When the 2015 West Coast port slowdown struck, one of our clients watched their 30-day transit time from Shanghai to Chicago stretch to 97 days—nearly collapsing their seasonal business. As founder of GeeseCargo with extensive experience navigating port disruptions, I've learned that labor strikes don't just cause delays; they create supply chain heart attacks that can paralyze businesses for months.

Port labor strikes can extend delivery times by 300-500%, with typical impacts ranging from 2-8 weeks of additional delays. The 2022-2023 US West Coast port labor disputes caused average delay increases of 18-26 days, with some vessels waiting 3+ weeks for berthing. These delays create cascading effects throughout supply chains, impacting manufacturing, inventory availability, and customer satisfaction.

Labor disruptions represent one of the most predictable yet devastating supply chain risks. Understanding their impacts and developing mitigation strategies separates resilient businesses from those crippled by port disruptions.

What Are the Immediate Operational Impacts of Port Strikes?

The direct effects begin immediately when labor actions commence, creating domino effects throughout port operations.

How Do Strikes Affect Vessel Operations and Scheduling?

Vessel berthing delays occur as productivity drops 70-90% during strikes. Instead of the normal 25-40 container moves per hour, strike-affected terminals may manage only 5-10 moves, creating massive vessel backlogs.

Vessel bunching happens as schedules collapse. When multiple vessels miss their windows, they arrive simultaneously once operations resume, creating secondary congestion that extends delays long after strikes end.

Vessel diversions to alternative ports increase costs and complexity. Carriers may bypass strike-affected ports entirely, adding 7-14 days transit time plus additional intermodal transportation to final destinations.

What Happens to Cargo Handling and Terminal Operations?

Container yard congestion makes retrieval nearly impossible. Even available containers become inaccessible when yard operations slow, with retrieval times extending from hours to days or weeks.

Gate operations slow dramatically, creating trucker queues. With reduced labor, terminal gates operate at 20-30% capacity, causing truck lines stretching miles and wait times exceeding 8-12 hours.

Equipment availability plummets as containers remain stuck. The normal equipment cycle breaks down, creating chassis and container shortages that ripple throughout the supply chain.

How Do Labor Disruptions Create Cascading Supply Chain Effects?

The initial port impacts trigger secondary effects that extend far beyond the waterfront, affecting entire supply chains.

How Does Inventory Management Get Disrupted?

Safety stock depletion occurs as replenishment delays continue. Most companies maintain 30-45 days of inventory, but extended strikes can exhaust these buffers, causing stockouts and lost sales.

Bullwhip effect distorts demand signals and inventory planning. The sudden stop-and-start of inventory flows creates massive ordering volatility that takes months to stabilize after strikes resolve.

Seasonal inventory mismatches cause long-term business impact. Holiday merchandise arriving in January or summer goods arriving in autumn destroys sales opportunities and creates massive discounting requirements.

What Manufacturing and Production Impacts Occur?

Production line stoppages happen when component inventories deplete. Just-in-time manufacturing systems are particularly vulnerable, with strikes potentially idling factories within days.

Supplier reliability issues emerge throughout the supply chain. Even companies not directly affected by strikes face disruptions when their suppliers experience strike-related challenges.

Sourcing cost increases as companies seek alternatives. Expedited shipping, air freight, and alternative sourcing typically cost 3-7x normal rates during extended disruptions.

Which Ports and Trade Lanes Face the Highest Strike Risks?

Understanding geographic and labor relationship patterns helps anticipate potential disruption hotspots.

Which US Ports Have the Highest Strike Vulnerability?

US West Coast ports face recurring labor negotiations every 6 years. The International Longshore and Warehouse Union (ILWU) negotiations with Pacific Maritime Association historically create the most significant US disruption risks.

US East and Gulf Coast ports have different labor dynamics. The International Longshoremen's Association (ILA) negotiations create periodic risks, though historically with fewer extended disruptions than West Coast ports.

