Importers are often surprised when customs duties cost more than the product itself. The truth is, many overpay because of incorrect classification or missing documents — not because the rules are unfair.

Freight forwarders can help reduce customs tariffs by guiding proper HS code classification, preparing compliant documents, and applying duty-reduction strategies based on trade agreements.

At GeeseCargo, we’ve helped U.S. and EU buyers save thousands on import duties — not by bending the rules, but by understanding them better than their suppliers. Here’s how it works.

How freight forwarders assist with tariff classification

Customs duties are based on your product’s classification — defined by a six-to-ten-digit HS code. One wrong number, and you could pay 5–10% more in taxes.

Freight forwarders help identify the correct HS code, ensure alignment with customs databases, and reduce the risk of overpayment due to misclassification.

What is tariff classification?

Every product has a Harmonized System (HS) code used to:

- Identify the type of good

- Apply the correct duty rate

- Flag goods for special regulation (FDA, CE, etc.)

For example:

| Product | HS Code | U.S. Duty Rate |

|---|---|---|

| Cotton T-shirt | 6109.10.00 | 16.5% |

| Plastic Hair Clip | 9615.11.10 | 2.7% |

| LED Light Fixture | 9405.40.80 | 3.9% |

| Laptop Computer | 8471.30.01 | 0% (duty-free) |

Choosing the wrong code — or letting your supplier guess — often results in higher rates or rejected entries.

How do freight forwarders get it right?

We at GeeseCargo use:

- Product samples and photos

- Material composition details

- Official customs databases

- Historical clearance records

- Consultation with licensed brokers

By understanding your product, we apply the lowest legally correct duty rate — backed by documentation.

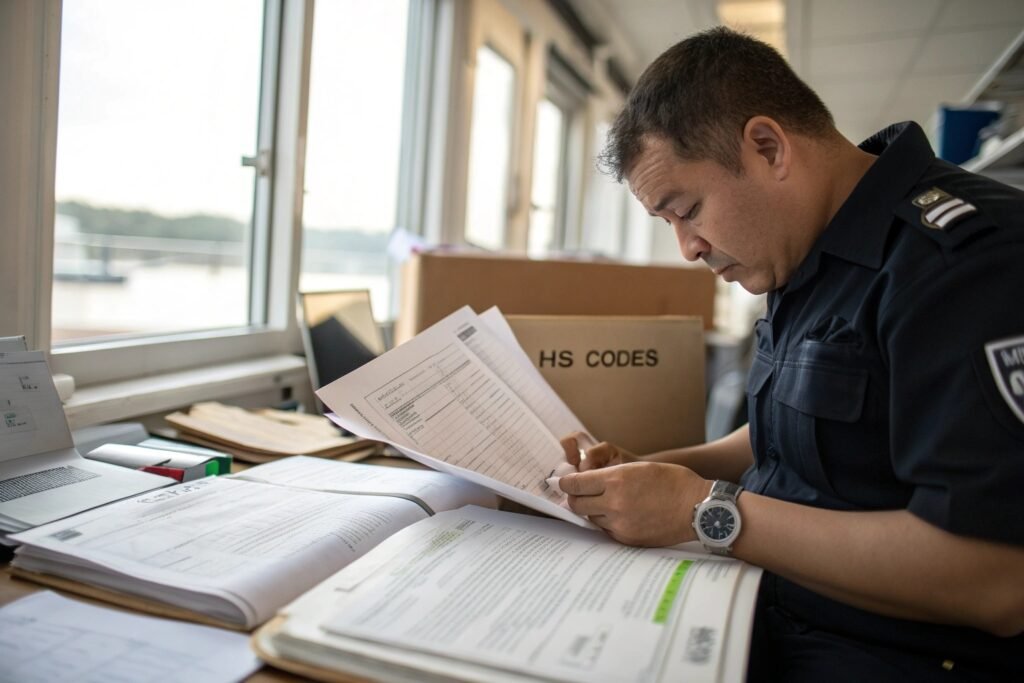

Tips to minimize import duties through proper documentation

Your documents tell customs what’s in the box, how much it’s worth, and what rules apply. The more accurate they are, the less you risk paying extra.

