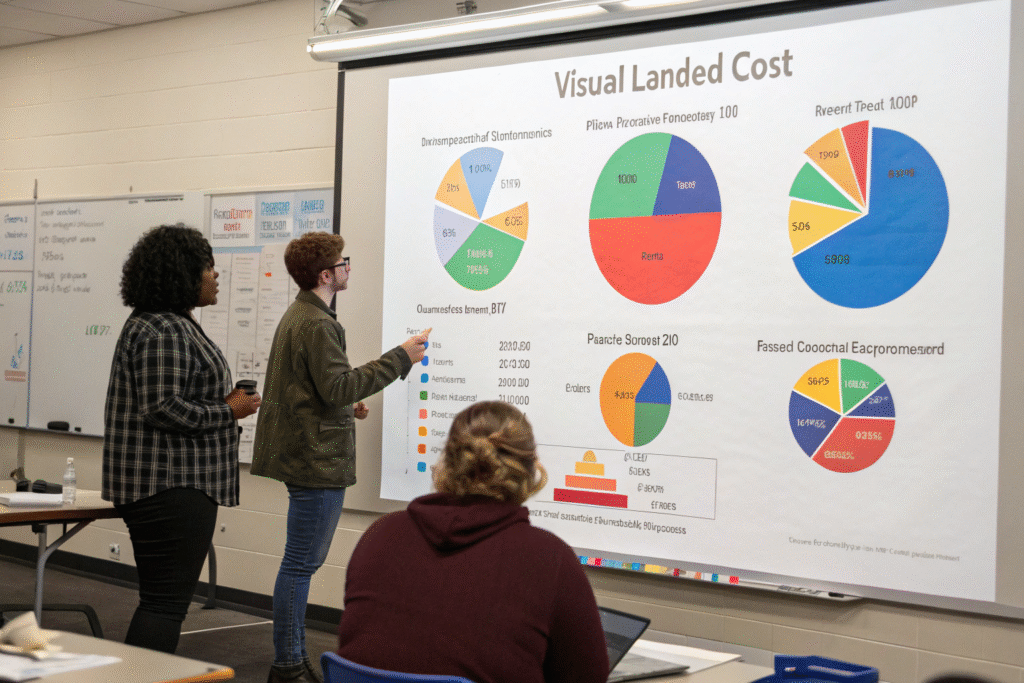

Many importers make the critical mistake of focusing only on the product cost when sourcing from China, only to discover their actual expenses are much higher than anticipated. Understanding your true landed cost—the total cost of a product delivered to your door—is essential for pricing decisions, profitability analysis, and business planning.

To accurately calculate your landed cost from China, you must include product costs, international freight charges, insurance, customs duties and taxes, domestic transportation, and all ancillary fees. The formula is: Landed Cost = Product Cost + Shipping + Insurance + Duties + Taxes + Additional Fees. Missing any component can result in severe miscalculations of your true costs.

Let's break down each cost component and explore practical methods for calculating and optimizing your total import expenses.

What are the core components of landed cost?

Landed cost comprises all expenses incurred in getting products from your supplier's door to your warehouse. Many importers overlook critical elements, leading to unexpected costs that erode profit margins. A systematic approach ensures you capture every cost component.

The essential elements include product cost (including packaging), international freight charges (air or sea), insurance coverage, customs duties and taxes, destination port fees, trucking to your warehouse, and various handling charges. Additionally, you must factor in currency exchange costs, payment processing fees, quality inspection expenses, and the cost of capital during transit. Only by accounting for all these elements can you determine your true cost per unit and set appropriate selling prices.

How do you calculate product and packaging costs?

Product cost goes beyond the unit price and includes:

- Manufacturing costs per unit including labor and materials

- Tooling and mold costs amortized across your order quantity

- Packaging materials including inner and outer packaging

- Labeling and documentation preparation by the supplier

- Quality control inspections before shipment

- Payment transaction fees for international transfers

These elements combined give you your true product cost before transportation.

What freight charges must you include?

International freight involves multiple cost components:

- Basic ocean or air freight charges based on weight or volume

- Fuel surcharges (BAF for sea, FSC for air) that fluctuate regularly

- Terminal handling charges at both origin and destination ports

- Security fees for various screening requirements

- Peak season surcharges during high-demand periods

- Container freight station charges for LCL shipments

Understanding these individual elements helps identify optimization opportunities.

How do customs duties and taxes impact your costs?

