When one of our e-commerce clients strategically shifted their Q3 shipping to avoid peak surcharges, they saved $128,000 while competitors paid premium rates during the holiday crunch. As founder of GeeseCargo with over a decade navigating seasonal shipping cycles, I've learned that understanding these patterns transforms seasonal challenges into competitive advantages. Companies that master seasonal timing typically reduce shipping costs by 18-35% and improve delivery reliability by 40-60% during critical periods.

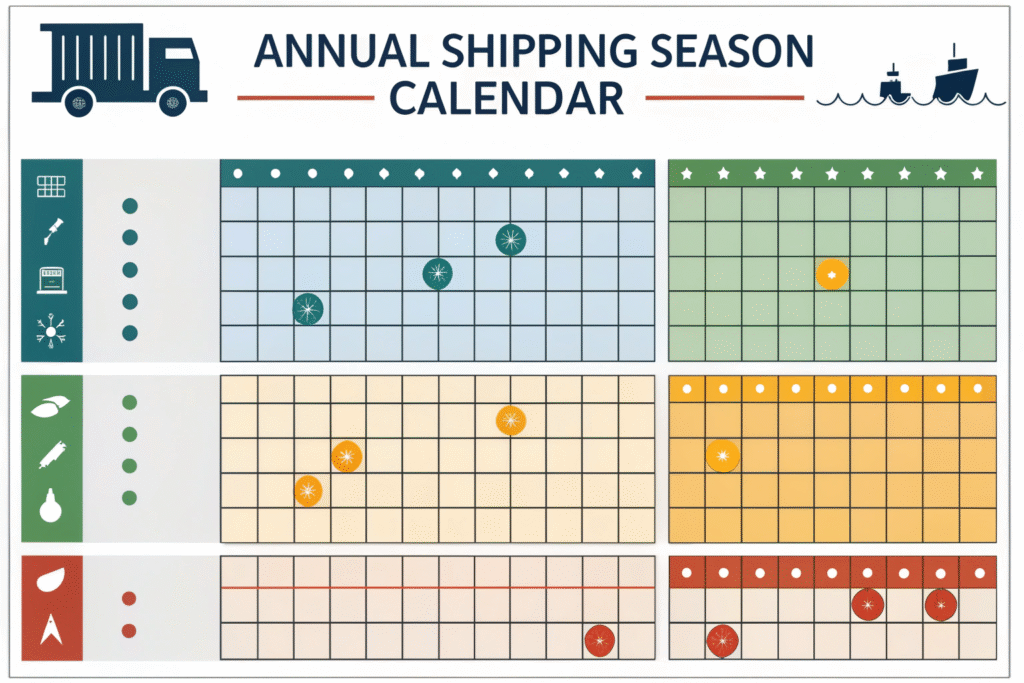

Seasonal shipping trends follow predictable patterns: January-February (post-holiday slowdown), March-May (spring buildup), June-August (peak season with surcharges), September-October (holiday preparation), and November-December (holiday peak). Strategic shippers book capacity 8-12 weeks before peaks, leverage shoulder seasons for cost savings, and build relationships that secure priority access during capacity crunches.

The most successful companies don't just react to seasonal trends—they build them into their operational DNA, using predictable fluctuations to optimize costs, secure capacity, and outmaneuver competitors who pay peak rates for rushed shipments.

What Are the Key Seasonal Shipping Patterns Throughout the Year?

Understanding the annual shipping calendar enables proactive planning rather than reactive scrambling.

How Does the Annual Shipping Cycle Unfold?

Q1 (January-March) offers the year's lowest rates and greatest capacity. Chinese New Year typically creates a 2-4 week production and shipping slowdown in February, followed by a gradual buildup as factories resume full production. This period provides 15-25% rate advantages over peak seasons with minimal congestion.

Q2 (April-June) transitions toward peak conditions. Rates typically increase 8-12% as retailers build inventory for back-to-school and early holiday seasons. Capacity remains generally available with proper planning, though late June begins seeing the first peak season surcharges.

Q3 (July-September) represents the true peak shipping season. Carriers implement Peak Season Surcharges (PSS) adding $800-$2,000 per container, with capacity constraints causing rolling bookings and equipment shortages. This period requires advanced planning and often justifies premium services.

Q4 (October-December) combines holiday shipping with year-end pressures. While some consumer shipping eases after Cyber Week, industrial and retail replenishment continues strong through mid-December before the holiday slowdown.

What Industry-Specific Seasonal Patterns Matter?

Retail and E-commerce face pronounced Q3-Q4 peaks with Black Friday/Cyber Monday creating the year's highest demand. Successful retailers ship holiday inventory June-August to avoid peak surcharges and ensure November store arrival.

Fashion and Apparel follow seasonal collection cycles with spring/summer shipments December-February and fall/winter shipments June-August. Missing these windows creates inventory mismatches and margin erosion through discounting.

