In July 2025, global ocean freight rates on major trade lanes—especially from Asia to the U.S. and Europe—have dropped more than 60% compared to early 2024. For importers, this might sound like good news. But for shipping lines, falling rates threaten profitability.

To prevent further rate collapse, carriers are resorting to blank sailings and implementing General Rate Increases (GRI). These tactics reduce capacity and attempt to artificially prop up rates.

If you're importing clothing or accessories from China like many of our clients, you might be wondering: How do these strategies affect your shipping costs and delivery timelines? Let’s explore.

What Are Blank Sailings and Why Do They Matter?

Blank sailings happen when a scheduled vessel departure is canceled. The ship doesn’t call at certain ports or skips an entire voyage.

Carriers use blank sailings to reduce available capacity and create artificial demand, aiming to boost freight rates. For shippers, this means potential delays and re-bookings—especially on high-volume lanes like Asia–U.S. West Coast.

How Do Carriers Decide Which Sailings to Cancel?

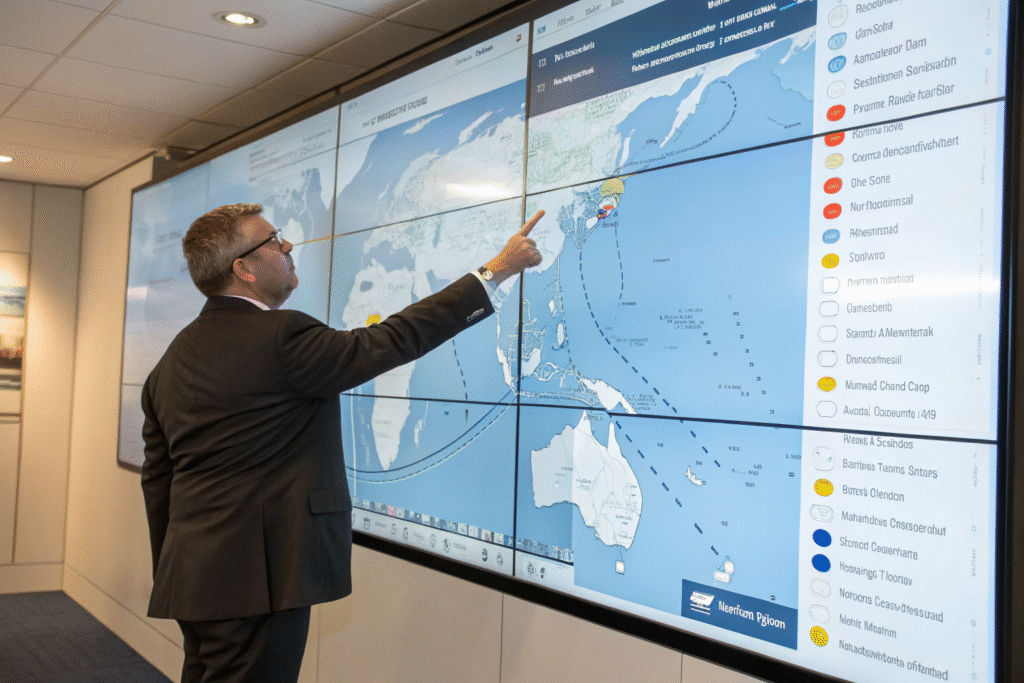

Carriers analyze vessel load factors and forecast demand weekly. If too many slots go unsold, they may pull that sailing and consolidate bookings onto fewer ships. This creates a “capacity squeeze.”

Companies like Sea-Intelligence track blank sailing data across alliances like 2M, Ocean Alliance, and THE Alliance. July reports show over 30 blank sailings from Asia to North America alone.

These cancellations reduce options for shippers and often lead to higher spot rates just before and after blank sailing windows.

What Should Importers Do When Facing Blank Sailings?

Shippers need to:

- Plan bookings at least 2–3 weeks ahead

- Avoid relying solely on single-carrier routes

- Ask forwarders for alternative port pairings (e.g., Qingdao–LA vs. Ningbo–Oakland)

- Maintain flexibility in lead times

We at GeeseCargo provide clients with weekly sailing updates and alternatives when blank sailings are issued. Tools like Xeneta also help benchmark rates during volatile periods.