Correct, clear, and complete documentation helps customs apply the correct duty, avoid reclassification, and prevent added fines or delays.

What documents matter most?

| Document | Purpose |

|---|---|

| Commercial Invoice | Declares product value and origin |

| Packing List | Confirms product packaging and quantity |

| Bill of Lading | Confirms carrier and shipment route |

| Certificate of Origin | Qualifies for duty reductions (e.g., EU trade agreements) |

| Compliance Certificate | Required for electronics, chemicals, etc. |

| HS Code Declaration | Tells customs which tariff to apply |

If your commercial invoice says “gift items” and your HS code says “apparel,” your shipment will get flagged. That means inspection, delay, and possibly higher duties.

What are the top document tips to save on duty?

- Match HS code to actual product specs

- Include product material and usage in invoice description

- Declare correct country of origin

- Use precise, non-generic product names

- Ask your forwarder to review your draft invoice and packing list

We offer all our clients a document template pack with best practices, so customs entries are accurate from the start.

Can HS codes impact your customs charges?

Yes — more than anything else. Customs decisions start and end with the HS code. It determines the duty rate, the inspection risk, and whether your product is restricted.

The HS code determines your customs tariff. Selecting the correct — and most favorable — code can legally reduce your import taxes by 5% or more.

How does the wrong HS code cost you?

Example:

- Your product: Woven cotton tote bag

- Supplier HS code: 4202.92.90 (12% duty)

- Correct code with origin proof: 4202.92.20 (Free under GSP)

We’ve saved clients thousands by verifying these codes and applying special tariff programs.

| Product | Supplier HS Code | Our Recommended HS Code | Duty Savings |

|---|---|---|---|

| Polyester Scarf | 6214.30 (12%) | 6214.40 (5%) | 7% |

| Children’s Hat | 6505.00.90 (20%) | 6505.00.05 (Free, under 9801 return clause) | 20% |

| LED Light Strip | 9405.40.80 (10%) | 8543.70.99 (2%) | 8% |

Can HS codes be negotiated with customs?

Yes — but only with proof. That’s where a forwarder’s classification report helps. We prepare:

- Product specs

- Comparison codes

- Supportive rulings from U.S. CBP or EU TARIC databases

This lets customs understand your product and apply the fairest rate.

Role of freight forwarders in duty-saving strategies

Freight forwarders are not just transport coordinators — they’re your partner in duty management. When used right, they help you protect your margin from the moment your PO is placed.

Freight forwarders reduce tariffs by advising on classification, optimizing packaging, using trade agreements, and flagging duty reduction opportunities.

What strategies do we use at GeeseCargo?

| Strategy | Result |

|---|---|

| Use of correct HS codes | Lower applied duties |

| Pre-clearance consultation | Faster customs release |

| Apply GSP / MFN / bilateral FTAs | Up to 100% duty exemption |

| Packaging optimization | Reduces dutiable weight or volume |

| DDP shipping structure | Ensures accurate declaration by our team |

| Product bundling advice | Changes classification to favorable duty rate |

For example, we advised one apparel importer to ship knit and woven items separately — which placed them under lower-taxed categories. The savings over a year? More than $35,000.

When should you involve a forwarder in duty planning?

The best time is before booking the shipment. If you wait until cargo arrives, it’s too late to change documents, codes, or duty status.

That’s why we offer duty consultation during the quoting phase — not after the shipment has sailed. Our goal is to help you build a cost-effective import plan from day one.

Conclusion

Freight forwarders don’t just move boxes — they help you move smarter. By managing classification, preparing documents, and using strategic exemptions, they help reduce customs tariffs and protect your business profits.