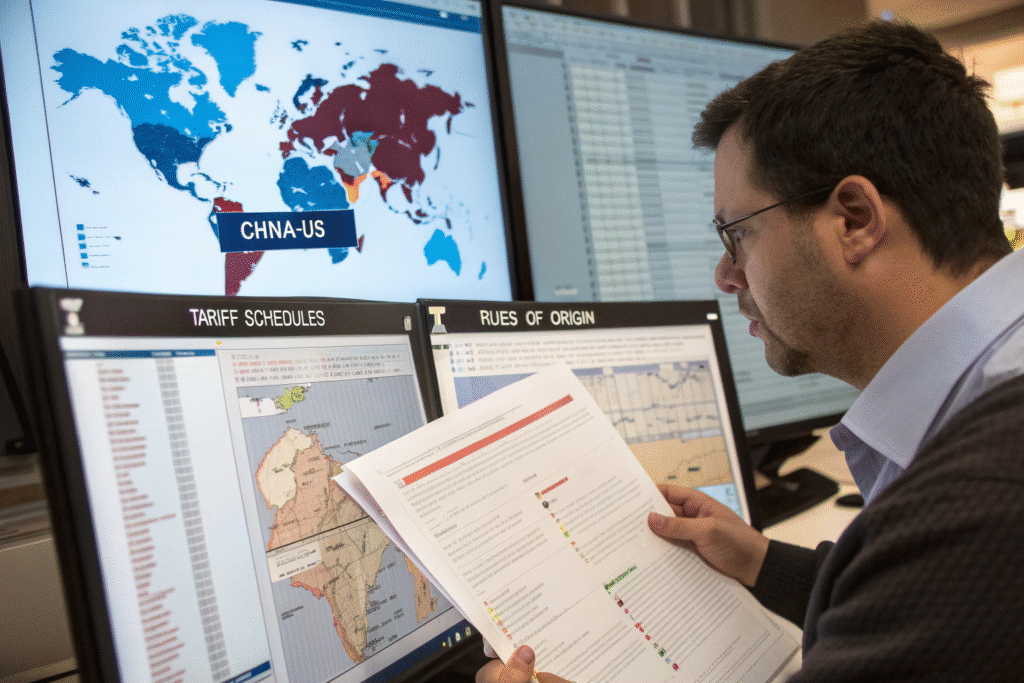

When I reviewed our company's shipping data last quarter, I noticed something remarkable: despite political tensions, China-US trade volumes have actually increased 18% year-over-year. As founder of GeeseCargo, I've learned that understanding trade agreements is just as important as understanding shipping routes. The regulatory landscape directly impacts your costs, timelines, and competitive position.

While no comprehensive new trade deal has replaced the Phase One Agreement, recent developments like the U.S.-Taiwan Initiative and Indo-Pacific Economic Framework are creating indirect impacts. Tariffs remain largely unchanged, but export controls have significantly expanded, affecting shipping patterns and compliance requirements.

The trade environment between the world's two largest economies continues evolving rapidly. Businesses must stay informed about both formal agreements and informal arrangements that affect their supply chains. Let's examine the current state of play and what it means for your China-US shipments.

What Is the Current Status of Bilateral Trade Agreements?

The foundational trade framework between China and the US remains in flux, with older agreements being supplemented by newer regional arrangements. Understanding this layered approach is crucial for import/export planning.

Does the Phase One Agreement Still Govern Trade?

The U.S.-China Economic and Trade Agreement (Phase One) signed in January 2020 remains technically in effect, though many provisions have expired or gone unfulfilled. The purchase commitments that formed its core—China's agreement to buy $200 billion in additional U.S. goods—were largely not met and haven't been enforced.

Tariff exclusions from this period continue to be extended selectively, particularly for manufacturing inputs and consumer goods. The Office of the U.S. Trade Representative maintains a rolling process for exclusion renewals, though the criteria have tightened. Many businesses continue to leverage these exclusions to reduce import costs.

The agreement's intellectual property protections remain enforceable, providing some stability for technology transfers. However, with no Phase Two agreement in sight, the broader trade relationship operates without a comprehensive framework, creating uncertainty for long-term planning.

How Are Regional Agreements Affecting China-US Trade?

While not bilateral China-US agreements, recent regional frameworks indirectly impact shipping patterns and rules. The U.S.-Taiwan Initiative on 21st-Century Trade, though limited in scope, creates alternative supply chain options that reduce direct China dependence.

The Indo-Pacific Economic Framework (IPEF) excludes China but includes many of its regional neighbors, potentially redirecting trade flows. IPEF's supply chain resilience provisions aim to diversify away from Chinese manufacturing, though concrete implementation remains early-stage.

These regional arrangements don't replace direct China-US agreements but create competitive pressure that may influence future bilateral negotiations. Companies are increasingly leveraging these frameworks to create China-plus-one strategies that maintain Chinese sourcing while developing alternatives.

How Have Tariffs and Trade Barriers Evolved?