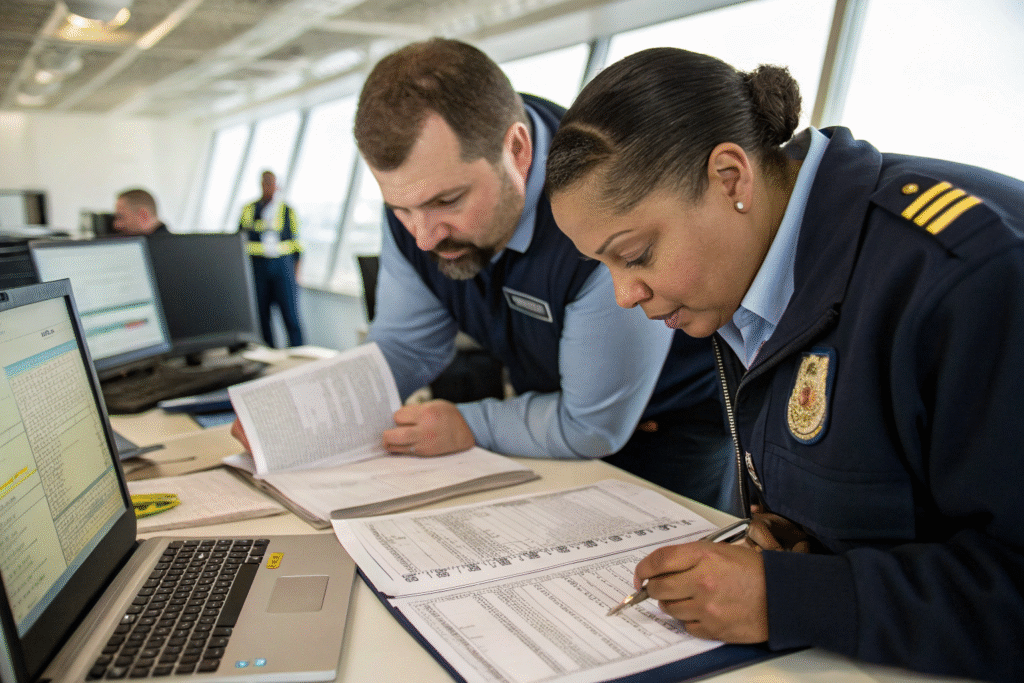

Customs charges represent one of the most variable and often misunderstood components of landed cost. Many importers struggle with accurate duty estimation, leading to unexpected expenses that significantly impact profitability.

Duties are calculated as a percentage of your product's customs value, which typically includes product cost, freight, and insurance. The specific rate depends on the HS code classification of your products. Additionally, you may owe merchandise processing fees, harbor maintenance fees, and other government charges. For formal entries (shipments over $2,500), you'll need a customs bond. Some states also impose additional taxes upon importation.

How can you accurately estimate duty rates?

Proper duty estimation requires:

- Correct HS code classification for each product type

- Understanding trade program eligibility for preferential rates

- Knowing product valuation rules for customs purposes

- Anticipating additional taxes like anti-dumping duties

- Factoring in merchandise processing fees (currently 0.3464% with $27.75 minimum)

Working with customs experts ensures you don't underestimate these government charges.

What hidden customs costs often surprise importers?

Beyond basic duties, watch for:

- Customs bond costs for formal entries

- Exam fees if customs selects your shipment for inspection

- Laboratory testing fees for certain regulated products

- Post-summary corrections if errors are discovered later

- Fines and penalties for compliance violations

Budgeting for these potential additional costs prevents unpleasant surprises.

What domestic destination charges complete the picture?

Many importers make the mistake of stopping their cost calculation when goods reach the US port, forgetting that significant expenses remain before products reach their final destination. These "last mile" costs can substantially impact your total landed cost.

Domestic charges include port unloading fees, terminal handling charges, customs examination fees (if applicable), trucking from port to warehouse, warehouse receiving fees, and potential storage charges if you can't collect immediately. Additionally, you may need to factor in palletization or deconsolidation costs for LCL shipments, as well as any special handling requirements for your specific products.

How do you calculate final transportation costs?

Final transportation involves:

- Drayage costs from port to local warehouse

- Fuel surcharges for trucking services

- Accessorial fees for special equipment or services

- Liftgate services if your location lacks loading docks

- Inside delivery charges for placement within your facility

- Waiting time fees if truckers experience delays

These costs vary significantly by location and facility type.

What warehouse and handling costs should you include?

Upon arrival, consider these expenses:

- Unloading labor for moving goods from trucks

- Pallet exchange or rental fees if using pooled pallets

- Quality inspection upon receipt at your facility

- Inventory processing into your management system

- Storage costs until goods move to sales channels

- Damage or shrinkage during the final handling

These operational costs complete your true landed cost calculation.

How can technology improve landed cost accuracy?

Modern tools and systems have transformed landed cost calculation from an error-prone manual process to a precise, automated function. Businesses leveraging technology gain significant advantages in cost control and decision-making.

Advanced landed cost calculators incorporate real-time freight rates, current duty databases, currency exchange rates, and comprehensive fee structures. These systems can model different scenarios, track actual costs against estimates, and provide detailed analytics for continuous improvement. The most sophisticated platforms integrate with your procurement and accounting systems, creating a seamless flow of cost information throughout your organization.

What features do advanced landed cost tools offer?

Sophisticated calculation tools provide:

- Real-time rate integration from multiple carriers and suppliers

- Automated HS code lookup with duty rate determination

- Currency conversion at current exchange rates

- Scenario modeling for different shipping methods

- Cost allocation across product lines and SKUs

- Performance tracking comparing estimated vs. actual costs

These capabilities transform costing from guesswork to precision.

How can you implement ongoing cost tracking?

Effective cost management requires:

- Regular cost audits verifying actual expenses against estimates

- Variance analysis identifying areas for improvement

- Supplier performance tracking monitoring cost reliability

- Market monitoring watching for rate and regulation changes

- Process documentation ensuring consistent calculation methods

Continuous tracking ensures your landed cost calculations remain accurate over time.

Conclusion

Accurate landed cost calculation is not a one-time exercise but an ongoing discipline essential for import profitability. By systematically accounting for all cost components—from product purchase through domestic delivery—you gain the visibility needed to make informed sourcing, pricing, and logistics decisions. The most successful importers treat landed cost calculation as a strategic capability rather than an administrative task, leveraging technology and expertise to maintain precision in their cost models. With complete cost understanding, you can identify optimization opportunities, avoid profit-eroding surprises, and build a sustainable import business.