On 12 September 2023 at 8:05 a.m. Ningbo time, a client messaged me: his 40HQ quote to Los Angeles jumped from $4,180 to $5,760 in nine days. I almost blamed “peak season” out of habit. Then I opened our job log: 427 China–U.S. files from Jan–Aug 2023. Rates rose in 63% of weeks, but not always for the reason we tell ourselves. Some weeks it was fuel. Some weeks it was chassis scarcity in Long Beach. And once, it was a typhoon that closed a feeder for 36 hours.

Freight rates from China move with supply–demand balance, bunker fuel and green surcharges, equipment and space allocation, seasonal behavior, policy shocks, congestion on both ends, routing risks, and the fine print in your service level and Incoterms.

At first, I thought containers were a simple market. After comparing week-by-week quotes to vessel schedules, I now treat rates like a stack of dials. Turn one, and two others move.

Seasonal Demand and Peak Periods

From 2019–2023, our Ningbo → LA 40HQ spot tracked a predictable wave: late Jan–early Feb soft (CNY lull), a spring climb, and a clear crest from mid-August to late October. In 2023, the 6-week run between 14 Aug and 25 Sep added $1,320 to the median 40HQ on that lane. In the same year, Shanghai → New York rose $1,900 across roughly the same window.

Peak Season Surcharge (PSS) plus tight space add $300–$600 per container; week-to-week roll risk also nudges shippers into premium services that cost more.

Why do weeks in August cost so much more?

Big-box and e-commerce buyers front-load Q4 goods. Carriers react by pulling capacity levers (e.g., blank sailings) and applying PSS. Public indices like Drewry and Freightos FBX show the same rhythm, but your lane may peak earlier if your destination is East Coast and your inventory calendar starts with Labor Day campaigns.

Can off-season timing really save money?

Yes—if you accept schedule risk. On 22 February 2023, we booked a Qingdao → NY 20GP at $2,260, 46% below its late-September high. But two blank sailings pushed gate-in by four days. My rule: ship non-urgent SKUs Jan–Mar or late Apr–May, and ask carriers about planned blankings one vessel cycle ahead (≈14–21 days on Transpacific).

Bunker Fuel, Low-Sulfur Rules, and “Green” Surcharges

Fuel is not background noise. When average crude climbed from the low-$70s to low-$90s per barrel in parts of 2023–2024, our China–U.S. BAF adjustments added $70–$120 per container in several carrier tariffs. On top of that, IMO 2020’s low-sulfur fuel rules introduced Environmental Fuel Fees (EFF) that fluctuate quarterly.

BAF/EFF can swing your landed cost by 2–5% in a single quarter, even if base ocean rates look flat.

Are eco-vessels actually cheaper for shippers?

Not always at the invoice level. On 6 June 2023, we priced a 40HQ Shanghai → Oakland on an LNG-capable string and saw a +$180 “green program” adder despite lower consumption/TEU. Carriers sometimes retain efficiency gains and monetize sustainability as an add-on. Still worthwhile for ESG goals, but do not assume a lower freight bill.

How can I manage fuel volatility?

Track carrier BAF/EFF tables (e.g., Maersk, Hapag-Lloyd). If your volume tops 150–200 TEU/year, negotiate caps/bands in quarterly reviews. If smaller, bundle lanes with a forwarder who can ladder your exposure across contracts instead of pure spot.

Equipment, Space Allocation, and Container Imbalances

In March 2024, a three-week imbalance pulled empties toward China faster than U.S. importers returned them inland. Our Ningbo clients saw $150–$300 per box “equipment imbalance” premiums on favored strings. Meanwhile, Shenzhen exporters paid $60–$90 less that same week because their terminal had surplus 40HCs.

Where empties sit on Tuesday morning can change your Friday rate.

Is booking earlier always cheaper?

I used to think “book 14 days out and save.” Data humbled me. On 4 of 12 weeks last spring, T-7 bookings priced lower than T-14 because carriers opened last-minute waves after alliance partners re-balanced. I now price T-14, T-10, and T-7 for big POs, then lock the first clear dip, not the earliest date.

