For importers, distributors, and sourcing managers alike, 2025 has brought a new wave of complexity: increased tariffs from major global economies. These tariff hikes are already reshaping how we move goods from China to the United States and Europe. If you’re not updated on these changes, you risk cost overruns, delayed customs clearance, or even shipment rejections.

In this article, I’ll walk you through the full list of countries that have implemented new tariffs in 2025, the updated rates, and how these changes can impact your bottom line—especially if you're shipping from China.

With over a decade of freight forwarding experience at GeeseCargo, I’ve seen how unexpected tariff policy shifts have disrupted supply chains. Now more than ever, understanding and planning for these changes is key to keeping logistics stable, fast, and affordable.

What Are the 2025 Tariff Updates by Country?

Which Countries Have Imposed New Tariffs in 2025?

2025 has marked a return to protectionist trade policies for many countries. The U.S., European Union, India, Brazil, and Turkey have all introduced or raised tariffs on certain imports. For instance, the United States Trade Representative announced a 25% tariff on electric vehicles and 10% on textile imports from China starting March 1, 2025.

India, in an attempt to boost its domestic manufacturing, added up to 20% duties on apparel, electronics, and plastic products. Similarly, Brazil’s Ministry of Economy published Resolution No. 187 which raises rates on Chinese footwear, handbags, and toys to 35% from the previous 18%.

Turkey increased tariffs on fast fashion and electronics originating from East Asia, targeting market saturation concerns. These moves are not just political; they're strategic efforts to shield domestic industries.

What Goods Are Most Affected by These Changes?

The most affected categories in 2025 include:

| Product Category | Countries Affected | Tariff Rate Range |

|---|---|---|

| Electric Vehicles | USA, EU | 20%–30% |

| Apparel & Textiles | USA, India, Brazil | 10%–25% |

| Footwear | Brazil, Turkey | 20%–35% |

| Electronics | USA, India, Turkey | 10%–20% |

| Plastics & Packaging | India | 15%–20% |

According to Bloomberg, luxury goods and commodities like leather bags and watches have also seen new surcharges, mostly by the EU. This trend signifies that brands shipping such goods from Asia must now double-check product HS codes and country-specific tariff updates before finalizing contracts.

How Do 2025 Tariffs Impact Shipping Costs?

Will DDP Shipping Become More Expensive in 2025?

Absolutely. Since DDP (Delivered Duty Paid) includes the final tariff costs in the total freight bill, freight forwarders like us have to adjust rates accordingly. When tariffs rise, so do your landed costs. For example, a $10,000 shipment of clothing might now include $2,000 in tariffs instead of $500, depending on the product category and destination country.

This hits importers hard—especially those shipping to the USA or Brazil. That’s why many of our U.S. clients are switching from DDP to FOB terms to shift risk and cost management to the destination partner. However, that also means you need a more hands-on freight partner on the receiving end.

Can Tariff Engineering Still Help Reduce Duties?

Yes—but it’s getting more complex. Tariff engineering, the legal practice of designing products or packaging to fall into a lower-tariff HS code, is still viable. However, customs authorities are tightening regulations.

At GeeseCargo, we collaborate with customs brokers who analyze tariff classifications in real time and flag risky shipments before they leave the factory. Even small tweaks in labeling, component sourcing, or packaging can alter duty rates—but you must stay compliant.

What Are the Strategic Responses for US & EU Importers?

Should You Reevaluate Sourcing Countries?

Yes. Many U.S. and EU importers are exploring alternatives to China like Vietnam, Bangladesh, or Turkey. These countries may offer lower labor costs and, in some cases, more favorable tariff rates due to trade agreements.

