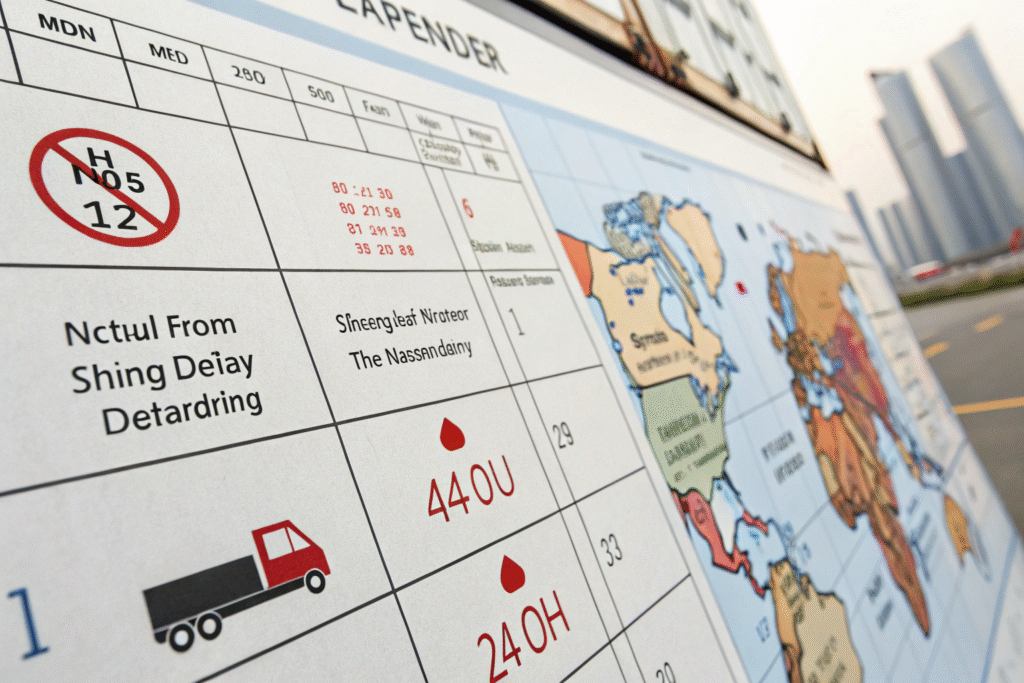

If you’ve been struggling to secure space for your shipments from China in 2025, you’re not alone. While 20FT and standard 40FT containers are still available, delays are mounting due to growing shortages of NOR (Non-Operating Reefer) and 40HC (40-foot High Cube) containers.

Yes, NOR and 40HC container shortages are causing measurable delays in China cargo movements—especially for volume-based shippers relying on high-capacity units. This squeeze is tightening lead times, rates, and route availability.

So how does this affect your apparel, accessories, or gift shipments from China to the U.S. or Europe? Let’s break it down clearly.

What’s Causing the Shortage of NOR and 40HC Containers?

Container shortages aren’t just about demand—they’re about repositioning, equipment imbalance, and global trade disruptions. NOR and 40HC units, which offer more capacity than standard boxes, are particularly affected.

The surge in U.S. imports, vessel blank sailings, and regional depot congestion have reduced the availability of 40HC and NOR units in key Chinese ports like Ningbo, Yantian, and Qingdao.

Why Are NOR Containers in Such Short Supply?

NORs are reefer containers used without power for dry cargo to reposition equipment. When reefer trade is down—like post-pandemic seafood exports from Asia—carriers stop offering NOR slots. According to MSC, NOR capacity has dropped by over 30% on the China-Europe route in 2025.

What’s Behind the 40HC Availability Crunch?

40HC containers are in high demand due to e-commerce and bulk garment shipments. However, they’re heavier and take longer to unload. Port congestion in Los Angeles and Rotterdam is slowing turnaround, so fewer 40HCs return to China in time—creating a snowball effect.

How Do These Shortages Impact China Cargo Timelines?

Lack of 40HC or NOR units means either you wait for equipment—or pay for partial loads in smaller containers. Either way, the clock ticks while your competitors’ goods are already at sea.

Container shortages are adding 7–14 days in lead times, forcing buyers to book earlier or downgrade cargo to standard boxes at higher per-unit costs.

What Does This Mean for Delivery Scheduling?

Missed factory ship-out dates can derail delivery schedules, especially for seasonal goods. If your PO calls for 40HC but only 40FT is available, you may need two containers instead of one—affecting both cost and ETD reliability.

Which Routes Are Affected Most?

China–US West Coast and China–Europe via Suez are bearing the brunt. As reported by The Loadstar, NOR availability is near zero in Qingdao, while 40HC units are being rationed in Shenzhen. Rail options via Chongqing are rising in popularity as a result.

