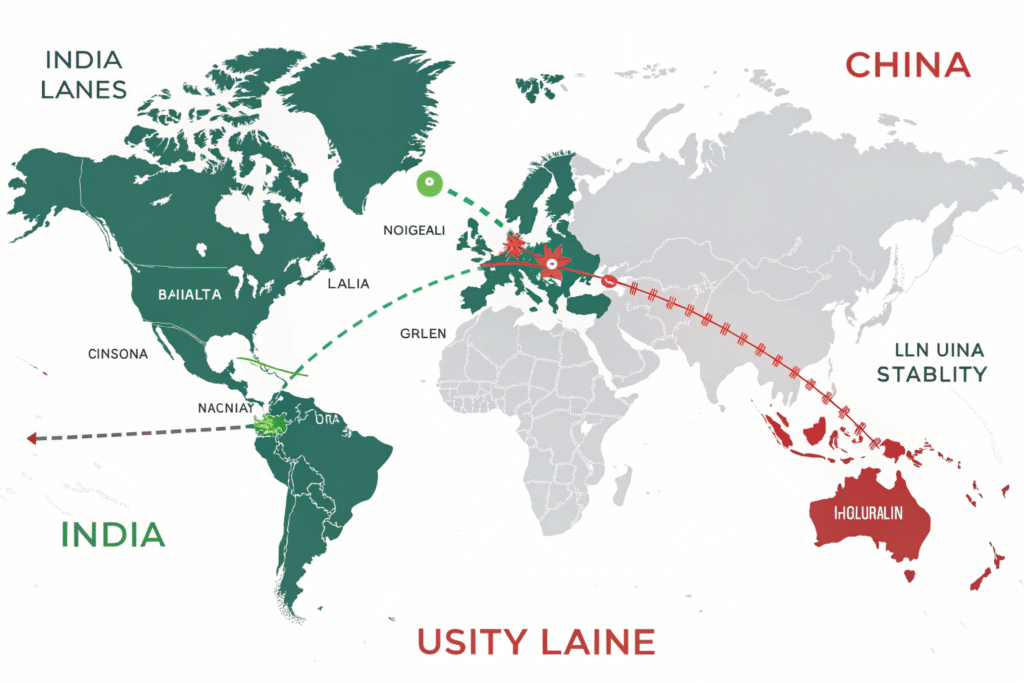

When sudden trade tariffs disrupt global supply chains, importers and distributors face a painful reality — unpredictable freight costs. For many US buyers who once diversified sourcing between India, China, and other Asian markets, the recent tariff hikes on certain corridors have forced a rethink. While some trade lanes face volatility, the China-US route has shown remarkable stability in pricing, sailing schedules, and customs efficiency. That’s why many apparel, accessories, and gift buyers are shifting more volume back to China.

The truth is simple — stable freight routes mean predictable profits. For industries where margins are tight, cost predictability is not a luxury, it’s a survival tool. China’s established shipping network, combined with experienced freight forwarders like GeeseCargo, can help buyers bypass volatile tariff-impacted routes and secure consistent, competitive shipping rates.

If you’re navigating a maze of changing policies, freight surcharges, and supply chain disruptions, this article will give you practical insights. We’ll break down why China-US ocean and air freight remain more stable than tariff-affected corridors, and how you can lock in predictable freight costs even during global trade uncertainty.

How Tariff-Impacted Routes Create Cost Volatility

Tariffs can act like a tax earthquake, shaking up the entire cost structure for importers. US buyers importing from India have recently seen a steep jump in landed costs due to policy changes. The 50% tariff on certain categories doesn’t just affect the product price — it impacts your freight strategy too.

When tariffs inflate the product’s value, the duty base rises, meaning your customs duties increase in absolute terms. This ripple effect can make shipping from tariff-heavy routes financially unpredictable. Buyers end up scrambling to renegotiate supplier contracts, recalculate landed costs, and in many cases, absorb profit loss.

On the other hand, China-US freight lanes have avoided such sudden shocks. Despite global rate fluctuations, long-standing partnerships between Chinese ports and US terminals ensure a more stable environment for rate agreements, sailing schedules, and customs handling.

What are the biggest cost risks when tariffs hit a route?

