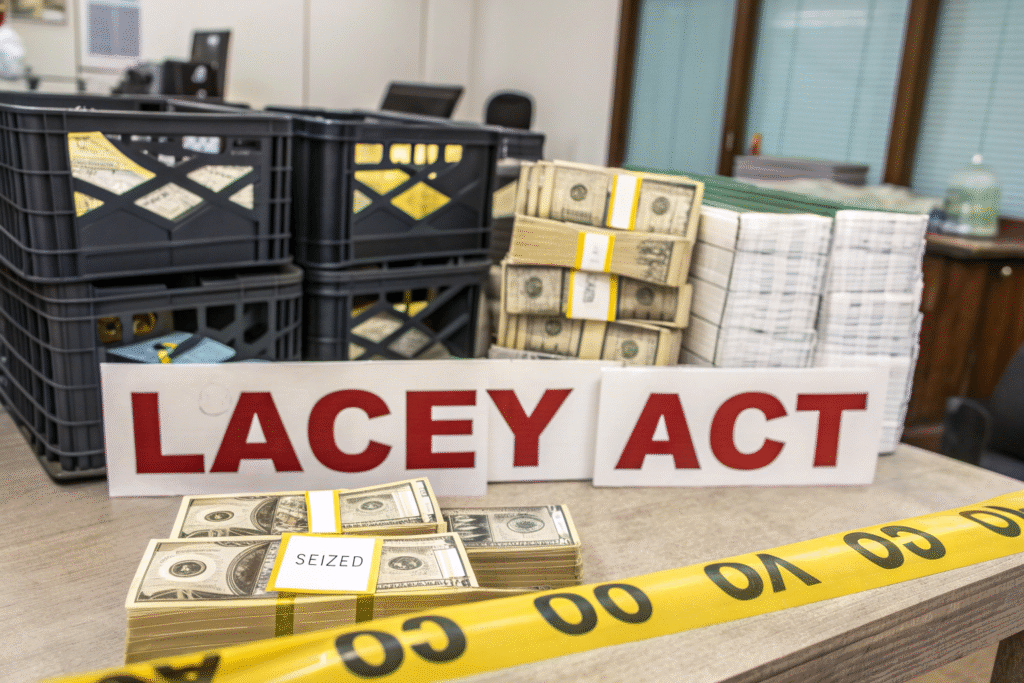

When one of our furniture importers faced a $125,000 penalty for Lacey Act violations on imported teak furniture, I realized how many businesses misunderstand this critical regulation. As founder of GeeseCargo with extensive experience in regulated imports, I've witnessed how the Lacey Act's reach extends far beyond what many importers anticipate. Understanding its applicability isn't just about compliance—it's about avoiding devastating penalties that can cripple your business.

The Lacey Act applies to virtually all wood products imported into the United States, including furniture, flooring, paper, musical instruments, and any products containing wood components. The law requires importers to declare the genus, species, country of harvest, and other specific information for all plants and plant products, with severe penalties for false declarations or illegal sourcing.

The Lacey Act represents one of the most comprehensive wildlife protection laws globally, with enforcement that has significantly intensified in recent years. Importers who properly manage Lacey Act compliance typically avoid the 5-15% of shipments that face enforcement actions and the substantial penalties that accompany violations.

What Products Fall Under Lacey Act Jurisdiction?

The Lacey Act's scope extends to an incredibly broad range of plant and wood products, with specific requirements that many importers find surprising.

Which Wood Products Require Lacey Act Declarations?

All products containing wood fall under Lacey Act jurisdiction, regardless of processing level. This includes raw lumber, plywood, veneers, furniture, flooring, tools, musical instruments, and any manufactured items containing wood components.

Paper and paperboard products have specific declaration requirements. While some exceptions exist for common paper products, most printing paper, packaging, and paper-based products require Lacey Act declarations.

Composite wood products and materials containing plant fibers are regulated. Particle board, MDF, bamboo products, rattan, willow, and other plant-based materials all fall under the Act's requirements.

Are There Any Exemptions or Exclusions?

Common food products and live plants have specific exemptions. Most agricultural commodities intended for food consumption are exempt, though certain exotic foods and plants may still require declarations.

Products made entirely from recycled materials may qualify for exemptions. However, the burden of proof rests with the importer to demonstrate the recycled nature of all components.

Products where plant material is incidental may be excluded. Items where plant material constitutes a minimal component (under a specific percentage threshold) may be exempt, though definitions remain strict.

What Are the Specific Declaration Requirements?

The Lacey Act declaration requires specific information that many suppliers struggle to provide, creating compliance challenges for importers.

What Information Must Be Included in the Declaration?

Genus and species names must use scientific nomenclature. Common names alone are insufficient—the declaration requires the Latin botanical name for each wood species in the product.

Country of harvest means where the tree was originally cut, not where processing occurred. This distinction often confuses importers who assume manufacturing country determines declaration requirements.

Quantity and unit of measure must be accurately reported. The declaration requires the volume of wood in standard units (cubic meters, kilograms, etc.) for each species present in the shipment.

How Should Complex Products With Multiple Components Be Declared?

Composite products require declaration of all constituent wood species. A piece of furniture containing oak, maple, and plywood would need each species declared separately with their respective quantities.

Layered products like plywood must declare all component layers. While the face veneer might be one species, core layers and back veneers of different species all require individual declaration.