Port-specific factors influence individual terminal vulnerability. Some terminals have more contentious labor histories or face local issues that increase their specific strike probability.

What Global Regions Face Significant Labor Risks?

European ports experience frequent labor actions with varying impacts. Ports in Germany, Belgium, and the UK have faced significant strikes, though typically shorter duration than US disruptions.

Asian ports generally have lower strike risks but face other challenges. While overt strikes are less common, weather, congestion, and regulatory issues create different types of disruptions.

Emerging markets face complex labor environments. Ports in developing regions may experience unpredictable labor actions with limited resolution mechanisms.

What Timeframes and Patterns Characterize Port Strikes?

Labor disruptions follow predictable patterns that informed shippers can anticipate and monitor.

How Do Labor Negotiation Cycles Create Predictable Risk Windows?

Contract expiration dates create known risk periods. Major US West Coast labor contracts expire every 6 years, with the current agreement covering until July 1, 2028, creating predictable risk windows.

Pre-negotiation posturing typically begins 6-12 months before expiration. Union and employer positioning before formal negotiations signals potential contention levels.

Extension periods sometimes provide temporary stability. Contracts may be extended while negotiations continue, though work slowdowns often occur during these periods.

What Escalation Patterns Typically Occur?

Work-to-rule slowdowns often precede full strikes. Labor may follow all procedures exactly, dramatically reducing productivity without technically striking.

Rotating strikes target specific terminals strategically. Rather than complete port shutdowns, unions may strike one terminal at a time to maximize disruption while minimizing lost wages.

Lockouts represent management-initiated disruptions. Employers may preemptively close operations rather than accept reduced productivity during negotiations.

How Can You Mitigate Strike Impacts on Your Supply Chain?

Proactive strategies can significantly reduce vulnerability to labor disruptions.

What Diversification Strategies Reduce Vulnerability?

Multi-port strategies avoid single-point failures. Importing through both West Coast and East Coast/Gulf ports creates natural redundancy during regional disruptions.

Carrier diversification provides routing flexibility. Using multiple carriers with different port call patterns increases options for rerouting during disruptions.

Modal flexibility enables rapid adaptation. Maintaining air freight capacity and rail options provides alternatives when ocean transport becomes unreliable.

How Can Inventory and Planning Strategies Help?

Strategic buffer inventory covers predictable risk periods. Increasing safety stock before known negotiation deadlines provides protection during potential disruptions.

Demand planning adjustments manage customer expectations. Proactively communicating potential delays and adjusting promotions prevents customer dissatisfaction.

Supplier collaboration creates shared contingency planning. Working with suppliers to develop strike response plans ensures coordinated action when disruptions occur.

What Real-Time Monitoring and Response Tactics Work Best?

Early detection and rapid response minimize strike impacts when disruptions occur despite prevention efforts.

What Early Warning Indicators Should You Monitor?

Labor negotiation progress provides the clearest warning. Monitoring bargaining progress, public statements, and mediator involvement helps anticipate disruptions.

Port productivity metrics signal developing issues. Decreasing container moves per hour, increasing vessel wait times, and growing yard congestion indicate developing problems even before formal strikes.

Carrier communications reveal operational assessments. Shipping lines typically provide detailed updates about port conditions and contingency planning during labor disruptions.

What Response Protocols Minimize Business Impact?

Pre-defined escalation criteria trigger contingency plans. Clear metrics (vessel wait times exceeding 7 days, productivity drops below 50%) should automatically activate response plans.

Communication protocols manage stakeholder expectations. Pre-developed customer communications, supplier updates, and internal alerts ensure consistent messaging during crises.

Financial authorization streamlining enables rapid decision-making. Pre-approved budgets and authority limits for premium transportation prevent delays in implementing contingency plans.