Consumer Electronics cluster around major product launches (typically August-October for holiday products) and back-to-school (June-July). Component manufacturers face different cycles based on their position in the supply chain.

How Can You Strategically Time Your Shipments for Maximum Advantage?

Proactive timing transforms seasonal challenges into cost savings and competitive advantages.

What Are the Most Impactful Timing Strategies?

Pre-peak shipping moves inventory before surcharges activate. Shipping 4-6 weeks before peak season typically avoids 15-30% rate premiums while maintaining adequate lead time for holiday sales.

Shoulder season utilization leverages periods between peaks. The windows between Chinese New Year and summer peak (March-May) and between summer peak and holiday season (late September-October) offer near-peak reliability at off-peak pricing.

Post-holiday replenishment capitalizes on January-February rate reductions. While too late for holiday sales, this period offers the year's best rates for rebuilding depleted inventory without time pressure.

How Can Production Scheduling Align with Shipping Optimization?

Staggered production creates continuous but manageable shipping volumes. Rather than concentrating production, spreading manufacturing across multiple months enables consistent shipping volumes that secure carrier relationships without peak premiums.

Strategic inventory positioning uses early shipping for predictable demand. Shipping core products with stable demand patterns early creates cost savings that offset expedited shipping for fast-moving or unpredictable items.

Component versus finished goods timing optimizes different product categories. Shipping raw materials and components during peak periods for assembly into finished goods during off-peak periods can dramatically reduce total logistics costs.

What Capacity Planning Strategies Ensure Seasonal Success?

Securing capacity during constrained periods requires different approaches than standard shipping.

How Far in Advance Should You Secure Peak Season Capacity?

Ocean freight requires 8-12 week advance planning for peak seasons. July-August peak shipments should be booked by May-June, while holiday shipments need September bookings for November arrivals.

Air freight needs 4-6 week planning for predictable peaks. While air offers more flexibility, guaranteed space during peak periods requires advanced commitment and often minimum volume guarantees.

Trucking and final mile demand 2-4 week reservations during holidays. Local transportation faces its own capacity crunches, particularly during the November-December holiday delivery peak.

What Relationship Strategies Improve Capacity Access?

Annual volume commitments secure priority treatment during constraints. Carriers typically allocate 60-80% of peak capacity to contracted customers, leaving only 20-40% for spot market transactions.

Multi-modal relationships provide flexibility when primary modes face constraints. Having established relationships with ocean, air, and rail providers enables mode shifting when specific options become constrained or cost-prohibitive.

Port and lane diversification reduces vulnerability to local congestion. Using multiple port pairs (Shanghai-Los Angeles and Yantian-New York) provides alternatives when specific corridors face unusual congestion.

How Can Pricing Strategies Capitalize on Seasonal Fluctuations?

Strategic approaches to seasonal pricing transform cost structures from reactive expenses to competitive advantages.

What Contract Structures Optimize Seasonal Pricing?

Fixed-rate contracts with clearly defined peak season terms provide cost certainty. The best contracts specify exact surcharge amounts or percentage increases during defined peak periods rather than open-ended market-based adjustments.

Tiered volume commitments align with seasonal patterns. Rather than flat monthly volumes, contracts that recognize seasonal fluctuations (higher minimums in peak seasons, lower in off-peak) typically secure better pricing and priority treatment.

Multi-season contracts lock in annual rates rather than spot market exposure. Companies committing to year-round volumes typically achieve 12-18% better pricing than those using seasonal spot market purchasing.

How Can Surcharge Management Reduce Costs?

Peak Season Surcharge (PSS) avoidance through timing saves significant costs. Many surcharges have specific effective dates, making slight timing adjustments potentially save thousands per container.

Fuel and cost adjustment factor management requires understanding calculation methods. Some carriers calculate these charges differently, making carrier selection during high-fuel periods potentially impactful.

Accessorial charge negotiation limits unexpected costs. Clearly defining what additional charges apply during peak periods prevents surprise fees that erode cost advantages.

What Operational Adjustments Support Seasonal Success?

Tactical operational changes during peak periods maintain service levels despite system-wide challenges.

How Should Inventory Management Adapt to Seasonal Shipping?

Safety stock adjustments account for longer transit times and higher variability. Increasing safety stock levels 15-25% during peak seasons prevents stockouts caused by shipping delays.

ABC inventory analysis prioritizes shipping resources. Applying tighter controls and premium shipping to A-items while accepting slower transit for C-items optimizes shipping costs during constrained periods.

Dynamic reorder points reflect seasonal lead time variability. Automatically adjusting reorder points based on current transit time performance prevents both stockouts and overstocking.

What Communication Strategies Enhance Seasonal Performance?

Proactive carrier communication ensures alignment during constraints. Regular updates with carriers about volume forecasts, timing changes, and special requirements prevent last-minute capacity issues.

