Many U.S. importers sourcing from China are facing uncertainty as the August 1st, 2025 U.S. tariff deadline approaches. For businesses that rely on predictable landed costs, especially in industries like apparel, accessories, electronics, and home goods — this deadline could mean tighter margins and urgent decision-making.

This tariff deadline may introduce up to 25% additional duties on certain Chinese goods, affecting everything from FOB pricing to final warehousing costs in the U.S.

As a freight forwarder based in China, with years of experience supporting North American clients, I want to explain how this new deadline can affect your sourcing operations — and how GeeseCargo can help minimize the risk.

Which Product Categories Will Be Affected the Most?

If you're importing high-volume products, you can't afford to ignore this.

The most impacted categories will be electronics, textiles, plastics, and some household goods — many falling under HTS codes previously exempt or reduced under Section 301 tariffs.

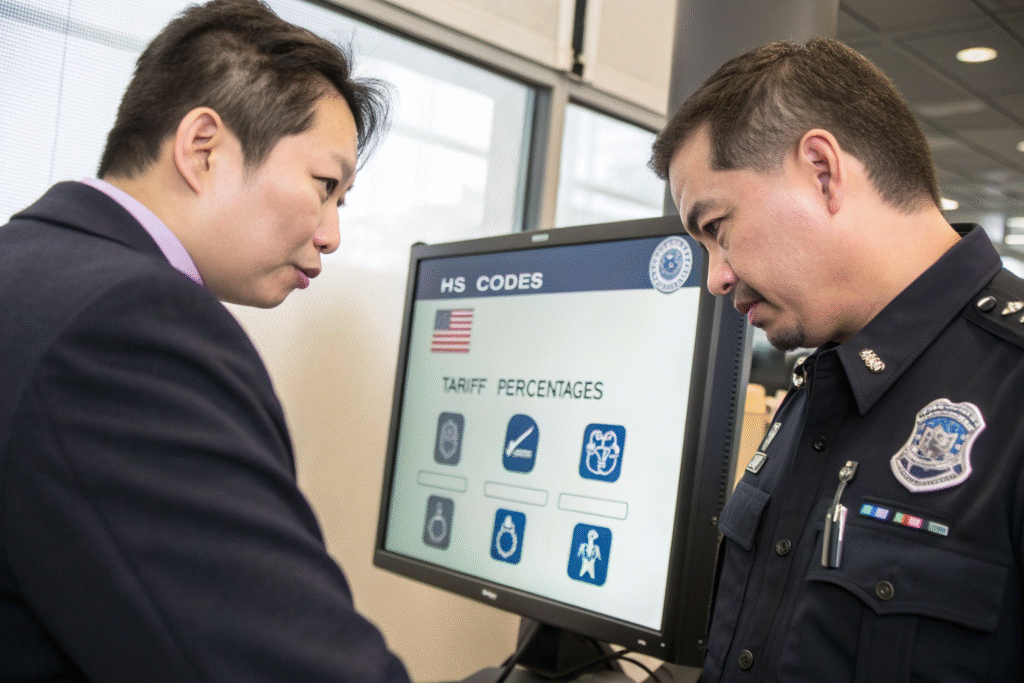

What Are the Risk Zones According to HTS Codes?

The Office of the United States Trade Representative (USTR) is reinstating certain Section 301 tariffs on goods previously excluded. If your product falls into an HTS classification that was granted a waiver — like subheadings in 8504 or 9401 — you could now face up to a 25% hike.

Our customs team has created a tracking matrix to help clients identify whether their SKUs are at risk, and we’ve shared it with several importers in the apparel and electronics space.

Are Exclusions Being Extended or Phased Out?

As of mid-July, the exclusion list shows that about one-third of existing exemptions are being phased out. Items like LED lighting, medical parts, and fabric blends used in outerwear will lose their exemption status by August 1st.

GeeseCargo offers real-time classification consulting and can advise if your supplier’s declaration matches the correct duty rate before shipment.

How Will This Tariff Change Affect Landed Costs?

Tariffs don't just increase customs fees — they ripple across your entire sourcing budget.

A 25% tariff can increase the landed cost of your goods by 18–30% depending on FOB price, freight class, and incoterms.

What’s the Real Cost Increase After Tariffs?

Let’s take an example. A product valued at $10,000 per shipment may incur the following:

| Component | Pre-Tariff | Post-Tariff (25%) |

|---|---|---|

| Base Product | $10,000 | $10,000 |

| Ocean Freight | $1,200 | $1,200 |

| Customs Duties | $0 | $2,500 |

| Clearance Fees | $200 | $250 |

| Total Landed | $11,400 | $13,950 |

That’s a $2,550 increase in cost per container. Unless you adjust your supply chain strategy or renegotiate FOB terms, this will eat into profits significantly.

Can I Offset the Tariff With Better Freight Rates?

Possibly. July 2025 has seen a historic 63% drop in China–U.S. West Coast freight rates. If you’re shipping large volumes, these savings can partially offset duty increases — but only temporarily.

At GeeseCargo, we’re helping clients time their shipments before the August 1st spike and blend DDP service models with bonded warehousing where feasible.

What Are the Best Sourcing Strategies to Minimize Risk?

Tariff volatility is part of global trade — but it doesn’t mean you have to lose control.

Smart importers are combining strategic timing, supplier diversification, and better customs planning to shield their margins.

Should I Ship Before the August 1 Deadline?

If your goods qualify for waived or reduced tariffs today, yes — get them out before the deadline. This means confirming ETD by mid-July and choosing faster booking routes or air freight for urgent SKUs.

GeeseCargo offers DDP fast-track options with U.S. West Coast port priority clearance for all shipments booked before July 20th.

Is China-Plus-One a Viable Alternative?

It depends. Countries like Vietnam, Bangladesh, and Malaysia offer lower tariffs — but may lack scale or quality control compared to your China suppliers.

If you go this route, use a third-party QC firm to verify new factories and make sure logistics still flow through familiar hubs like Shenzhen or Ningbo.

What Can Freight Forwarders Like GeeseCargo Do to Help?

Your freight partner shouldn’t just ship — we should solve problems before they become losses.

At GeeseCargo, we specialize in tariff forecasting, documentation optimization, and bonded DDP models that shield our clients from surprise costs.

Can You Help Reroute or Delay Imports Strategically?

Yes. We provide bonded zone entry points near Shanghai and Guangzhou where your goods can wait without triggering customs entry. This gives your team time to assess changes after August 1st before clearing cargo.

You can learn more about bonded warehouse logistics and how they serve tariff planning strategies.

Do You Offer HTS Consulting and Customs Pre-Filing?

We do. Our compliance team checks HS codes against real-time U.S. Customs ACE database and advises on any misclassification risk. We also offer full pre-filing of entries under DDP terms — so there are no surprises at the border.

Conclusion

The August 1st, 2025 U.S. tariff deadline could reshape the economics of China-based sourcing. Whether you’re importing fashion accessories, promotional goods, or electronics, the choices you make now will decide your profitability for the next 12 months.

At GeeseCargo, we’re not just watching the calendar — we’re helping clients beat it. From advanced HTS screening to bonded warehousing and DDP risk control, we’ve got your back.

If you're sourcing from China, let’s make sure August 1st doesn’t become a margin killer.