Choosing a customs broker is one of the most critical decisions for importers, yet many businesses select partners based on price alone or random referrals without proper evaluation. The right broker becomes an extension of your team, ensuring compliance while optimizing costs. The wrong choice can lead to costly delays, penalties, and operational headaches that impact your bottom line and supply chain reliability.

Select the right customs broker by evaluating their specific industry experience, technology capabilities, compliance track record, communication practices, and scalability. The ideal partner should demonstrate expertise in your product category, provide transparent pricing, offer robust technology integration, and maintain strong relationships with customs authorities.

Let's examine the specific criteria and evaluation process that will help you identify a customs broker who can protect your business while optimizing your import operations.

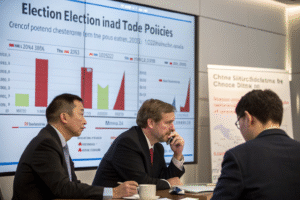

What specific industry experience should you prioritize?

Industry-specific knowledge separates adequate brokers from exceptional ones. A broker who understands your product category's unique regulations, classification challenges, and compliance requirements can prevent problems before they occur and identify opportunities you might otherwise miss.

Look for brokers with demonstrated experience in your specific industry—whether electronics, apparel, food products, automotive parts, or other specialized commodities. They should understand the particular regulatory agencies governing your products (FDA, FCC, CPSC, etc.) and have experience with the specific compliance issues common to your industry. The right broker will speak knowledgeably about recent regulatory changes affecting your sector and provide examples of how they've helped similar businesses navigate complex compliance situations.

What questions reveal true industry expertise?

Ask potential brokers these revealing questions:

- What specific regulations currently affect my product category?

- Which government agencies typically review my type of imports?

- What classification challenges have you encountered with similar products?

- Can you share examples of compliance issues you've resolved for similar importers?

- What recent regulatory changes should we anticipate in our industry?

Their answers demonstrate whether they possess current, practical industry knowledge.

How can you verify their claimed experience?

Validation methods include:

- Requesting client references in your industry

- Checking industry associations for their participation level

- Reviewing case studies demonstrating specific expertise

- Asking about recent rulings or protests they've handled

- Verifying staff credentials and specialized training

These verification steps ensure their expertise matches their marketing claims.

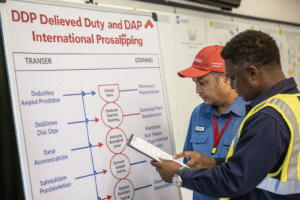

What technology capabilities are essential today?

Modern customs brokerage requires sophisticated technology for efficiency, accuracy, and compliance. The days of paper-based processes and manual data entry are gone, replaced by integrated platforms that provide real-time visibility and automated compliance checking.

Evaluate brokers based on their technology platform's capabilities for electronic filing, document management, compliance validation, and integration with your systems. The ideal platform should provide real-time status updates, automated HS code classification assistance, document storage and retrieval, performance analytics, and seamless data exchange with your ERP or inventory management systems. Technology shortcomings often manifest as manual data entry errors, communication gaps, and missed compliance opportunities.

What specific technology features provide the most value?

Essential technology capabilities include:

- Automated entry filing with error checking before submission

- Digital document management with cloud storage and retrieval

- Real-time tracking of customs status and potential issues

- Compliance databases with current regulatory information

- API integration with your business systems

- Analytics and reporting on customs performance and costs

These features transform customs from an administrative burden to a strategic function.

How can you test their technology effectiveness?

Practical evaluation methods:

- Request a platform demonstration showing real workflows

- Ask about data integration capabilities with your systems

- Inquire about update frequency for regulatory changes

- Check mobile accessibility for on-the-go management

- Verify security protocols for protecting your data

Hands-on testing reveals whether their technology delivers practical benefits.

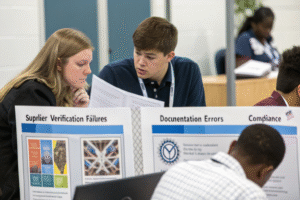

What compliance track record should you expect?

A broker's compliance performance directly impacts your risk exposure and operational efficiency. While all brokers claim compliance expertise, their actual track record with customs authorities reveals their true capabilities.