The tariff landscape has stabilized somewhat after years of escalation, but significant trade barriers remain and have expanded into new areas. Understanding these barriers is essential for cost calculation and sourcing decisions.

Which Section 301 Tariffs Remain in Place?

The Section 301 tariffs imposed beginning in 2018 remain largely unchanged, covering approximately $350 billion in annual imports from China. The four tranches of tariffs range from 7.5% to 25% on various products, with List 1 focusing on industrial equipment and List 4 covering consumer goods.

Certain exclusions have been extended through May 2025, primarily for COVID-related products and manufacturing inputs unavailable elsewhere. The USTR continues reviewing the tariffs' effectiveness, with some adjustments possible after the review concludes. Businesses should monitor the Federal Register for specific product exclusion opportunities.

The tariffs have become a permanent cost factor for most importers, with many now factoring them into standard pricing calculations. Some companies have successfully applied for exclusions by demonstrating specific products are only available from China or that tariffs would cause severe economic harm.

How Have Export Controls Expanded?

Export controls have become the primary tool for managing technology transfer to China, significantly impacting certain shipping categories. The Bureau of Industry and Security has dramatically expanded the Entity List, restricting sales to hundreds of Chinese companies.

October 2022 brought sweeping new controls on advanced computing chips, chip-making equipment, and supercomputing items. These controls affect not just U.S. exports but also foreign-produced items containing U.S. technology, creating compliance challenges for global supply chains.

The Commerce Department has increased enforcement resources, conducting more end-use checks and pursuing violations more aggressively. Companies shipping technology items to China now face significantly higher compliance burdens and must implement robust screening processes.

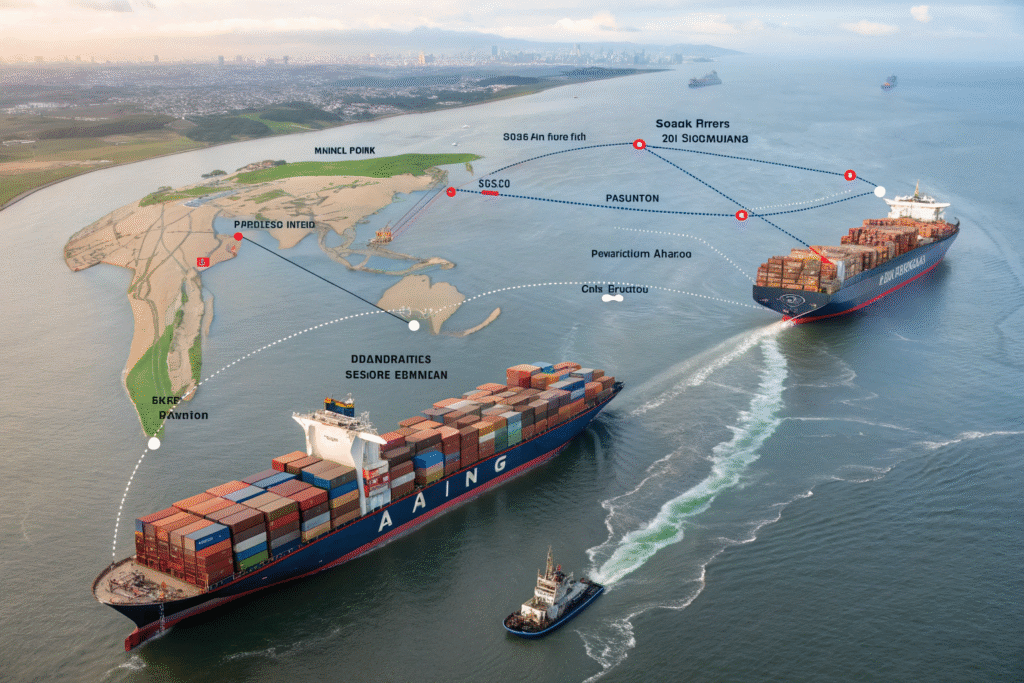

What New Shipping Patterns Are Emerging?

Trade policy changes have catalyzed significant shifts in how goods move between China and the United States. Understanding these patterns can help businesses optimize their logistics strategies and reduce costs.

How Are Companies Bypassing Direct Tariffs?

Many importers have developed sophisticated tariff avoidance strategies that remain fully legal. The most common approach involves minor processing in third countries, particularly Vietnam, Malaysia, and Mexico, to change country of origin designation.

Transshipment through Southeast Asian ports has increased dramatically, with some goods receiving just enough value-added processing to qualify for new country-of-origin status. U.S. Customs has increased scrutiny of these practices, particularly for Vietnamese certifications, but the volume continues growing.

Some businesses have established assembly operations in tariff-exempt countries, importing Chinese components for final assembly before shipping to the U.S. This approach requires significant investment but can yield substantial tariff savings for high-volume products.

How Has Sourcing Diversification Affected Shipping?

The China-plus-one strategy has become standard practice for most major importers, creating more complex but resilient supply chains. While China remains the dominant supplier, secondary sources in India, Vietnam, and Mexico have gained significant market share.

