Timing your shipments from China can mean the difference between smooth logistics and costly delays. While year-round shipping presents challenges, certain periods consistently create perfect storms of congestion, capacity shortages, and rate spikes that can disrupt even the most carefully planned supply chains.

The absolute worst time to ship from China is during the Chinese New Year period (typically late January to mid-February), followed closely by the pre-holiday peak season (August-November). These periods combine factory closures, labor shortages, and overwhelming demand to create shipping conditions that can double costs and triple transit times compared to off-peak periods.

Let's examine the specific challenges of each difficult shipping period and strategic approaches to navigate these annual supply chain disruptions.

Why is Chinese New Year the most challenging shipping period?

Chinese New Year (CNY) creates a perfect storm of supply chain disruptions that typically lasts 4-6 weeks and impacts shipping for months through ripple effects. The combination of factory closures, mass worker migration, and urgent pre-holiday shipping creates unprecedented logistics challenges.

The core problem begins with factories rushing to complete orders before the holiday, creating a massive shipment surge in the 3-4 weeks before CNY. Then complete manufacturing shutdown occurs for 2-3 weeks during the actual holiday period. When factories reopen, they face labor shortages as workers extend holidays or change jobs, creating production delays that extend shipping backlogs for another 4-6 weeks. This entire cycle typically increases shipping costs by 60-120%, extends transit times by 2-3 weeks, and reduces schedule reliability to 40-60% compared to normal periods.

What specific challenges occur during each CNY phase?

Pre-holiday phase (3-4 weeks before CNY):

- Extreme port congestion as factories rush shipments before closures

- Equipment shortages with containers stranded at factories and ports

- Capacity constraints as vessels fill 2-3 weeks in advance

- Rate spikes with carriers implementing peak season surcharges

- Documentation delays from overwhelmed forwarders and customs

Holiday phase (2-3 weeks during CNY):

- Complete manufacturing cessation across most of China

- Skeleton logistics operations with reduced staffing and services

- Limited communication as key contacts take extended leave

- Frozen operations at Chinese ports and service providers

Post-holiday recovery (4-6 weeks after CNY):

- Labor shortages as workers delay return or change employers

- Production backlogs from accumulated orders during closure

- Extended shipping delays as logistics pipelines refill

- Quality issues from new workers and rushed production

How can you calculate exact Chinese New Year dates?

CNY timing varies annually based on the lunar calendar:

- 2024: February 10 (Year of the Dragon) - worst shipping: January 15 to March 15

- 2025: January 29 (Year of the Snake) - worst shipping: January 6 to March 10

- 2026: February 17 (Year of the Horse) - worst shipping: January 26 to March 20

- 2027: February 6 (Year of the Goat) - worst shipping: January 15 to March 12

The holiday itself lasts one week, but disruptions extend 2-3 weeks before and 4-5 weeks after.

What makes the pre-holiday peak season so difficult?

The August through November period creates the second-worst shipping conditions as global retailers build inventory for holiday sales. This peak season combines high demand with operational constraints to create sustained challenging conditions.

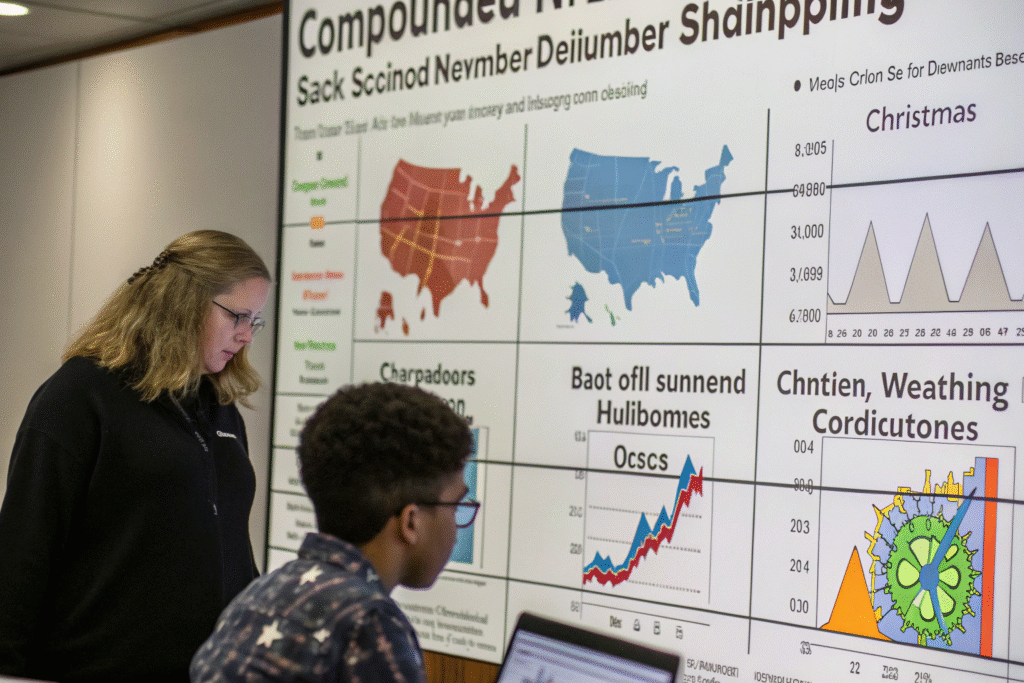

The peak season challenge begins with back-to-school shipments in August, builds through Halloween inventory in September-October, and peaks with Christmas merchandise in October-November. This sustained high demand coincides with potential typhoon season disruptions in Asian waters and the beginning of winter weather impacts on US and European ports. The result is typically 40-80% rate increases, 1-2 week transit time extensions, and equipment shortages that can leave cargo stranded for weeks.

