Tariffs are a major concern for importers. Duties and taxes can cut deeply into profit margins. Many small and medium businesses ask how they can lower these costs without breaking trade rules.

Importers can reduce tariff costs by using correct product codes, exploring trade agreements, preparing documents carefully, and working with skilled freight forwarders.

Here are the main ways to control tariffs when importing from China.

Why Does Product Classification Matter?

Tariffs depend on how goods are classified.

Correct HS codes make sure the right duty rates are applied. Wrong codes often increase costs.

How Do HS Codes Affect Tariffs?

Each product has a Harmonized System (HS) code. Customs uses this code to assign tariffs. If the code is wrong, you may pay more than necessary. The World Customs Organization provides HS classification guidance.

What Happens if Classification Is Wrong?

Mistakes in classification create delays, penalties, or higher duties. Importers should check codes with suppliers or forwarders. The U.S. Customs and Border Protection offers tools to verify product codes.

Can Trade Agreements Lower Tariffs?

Trade agreements can help reduce tariffs.

Some goods qualify for lower duty rates under free trade deals or special programs.

Which Agreements Apply to China?

China has agreements with countries in Asia, Europe, and other regions. Products under these agreements may enjoy reduced tariffs. China FTA Network lists current deals.

How Can Importers Benefit?

Importers must confirm eligibility. Certificates of origin are often required. Trade.gov explains how to use trade programs effectively.

Why Is Customs Planning Important?

Tariff costs rise when planning is poor.

Accurate paperwork and early preparation help avoid mistakes, delays, and fines.

What Documents Must Be Ready?

Importers must prepare invoices, packing lists, bills of lading, and compliance certificates. Missing or wrong documents increase costs. Export.gov stresses the importance of complete paperwork.

Can Duty Drawback Programs Help?

Yes. Some countries refund duties if goods are re-exported. Importers should check their local laws. The U.S. International Trade Commission explains duty drawback programs.

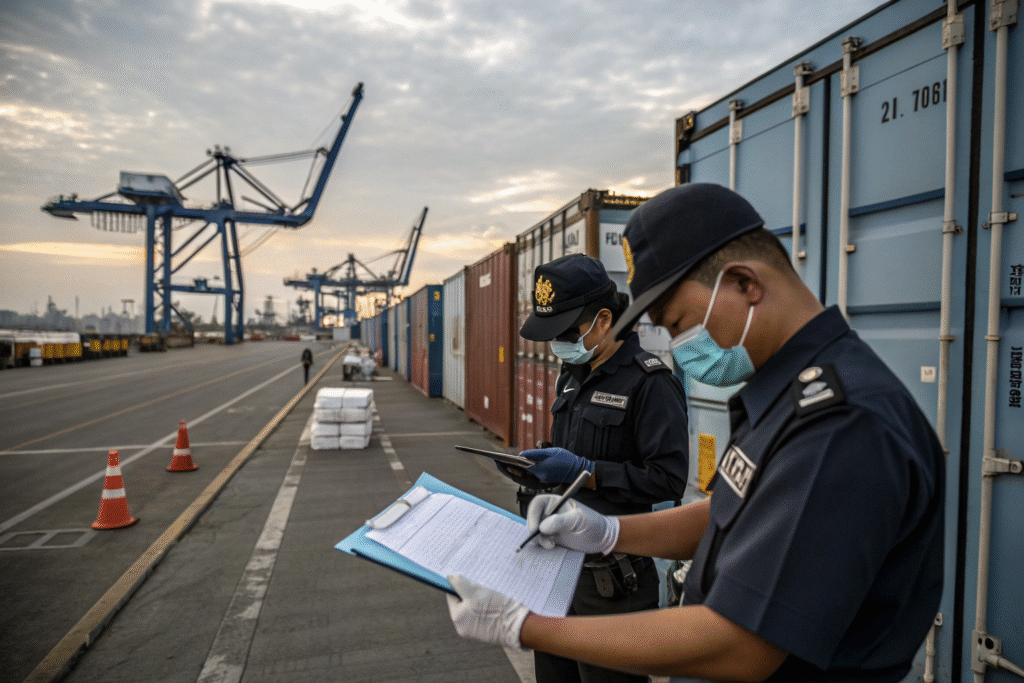

How Do Freight Forwarders Help Reduce Tariff Costs?

Freight forwarders play a key role in tariff management.

They understand customs rules and prevent costly errors.

What Expertise Do Forwarders Provide?

Forwarders advise on HS codes, duty calculations, and trade program eligibility. They also prepare correct customs paperwork. The International Chamber of Commerce explains their role in global trade.

Why Does Forwarder Support Save Money?

Mistakes with codes or documents can cost thousands. A skilled forwarder helps avoid these losses. Freightos shows how forwarders save money through planning and expertise.

Conclusion

Tariffs are a big cost when importing from China. But importers can reduce them with smart planning. Using the right product codes, applying trade agreements, and preparing accurate paperwork all help.

Working with a freight forwarder adds another layer of protection. They guide importers, prevent mistakes, and keep costs down. With the right approach, tariff costs become manageable, and supply chains stay efficient.