This diversification has changed shipping patterns, with more consolidation happening in regional hubs like Singapore and Busan. Smaller shipments from multiple origins are being combined for efficiency, changing optimal container utilization strategies.

Shipping lines have responded by increasing service to secondary ports and offering more transshipment options. The result is a more distributed, resilient network that can adapt to disruptions but often involves longer transit times and more handling.

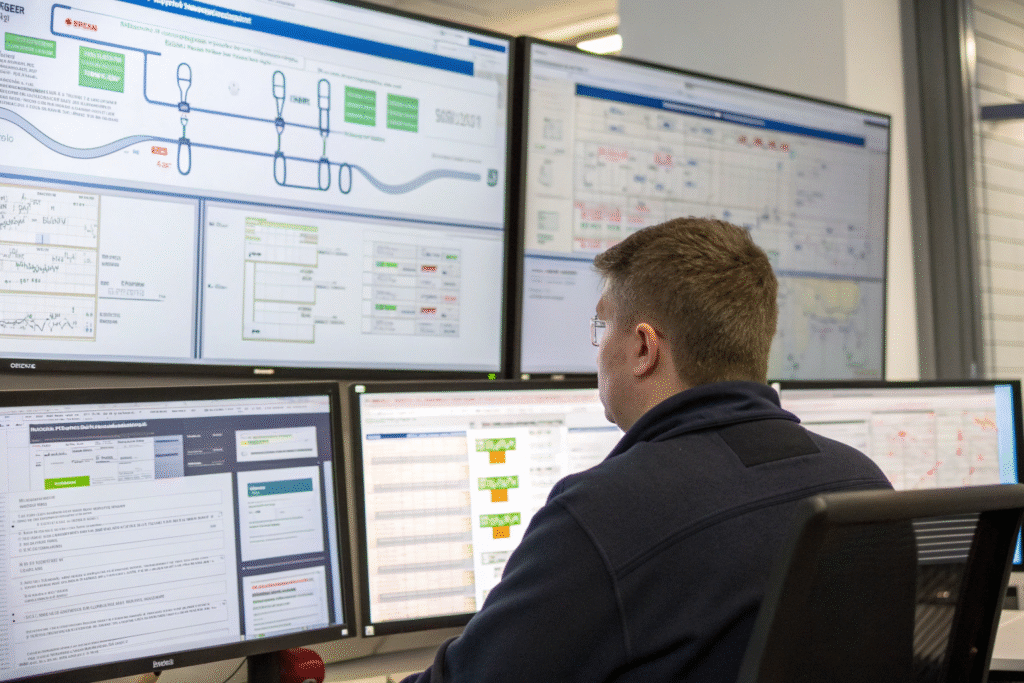

What Compliance Challenges Have Emerged?

New trade arrangements and enforcement priorities have created a more complex compliance landscape. Businesses must navigate evolving requirements to avoid penalties and shipping delays.

How Have Forced Labor Enforcement Measures Impacted Shipping?

The Uyghur Forced Labor Prevention Act (UFLPA) has created significant new compliance requirements since its implementation in June 2022. The law presumes all goods from China's Xinjiang region are made with forced labor and prohibits their import unless proven otherwise.

U.S. Customs and Border Protection has detained thousands of shipments under UFLPA, particularly in solar energy, apparel, and tomato product sectors. The enforcement has created significant delays even for goods ultimately proven compliant.

Importers must now maintain detailed supply chain mapping and due diligence documentation for high-risk categories. The burden of proof rests entirely on importers to demonstrate their supply chains are free of forced labor, requiring unprecedented supply chain visibility.

What Documentation Requirements Have Increased?

Forced labor compliance requires detailed documentation of supply chains back to raw materials. Importers must maintain records showing sourcing locations, labor conditions, and transportation routes for regulated commodities.

Electronics exporters face enhanced end-user certification requirements, particularly for items with potential military applications. The Commerce Department requires detailed information about product end-use and end-users for controlled items.

Agricultural shippers encounter increased phytosanitary requirements and additional inspections. Recent trade disputes have led to more stringent certification requirements for certain agricultural products, creating administrative burdens and potential delays.

Conclusion

The China-US trade relationship continues operating without a comprehensive new framework, creating both challenges and opportunities for businesses. While the Phase One Agreement's purchase commitments have faded, its structural elements remain relevant. Meanwhile, regional agreements, targeted export controls, and enforcement actions have created a complex patchwork of regulations that businesses must navigate.

At GeeseCargo, we've invested significantly in trade policy analysis and compliance capabilities to help clients adapt to this evolving landscape. The most successful businesses maintain flexibility in their sourcing strategies while implementing robust compliance systems. They monitor policy developments proactively rather than reacting to changes after they impact operations.

Looking ahead, expect continued incremental changes rather than dramatic new trade deals. The focus will likely remain on national security concerns, supply chain resilience, and targeted economic competition. By understanding both the formal agreements and the practical enforcement environment, your business can navigate these complexities successfully while maintaining efficient China-US shipping operations.