How do different peak season months compare?

Monthly peak season challenges:

- August: Back-to-school peak with initial capacity constraints

- September: Halloween shipments with growing congestion and rates

- October: Christmas inventory peak with maximum capacity pressure

- November: Last-minute holiday shipments with premium service demands

Each month presents distinct challenges requiring specific strategies.

What specific peak season surcharges should you expect?

Common peak season charges:

- Peak Season Surcharge (PSS): $800-1,200 per container

- Port Congestion Surcharge (PCS): $400-800 per container

- Equipment Imbalance Surcharge (EIS): $200-500 per container

- Emergency Revenue Charge (ERC): Varies by carrier and demand

- Priority Loading Surcharge: For guaranteed vessel space

These surcharges can increase total costs by 40-100% during peak periods.

How do weather seasons impact shipping reliability?

Seasonal weather patterns create predictable disruptions that compound during already challenging shipping periods. Understanding these weather impacts helps anticipate additional delays beyond demand-based challenges.

The typhoon season (July-October) affects Southern China ports like Shenzhen, Hong Kong, and Yantian, causing vessel diversions and port closures. The winter storm season (November-March) impacts US West Coast and European ports, creating berthing delays and equipment handling restrictions. The fog season (March-May) affects Northern China ports like Qingdao and Tianjin, causing vessel scheduling disruptions. These weather events typically add 3-10 days to transit times and increase insurance costs during affected periods.

What are the most weather-vulnerable shipping routes?

Weather-sensitive trade lanes:

- China Southern to US West Coast: Typhoon impacts July-October

- China Northern to Europe: Winter North Atlantic storms November-March

- Intra-Asia routes: Frequent tropical weather disruptions year-round

- China to US East Coast via Panama: Hurricane season June-November

- China to Europe via Suez: Sandstorm and political volatility impacts

Route selection during vulnerable periods can minimize weather disruptions.

How can you monitor and anticipate weather disruptions?

Weather monitoring strategies:

- Typhoon tracking services for Western Pacific forecasts

- Port condition reports from carriers and terminal operators

- Vessel schedule adjustments based on weather routing

- Alternative routing plans for severe weather scenarios

- Buffer time incorporation into delivery planning

Proactive weather monitoring prevents surprise disruptions during volatile periods.

What other annually challenging periods should you anticipate?

Beyond the major peak seasons, several other predictable periods create significant shipping challenges through combination of factors like holidays, weather, and market conditions.

Chinese National Week (Golden Week, October 1-7) creates a mini-version of Chinese New Year disruptions with factory closures and port congestion. The beginning of Q1 (January) suffers from post-holiday recovery issues. The end of Q2 (June) experiences mid-year inventory pushes. US West Coast port labor negotiations (typically every 3-5 years) create uncertainty and potential disruptions. Each of these periods typically increases costs by 20-40% and extends transit times by 1-2 weeks.

How does Golden Week compare to Chinese New Year?

Golden Week (October 1-7) impacts:

- Shorter duration: 1-week closure versus 2-3 weeks for CNY

- Less severe: 30-50% cost increases versus 60-120% for CNY

- Faster recovery: 2-3 weeks versus 4-6 weeks for CNY

- Different timing: Autumn versus winter weather impacts

- Reduced labor issues: Workers less likely to change jobs mid-year

While challenging, Golden Week disruptions are more manageable than CNY.

What political and labor factors create uncertainty?

Non-seasonal disruption factors:

- US West Coast labor negotiations (2028 next expected)

- Chinese policy announcements affecting manufacturing regions

- Trade policy changes creating tariff or documentation uncertainty

- Carrier alliance restructuring affecting service patterns

- Environmental regulation implementations changing equipment availability

These factors create unpredictable challenges beyond seasonal patterns.

What strategies work best during worst shipping periods?

Surviving the most challenging shipping periods requires advanced planning, strategic relationships, and operational flexibility. Companies that master these approaches turn difficult periods into competitive advantages.

The most effective strategies include booking space 4-6 weeks in advance during peak periods, developing relationships with multiple carriers for capacity access, using multi-modal options to bypass congestion, implementing inventory buffers to absorb delays, and negotiating all-inclusive contracts to avoid surprise surcharges. These approaches typically require 20-30% additional planning effort but can save 40-60% in peak period costs and prevent stockouts.

How far in advance should you plan for worst periods?

Advanced planning timelines:

- Chinese New Year: Finalize Q1 shipments by early November

- Peak season: Book August-November space by end of June

- Weather disruptions: Monitor forecasts 2-3 weeks in advance

- Labor negotiations: Develop contingencies 6 months before contract expirations

- Policy changes: Maintain flexibility for sudden regulation changes

Advanced planning is the most effective cost control strategy.

What contingency strategies provide the most value?

High-value contingency approaches:

- Air freight options for critical shipments during ocean delays

- Alternative port routing to avoid specific congestion points

- Nearshore inventory buffers for time-sensitive products

- Multi-carrier allocations ensuring space access during constraints

- Premium service relationships for guaranteed treatment

These contingencies typically cost 10-20% more but prevent catastrophic disruptions.

Conclusion

The worst times to ship from China cluster around Chinese New Year (January-February) and the pre-holiday peak season (August-November), with secondary challenges during Golden Week (October) and weather-sensitive periods. These difficult windows typically increase costs by 40-120%, extend transit times by 1-3 weeks, and reduce reliability by 30-50 percentage points compared to optimal shipping periods. The most successful importers treat these challenging periods as predictable events requiring specialized strategies rather than unexpected crises. By understanding the specific challenges of each difficult period, implementing advanced planning, and maintaining operational flexibility, businesses can navigate even the worst shipping times while competitors struggle with disruptions and excess costs.