Import duties on Indian-origin goods entering the US can be steep, especially when trade policies change quickly. For importers managing multi-origin supply chains, paying full tariffs on every separate shipment can drain margins fast. One increasingly popular strategy is to consolidate goods from various countries — including India — at Chinese ports before shipping to the US.

By using China as a consolidation hub, you can optimize container space, streamline customs paperwork, and in some cases reduce your average duty rate. While this approach must comply with rules of origin and US customs law, when managed correctly, it can offer significant savings and smoother logistics.

In this article, I’ll break down how Chinese port consolidation works, the compliance factors you need to watch, and how GeeseCargo has helped clients turn this into a competitive advantage.

Why Consider Consolidating at Chinese Ports?

Consolidating shipments at a major Chinese port means gathering goods from multiple origins — like India, Vietnam, and domestic Chinese suppliers — into a single container or air cargo load.

This reduces per-unit freight costs, shortens handling time at US ports, and can create opportunities for tariff optimization if part of the shipment qualifies for lower duty rates.

How Does Consolidation Improve Freight Efficiency?

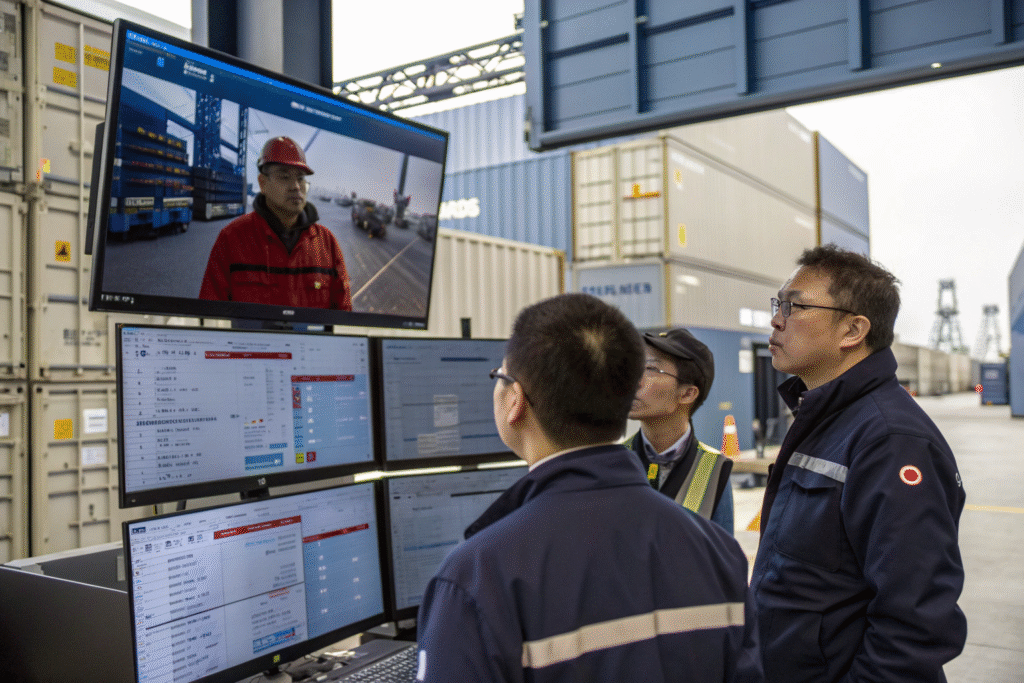

By combining loads, you increase container utilization from 60–70% to near 100%, reducing the cost per cubic meter. Ports like Shanghai and Ningbo-Zhoushan have advanced facilities to handle these multi-origin consolidations quickly.

Can Consolidation Lower Tariff Costs?

If your shipment includes items with different HS codes and duty rates, consolidating them can lower the overall weighted average duty. However, goods from India will still be subject to US-India tariffs unless they undergo substantial transformation in China, as defined by US Customs.

Compliance Rules You Must Follow to Avoid Penalties

Tariff savings from consolidation are only legitimate if the rules of origin are respected. Failing to comply can lead to reclassification, fines, or seizure of goods.

At GeeseCargo, we verify all origin documentation and ensure that goods are declared accurately to US Customs, even when consolidated.

What Counts as “Substantial Transformation”?

According to US Customs, goods must be materially changed in a way that alters their name, character, or use to qualify as originating in a new country. Simple repackaging in China is not enough. More details can be found in the CBP Informed Compliance Publication.

How to Handle Multi-Origin Paperwork?

Each product’s HS code, value, and origin must be declared separately, even within the same container. We prepare detailed packing lists and commercial invoices to prevent clearance delays.

The Role of Chinese Free Trade Zones in Consolidation

Free Trade Zones (FTZs) in China offer duty suspension, efficient re-export services, and secure storage for multi-origin shipments.

Using an FTZ allows you to hold goods duty-free while you complete consolidation, documentation, or even light assembly work before export.

Which Ports Offer the Best FTZ Services?

Shanghai Waigaoqiao FTZ and Shenzhen Qianhai FTZ are among the most popular for US-bound consolidations, offering quick processing and strong logistics connections.

How Does an FTZ Affect US Tariff Calculation?

While FTZ use in China doesn’t automatically change origin, it can help manage shipment timing to avoid rate increases and combine goods more efficiently for transport.

How GeeseCargo Manages Cost-Effective and Compliant Consolidations

We’ve developed a step-by-step consolidation process designed to maximize cost efficiency without crossing compliance lines:

- Supplier Coordination – Aligning production schedules across countries.

- Inbound Transport – Moving goods to Chinese ports or FTZs.

- Verification – Checking all origin and product details for customs accuracy.

- Consolidation – Loading goods strategically to protect high-value items.

- Export Filing – Completing all China export and US import paperwork in advance.

What Cost Savings Can You Expect?

Our clients typically save 10–18% on total freight costs through container optimization alone, with additional savings possible from smarter tariff management.

How to Start Using China as Your Consolidation Hub?

Begin by evaluating your current supplier network. If you already source from China and India, you may be able to integrate consolidation with minimal disruption. We offer free consultations to assess feasibility.

Conclusion

Consolidating India-origin shipments through Chinese ports can offer real savings in freight efficiency and potentially lower tariff exposure — provided you respect all customs regulations. With the right partner, this strategy can protect your margins and simplify logistics.

At GeeseCargo, we have the infrastructure, compliance expertise, and carrier relationships to make multi-origin consolidation seamless. To discuss how we can optimize your shipments, contact Ben Zhu at benzhu@geesecargo.com today.