Products with minor wood components still need full declaration. Even small wood elements like drawer pulls, trim, or packaging materials containing wood fall under declaration requirements.

How Can You Ensure Supply Chain Compliance?

Managing Lacey Act compliance requires proactive supply chain management and thorough documentation practices.

What Supplier Management Practices Ensure Compliance?

Supplier agreements must include specific Lacey Act compliance requirements. Contracts should mandate that suppliers provide accurate species identification, harvest documentation, and chain of custody records.

Supplier audits and verification processes validate compliance claims. Regular audits of suppliers' sourcing practices and documentation systems help ensure the accuracy of their declarations.

Supplier education and training prevent unintentional violations. Many violations occur because suppliers don't understand US requirements, making education a crucial compliance investment.

What Documentation Should You Collect and Maintain?

Species verification documentation provides scientific basis for declarations. Laboratory analysis, expert verification, or certified forester reports help substantiate species claims.

Chain of custody records trace wood from harvest to export. Documentation showing each transfer of ownership and location helps verify country of harvest claims.

Harvest permits and legal cutting verification demonstrate legal sourcing. Documentation showing wood was legally harvested according to source country laws satisfies Lacey Act requirements.

What Are the Consequences of Non-Compliance?

Lacey Act violations carry severe penalties that extend beyond financial impacts to include operational disruptions and reputational damage.

What Financial Penalties Apply to Violations?

Civil penalties can reach $10,000 per violation, with each false declaration constituting a separate violation. For shipments containing multiple wood species or products, penalties can quickly reach six or seven figures.

Criminal penalties include fines up to $500,000 and imprisonment up to five years for knowingly importing illegally sourced wood. Willful violations or repeated offenses trigger significantly heightened penalties.

Asset forfeiture allows the government to seize illegal shipments and any equipment used in violations. This includes not only the prohibited wood products but also vehicles, machinery, and facilities used in illegal activities.

What Operational Impacts Result from Violations?

Shipment seizures and delays disrupt supply chains. Customs can detain shipments indefinitely while investigating potential Lacey Act violations, creating stockouts and production disruptions.

Import privilege suspensions can prohibit future imports. Repeat violators may lose their ability to import any goods into the United States, effectively ending their international business.

Reputational damage affects customer relationships and market position. Publicized Lacey Act violations can trigger customer defections, activist campaigns, and retail partner terminations.

How Can You Implement Effective Compliance Programs?

Systematic compliance approaches transform Lacey Act requirements from burdensome regulations to competitive advantages.

What Elements Should a Compliance Program Include?

Risk assessment identifies high-risk products and suppliers. Evaluating wood species, source countries, and supplier capabilities helps focus compliance resources where risks are highest.

Due diligence procedures standardize supplier verification. Systematic processes for verifying species, harvest legality, and documentation accuracy prevent oversights and inconsistencies.

Internal controls ensure consistent declaration accuracy. Separation of duties, management review, and audit trails prevent errors and detect potential issues early.

How Can Technology Support Compliance Efforts?

Product information management systems centralize declaration data. Systems that maintain species information, supplier documentation, and declaration history streamline the compliance process.

Supply chain visibility tools track wood from source to import. Technology that provides transparency into the supply chain helps verify country of harvest and chain of custody claims.

Automated declaration systems reduce manual errors. Integration between compliance systems and customs filing platforms ensures accurate, consistent declaration submission.

What Are Common Lacey Act Compliance Mistakes?

Understanding frequent errors helps importers avoid preventable violations and compliance problems.

What Declaration Errors Occur Most Frequently?

Species misidentification causes the majority of declaration errors. Suppliers often misidentify wood species or use inconsistent naming conventions, creating inaccurate declarations.

Confusing country of origin with country of harvest creates violations. Many importers mistakenly declare the manufacturing country rather than where the tree was originally harvested.

Inadequate declaration for complex or composite products leads to incomplete filings. Importers often declare only the primary wood species while missing secondary species in composite materials.

What Supply Chain Management Errors Cause Problems?

Over-reliance on supplier claims without verification creates compliance risk. Assuming suppliers understand and comply with Lacey Act requirements without independent verification guarantees eventual violations.

Inadequate documentation retention hampers audit defense. Failure to maintain supporting documentation for declarations makes responding to enforcement inquiries impossible.

Poor communication of requirements to offshore suppliers causes misunderstandings. Assuming suppliers understand complex US regulatory requirements without clear communication and training leads to unintentional violations.

Conclusion

The Lacey Act applies to virtually all imported wood products, with requirements that demand careful attention and systematic compliance management. The most successful importers treat Lacey Act compliance not as a regulatory burden but as an integral component of their sustainable sourcing and risk management strategies. By implementing robust compliance programs, maintaining thorough documentation, and proactively managing supplier relationships, companies can navigate Lacey Act requirements while building more transparent, responsible supply chains.

At GeeseCargo, we've helped clients reduce Lacey Act compliance issues by over 90% through systematic approaches that combine supplier management, documentation controls, and technology solutions. The key is recognizing that Lacey Act compliance requires ongoing attention rather than one-time fixes, with continuous improvement as regulations evolve and enforcement intensifies.

Begin your Lacey Act compliance journey by conducting a comprehensive assessment of your imported products, then develop graduated compliance approaches that match the sophistication of your program to your risk profile. Remember that in Lacey Act compliance, prevention is dramatically more cost-effective than correction—the investment in proper compliance systems typically returns many times over in avoided penalties and operational disruptions.