When one of our clients analyzed their shipping costs and discovered that crew expenses represented 28% of their container shipping expenses, the potential of autonomous shipping became immediately compelling. As founder of GeeseCargo with extensive exposure to maritime innovation, I've witnessed how autonomous vessel technology could transform ocean freight economics. However, the reality is more nuanced than simple cost reduction—it's about fundamentally restructuring maritime operations.

Autonomous ships are projected to reduce freight costs by 15-30% through crew elimination, fuel optimization, and increased operational efficiency, but these savings will materialize gradually over 10-20 years. Initial implementations will focus on specific routes and vessel types, with widespread adoption requiring significant infrastructure investment and regulatory evolution.

The transition to autonomous shipping represents one of the most significant transformations in maritime history, but the timeline and impact vary dramatically across different shipping segments and trade routes. Understanding the phased implementation and mixed impact on different cost components is essential for realistic planning.

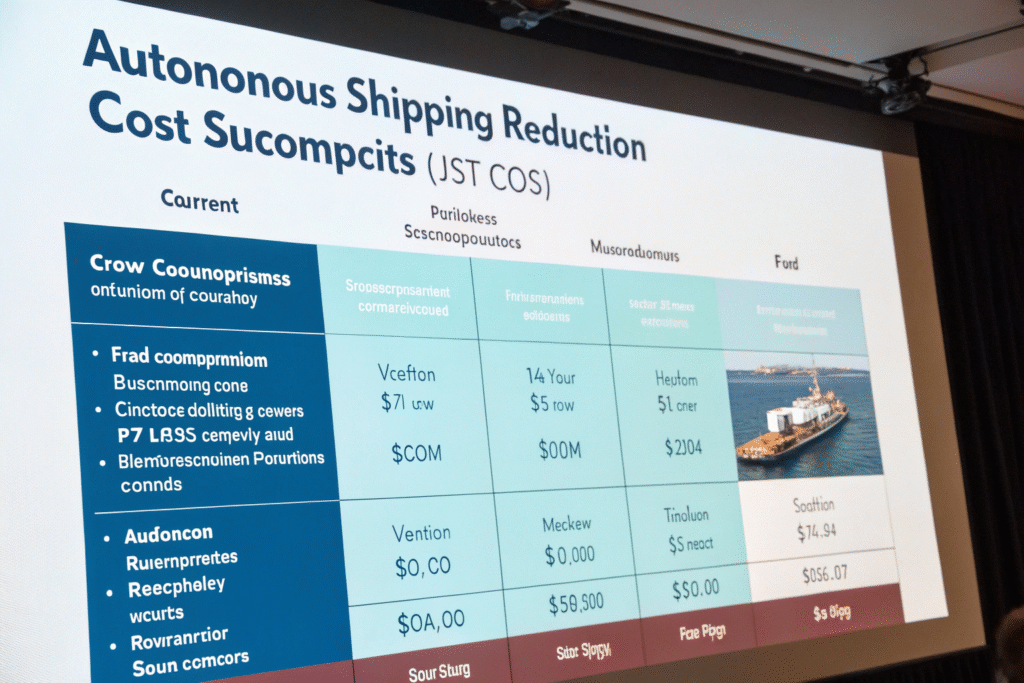

What Cost Components Will Autonomous Shipping Actually Affect?

Autonomous vessels target specific operational cost centers through technological substitution and optimization.

How Significant Are Crew-Related Cost Savings?

Crew costs typically represent 25-35% of vessel operating expenses. These include salaries, benefits, training, accommodations, and provisions for 15-25 crew members on conventional vessels.

Eliminating crew quarters increases cargo capacity by 5-8%. The space dedicated to crew facilities, mess halls, and recreation can be repurposed for additional container slots or more efficient hull designs.

Reduced vessel complexity lowers construction and maintenance costs. Without human habitability requirements, ships can have simpler systems for ventilation, plumbing, and accommodations.

How Does Autonomous Operation Affect Fuel Efficiency?

Optimized routing and speed management reduce fuel consumption by 10-20%. Autonomous systems can continuously adjust routes and speeds based on weather, currents, and schedule requirements without human limitations.

Hull design optimization for unmanned operation improves efficiency. Vessels designed specifically for autonomous operation can have more hydrodynamic designs without bridge visibility requirements.