Customer expectation management balances service promises with operational reality. Adjusting delivery promises during known peak periods maintains customer satisfaction despite longer transit times.

Internal stakeholder alignment prevents conflicting priorities. Ensuring sales, marketing, and operations share understanding of seasonal shipping realities prevents unrealistic commitments.

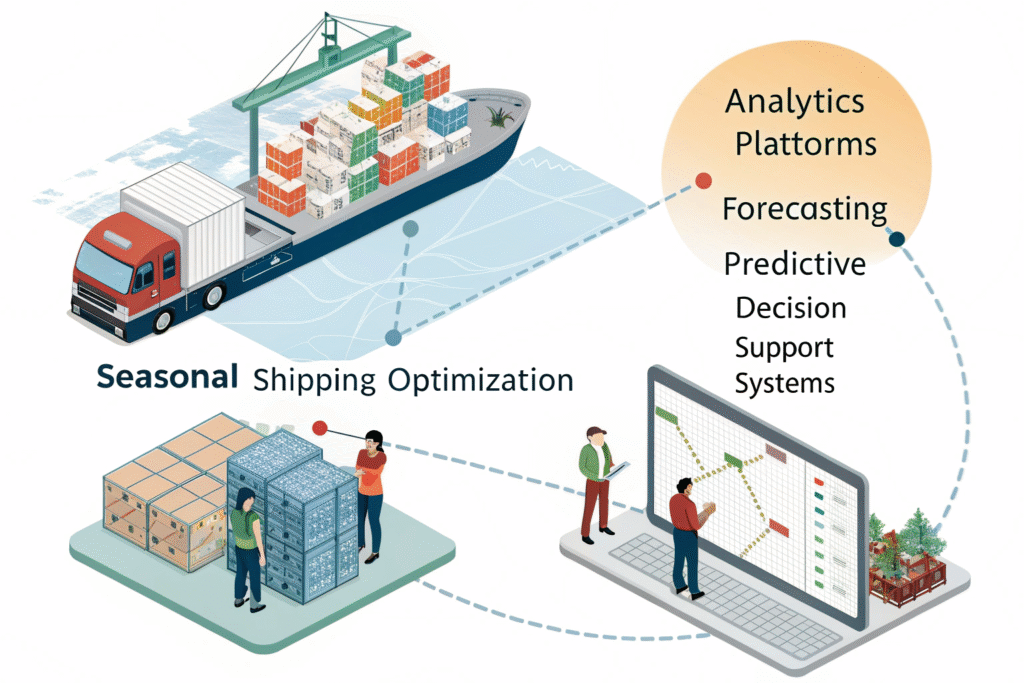

What Technology and Data Strategies Unlock Seasonal Advantages?

Advanced analytics and technology solutions transform seasonal shipping from art to science.

What Data Analytics Reveal Seasonal Opportunities?

Historical shipping pattern analysis identifies company-specific seasonal trends. Beyond industry patterns, understanding your own historical shipping volumes, costs, and performance by season enables precise planning.

Cost trend forecasting predicts rate movements with surprising accuracy. Analyzing fuel prices, capacity indicators, and economic factors typically enables 80-90% accurate rate forecasting 60-90 days in advance.

Performance analytics identify seasonal carrier performance variations. Some carriers maintain reliability better during peaks, making seasonal carrier selection potentially more impactful than annual averages suggest.

How Can Automation Improve Seasonal Execution?

Automated booking systems secure capacity at optimal times. Systems that automatically book space when rates reach predetermined levels or capacity becomes available prevent missed opportunities.

Dynamic routing optimization adjusts to changing conditions. Systems that continuously evaluate carrier performance, port congestion, and cost factors can reroute shipments around emerging bottlenecks.

Performance monitoring provides early warning of developing issues. Real-time tracking of vessel schedules, port conditions, and carrier performance enables proactive response to seasonal challenges.

Conclusion

Seasonal shipping trends represent one of the most predictable yet underutilized opportunities in global logistics. Companies that systematically analyze patterns, build strategic relationships, and implement disciplined seasonal processes typically achieve significantly lower costs, higher reliability, and stronger competitive positioning. The most successful approaches treat seasonal management as a core competency rather than an annual challenge.

At GeeseCargo, we've helped clients reduce their peak season shipping costs by 22-38% through strategic seasonal management, with the best results coming from companies that integrate seasonal thinking throughout their organizations rather than isolating it within logistics. The key is recognizing that seasonal advantages compound over time—each well-executed season strengthens carrier relationships, deepens market understanding, and builds operational capabilities that deliver increasing advantages.

Begin your seasonal optimization by analyzing your historical shipping patterns to identify your specific seasonal profile, then develop a comprehensive seasonal strategy that addresses timing, capacity, pricing, and operational adjustments. Remember that in seasonal shipping, the early planner captures the advantages while the reactive payer bears the costs.