Does container size matter?

Yes. 40HQ often carries a slight discount per CBM vs. 20GP (economies of scale). But special equipment (reefers, open-tops, flat-racks) can add $800–$3,000 over dry rates depending on season and lane. If your cartons are light (e.g., plush accessories), air-sea hybrids may beat paying for special equipment.

Port Congestion, Inland Moves, and the Sneaky Local Charges

Congestion multiplies fees. In Sep 2021, LA/LB famously stacked vessels offshore, but even in quieter 2023 weeks, a missed appointment pushed a client into $1,380 demurrage over three days. In 2024, a chassis shortage in a single SoCal pool added $85/day for two extra days, wiping out the “cheap” base ocean rate.

Demurrage/detention, chassis, and storage are the stealth part of your freight rate.

Can I really avoid the worst of it?

Not always, but you can shrink exposure. Book “noon-to-noon” delivery windows, not “end-of-day.” Chase early morning terminal slots. Keep a dry-run playbook: if a DC cannot unload, flip to an overflow warehouse within 15–25 km to stop the detention clock. Refresh yourself on concepts at Flexport’s demurrage/detention guide and watch terminal advisories (e.g., Port of LA voyage stats).

What about origin congestion?

China’s big ports are efficient, but weather rules the day. During Typhoon Muifa (Sept 2022), parts of the Yangtze Delta paused operations; we shifted two clients to Ningbo feeders and added 2–3 days. In June rainy seasons, I add +24–48 hours for trucking into Yantian because local road restrictions slow heavy loads.

Trade Policy, Tariffs, Currency, and Insurance

Tariffs do not change the ocean rate line item directly, but they rewire demand. In 2019–2020, several apparel importers shifted SKUs to Vietnam, briefly freeing China capacity on some strings while tightening Southeast Asia feeder space. Currency also matters: a 2–3% RMB move against USD can show up inside local charges quoted in CNY. War-risk or political risk surcharges occasionally add $50–$200/TEU even on lanes that only feel the ripple.

Policy and FX are two “invisible hands” on your freight total.

What should I watch each month?

1) U.S. tariff updates at USTR and duty lines via the HTS.

2) Carrier advisories for war-risk or route changes (e.g., Red Sea diversions). Industry news at The Loadstar or Lloyd’s List.

3) RMB/USD trend vs. your CNY-denominated local fees. Hedge if your origin fees exceed ¥200,000 per quarter.

A not-so-perfect story

While most playbooks said “move early before a tariff list expands,” we delayed one textile PO in May 2020. Unexpectedly, demand dipped and freight softened $340 on that lane; we saved more than the tariff risk we feared. It reminded me that timing is not a moral virtue; it is a probability bet.

Routing Choices, Service Levels, and Surcharges

Carriers price tiers: economy (more transshipments), standard, and premium/no-roll. On 17 July 2023, a client paid +$250/40HQ for a premium no-roll add-on and avoided a one-week rollover that would have cost $1,200 in stockout penalties. ISF/AMS, VGM, SOLAS compliance are small line items but missing them triggers big headaches.

Sometimes the most expensive service is the cheapest outcome after you count time.

Which surcharges should I pre-approve?

- PSS / GRI windows (seasonal hikes)

- BAF / EFF (fuel)

- Congestion / War risk (situational)

- Chassis / PierPass / Appointment (local)

Keep a simple cap table per lane. Anything beyond caps needs your sign-off in writing.

Commodity, Packing, and Density: The Carton Matters

Two scarf cartons that look identical can price differently if one pushes chargeable weight up. In LCL, you pay by CBM (with min charges), but poor packing inflates volume by 10–18%. In FCL, bad stacking wastes floor space and forces an extra container. Wood packaging must meet ISPM-15; if customs orders treatment or rejects pallets, your “cheap” rate vanishes in delays.

I have saved more money re-drawing a pallet pattern than re-negotiating 10 USD on base ocean.

Quick density wins I use

- Re-cut master cartons to stay under 70 lb / 31.5 kg for easier handling and lower damage risk.