Consistent operation eliminates human performance variation. Automated systems maintain optimal performance continuously, unlike human crews who may vary in their operational efficiency.

What Is the Realistic Timeline for Autonomous Shipping Adoption?

The transition to autonomous shipping will be gradual, with different vessel types and routes adopting at different paces.

Where Will We See Early Adoption (2024-2030)?

Short-sea shipping and feeder routes will lead adoption. Fixed routes with proximity to shore support, like Baltic and North Sea operations, already have autonomous vessel projects underway.

Specific controlled environments enable early implementation. Mining companies in Australia and Norway are developing autonomous bulk carriers for point-to-point operations in controlled environments.

Crew-reduced operations represent the intermediate step. Many new vessels are being built with "future autonomous" capabilities, operating with reduced crews while maintaining some human oversight.

When Will Transoceanic Autonomous Shipping Become Common (2030-2040)?

Progressive autonomy implementation will phase in capabilities. Vessels will initially automate specific functions (navigation, engine control) before progressing to full autonomy.

Flag state and regulatory approval will determine pace. Countries with advanced maritime industries like Norway, Japan, and Singapore are leading regulatory development, while others will follow gradually.

Retrofitting existing vessels will extend transition timelines. Many current vessels will continue operating with crews through their 25-30 year lifespans, slowing full transition.

How Will Autonomous Shipping Impact Different Cargo Types?

The benefits and adoption timing of autonomous shipping vary significantly across different shipping segments.

Which Cargo Types Will Benefit Most from Autonomous Shipping?

Container shipping presents the strongest economic case. High-value, time-sensitive container operations benefit most from optimized routing and consistent operation.

Bulk carriers operating fixed routes will see early adoption. Point-to-point bulk operations with standardized cargo handling are technically simpler to automate.

Tankers may see delayed adoption due to safety concerns. The high consequences of accidents with hazardous cargo will necessitate more extensive testing and regulatory oversight.

Which Shipping Segments Will See Limited Near-Term Impact?

Specialized vessels with complex cargo operations. Ships requiring sophisticated cargo management like heavy-lift, livestock, or research vessels will maintain human crews longer.

Vessels operating in challenging environments. Ice navigation, complex port approaches, and regions with poor connectivity will require human oversight longer.

Smaller vessels and niche operators. The investment required for autonomous systems may be prohibitive for smaller operators, extending crewed operations in certain segments.

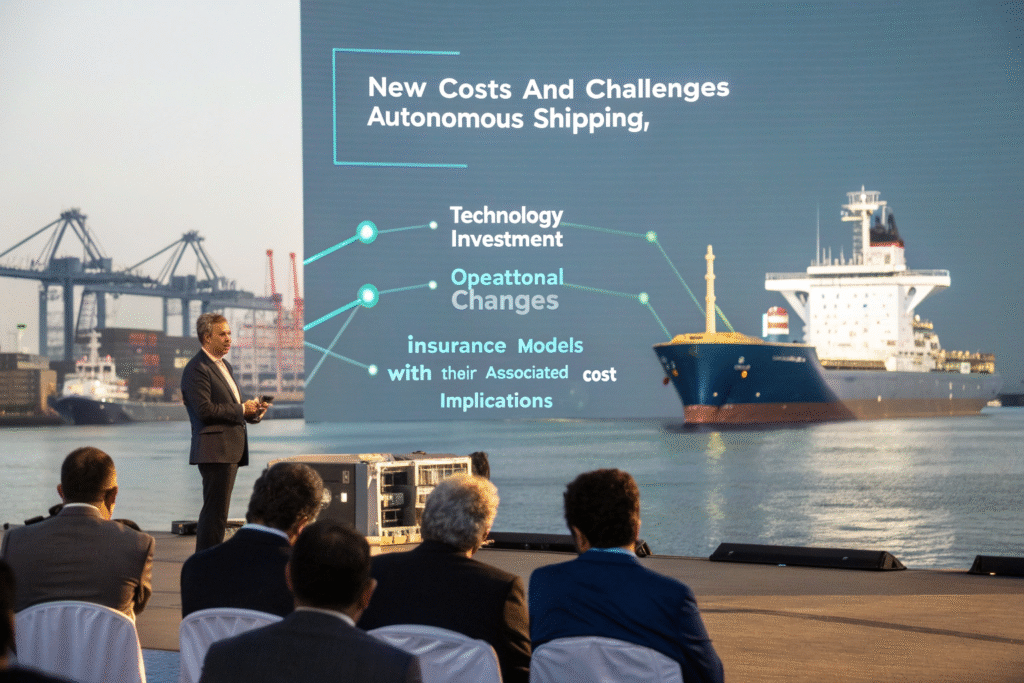

What New Costs and Challenges Will Emerge?