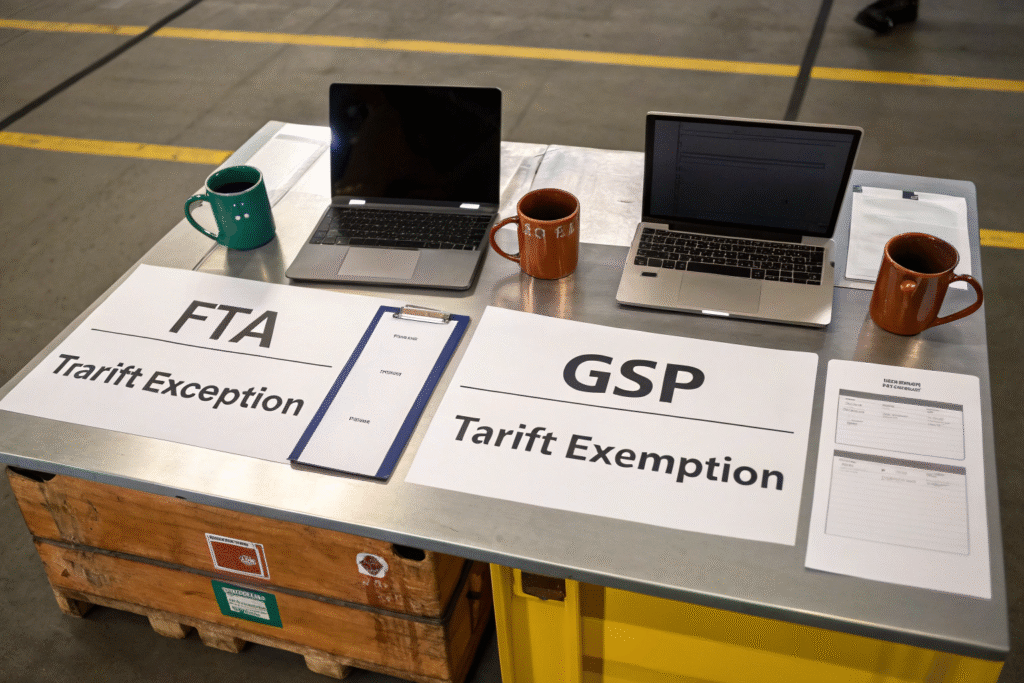

For instance, Bangladesh benefits from GSP (Generalized System of Preferences) status with the EU, meaning many of its apparel exports enter Europe with zero duties. Similarly, Vietnam’s trade deals with the EU and U.K. create a competitive edge.

Still, shifting sourcing is no small task. It involves logistics route changes, quality control risks, and longer lead times. That’s where a freight forwarder familiar with multi-country routing comes in handy.

How Can You Negotiate with Suppliers to Offset Tariff Hikes?

One strategy that works is splitting tariff burdens. In 2025, we’ve helped several clients renegotiate supply contracts where part of the tariff is absorbed by the supplier in exchange for long-term volume commitments.

Another effective approach is to ask suppliers to switch Incoterms—perhaps from DDP to EXW—giving you more control over how duties are managed. This often results in better forecasting, especially when coupled with bonded warehouse use in U.S. ports.

Which Trade Agreements Can Reduce 2025 Tariff Exposure?

What FTAs Should You Pay Attention To?

Free Trade Agreements (FTAs) can save you thousands in import duties. In 2025, some of the most impactful FTAs for reducing tariffs include:

- USMCA (for U.S. imports from Canada/Mexico)

- EU–Vietnam FTA

- RCEP (covering much of Asia-Pacific)

- EU–Japan EPA

For example, goods made in South Korea or Vietnam may enter U.S. ports with significantly lower tariffs compared to Chinese-made goods. This only applies if you comply with the FTA’s rules of origin and have correct documentation.

Can Bonded Warehousing Help with Duty Deferral?

Definitely. Bonded warehouses in the U.S. allow you to defer duties until goods are officially withdrawn for distribution. This is especially useful for sellers using Amazon FBA or 3PL services who want to control timing.

We’ve helped multiple clients store products at bonded facilities near the Port of Los Angeles. Doing so enabled them to delay tariff payments until sales occurred. According to CBP guidelines, this can be a legally sound and profitable method of managing cash flow.

Conclusion

The 2025 wave of tariff increases isn't just a blip—it's a structural change in global trade policy. From the U.S. to India, countries are aggressively protecting local industries with steep import duties. For importers, brands, and distributors, staying informed and flexible is now a matter of survival.

At GeeseCargo, we don’t just ship goods. We help our clients navigate tariff codes, optimize Incoterms, and stay cost-effective even in the face of protectionist policies. If your company wants to avoid expensive surprises and keep your shipments moving smoothly, reach out to us.

You can contact Ben Zhu at: benzhu@geesecargo.com. We’re here to make international freight more predictable—and more profitable.