How Can You Secure 40HC or NOR Capacity Efficiently?

Getting the right container type today is less about luck and more about proactive planning and smart partnerships.

Working with a forwarder like GeeseCargo gives you access to early booking windows, depot-level intel, and flexible routing options that make it easier to lock in 40HC or NOR space when others can’t.

What Are Pre-Booking Best Practices?

Book 2–3 weeks ahead of your cargo ready date. If you’re shipping in peak periods, ask your forwarder to “pre-alert” space based on forecasts. Platforms like Container xChange offer real-time container inventory dashboards—use them to decide on alternate ports if needed.

Can You Use Substitutions?

Yes. If 40HC isn’t available, consider loading into 2x 20FTs or mixing with LCL shipments. For NORs, confirm with your forwarder if standard dry reefers can be used in dry mode, though capacity is limited. GeeseCargo helps clients model these trade-offs for each shipment.

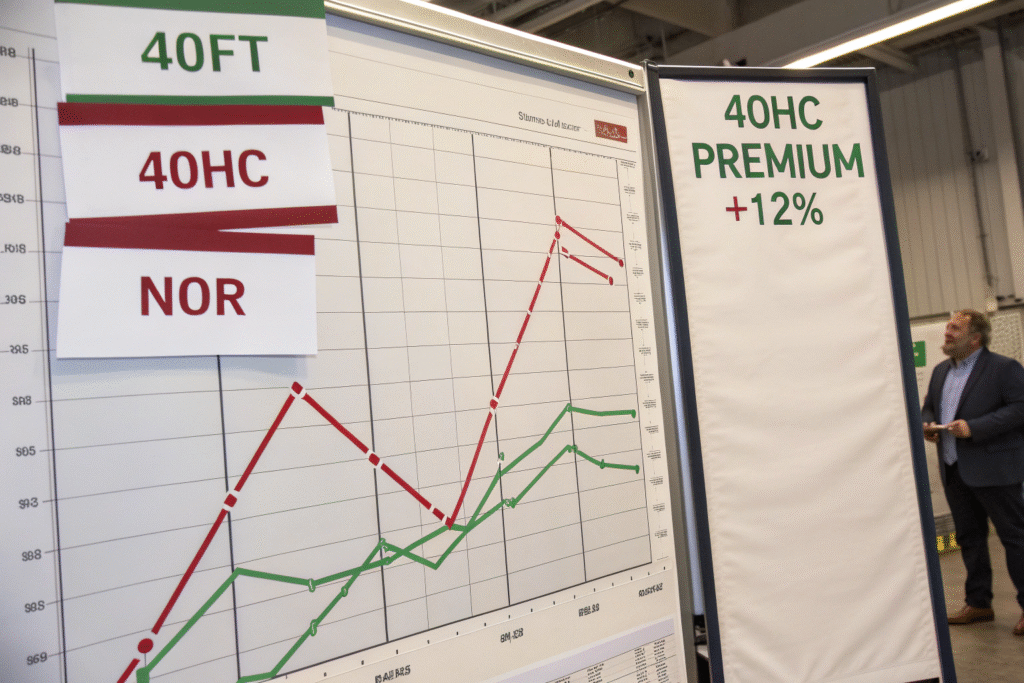

What Are the Cost Implications of Container Shortages?

Shortages don’t just affect time—they hit your wallet too. Premiums for 40HC containers can add hundreds of dollars to each shipment, while NOR deals are disappearing fast.

In July 2025, 40HC premiums on China–US routes average $400–$600 per container, while NOR discounts are rare and conditional. These fluctuations must be factored into landed cost calculations.

How Much More Are You Paying?

| Container Type | Avg. Rate (Per FEU) | Premium Over Standard |

|---|---|---|

| 40FT Standard | $2,100 | 0% |

| 40HC | $2,550 | +21% |

| NOR | $2,300 (if available) | +10% |

You may also face equipment imbalance surcharges if your carrier needs to reposition containers at your origin or destination.

What Can You Do to Control Costs?

Use flexible Incoterms like FOB or DDP with a reliable partner. GeeseCargo consolidates volume across clients to get better container allotments. We also help you avoid last-minute rollovers and manage customs windows to prevent storage fees.

Conclusion

As global demand flows shift and equipment imbalances rise, NOR and 40HC container shortages are delaying shipments, increasing costs, and frustrating even experienced importers. You can’t fix global repositioning—but you can prepare for it.

At GeeseCargo, we monitor container availability across all major Chinese ports, secure bookings early, and offer real-time rerouting options so your cargo doesn’t sit idle. Whether you ship garments, accessories, or mixed retail goods, we help you move smarter—not just bigger.

If container availability is hurting your bottom line, now is the time to act. Let’s plan your shipments proactively, and stay ahead of every disruption.