The question of increasing US customs duties on Chinese goods weighs heavily on importers who rely on China-based manufacturing. With ongoing trade tensions and evolving political dynamics, businesses face significant uncertainty about future cost structures. Many companies are struggling to determine whether they should accelerate shipments, diversify sourcing, or absorb potential cost increases.

Based on current trade policy directions and legislative proposals, US customs duties on certain Chinese goods are likely to increase in 2024-2025, particularly for strategic sectors like electronics, green energy components, and industrial materials. However, the extent and timing of these increases remain uncertain and will likely vary significantly by product category.

Let's examine the factors influencing potential duty increases and how businesses can prepare for different scenarios while protecting their supply chains and profit margins.

What factors are driving potential duty increases?

Multiple political, economic, and strategic considerations are converging to create pressure for higher tariffs on Chinese imports. Understanding these drivers helps businesses assess the likelihood and potential scope of future duty increases.

The primary factors include ongoing national security concerns regarding technology transfer, efforts to reshore strategic manufacturing capabilities, political pressure to address trade imbalances, and environmental considerations affecting green technology sectors. Additionally, the upcoming US election cycle creates pressure for demonstrative trade actions. These factors combine to make further tariff increases politically likely, though the specific implementation timing and product targeting remain uncertain.

How do political timelines affect tariff decisions?

Election cycles significantly influence trade policy timing:

- Pre-election periods often feature demonstrative trade actions

- Administration transitions can delay or accelerate implemented changes

- Congressional review processes create implementation timelines

- International negotiation schedules affect unilateral action timing

- Economic data releases influence policy implementation urgency

Businesses should pay particular attention to political calendars when assessing the likelihood and timing of potential duty changes.

What strategic sectors face the highest increase risks?

Certain industries face greater vulnerability to duty increases:

- Semiconductors and electronics for national security reasons

- Electric vehicle components for industrial policy considerations

- Solar energy products addressing domestic manufacturing concerns

- Critical minerals for supply chain security

- Advanced manufacturing equipment supporting technological competition

Companies in these sectors should prepare for potentially significant duty increases regardless of broader trade negotiations.

How can businesses prepare for potential duty increases?

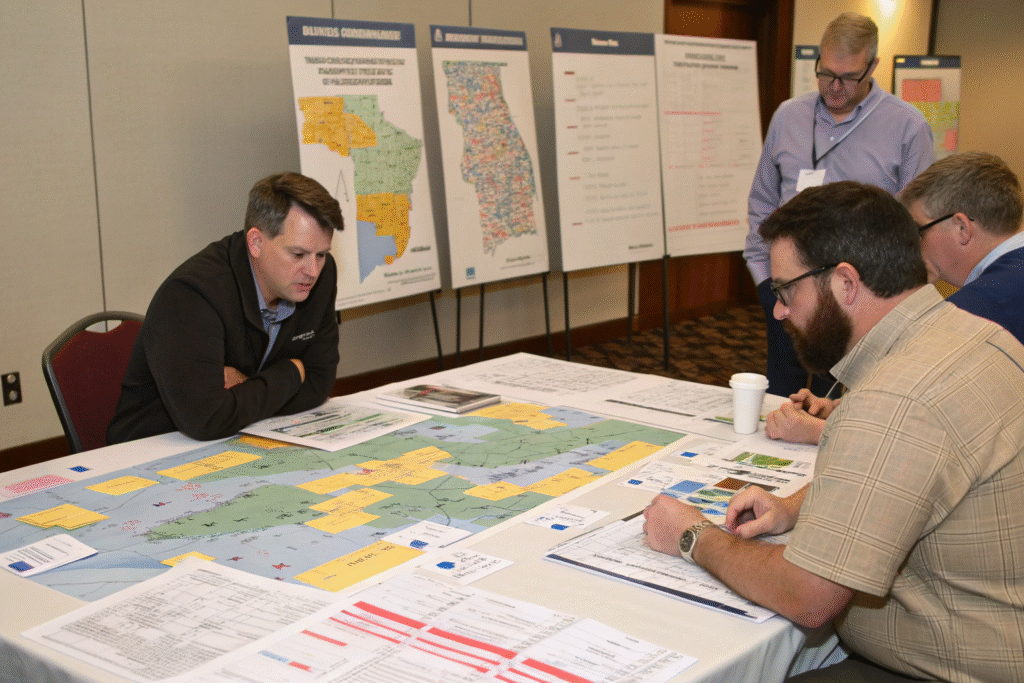

Proactive preparation can significantly mitigate the impact of potential duty increases. Businesses that wait for official announcements often face crowded shipping lanes, limited alternative sourcing options, and rushed operational changes that increase costs and risks.