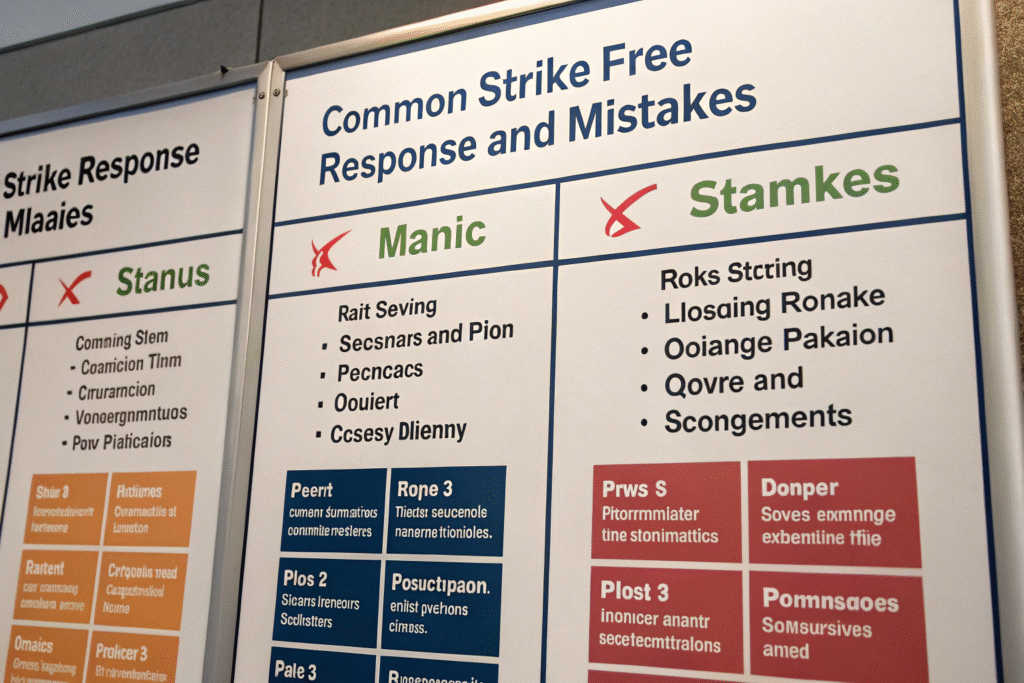

What Are the Most Common Strike Response Mistakes?

Understanding frequent errors helps businesses avoid self-inflicted damage during labor disruptions.

What Strategic Errors Worsen Strike Impacts?

Over-reaction to early signals creates unnecessary costs. Implementing expensive contingencies at the first sign of trouble often costs more than the disruption itself.

Under-estimation of disruption duration compounds problems. Assuming short resolutions and delaying responses typically increases total impact and recovery time.

Isolated decision-making misses coordination benefits. Departments making independent decisions without supply chain-wide coordination creates conflicting actions.

What Operational Mistakes Increase Costs and Delays?

Poor communication with customers damages relationships. Failing to proactively manage customer expectations during delays typically causes permanent customer loss.

Inefficient contingency execution wastes resources. Without pre-planned processes, emergency responses often involve duplicate efforts and premium costs without corresponding benefits.

Inadequate documentation hampers recovery and claims. Failing to properly document disruption impacts, additional costs, and mitigation efforts prevents potential insurance recovery or contractual compensation.

Conclusion

Port labor strikes represent one of the most significant yet manageable risks in international shipping. The most resilient companies treat strike preparedness as an ongoing capability rather than a reactive response, building flexibility, visibility, and response capacity into their normal operations.

At GeeseCargo, we've helped clients navigate multiple labor disruptions with impacts 60-80% lower than industry averages through systematic preparation and disciplined response. The key is recognizing that while strikes are inevitable, their business impact is largely controllable through proper planning and execution.

Begin your strike preparedness by analyzing your vulnerability to various port disruptions, then develop graduated response plans that match action levels to disruption severity. Remember that in supply chain risk management, the cost of preparation is always lower than the cost of reaction—investing in resilience before disruptions occur provides returns many times over when strikes inevitably happen.