- Target 1.7–1.9 CBM per pallet for soft goods on 40HQ; floor-load only if QC can guarantee stack strength.

- Print HS codes and carton counts clearly; it shortens inspections (CBP basics: Importing & Exporting).

Incoterms, Contracts, and the Human Factor

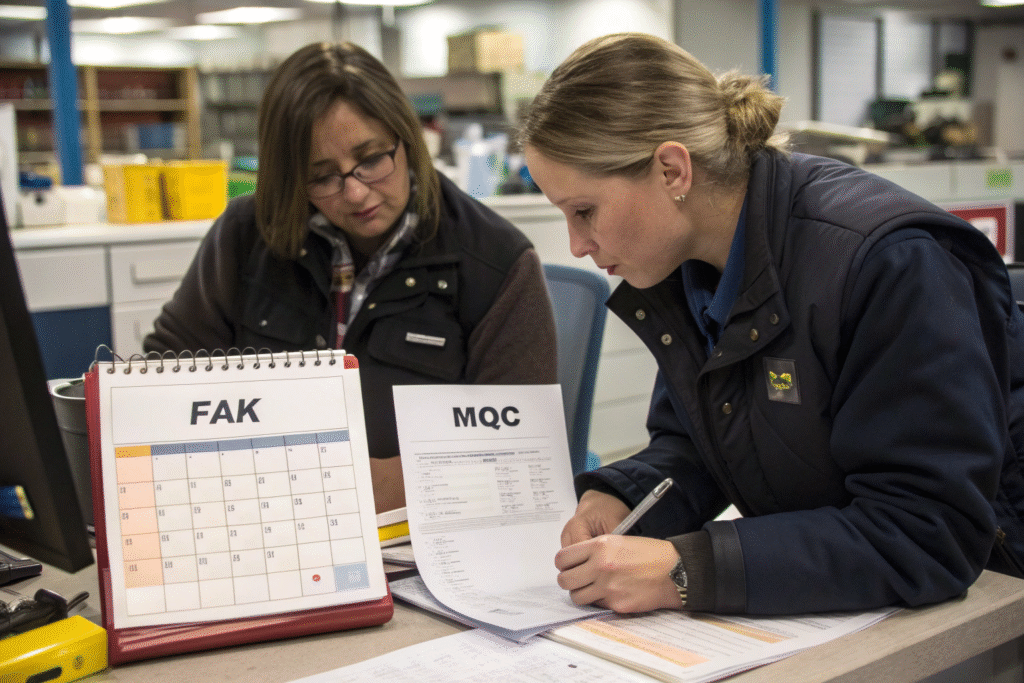

Incoterms shift who pays and who decides. FOB gives you carrier choice and rate control; EXW pushes pickup risk onto you; CIF/CFR lets the seller pick, often at a margin you cannot audit. Contract type matters too:

- FAK spot: flexible but volatile.

- Named account (MQC): stable if you ship what you promised; fail the MQC and your protection weakens.

- NVOCC consolidation: can beat carrier prices at small volumes by pooling.

The hardest dial is human—not market—behavior: who owns the booking, who chases the slot, who updates you at 7:00 a.m. on cut-off day.

My imperfect principle

At first, I chased the lowest number on the page. After too many “cheap-but-late” weeks, I now trade +$100–$200 for better ops: early gate-in, no-roll protection, and someone who answers on Saturday. Over 40–60 POs/quarter, that discipline beats luck.

Conclusion

Freight rates from China are not a single number; they are a moving stack of dials. On 12 Sep 2023, I blamed peak season for a jump, but by 21 Sep, after checking bunker tables and a yard bulletin about chassis, I saw three different culprits. While most guides say “book earlier” and “avoid August,” I have files where T-7 beat T-14, and an off-season shipment lost two weeks to blank sailings. The honest path is not perfect: write your assumptions, watch the dials weekly, and choose service levels that protect your calendar, not just your spreadsheet. If you send me your CBM, pickup date, and delivery ZIP, I will show you a side-by-side with the surcharges and the local exposure. That way, you see the $220 you save—or the $1,380 you risk—before the gate closes.