Effective preparation strategies include supply chain mapping to identify China dependencies, developing alternative sourcing options, exploring tariff engineering opportunities, evaluating foreign trade zone usage, and building financial models that account for different duty increase scenarios. The most successful businesses implement flexible strategies that can adapt to various potential outcomes rather than betting on a single scenario.

What supply chain adaptations provide protection?

Several supply chain strategies can reduce tariff vulnerability:

- Multi-country manufacturing spreads risk across locations

- Nearshoring options in Mexico or Central America reduce exposure

- Inventory strategy adjustments balance carrying costs against duty savings

- Product design modifications enabling alternative sourcing

- Supplier relationship diversification beyond single sources

Businesses implementing these strategies typically withstand duty changes with minimal disruption.

How can tariff engineering legally reduce exposure?

Legitimate tariff engineering approaches include:

- Component-level importation rather than finished goods

- Product modification changing HS code classification

- Assembly operations in third countries or foreign trade zones

- First sale rule applications for multi-tiered transactions

- Preferential program optimization using available trade agreements

These approaches require careful legal analysis but can significantly reduce duty liabilities when properly implemented.

What monitoring systems provide early warning?

Early detection of potential duty changes provides crucial time for adaptation. Businesses that establish systematic monitoring processes typically gain several weeks or months of preparation advantage over competitors who rely on general news sources.

Effective monitoring includes tracking legislative developments, regulatory announcements, policy statements from key officials, industry association alerts, and customs brokerage advisories. The most comprehensive approaches combine automated news monitoring with human analysis of political developments and trade policy expertise. This multi-layered monitoring provides both broad awareness and nuanced interpretation of potential changes.

What official channels provide reliable information?

Key information sources include:

- USTR publications and Federal Register notices

- CBP guidance and customs directives

- Congressional committee proceedings and reports

- International Trade Commission investigations and findings

- Commerce Department trade administration updates

These official sources provide authoritative information before changes become widely publicized.

How can industry networks enhance monitoring?

Professional networks offer valuable intelligence:

- Trade association alerts from sector-specific organizations

- Customs broker advisories with practical implementation guidance

- Legal firm updates analyzing regulatory developments

- Logistics provider insights from operational experience

- Peer company information sharing within industry groups

These networks often provide context and interpretation beyond raw regulatory announcements.

What financial planning adjustments are necessary?

Duty increases directly impact cost structures and require corresponding financial planning adjustments. Businesses that proactively update their financial models typically manage the transition more smoothly than those reacting to implemented changes.

Essential financial planning adaptations include revised product costing models, updated pricing strategies, cash flow planning for duty payment timing, inventory valuation adjustments, and financial contingency planning for implementation periods. Companies should develop multiple financial scenarios reflecting different potential duty increase levels and implementation timelines to ensure preparedness across various outcomes.

How should pricing strategies evolve?

Effective pricing adaptations include:

- Phased price increases managing customer relationships carefully

- Product mix optimization emphasizing less-affected items

- Value engineering maintaining margins through cost reduction

- Channel-specific pricing reflecting different competitive pressures

- Contractual terms review addressing cost pass-through provisions

Businesses that communicate changes transparently typically achieve better customer retention during price adjustments.

What cash flow impacts should businesses anticipate?

Duty increases affect cash flow through:

- Higher working capital requirements for duty payments

- Potential inventory buildup ahead of implementation

- Supply chain transition costs during diversification

- Price adjustment timing gaps between cost increases and revenue

- Consulting and legal expenses for adaptation planning

Advanced cash flow planning prevents liquidity challenges during transition periods.

Conclusion

While significant US customs duty increases on Chinese goods appear likely in the coming years, the exact timing, product scope, and percentage increases remain uncertain. Businesses that take proactive steps to monitor developments, diversify sourcing, optimize customs strategies, and adapt financial planning will be best positioned to manage whatever changes emerge. The most successful companies will treat potential duty increases as an opportunity to build more resilient, diversified supply chains rather than merely as a cost management challenge. By implementing comprehensive preparation strategies now, businesses can protect their competitive position regardless of how US-China trade policies evolve.