDP air freight is ideal for fast-moving SKUs like fashion, skincare, and electronics under 20kg per carton.

When to Use Bonded + Partial Release?

For B2B or large retail shipments, we recommend using bonded warehouses to store unsold inventory. Release only what’s needed weekly or monthly—paying tariff in stages instead of upfront.

This helps manage cash flow and aligns tax with actual product movement.

Conclusion

South Korea’s 15% tariff policy doesn’t have to disrupt your business. With proper HS code classification, FTA paperwork, DDP shipping, and bonded strategies, you can keep duties low and delivery fast.

At GeeseCargo, we guide cross-border sellers in every step—from customs compliance to door-to-door DDP solutions. If you’re shipping to South Korea in 2025, contact Ben Zhu at benzhu@geesecargo.com to get a tailored import plan and reduce your landed costs today.