Look for brokers with low penalty rates, successful prior disclosure records, and positive relationships with customs officials. They should demonstrate systematic approaches to compliance management rather than reactive problem-solving. The best brokers conduct internal audits, maintain detailed compliance documentation, and proactively identify potential issues before they become problems. Avoid brokers who seem focused primarily on speed over accuracy or who suggest questionable compliance shortcuts.

How can you assess their compliance effectiveness?

Key assessment metrics include:

- Examination rate history compared to industry averages

- Prior disclosure activity showing proactive compliance

- Penalty avoidance record demonstrating issue prevention

- Customs relationship evidence through testimonials or references

- Internal audit processes ensuring ongoing compliance

These metrics provide objective measures of compliance performance.

What compliance resources do they provide?

Effective brokers offer:

- Regular regulatory updates specific to your industry

- Classification support with technical research capabilities

- Training resources for your staff on compliance topics

- Compliance audits identifying potential vulnerabilities

- Protest and ruling capabilities for challenging decisions

These resources demonstrate commitment beyond basic filing services.

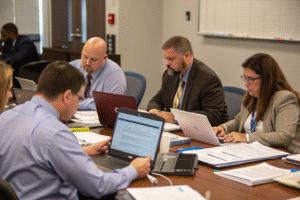

How should communication and service models align with your needs?

The broker-client relationship requires clear communication channels and service models that match your operational style and requirements. Misalignment in communication expectations creates frustration and operational gaps.

Evaluate their primary communication methods, response time standards, account management structure, and escalation procedures. The ideal broker should provide a dedicated account team familiar with your business, establish clear service level agreements, offer multiple communication channels, and provide proactive updates rather than requiring you to constantly seek information. Their service model should scale with your business growth and adapt to your changing needs.

What communication standards should you expect?

Reasonable communication expectations include:

- Designated account contacts with backup support

- Response time commitments for different inquiry types

- Proactive status updates without requiring your initiation

- Regular business reviews assessing performance and opportunities

- Clear escalation paths for urgent issues or disputes

These standards ensure smooth daily operations and issue resolution.

How does their service model impact your experience?

Service model considerations:

- Dedicated versus shared teams and the implications for attention

- Geographic coverage matching your port usage patterns

- Staff experience levels and turnover rates

- After-hours support availability for time-sensitive issues

- Scalability capacity as your import volume grows

The right service model feels like an extension of your team rather than a distant vendor.

What financial stability and pricing transparency matter?

The business aspects of brokerage relationships significantly impact long-term partnership viability. Pricing structures should be transparent and sustainable, while financial stability ensures they'll be there when you need them.

Request references that speak to the broker's financial reliability and business practices. Examine their pricing structure for hidden fees or unexpected charges. Understand how they handle duty payments and their bonding capacity relative to your import volume. The most successful relationships feature transparent, predictable pricing and financial stability that supports your growth rather than creating constraints.

What pricing models work best for different businesses?

Common pricing approaches:

- Per-entry pricing suitable for consistent volume importers

- Hourly consulting appropriate for complex compliance projects

- Monthly retainers effective for businesses wanting dedicated resources

- Transaction percentage sometimes used for high-value shipments

- Hybrid models combining different approaches for flexibility

The right model aligns with your shipment patterns and service needs.

How can you verify financial stability and practices?

Verification methods include:

- Requesting financial references from carriers or service partners

- Checking bond capacity relative to your potential duty exposure

- Reviewing industry standing through trade associations

- Asking about duty payment processes and timing

- Understanding error liability and resolution procedures

These checks ensure financial practices match service promises.

Conclusion

Selecting the right customs broker requires careful evaluation across multiple dimensions—industry expertise, technology capability, compliance track record, communication practices, and business stability. The ideal partner demonstrates specific knowledge of your products, provides modern technology integration, maintains excellent compliance performance, communicates proactively and clearly, and operates with financial transparency and stability. By conducting thorough due diligence across these areas rather than focusing solely on price, you can identify a broker who will protect your compliance interests while optimizing your import operations. The most successful importer-broker relationships become strategic partnerships that grow and adapt together, creating competitive advantages through efficient, compliant international trade operations.