In international logistics, operational errors translate into higher landed costs, delayed lead times, and potential regulatory penalties. Experienced supply chain managers recognize that many inefficiencies result not from external shocks but from avoidable mistakes in planning, documentation, and compliance.

The most common shipping mistakes include inaccurate documentation, misuse of Incoterms, inadequate export packaging, insufficient cargo insurance, and neglect of customs and regulatory compliance.

From my work with U.S. importers, I have observed that these errors consistently increase demurrage, detention, and indirect costs across the supply chain. Addressing them proactively strengthens resilience and reduces financial exposure.

Why Is Inaccurate Documentation a Critical Risk?

Documentation discrepancies are a leading cause of clearance delays. Misaligned data between the commercial invoice, packing list, and Bill of Lading (B/L) triggers customs holds or penalties.

Key documents include the B/L, commercial invoice, packing list, certificate of origin, and—in specific sectors—compliance certificates such as phytosanitary or textile declarations.

I once handled a shipment delayed 10 days because the invoice HS classification did not match the declaration, resulting in an additional customs audit.

Why Is the Bill of Lading a Compliance Instrument?

The Bill of Lading functions not only as a receipt but also as a document of title. Errors compromise cargo release and financing.

How Do HS/HTS Codes Affect Clearance?

CBP.gov emphasizes that misclassification of HS/HTS codes leads to re-inspection, penalties, and incorrect duty assessments. Using HTS Search mitigates risk.

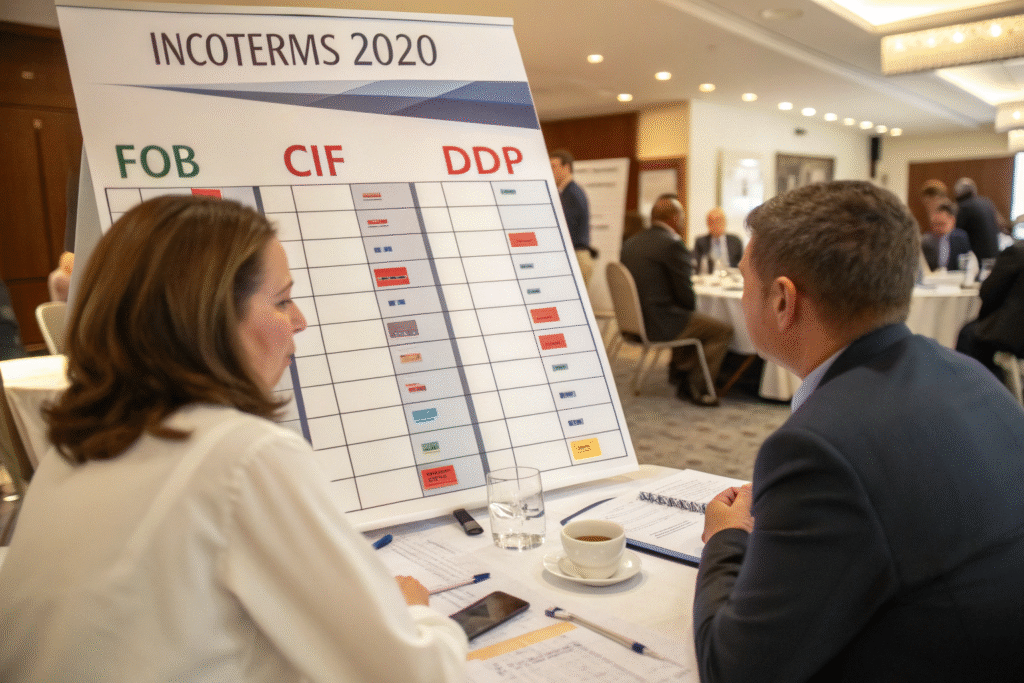

How Does Misuse of Incoterms Create Financial Exposure?

Incoterms 2020 define the division of risk, cost, and responsibility between trading partners. Misapplication results in hidden charges and operational disputes.

Common errors include importers choosing FOB or CIF without considering port handling charges, or failing to negotiate Delivered Duty Paid (DDP) when predictable landed cost is required.

A U.S. apparel buyer selected CIF and underestimated port storage and brokerage fees, which raised his landed cost by 11%.

Why Is DDP Often Preferred?

According to the International Chamber of Commerce, DDP transfers compliance obligations and duty payments to the seller, providing cost transparency.

How Do FOB and CIF Increase Exposure?

As Investopedia notes, under FOB and CIF the buyer assumes clearance and delivery risks, creating unbudgeted terminal handling charges and customs liabilities.

Why Does Inadequate Packaging Lead to Cargo Losses?

Export packaging must withstand extended transit, multiple handling points, and environmental stress. Inadequate packaging results in cargo claims, higher insurance premiums, and reputational damage.

Failure to meet ISO and ASTM packaging standards exposes importers to losses that could have been avoided with compliance-oriented packaging design.

I managed a case where poor carton strength resulted in product breakage during consolidation. The importer not only incurred cargo loss but also additional detention charges while claims were processed.

Why Are Export Packaging Standards Important?

ISO.org provides international guidelines ensuring packaging integrity in global supply chains.

How Do Carriers Address Poor Packaging?

UPS notes that inadequate packaging often voids carrier liability, shifting responsibility back to the shipper.

Why Is Neglecting Cargo Insurance a Strategic Error?

Carriers operate under limited liability, typically governed by Hague-Visby Rules or COGSA, which cap compensation far below cargo value.

Without marine cargo insurance, importers bear the full financial burden in cases of loss, damage, or General Average declaration.

One electronics importer lost $80,000 in damages from seawater exposure during loading, with recovery limited to $500 under carrier liability.

What Is Covered Under Cargo Insurance?

Allianz Trade details coverage against fire, theft, and natural disasters, mitigating high-value losses.

Why Are Carriers’ Liability Limits Insufficient?

Freightos explains that compensation often covers only a fraction of real cargo value, making insurance essential.

Why Is Non-Compliance with Customs Regulations So Costly?

Customs non-compliance—ranging from misclassification to failing FDA/USDA requirements—leads to penalties, re-export orders, or seizure.

Importers must integrate compliance management systems to validate HS codes, duty payments, and regulatory approvals before shipping.

One food importer faced destruction of cargo after failing to comply with FDA labeling requirements.

Why Are HS Codes Central to Compliance?

HTS Search shows that classification accuracy impacts duty assessment and admissibility. Misuse leads to audit exposure.

Which Agencies Require Additional Approvals?

USDA and FDA enforce strict entry controls for agricultural and food products. Ignoring these rules results in cargo rejection.

Conclusion

Common importer mistakes—incorrect documentation, misuse of Incoterms, inadequate packaging, lack of marine insurance, and regulatory non-compliance—undermine supply chain efficiency and financial performance. For professionals managing international logistics, avoiding these errors through structured compliance protocols, forwarder partnerships, and robust risk management is essential to achieving predictable landed costs and operational resilience.