While autonomous shipping reduces certain costs, it introduces new expenses and complexities that partially offset savings.

What Technology Infrastructure Investments Are Required?

Shore control centers represent significant new capital expenditure. These facilities require advanced communications, monitoring systems, and highly trained staff to oversee vessel operations.

Redundant systems and fail-safes increase vessel construction costs. Autonomous vessels require backup systems, redundant communications, and advanced sensors that add to initial costs.

Cybersecurity infrastructure becomes critical and expensive. Protecting autonomous systems from hacking, spoofing, and interference requires continuous investment in security measures.

How Will Insurance and Liability Models Change?

New risk assessment models will initially maintain high premiums. Insurers will likely charge premium rates during early adoption until sufficient operational data demonstrates safety.

Liability shifting creates new contractual complexities. Determining responsibility between vessel owners, technology providers, and operators will require new legal frameworks.

Cyber insurance becomes a necessary additional cost. Protection against digital threats represents a new insurance category that didn't exist for conventional shipping.

How Should Importers Prepare for the Autonomous Transition?

Strategic preparation enables businesses to capitalize on autonomous shipping benefits as they emerge.

What Short-Term Actions Make Sense Now?

Monitor autonomous shipping developments in your key trade lanes. Understanding which routes and carriers are investing in autonomy helps anticipate where benefits will emerge first.

Build relationships with innovation-focused carriers. Shipping companies leading autonomous development will likely offer early access to cost-saving technologies.

Include technology adaptation clauses in long-term contracts. Provisions that allow renegotiation when significant technological changes occur protect against being locked out of future savings.

What Medium-Term Planning Should Businesses Consider?

Evaluate how autonomous shipping might affect your inventory strategies. More reliable transit times and potentially faster voyages could reduce safety stock requirements.

Assess port and infrastructure readiness in your supply chain. Ports that invest in autonomous vessel compatibility may become more competitive, influencing routing decisions.

Develop internal expertise in autonomous logistics. Staff understanding the operational and cost implications of autonomous shipping will be better positioned to capitalize on emerging opportunities.

What Are the Potential Risks and Limitations?

Despite promising benefits, autonomous shipping faces significant challenges that may delay or limit cost reductions.

What Technical and Operational Challenges Persist?

Technology reliability in extreme conditions remains unproven. The ability of autonomous systems to handle severe weather, mechanical failures, and unusual situations requires extensive validation.

Port integration and cargo handling complexities. While vessels can operate autonomously at sea, port operations often require human intervention for mooring, cargo operations, and troubleshooting.

Communications reliability across ocean regions. Maintaining continuous satellite connectivity for remote monitoring and control presents technical and cost challenges.

What Regulatory and Social Hurdles Exist?

International regulatory harmonization will take years. Different countries have varying safety standards, liability frameworks, and operational requirements that must be aligned.

Labor union resistance may delay implementation. Maritime unions strongly oppose crew elimination and may use political influence to slow autonomous adoption.

Public perception and acceptance affect implementation pace. Concerns about safety, environmental protection, and job losses may create resistance in some regions.

Conclusion

Autonomous shipping will gradually reduce freight costs over the coming decades, but the transformation will be evolutionary rather than revolutionary. The most significant savings will materialize in the 2030-2040 timeframe as the technology matures, regulations stabilize, and infrastructure adapts. Businesses that understand the phased nature of this transition can strategically position themselves to capture cost advantages as they emerge.

At GeeseCargo, we're helping clients develop graduated autonomous shipping strategies that match implementation timelines to their specific trade patterns and business models. The key is recognizing that autonomous shipping isn't a binary switch but a spectrum of increasing automation—from decision-support systems today to fully unmanned operations in the distant future.

Begin your autonomous shipping preparation by analyzing which cost components represent your largest freight expenses, then monitor how autonomous technologies specifically target those areas. Remember that in maritime innovation, timing is everything—being prepared to adopt at the right moment provides competitive advantage, while premature commitment creates risk without reward.