From August 1 or 7, 2025, the United States is imposing new reciprocal tariffs on a wide list of trading partners. For freight forwarders, this means an urgent need to adjust compliance procedures, shipping strategies, and duty simulations to avoid costly missteps.

If you're managing imports from the EU, Japan, Korea, India, or other affected nations, this article will walk you through exactly what to prepare, with actionable solutions to maintain seamless operations.

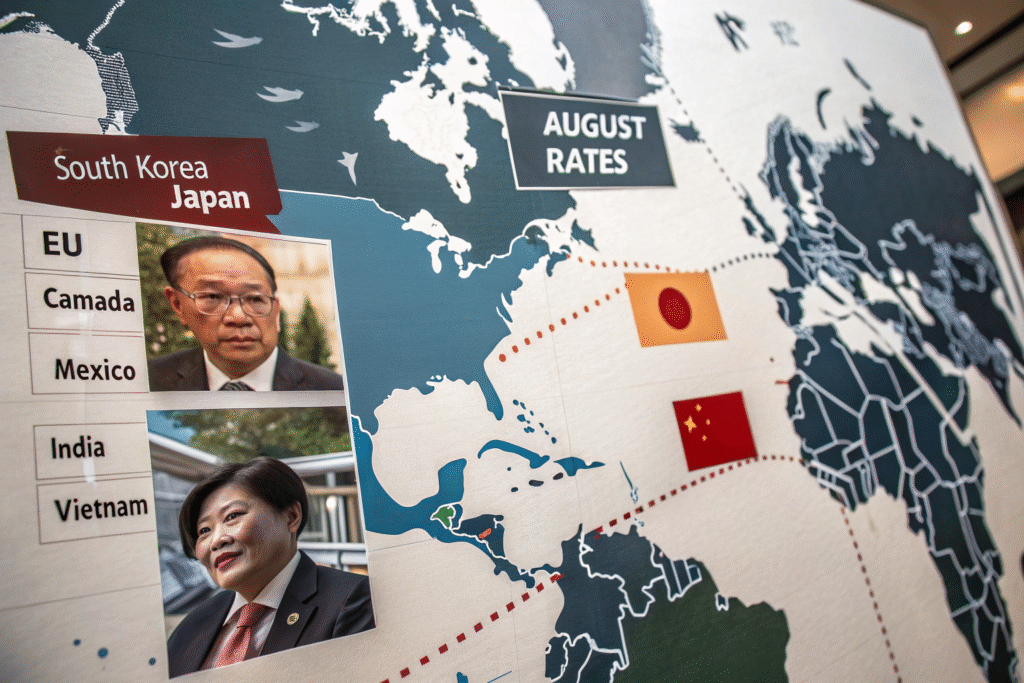

Which Countries Face August 2025 Tariff Hikes?

The new tariff policy targets over a dozen countries. Below is a summary of the updated rates:

| Country | Effective Date | New Tariff Rate |

|---|---|---|

| Japan | Aug 1, 2025 | 25% |

| South Korea | Aug 1, 2025 | 25% |

| EU Countries | Aug 1, 2025 | 30% |

| Mexico | Aug 1, 2025 | 30% |

| India | Aug 7, 2025 | 25% |

| Vietnam | Aug 1, 2025 | 20% |

| Indonesia | Aug 1, 2025 | 19% |

| Philippines | Aug 1, 2025 | 19% |

| Others | Aug 1, 2025 | 10% base rate |

🚨 China is excluded until August 12, under a temporary pause.

💡 Rates are tied to reciprocal trade behavior and U.S. import reliance metrics.

How Do These Tariffs Affect Freight Forwarders?

Key Responsibilities That Shift:

- Update HS Classification Tools to reflect country-specific rates

- Recalculate landed costs for clients with affected suppliers

- Modify routing and shipping schedules to avoid post-deadline penalties

- Ensure Certificate of Origin (COO) documents are valid and complete

- Avoid de minimis reliance—especially for China (ending August 29)

📦 Missed compliance updates = delayed clearance, higher duties, and damaged customer trust.