When tariffs hit, freight forwarders often face sudden booking cancellations or shifts in cargo volumes. This unpredictability pushes up short-term rates, especially for Full Container Load (FCL) shipments. Less-than-Container Load (LCL) buyers also feel the pinch, as consolidation becomes less efficient. Insurance premiums can rise too, since higher cargo values mean bigger liabilities.

Can switching trade lanes really stabilize costs?

Yes, especially if the alternative lane has consistent demand and capacity. The China-US West Coast and East Coast routes have robust carrier competition, which helps keep rates competitive. Stable trade volumes also make long-term contracts possible, shielding you from weekly rate spikes.

Why China-US Ocean Freight Remains Consistent

China has invested heavily in port automation, deep-water berths, and integrated rail-ocean logistics. This means faster turnaround times, fewer port delays, and a steady flow of vessels to the US. For US buyers, this translates to reduced dwell times and predictable transit schedules.

In contrast to tariff-shocked trade lanes, the China-US corridor benefits from decades of trade agreements, established carrier alliances, and experienced freight forwarders who know how to keep cargo moving efficiently.

Even during global disruptions like COVID-19, the China-US lanes recovered faster than most, offering stability in a world of uncertainty.

How do carrier alliances protect rate stability?

Carrier alliances such as THE Alliance and 2M Alliance coordinate vessel deployments and port calls. This reduces the risk of sudden blank sailings and keeps capacity aligned with demand, which helps prevent sharp rate spikes.

What role do Chinese port relationships play in reliability?

Freight forwarders with strong port contacts can secure earlier vessel slots, priority handling, and even faster customs inspections. At GeeseCargo, our network covers most major Chinese ports, allowing us to react quickly if a specific terminal experiences congestion.

Air Freight from China as a Fast, Tariff-Safe Option

For high-value, time-sensitive goods like fashion accessories, electronics, and promotional items, air freight from China offers a tariff-safe alternative. While air freight is costlier than ocean shipping per kilogram, it bypasses the weeks-long lead times of sea transport and avoids tariff disruptions in other corridors.

When importers need to meet retail deadlines or avoid production halts, China-US air freight delivers both speed and predictability.

This makes it especially attractive when tariff-impacted routes create uncertainty in lead times and cost structures.

Is air freight really more predictable during trade tensions?

Yes. Airlines often operate under bilateral agreements that remain stable even when maritime tariffs shift. The International Air Transport Association (IATA) framework also helps standardize processes, making it easier for freight forwarders to secure consistent rates and slots.

How can blended shipping strategies reduce risk?

Many importers now combine ocean and air freight — sending bulk orders by sea and urgent SKUs by air. This diversification helps balance cost efficiency with delivery speed, protecting profit margins during tariff turbulence.

Leveraging DDP Services to Lock in Landed Costs

Delivered Duty Paid (DDP) shipping from China can be a powerful tool for cost control. Under DDP terms, the seller (or your freight forwarder) assumes responsibility for all costs, including freight, duties, and delivery to your door. This shields buyers from unexpected tariff adjustments mid-shipment.

With DDP, your landed cost is fixed upfront, making budgeting far more predictable.

For US buyers facing unpredictable tariff hikes on other routes, DDP from China provides a safe harbor.

How does DDP simplify budgeting for importers?

DDP consolidates all shipping expenses into one invoice. This makes it easier for CFOs to project margins accurately, especially for seasonal products like apparel where price volatility can erode profitability. Incoterms rules define the responsibilities clearly, reducing disputes.

Is DDP always the cheapest option?

Not always, but it is often the safest for margin protection. In volatile trade climates, paying a slight premium for predictability can prevent much bigger losses caused by sudden tariff hikes or clearance delays.

Conclusion

Global trade volatility isn’t going away anytime soon, but smart logistics decisions can shield your business from the worst impacts. The stability of China-US freight — both ocean and air — gives US buyers a reliable alternative to tariff-impacted routes like India-US. By leveraging established shipping lanes, strong port relationships, and tools like DDP, you can maintain predictable freight costs and safeguard profit margins.

If you want to explore how to secure stable, competitive shipping rates for your US imports, contact our team at GeeseCargo. You can reach Ben Zhu at benzhu@geesecargo.com to discuss a customized solution for your supply chain.