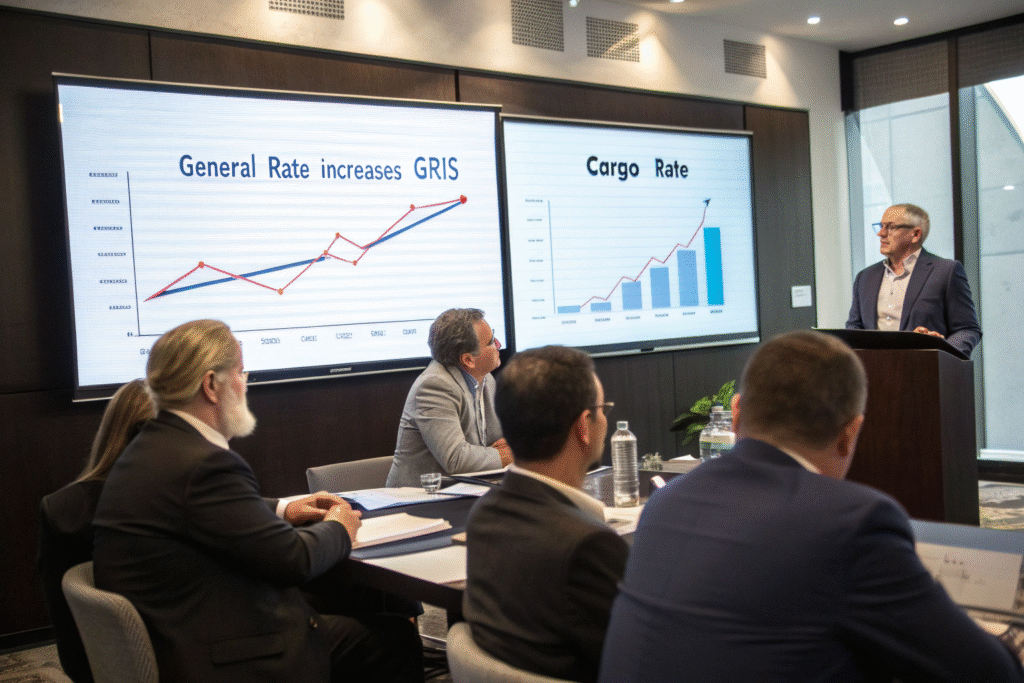

What Is a General Rate Increase (GRI) and How Is It Used?

A GRI is a rate hike imposed by carriers—usually monthly—to increase base freight charges on a specific route. It’s a pricing tool designed to lift falling rates during soft demand periods.

In July, many carriers announced GRIs of $500–$1000 per FEU from China to both U.S. East and West Coasts. The goal: raise average rate levels before the traditional peak season kicks in.

Why Are GRIs Implemented Even When Demand Is Soft?

It seems contradictory, but GRIs are often enforced to counteract continuous rate erosion. When space is plentiful and demand is soft, shippers push for discounts. GRIs help carriers regain leverage.

Major players like Maersk and CMA CGM issued GRIs in July targeting transpacific and Asia–Europe lanes. These rate adjustments usually last 15–30 days unless reinforced by additional GRIs.

We track GRI announcements across carrier alliances to notify clients early. This allows them to book before rate hikes take effect.

How Effective Are GRIs in Raising Freight Rates?

GRIs are often only partially successful. In highly competitive markets, many carriers offer rebates or short-term contracts that neutralize GRIs quickly.

However, when combined with blank sailings and tight space management, GRIs can push rates up temporarily. As of mid-July, rates to U.S. West Coast increased 15% week-on-week, according to Drewry’s WCI.

Our advice: always get multiple rate quotes and confirm validity periods. Booking early often shields you from mid-month GRIs.

How Do These Tactics Affect Clothing Importers?

If you’re importing apparel or accessories from China, you’re likely on high-volume routes affected by both blank sailings and GRIs.

These carrier tactics can impact your landed cost, delivery schedule, and inventory turnover—especially if you're running tight timelines. Understanding them helps you plan smarter and avoid surprises.

Will My Shipping Costs Suddenly Spike?

Possibly. During July, we’ve seen rate quotes fluctuate by $300–$600 in a single week, especially on LCL shipments. FCL bookings are more stable, but only if space is secured early.

We work with shippers to lock in space and rates when GRIs are first announced. By using NVOCC contracts and alternate ports, we mitigate exposure to rate surges.

For updated rate averages, we monitor platforms like Freightos Baltic Index.

What Happens If My Cargo Misses a Blank-Sailed Vessel?

Cargo that misses a blank-sailed departure may face:

- 7–14 day delays waiting for the next sailing

- Higher re-booking costs

- Roll-over charges by carriers

We prevent this by:

- Pre-warning clients of planned blank sailings

- Offering backup vessel schedules

- Using priority loading contracts with partner carriers

We also maintain live communication with port terminals and carrier ops teams to track and reroute urgent cargo quickly.

What Strategies Can Forwarders Use to Help Clients?

Blank sailings and GRIs are short-term levers, but forwarders play a long-term role in protecting client supply chains.

We use data, relationships, and experience to keep shipments moving, rates predictable, and clients competitive. Our edge is in proactive planning and daily market monitoring.

How Can Forwarders Like GeeseCargo Offset These Challenges?

We help our clients by:

- Pre-negotiating space with carriers across multiple alliances

- Splitting large shipments across departure windows

- Using alternative ports with lower congestion risk

- Monitoring real-time rates and alerting on GRIs

- Offering DDP terms that lock in full landed costs

We also leverage platforms like Project44 to improve cargo visibility and predict disruptions.

Should Importers Rethink Inventory Planning?

Yes. The July volatility proves that shippers should:

- Build buffer into transit schedules

- Diversify sourcing ports (e.g., Qingdao, Yantian, Xiamen)

- Switch to hybrid models (partial air + ocean for best timing)

- Explore fixed-rate contracts for Q3 and Q4

By working closely with forwarders, importers can use disruption as an advantage—while competitors scramble last minute, you ship on time and budget.

Conclusion

Blank sailings and GRIs are tactics used by carriers to stop freight rates from falling too far. While they help stabilize the shipping market, they introduce volatility for importers.

At GeeseCargo, we help you manage this risk by offering early booking, smart port choices, and cost forecasting. If you're importing from China in July or the peak months ahead, working with a proactive forwarder is your best defense against unexpected cost spikes or delays.

With the right planning and logistics partner, rate hikes and blank sailings won’t disrupt your business—they’ll become manageable variables in your global supply chain.