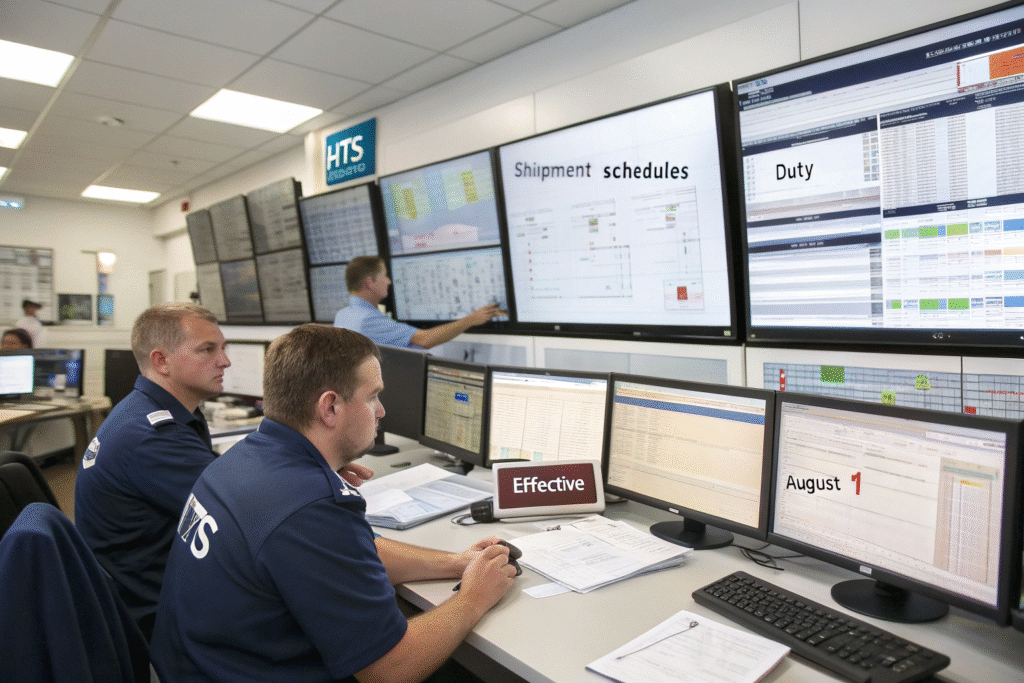

Practical Compliance Tips for Forwarders

Here’s what your ops and customs teams should do before August 1:

-

Audit In-Transit Shipments

- Flag shipments from newly tariffed nations

- Accelerate clearance where possible

-

Update Software Tools

- Modify tariff simulators to reflect August rates

- Refresh HTS code lookup databases

-

Client Notifications

- Alert shippers and buyers of new duty costs

- Provide re-quotes for post-August shipments

-

Classification Accuracy Checks

- Double-check product HS codes

- Consider advance CBP rulings for ambiguous goods

✅ Proactive preparation ensures forwarders stay ahead of cost spikes.

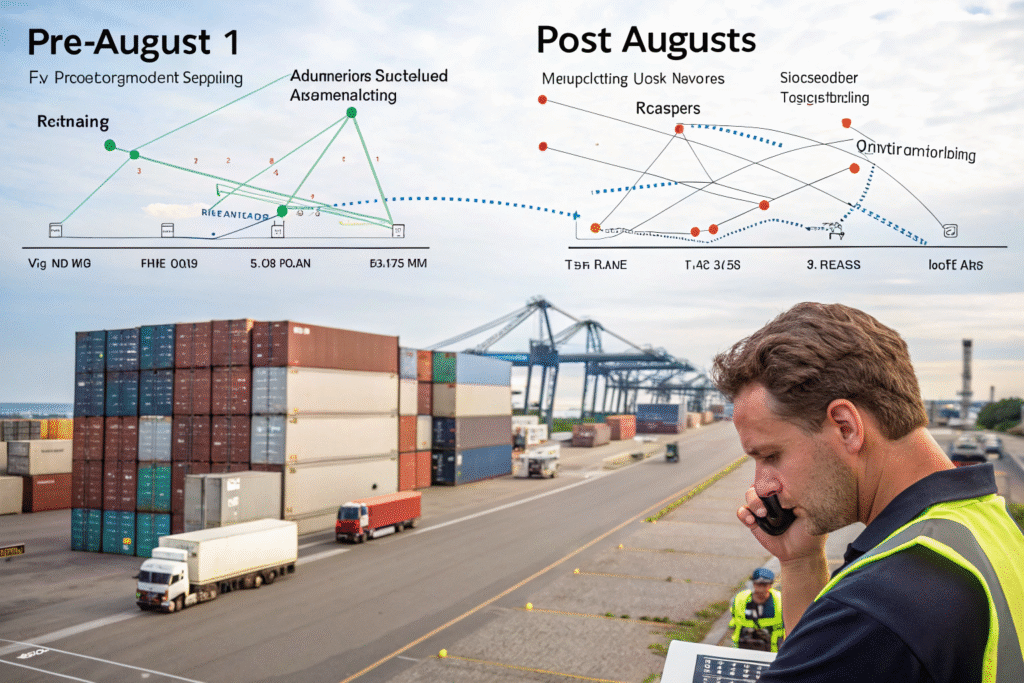

Can Routing or Timing Reduce Tariff Impact?

Yes. Freight forwarders can optimize shipment routing and timing to minimize tariff impact:

✔️ Ship Early

Move goods before the tariff effective date to qualify under old rates.

✔️ Use Bonded Warehousing

Store goods in bonded facilities and defer tax payment until favorable clearance timing.

✔️ Re-route Through Duty-Free Nations

Consider shipping via countries not listed under the new tariff schedule.

✔️ Activate FTA Benefits

If your clients qualify under USMCA, KORUS, or other FTAs—ensure documentation is correct to avoid unnecessary tariffs.

How to Advise Clients and Avoid Surprises

You should prepare clear, visual communications that outline:

- Pre- and post-August cost comparisons

- Duty risk scenarios by country and product

- Timing and routing options

- Document checklists for COO and FTA eligibility

✉️ Send templated alerts with tailored client data:

“Hi [Client Name],

Please note that your upcoming shipment from [Country] will face a new 25% import duty if it arrives after [Effective Date]. Let’s review whether early release or bonded entry might benefit you.”

This builds trust and prevents revenue loss from avoidable duty increases.

Conclusion: Be Proactive, Not Reactive

The August 2025 tariff changes are sweeping and fast-moving. Freight forwarders are the front line of compliance and cost forecasting. Those who act early will shield their clients—and their own margins—from financial pain.

At GeeseCargo, we help you:

- Simulate updated landed cost

- Pre-schedule bonded entries

- Reclassify HTS codes to lawful alternatives

- Provide full-service DDP quoting & documentation

📩 Contact Ben Zhu at benzhu@geesecargo.com for a tailored audit of your shipping strategy before the August tariff wave hits.